The Minneapolis housing market has followed the example set forth by national trends; that is to say, things are moving in a promising direction. In particular, prices continue to rise due to a distinct lack of inventory, and demand remains high in the face of historical appreciation. However, it is worth noting that while appreciation continues into its ninth consecutive year, real estate in Minneapolis is still relatively affordable. It’s cheaper to own a home in the Minneapolis housing market than to rent one, which bodes well for local investors. Long-term investors, however, look to benefit the most from tailwinds created in the wake of the Coronavirus. In particular, rental properties appear to be the preferred exit strategy in the Minneapolis housing market at the moment.

Minneapolis Real Estate Market 2022 Overview

-

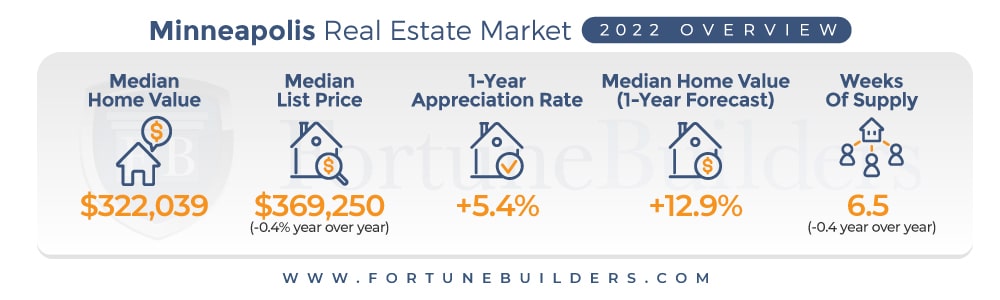

Median Home Value: $322,039

-

Median List Price: $369,250 (-0.4% year over year)

-

1-Year Appreciation Rate: +5.4%

-

Median Home Value (1-Year Forecast): +12.9%

-

Weeks Of Supply: 6.5 (-0.4 year over year)

-

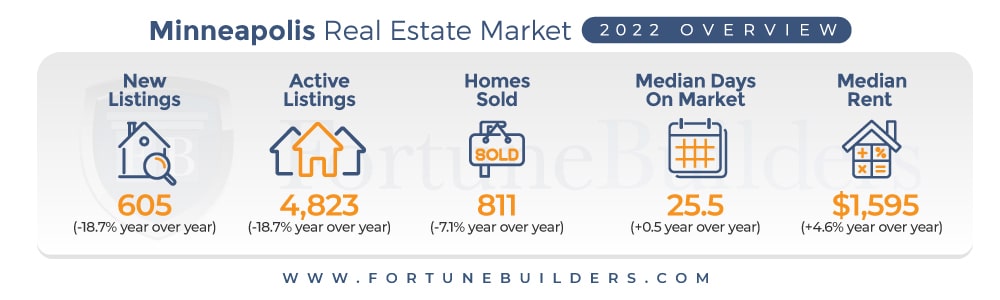

New Listings: 605 (-18.7% year over year)

-

Active Listings: 4,823 (-18.7% year over year)

-

Homes Sold: 811 (-7.1% year over year)

-

Median Days On Market: 25.5 (+0.5 year over year)

-

Median Rent: $1,595 (+4.6% year over year)

-

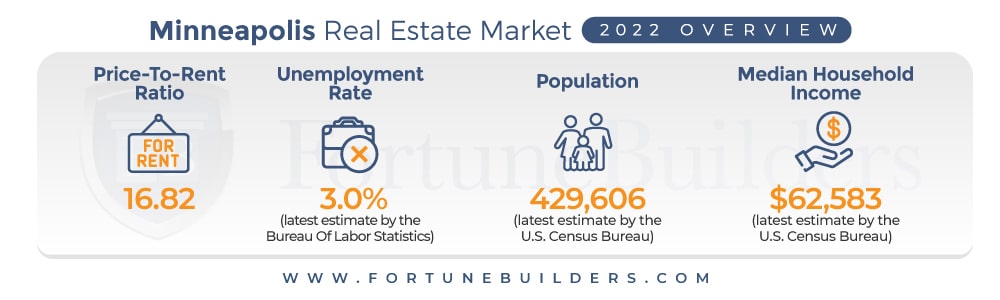

Price-To-Rent Ratio: 16.82

-

Unemployment Rate: 3.0% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 429,606 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $62,583 (latest estimate by the U.S. Census Bureau)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Minneapolis Housing Market Trends 2022

The Twin City housing market trends most people are familiar with today are directly correlated to the pandemic. In particular, the impact of COVID-19 has altered the landscape for everyone participating in the market: buyers, sellers and investors. Most notably, local real estate has become prohibitively expensive. While real estate in The Twin Cities has actually appreciated at a slower rate than the national average over the last 12 months, prices in Minneapolis continue to test new highs.

