Tax deductions can be one of the most attractive benefits available to real estate owners if they know how to use them. Property owners need to know the right way to classify business costs to take advantage of potential savings. One often forgotten deduction opportunity comes from appliance depreciation. Keep reading to learn more about the appreciation life of appliances in rental property, and prepare your real estate business for tax season.

What is Appliance Depreciation?

Appliance depreciation refers to the loss in value of an appliance over time. The IRS categorizes appliances as assets and provides set depreciation amounts depending on the appliance type and length of time. Real estate owners and landlords can then claim this depreciation amount as a deduction on their annual tax returns. Over time, this deduction can help redeem some of the initial costs of purchasing new appliances.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Methods Of Depreciation

There are two main methods for calculating appliance depreciation: the straight-line method or the accelerated method. There is not one right way to do it, but the methods can result in different tax savings. Keep reading to learn more.

Straight-Line Depreciation

Straight-line depreciation is the process of depreciating an asset by the same rate over time. For example, if you purchased a rental property for $100,000, and it depreciated over 27.5 years (per the IRS) the annual deprecation amount would be about $3,636. This number would stay the same year to year.

Accelerated Depreciation

Accelerated depreciation is the process of depreciating an asset in the first few years of ownership at a higher rate, instead of doing so over time at a steady rate. As a result, the depreciation could reduce the investor’s taxable income and result in tax savings up front. We will walk through an example of accelerated depreciation below.

How Long Do You Depreciate Appliances?

Rental property appliances depreciate for 5 years. Regardless of the day of the year that any appliance is bought, it is treated as though it were bought in the middle of the year for depreciation purposes, called the “Half-Year Convention.” This rule changes if 40% or more of the property’s appliance purchases are made within the last 3 months of the year. If that is the case, then the purchases are grouped by quarter. Here are some other things to keep in mind:

-

Used and new appliances depreciate for up to 5 years

-

The purchase price of depreciating appliances includes the sales tax, delivery charges and setup fees

-

Rental property purchases do not qualify for section 179 accelerated depreciation

Aside from appliances, the IRS also has specific parameters for depreciated rental property carpet and some furniture included in rental units.

How To Calculate Appliance Depreciation

Rental property depreciation is generally straightforward. If you own residential property for the full year, divide your cost basis by 27.5. If you only own the property for a portion of the year, the depreciation is calculated based on how many months of the year you own it. If you own commercial rental property, divide your cost basis by 39 to find your total depreciation.

When looking specifically at appliance depreciation, purchase price and age are important to consider. The following formula can be used to calculate appliance depreciation:

What Appliances Can You Depreciate?

According to the IRS, any built-in appliances can be depreciated, including:

-

Dishwashers

-

Stoves

-

Refrigerators

-

Washers and dryers

Actual Vs. Replacement Cash Value

When looking specifically at appliance depreciation, there are two main variables to consider: actual and replacement cash value. The actual cash value is the amount you would receive if you sold the appliance today, and the replacement value is the cost of buying a new appliance. When reviewing depreciation, the replacement value is typically the price you paid when buying the appliance. With this figure in mind, you can determine the actual value to date by figuring in age and depreciation. Note that appliances often depreciate at different rates, we will review one of the most popular methods for determining depreciation rates in the example below.

Appliance Depreciation Example

A few different methods can be used to calculate appliance depreciation in rental properties. The most common is called the double-declining balance, which is an accelerated depreciation model. As mentioned above, this means the depreciation deductions will be bigger at the beginning of the term and decrease over time. The benefit of using this method with appliance depreciation is because it maximizes potential deductions, as these assets may lose value quickly. Review the examples below to learn how to depreciate appliances in rental property.

