We Teach People How to Invest in Real Estate

Take control of your financial future with a Real Estate Investing Education. Learn our time-tested systems.

Welcome to FortuneBuilders

Welcome to the home of FortuneBuilders, the premier real estate investing education company! Here you can connect with our community, take in new real estate articles and news, catch episodes of our investing podcast and browse successful student-submitted real estate deals. Real Estate is one of the most rewarding endeavors and we are excited to share our passion for investing and business with our visitors. To learn more about us and investing in real estate check out the rest of the site.

Over a Billion Dollars of Real Estate Investment Experience

The three founders of FortuneBuilders Than Merrill, Paul Esajian, and Konrad Sopielnikow each have over 15 years of professional experience in the real estate investment and lending industry. They are the founders and principals in several real estate investment companies and have been involved in over $1 billion of residential and commercial real estate investments during that time frame.

Than, Paul, and Konrad are very active investors in today’s real estate market. In the last two years alone they’ve acquired over $300 million dollars worth of residential and commercial real estate around the country. On the residential side of the business they manage between 25 to 40 ongoing redevelopment single family and multi-family projects at a time. On the commercial side of the business they focus on acquiring apartment communities, retail shopping centers, and office buildings.

The roots of FortuneBuilders started over a decade ago because other real estate investors were constantly asking Than, Paul, and Konrad to teach them how to become more successful investors. More specifically, people wanted to learn their real estate business model, utilize their systems, and ultimately wanted help implementing their business processes and systems.

At FortuneBuilders we pride ourselves on teaching investors not only the foundational principles of sound real estate investing, but also how to build a successful business that is not dependent on you and, just as important, your time as the business owner. Feel free to look at some of our properties by clicking on the links below:

Real Estate Trends, Articles & Tips

FortuneBuilders In The Media

FortuneBuilders and our founder, Than Merrill, have received numerous accolades, appeared on TV, radio, podcasts, and contributed to major publications. We are privileged to share our expertise and insights into real estate. Visit our about page to read our story or check out the press room to find out more about us in the media.

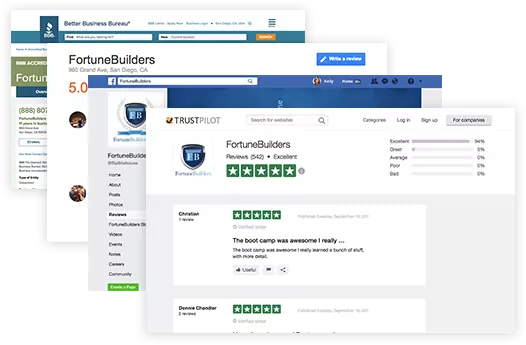

See What People Are Saying About Us

See what so many people just like you are saying about FortuneBuilders and our events.

4.9 | 428 Reviews

4.9 | 1,546 Reviews

9.8 | 860 Reviews