Appreciation is largely the result of more competition, lower borrowing costs, government stimuli, and a void of listings. The unique culmination of these factors inherently drove up competition at a time when homeowners weren’t willing to put their houses on the market. As a result, sellers have increased prices accordingly. In fact, prices will continue to rise in the Minneapolis housing market as long as employment opportunities keep increasing and supply fails to keep up with demand,

The one-sided seller’s market drove many prospective buyers to the rental market, where prices have also increased similarly (but not nearly as much as their home value counterparts). The departure of buyers from the housing market to the rental market increased demand for rentals, and should continue to do so for the foreseeable future. Therefore, opportunistic Minneapolis real estate investors should emphasize long-term rental property acquisitions. The latest increase in demand and rent should offset higher acquisition costs and enable years of positive cash flow.

Minneapolis Foreclosure Statistics 2022

According to ATTOM Data Solutions’ latest U.S. Foreclosure Market Report, “lenders started the foreclosure process on 25,209 U.S. properties in Q3 2021, up 32 percent from the previous quarter and up 67 percent from a year ago — the first double-digit quarterly percent increase since 2014.”

Foreclosure filings are increasing because government assistance is expiring. For the better part of two years lenders haven’t been allowed to foreclose on distressed owners, but assistance is coming to an end. With the pandemic hopefully giving way to a reopening, overdue homeowners will be expected to come current on payments.

“Despite the increased level of foreclosure activity in September, we’re still far below historically normal numbers,” said Rick Sharga, executive vice president at RealtyTrac, an ATTOM company. “September foreclosure actions were almost 70 percent lower than they were prior to the COVID-19 pandemic in September of 2019, and Q3 foreclosure activity was 60 percent lower than the same quarter that year. Even with similar increases in foreclosures over the next few months, we’ll end the year significantly below what we’d see in a normal housing market.”

The Minneapolis real estate market is no exception to the expected rise in foreclosures. Since moratoriums on foreclosures prevented many homeowners from losing their homes, any tempering of government aid will likely result in an influx of distressed homeowners. However, it is worth noting that Minneapolis has the added benefit of a strong employment rate. Therefore, while foreclosures will rise over the next year, they may be slightly more insulated than other cities. Still, foreclosures will jump, and investors need to be ready to help. The whole Minneapolis real estate investing community can position itself to help distressed homeowners avoid foreclosures and bankruptcy.

Minneapolis Median Home Prices 2022

The Minneapolis real estate investing community has seen a very positive trend regarding home values, which begs an important question: How much does it cost to buy a house in Minneapolis? The median home value in the Minneapolis real estate market is about $322,039. In one year, the median home value has appreciated 5.4%.

The latest increase may be attributed to several factors, not the least of which is the area’s price-to-rent ratio. At 16.82, the price-to-rent ratio suggests it is cheaper to rent a house than buy one. Traditionally, a 16.80 price-to-rent ratio would persuade more people to rent, but it’s a moot point in today’s market. With a mere 6.5 weeks of available inventory, the Minneapolis real estate market is nowhere near a balanced market. Without enough listings to keep up with demand, prices will continue marching higher. As long as inventory remains tight, which it’s expected to, local prices may increase by as much as 12.9% over the next year.

The Impact Of COVID-19 On The Minneapolis Housing Market

Nearly two years removed from the onset of the pandemic, the impact of COVID-19 on the Minneapolis housing market is starting to come into shape. For the better part of 2020, fear and uncertainty brought down many of the city’s most important indicators. It is safe to say there was a period of time nobody knew how the market would react. Fortunately, we have moved past uncertainty, and we have a better idea of the impact COVID-19 will have on the Minneapolis real estate market.

Up to this point, government intervention has played the biggest role. In particular, interest rates were dropped to historic lows to inspire buyers to get off the fence. At the beginning of 2021, the average commitment rate on a 30-year fixed-rate mortgage from Freddie Mac sat somewhere around 2.74%. Low rates have already persuaded many buyers to participate in the market, and they should continue doing so for the foreseeable future. Homeowners and investors have shown up to take advantage of lower rates, and more are expected to do so sooner rather than later. The resulting activity should help everyone in the Minneapolis real estate market: buyers, sellers, and investors.

Still, there isn’t enough inventory to keep up with demand. Regardless of how low rates are, insufficient levels of inventory will keep driving prices up. In fact, some expect prices to increase for at least a few more years.

Minneapolis Housing Market Forecast 2022

The Minneapolis real estate market has remained on the same trajectory as many of its national counterparts. Many of the same trends impacting primary cities across the country can be seen in Minneapolis, but on a more localized level. Here’s a more in-depth look at what most Minneapolis housing market forecasts are calling for through the end of 2022:

-

Minneapolis Home Values Will Increase: Not unlike every other city in the country, the Minneapolis housing market suffers from a distinct lack of inventory. With a mere 6.8 weeks of supply, there simply aren’t enough homes to keep up with the demand created by lower interest rates and increased savings from government stimuli and staying at home for the last two years. The imbalance has led to competition, which will inevitably increase home values—to the tune of about 12.9% by the end of 2022.

-

Interest Rates Will Rise: The Minneapolis real estate market will witness its rates increase with national trends. That said, the Fed has already announced a plan to gradually increase rates over the next few years. The increase will be incremental, and only at a pace the strengthening economy will allow, but it’s incoming sooner rather than later.

-

Rental Rates Will Increase: Home values have increased about 5.4% in the last year, and rental rates are up a slightly more modest 4.6%. However, the lack of available housing will surely drive more people to rent over the course of this year and next year. The added competition will assuredly increase the amount landlords are allowed to ask for.

-

Minneapolis Real Estate Investors Will Become Landlords: The indicators left over in the wake of the pandemic have created an environment that favors long-term exit strategies. In addition to lower profit margins and higher acquisition costs, rental properties look like the path of least resistance in 2022.

-

Buyers Will Migrate Further Away From The City: While not showing signs of being in a bubble, the Minneapolis housing market is more expensive than ever. Prices are high, and they are only going to get higher, which has already forced many to look outside of the city. The latest round of appreciation and work-from-home trends should allow more people to look elsewhere. More specifically, many buyers should migrate to more affordable homes just outside of the city limits.

Should You Invest In Minneapolis Real Estate?

A few years ago, the Minneapolis real estate market ranked among the top cities where flipping rates increased the most. In a year where U.S. home flipping rates reached a nine-year high (2019), Minneapolis saw a more significant increase than most of the national housing market. According to Attom Data Solutions, only a handful of markets saw larger increases in home flips in the first quarter of 2019 than the Minneapolis housing market.

“Along with Raleigh, Charlotte, and Milwaukee, other metro areas with a population of at least 1 million and a home flipping rate increasing in the double digits were San Antonio, Texas (up 47 percent); Houston, Texas (up 41 percent); Atlanta, Georgia (up 38 percent); Pittsburgh, Pennsylvania (up 36 percent); and Minneapolis, Minnesota (up 33 percent),” according to the Q1 2019 U.S. Home Flipping Report.

However, it should be noted that fundamentals have changed a lot in just two years. Since flipping rates peaked in 2019, homes have continued to increase in value; so much so that rehabbing has lost a lot of its profit margins. From the start of 2019 to today, in fact, home values have increased about 15 percent; that big of an increase in just over two years has detracted from flipping profit margins. In most cases, homes are too expensive to warrant using the flipping exit strategy.

In addition to higher home prices and lower profit margins, the Coronavirus also forced the Fed’s hand to lower borrowing costs. As of January, the average commitment rate on a 30-year fixed-rate mortgage was about 3.45%, according to Freddie Mac. While slightly higher year to date, an interest rate around three percent still represents a great opportunity. With borrowing costs considerably lower than in years past, it’s now possible for investors to simultaneously lower acquisition prices and increase monthly cash flow from properties placed in operation. With lower mortgage payments, investors can pocket more of the rent they charge each month.

Last but certainly not least is Minneapolis’ price-to-rent ratio; it’s more affordable to rent than own at its current level. As rent remains the more affordable option, landlords should continue to see their units in high demand. The added attention affordability has awarded landlords will combine with inventory shortages to make renting the easiest option, even for those who can afford to buy. Consequently, the increase in demand will limit vacancies and allow landlords to increase rent accordingly.

The culmination of these unique fundamentals has turned the Minneapolis real estate investing community towards long-term investment strategies. That’s not to say flipping doesn’t remain a viable exit strategy in the Minneapolis real estate market, but rather that tailwinds created by the pandemic have made rental properties more attractive than ever.

