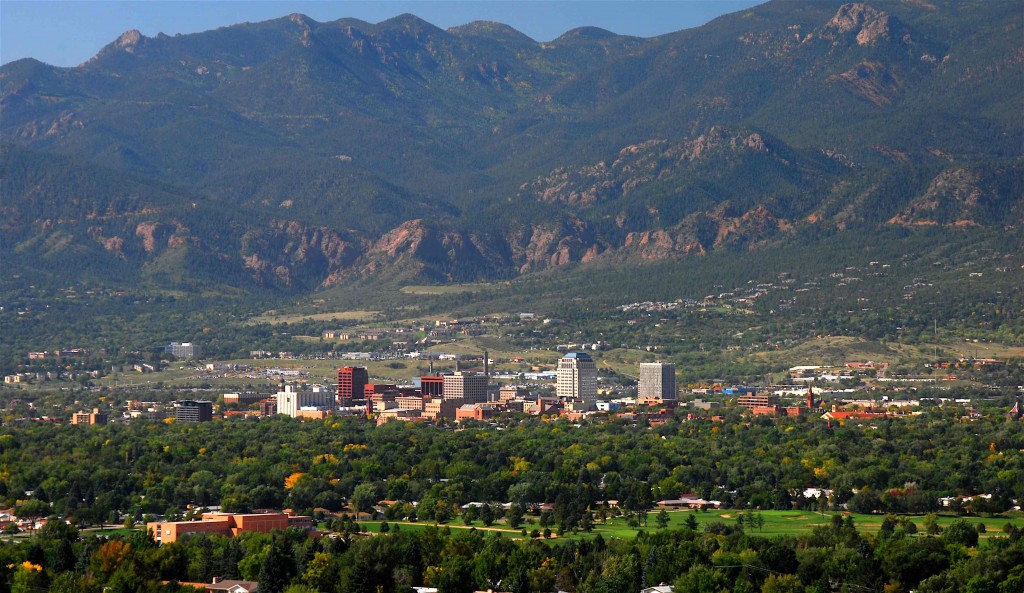

Nestled east of the Rocky Mountains, the Colorado Springs real estate market is quietly developing into one of the hottest housing markets in 2016. The first-half saw a medley of factors rule in favor of Colorado Springs real estate, which saw back-to-back gains in each quarter, as home prices, appreciation rates, and even the local economy all came back to life.

Additionally, the second quarter witnessed an influx in new housing construction for the area, while home affordability remained among the lowest in the country. The combination is expected to spur significant investment opportunities in the Colorado Springs real estate market years to come.

Colorado Springs, CO Real Estate Market Statistics:

While home prices in Colorado Springs are rising, appreciation rates are right where homeowners want them to be. The second quarter ushered in a one-year appreciation rate of 5.9 percent, compared to the national average of 4.9 percent, while three-year appreciation rates for Colorado Springs real estate rose to 18.2 percent. For Colorado Springs real estate investors and homeowners, price appreciation and principle payments in the last three years have boosted total equity growth since the recession. For those considering Colorado Springs real estate investments, the following highlights appreciation rates of previous years:

- Homes purchased in the Colorado Springs, CO housing market one year ago have appreciated, on average, by $18,541. The national average was $14,963 over the same period.

- Homes purchased in the Colorado Springs, CO housing market three years ago have appreciated, on average, by $51,442. The national average was $46,878 over the same period.

- Homes purchased in the Colorado Springs, CO housing market five years ago have appreciated, on average, by $89,883. The national average was $82,353 over the same period.

- Homes purchased in the Colorado Springs, CO housing market seven years ago have appreciated, on average, by $91,057. The national average was $77,054 over the same period.

- Homes purchased in the Colorado Springs, CO housing market nine years ago have appreciated, on average, by $65,548. The national average was $31,126 over the same period.

In terms of total equity, the Colorado Springs real estate market dominated in the second quarter of 2016. Both equity gains and appreciation rates for Colorado Springs real estate surpassed the national average with flying colors. Even better, homes purchased in 2005, which was the price peak for the real estate market, have accumulated an average of $88,568 in total equity, as opposed to the national average of $34,380.

Foreclosures, for what they are worth, are often an overlooked opportunity by many investors. As of September 2016, the Colorado Springs real estate market saw a total of 1,014 properties in some stage of foreclosures. According to RealtyTrac, the number of foreclosures in Colorado Springs during the month of September was 56 percent lower than the previous month, and 24 percent lower than the same time last year. For Bank Owned, the number of REO properties in Colorado Springs dropped 21.2 percent compared to the previous month, and 43.5 percent from the previous year.

Colorado Springs, CO: Real Estate Market Summary:

- Current Median Home Price: $259,300

- 1-Year Appreciation Rate: 5.9%

- 3-Year Appreciation Rate: 18.2%

- Unemployment Rate: 4.7%

- 1-Year Job Growth Rate: 2.4%

- Population: 439,886

- Median Household Income: $54,351

Colorado Springs, CO: Real Estate Market (2016) — Q2 Updates:

The second quarter was exceptionally plentiful for the Colorado Springs real estate market. Home prices, appreciation rates and affordability all surged past the national average, providing investors and homeowners a trifecta of benefits. That said, the median home price for Colorado Springs real estate was $259,300 during the second quarter, compared to the rest of the country of $239,167. In addition, gains in the last three years have extended the trend of positive price growth after the recession.

The Colorado Springs housing market has been fortunate to maintain affordability, despite rising home prices and appreciation rates. Homeowners paid 12.6 percent of their income to mortgage payments during the second quarter, as opposed to the national average which paid 15.8 percent. Although historically strong, the Colorado Springs housing market remains one of the more affordable in the country. This bodes well for rental properties in the area, as home affordability is generally what entices and repels would-be renters. Another factor helping affordability is the local economy. Unemployment in Colorado Springs is better than the national average and improving, while employment growth remains positive. Colorado Springs saw an unemployment rate of 4.7 percent in the second quarter, whereas the national average reached 4.9 percent. Compared to other markets, job growth for Colorado Springs is strong. The second quarter saw one-year job growth rise to 2.4 percent, compared to the national average of 1.9 percent.

Lastly, the Colorado Springs real estate market has also benefited from new housing construction in 2016. The second quarter saw the level of construction in Colorado Springs reach 60.4 percent above the long-term average, while the number of single-family housing permits shot up to 28.6 percent. In comparison to the national average, which saw single-family housing permits settle at 10.6 percent in Q2, the increase should bode well for Colorado Springs real estate investing for years to come.

Moving forward, the Colorado Springs real estate market is forecasted to achieve stronger price growth in the next 12 months, compared to the rest of the U.S. According to the National Association of Realtors, Colorado Springs real estate is predicted to grow at a rate of 6.1 percent during the second-half of 2016, an eye-popping percentage compared to the national average of 3.6 percent. All things considered, the Colorado Springs real estate market should continue its hot streak in 2016 and beyond.