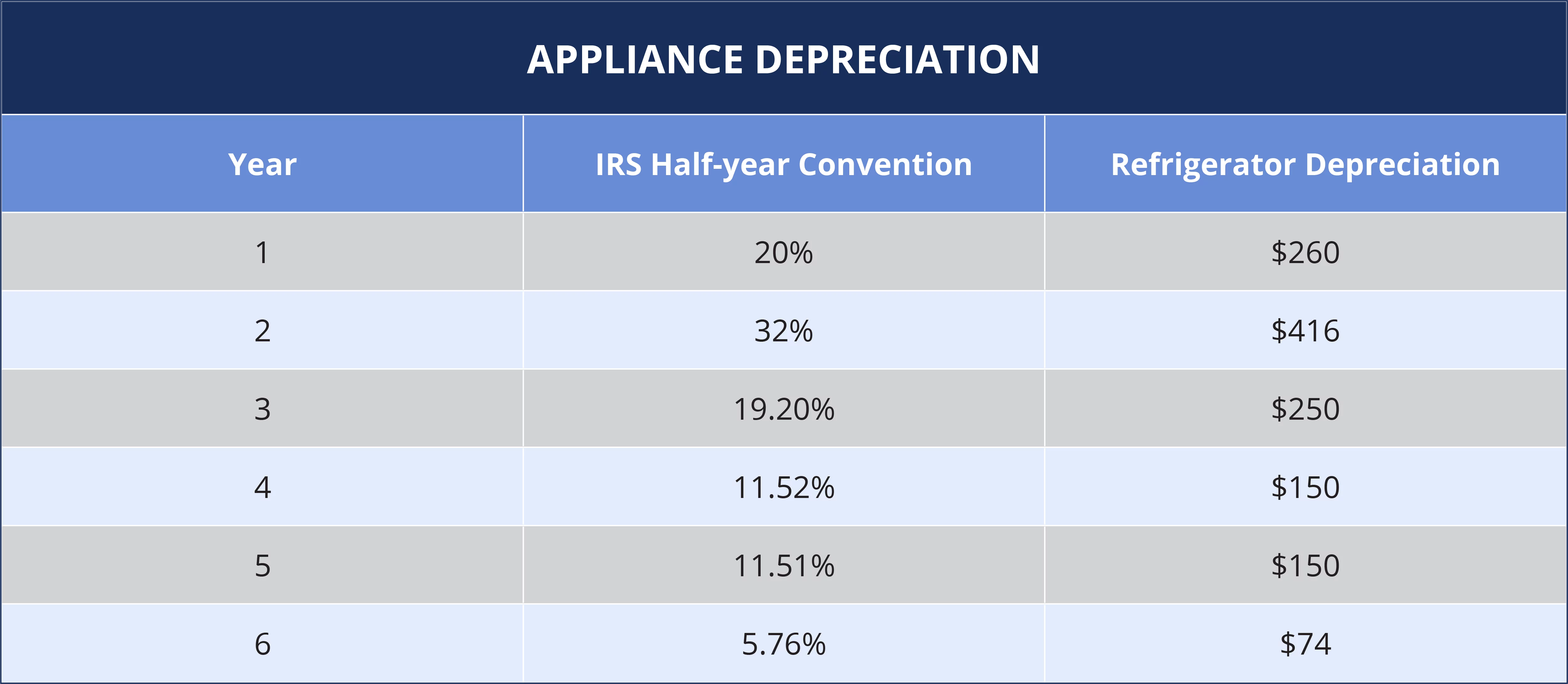

Than spends $1,200 on a fridge for a rental unit in July 2020. After accounting for delivery and set-up costs, the total purchase price is $1300. According to the IRS, this amount can be depreciated over five years. Because of the purchase date, we will use the half-year convention for this example. This allows owners to deduct a half year for the first and last years the asset is depreciated.

In year one, the asset will depreciate by 20 percent (or will be 20 percent less valuable), resulting in a $260 deduction. The asset will depreciate by 32 percent in two years, resulting in a $416 deduction. By year six, the IRS will deem the asset to have only depreciated by 5.76 percent resulting in just a 74$ deduction. Using this method, the depreciation amounts will look something like this:

Let’s look at another example:

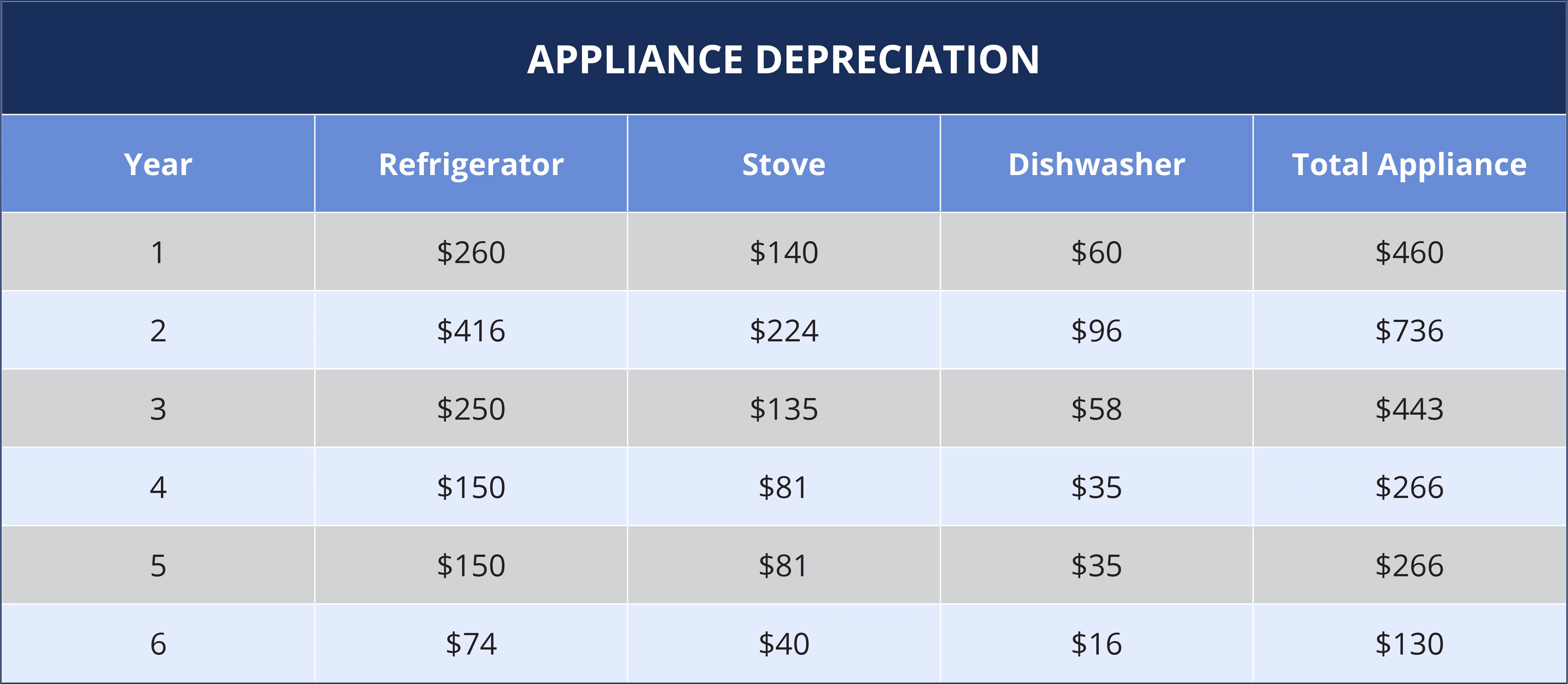

Now Than purchases a few appliances for his rental property at the same time. In addition to the refrigerator, he also buys a stove for $700 and a dishwasher for $300. Because they are purchased at the same time, these appliances would also follow the half-year convention. Than’s appliance depreciation would follow the same pattern above, except using each appliance’s total deduction value.

Depreciation appliances rental property information is crucial for investors looking to take advantage of the many tax benefits of real estate investing. The above estimates were calculated using IRS Publication 527, be sure to consult this guide for more information or to estimate your examples. Finally, remember to always consult a tax professional before relying on depreciation estimates.

Summary

Buying appliances for rental property can be a steep cost, so it is crucial to save money during the process. Thanks to appliance depreciation, landlords can claim the lost value as a tax deduction over time. Depending on the number of rental units in operation, this deduction could be an impressive opportunity. Pay attention to the appliance depreciation life and make sure you understand how to make full use of this tax deduction.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!