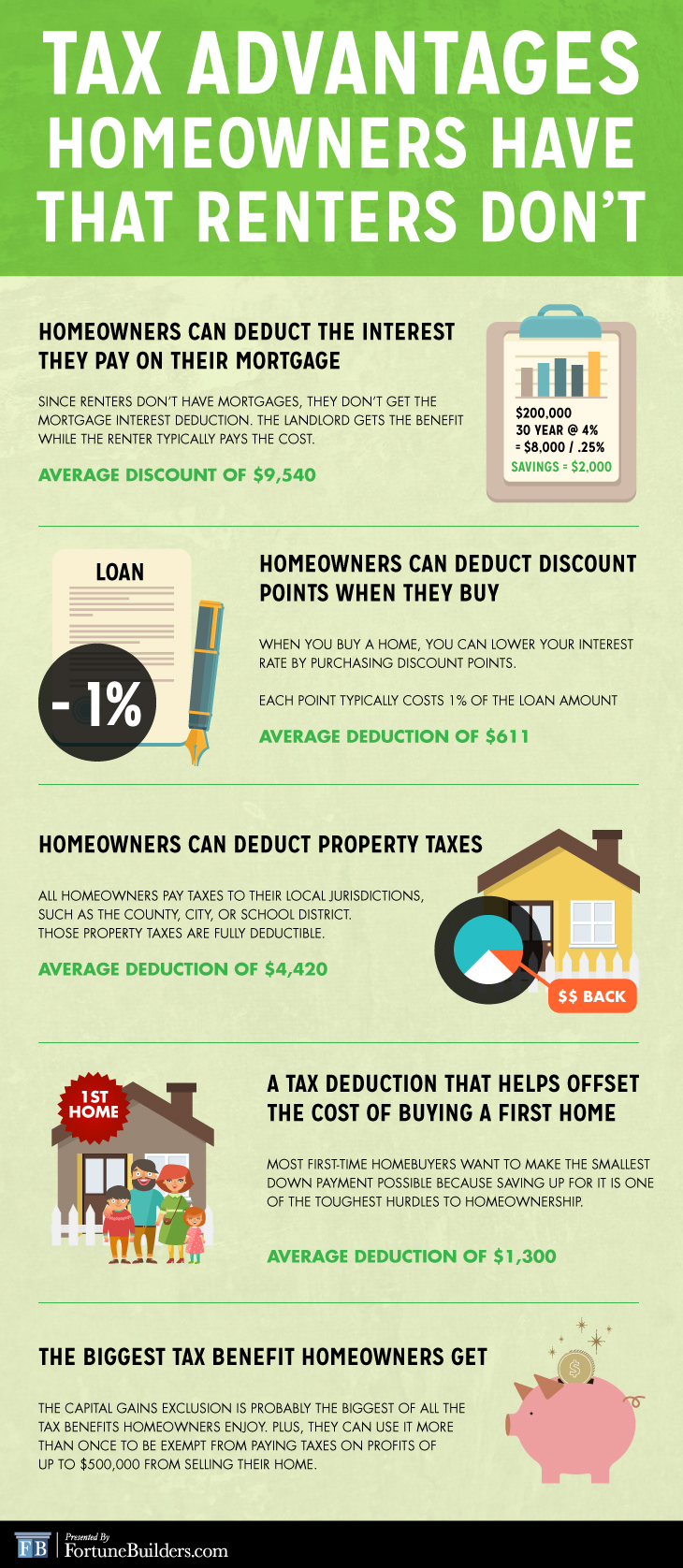

Homeowners, whether they know it or not, are given access to several tax benefits that renters don’t even know about. More often than not, those advantages can mean the difference between getting a significant amount of money back come tax time, or emptying your bank account to pay Uncle Sam. Of particular importance, however, are said advantages for real estate investors. When your business is dependent on real estate, there is no reason not to maximize your tax return. Buy and hold investments can offer a lot more than monthly rent checks. Critical tax deductions can make huge contributions to your bottom line ever year.

However, do homeowners really save that much more on their taxes than renters? In short — yes. Using data collected from the Internal Revenue Service (IRS), we calculated that a homeowner who took the average for each of four tax benefits would claim $15,871 in home-related deductions. Those factors are as follows:

- Interest paid on the mortgage

- Points paid on the mortgage

- The total cost of all property taxes

- The total cost of insuring the mortgage

Transitioning from a renter to a homeowner comes with significant tax benefits. See how much you can save when you buy a home: