Key Takeaways

- The earlier an entrepreneur can learn how to save for retirement, the easier it will be for them to compound profits in their golden years.

- There are several passive investment strategies to help people prepare for retirement when the time is right.

- Retirement for millennials shouldn’t be a distant thought, but rather a priority.

When is the best time for millennials to learn how to start saving for retirement? Is it ever too early to prepare for retirement? Better yet, how can today’s youth learn how to start saving for retirement in a way that benefits both their present and future?

Millennials are no strangers to retirement advice; their grandparents likely lived through The Great Depression and their parents were most likely raised with a penchant to start saving for retirement at an early age. However, the traditional school of thought isn’t what it used to be. While budgeting and 401(k)s can go a long way in helping one retire, these methods are quickly becoming antiquated in the face of a growing retirement dilemma: not enough people are retiring with enough money to supplement their golden years.

Although these retirement strategies have yielded positive results in the past, the same results aren’t expected for younger generations later in life. In fact, traditional retirement vehicles like Social Security are fading fast and may not be available when millennials reach retirement age. Not to mention, a large number of future retirees are simply failing to save for retirement.

As recently as 2016, a survey released on the U.S. News & World Report acknowledged that 40 percent of millennials don’t have a retirement income strategy in place, and 57 percent said they haven’t even begun saving yet. Meanwhile, the amount needed for retirement is growing and the current solutions we have in place don’t look like they will last forever.

According to The Motley Fool, “Today, only 15% of private-sector employees have a pension. Social Security’s full retirement age is 67 for most working adults, and its future is more uncertain than ever. The average life expectancy is 78.6, but the Social Security Administration estimates that one in three 65-year-olds retiring today will live past 90 and one in seven will live past 95.”

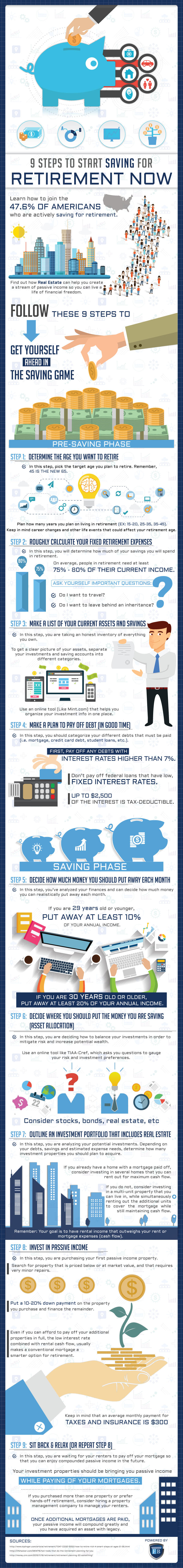

Saving for retirement isn’t what it used to be, which begs the question: When should millennials learn how to start saving for retirement? What does retirement for millennials look like in today’s landscape? And perhaps even more importantly, what can millennials do now that will simultaneously help them today and in the future? The following infographic should offer a good place to start:

A passive income portfolio may be just what today’s millennials need to retire comfortably in the future. A performing passive income portfolio has the power to not only provide short and long-term financial benefits, but may also produce residual income over each asset’s useful life. Even better, these passive income opportunities can be adjusted at anytime to meet their retirement goals.

When To Start Saving For Retirement

Start saving for retirement as soon as your finances will allow you to; it’s as simple as that. The earlier millennials are able to start saving for their golden years, the better their odds will be of retiring comfortably and on time. If for nothing else, people are living longer and inflation is increasing the amount everyone needs to retire on their own terms. Therefore, an early retirement strategy is advised for all millennials.

According to the Bureau of Labor Statistics via The Motley Fool, “the average American age 65 and up spends roughly $46,000 per year. Spend that much every year for 20 years, and you’re looking at a retirement that costs nearly $1 million — and that’s not even accounting for inflation.”

Long story short: start saving for retirement right now.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

How To Start Saving For Retirement

Understanding how important a retirement savings strategy is will prove useful to every millennial, but knowing how to start saving for retirement is an entirely different story. The act of actually implementing a well-devised retirement plan can be intimidating for millennials to even think about. However, knowing how to save for retirement will not only help them in the future, but it may even help them each and every year leading up to the day they retire.

Rather than blindly following the retirement guidelines of yesterday, which may or may not provide the financial foundation you need in the future, it’s important to consider your options. Below are eight ways millennials can successfully prepare for retirement:

- Stock Market

- Mutual Funds

- Self-Directed IRA

- Rental Properties

- Multifamily Properties

- Commercial Real Estate

- REITs

- Raw Land

Stock Market

Inflation has made traditional savings accounts all but obsolete. You see, any money left in a savings account may actually end up costing millennials money in the long run. While the money in a savings account may earn a small percentage of interest, it’s almost never enough to keep up with inflation. Therefore, millennials need to look for new places to store their money, like the stock market. According to NerdWallet, the S&P 500 returns “an average of about 10% annually over time,” which is considerably more than the average savings account.

Mutual Funds

A mutual fund is a company that allocates capital from several investors into a number of securities: stocks, bonds, and short-term debt. The companies mutual funds invest in make up its portfolio, and today’s millennials may invest in whichever mutual fund they find to be interesting. In the same vein as the stock market option, mutual funds offer yet a more enticing place to store one’s money. Slightly more diversified than stocks, mutual funds allow investors to invest in a number of companies by investing in a single mutual fund.

Self-Directed IRA

Individual retirement accounts, as their names suggest, are specifically intended to help individuals save for retirement. However, what many millennials don’t realize is that retirement accounts like 401(k)s may be self directed. Instead of placing money into a 401(k) for a custodian to disperse amongst stocks, for example, account holders may self direct their savings into real estate without being penalized for early withdrawals. In fact, real estate is one of the few vehicles the IRS will allow 401(k) holders to invest their savings in without being hit with an early withdrawal penalty. If the account is held by a custodian who will allow its members to self direct their funds, investors may choose to take the money they have in their 401(k) and invest it in real estate. However, there is a caveat: any money made from a rental property must be returned to the same retirement account from which it originated. Perhaps even more importantly, the returned money will be allowed to grow tax deferred.

Rental Properties

One of the quickest ways to prepare for retirement is through rental properties. Rather than a forever home, a rental property is utilized as an asset with someone else paying the monthly mortgage. Along with it appreciating over time, without you paying a dime, the property also has potential to earn income. For example, if the monthly mortgage is $1,250 and you rent it out for $1,450; this will secure a monthly profit of $200. Although meager, this represents automated income—a prized possession in retirement. The ability to earn monthly dividends without ever lifting a finger is a golden ticket for retirees; and as a millennial, you have the advantage of being able to start investing early therefore accruing more significant profits overtime.

Multifamily Property

Another layer of retirement with real estate is the purchase of a multifamily property. This multi-dwelling unit (MDU) entails two single-family properties under one roof with each unit having its own living quarters including a separate kitchen and bathroom. Common examples include duplexes and townhouses. Advantages of multifamily properties over single-family include: larger cash flow, more control over value, bigger pool of tenants, and scalability.

When planning a retirement strategy, multifamily properties should be a major consideration for millennials. Along with the ability to live mortgage-free (live in one unit while renting out the other), you have the option to rent out both units and earn double the income. This versatility offers many benefits in retirement, as your financial situation can alter course down the line. A multifamily property can help millennials better prepare for retirement by providing them with numerous backup options.

Commercial Real Estate

The idea of owning commercial real estate shouldn’t intimidate millennial investors. This investment vehicle, which consists of acquiring business properties and leasing individual units to collect rent, offers instant equity and increased cash flow compared to residential investments. Common examples of commercial real estate include retail, office, apartment, industrial and mixed-use buildings.

The appeal of commercial real estate, especially in retirement, is less competition and longer leases. In comparison to residential rentals, lease agreements for commercial real estate are signed for multiple years as opposed to a rental’s month-to-month lease. From an investor perspective, longer leases equate to lower vacancy risks. Along with earning higher income and cash flow compared to residential properties, commercial real estate holds immense value for those willing to take the risk.

REITs

REITs (Real Estate Investment Trust) are a form of passive income where investors can earn various types of income, long-term capital appreciation, and even investment portfolio diversification. Similar to stocks, REITs represent companies that own or finance income producing real estate. Depending on your retirement portfolio, including your ability to deal with risk, REITs may offer an additional level of reward your portfolio has otherwise been lacking.

Raw Land

Raw land is one of the more underrated investment options in real estate. A raw land investment is ideal in preparation for retirement as it can be milked in a variety of ways. Investors can subdivide and sell, build rental properties and lease, or simply buy and hold. For millennials, the appeal of buying raw land includes upfront profits and long-term dividends. In addition, raw land is easy to acquire with little-to-no competition, affordable to own and maintain, and has potential for short and long-term profit gains.

Summary

The golden years of retirement are different for everyone. Goals, aspirations and financial settings will change throughout the course retirement, which can be detrimental if not planned for properly. Having a strategy in place will help to answer your retirement questions now and later on, even if plans change down the road. In order to successfully learn how to save for retirement as a millennial it’s imperative you consider all your options and get started early. Appreciation is the name of the game in real estate, and the more real estate investments you accumulate early on, the better.

Have you taken any of these steps in your own retirement savings efforts? Let us know how your nest egg is looking in the comments below.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!