In addition to lower rates and increased cash flow potential, Minneapolis real estate investors have also come to appreciate the following:

-

Growing Job Market

-

Housing Market Is In Demand

-

Growing Rental Market

Growing Job Market

The Minneapolis housing market was already the beneficiary of a strong unemployment rate, and it appears to be getting better. Employment, in particular, has clawed its way back from the depths of the Coronavirus. While still not at the level it was prior to the pandemic, few cities are faring better than Minneapolis in returning to previous employment numbers. The latest numbers by the Bureau of Labor statistics put the civilian labor force somewhere in the neighborhood of 1,920.6 (the number of persons, in thousands, not seasonally adjusted). Strong employment numbers in The Twin Cities real estate market may be attributed to an increase in the life sciences, biotechnology, and medicine fields. Not only that, but the experience required for these growing fields has also increased the city’s average annual salary, which is now above the natural average. The unique culmination of these factors will undoubtedly make it easier for Minneapolis real estate investors to find tenants or buyers for their properties.

Housing Market Is In Demand

Much like most cities across the country, Minneapolis is growing fast. Minneapolis has nearly 50,000 more people living in its jurisdiction now than it did a decade ago, according to data released from the 2020 United States Census. Since then, the area’s biotech and life sciences renaissance has only contributed to an influx of new buyers. As a result, housing is not only in demand, it’s expected to be in demand for the foreseeable future. Buyers are already coming out in droves, and savvy investors should be able to use the competition to their advantage.

Growing Rental Market

As demand in the housing market grows, those who can’t afford to compete or can’t find the home they want will be resigned to the rental market. Therefore, anyone who can’t land one of the homes making up the 6.8 weeks of supply will need to look to local landlords and investors. There’s already not enough supply to keep up with demand in the housing market, and the growing disparity will only make rentals even more of a commodity. Not surprisingly, the added competition will work to investors’ favor.

Minneapolis Housing Market: Where To Invest

Here are some of the best places to invest in the Minneapolis housing market:

-

Central Minneapolis

-

North Loop

-

Midtown Phillips

Central Minneapolis

Central Minneapolis housing market trends can be broken down as follows:

-

Sale Price: $315,000 (-23.2% year over year)

-

Sale $/Sq. Ft.: $300 (+2.0% year over year)

-

Total Homes Sold: 43 (-15.7% year over year)

-

Homes Sold Over List Price: 14.0% (-20.9% year over year)

-

Homes With Price Drops: 19.5% (+62.2% year over year)

-

Days On Market: 32 (-35.4% year over year)

North Loop

North Loop housing market trends can be broken down as follows:

-

Sale Price: $303,000 (+21.2% year over year)

-

Sale $/Sq. Ft.: $331 (+8.2% year over year)

-

Total Homes Sold: 4

-

Homes Sold Under List Price: 1.4%

-

Days On Market: 36

Midtown Phillips

Midtown Phillips housing market trends can be broken down as follows:

-

Sale Price: $225,000 (+80.9% year over year)

-

Sale $/Sq. Ft.: $184 (+74.4% year over year)

-

Total Homes Sold: 5

-

Homes Sold Over List Price: 0.5%

-

Days On Market: 48

Summary

Not unlike most markets across the country, Minneapolis has seen its lack of available inventory drive up prices in a relatively short period. However, real estate in Minneapolis remains in high demand. Thanks, in large part, to a thriving economy and booming biotech industry, demand doesn’t appear as if it will taper off anytime soon. As a result, Minneapolis real estate investors can expect the city to weather the current Coronavirus storm and come out on the other end stronger.

Have you thought about investing in the Minneapolis housing market? Does Minneapolis real estate investing interest you in the slightest? If so, what are you waiting for? We would love to know your thoughts on real estate in Minneapolis in the comments below:

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/minneapolis-mn/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

https://www.redfin.com/news/data-center/

http://www.freddiemac.com/pmms/pmms30.html

https://theenergylogic.com/housing-tides/housing-tides-interface/

https://www.bls.gov/regions/midwest/mn_minneapolis_msa.htm

https://www.census.gov/quickfacts/minneapoliscityminnesota

https://www.redfin.com/neighborhood/190400/MN/Minneapolis/Central-Minneapolis/housing-market

https://www.redfin.com/neighborhood/549785/MN/Minneapolis/North-Loop/housing-market

https://www.redfin.com/neighborhood/549783/MN/Minneapolis/Midtown-Phillips/housing-market

https://www.attomdata.com/news/market-trends/flipping/q1-2019-home-flipping-report/

https://www.attomdata.com/news/market-trends/foreclosures/attom-september-and-q3-2021-u-s-foreclosure-market-report/