- Pittsburgh Real Estate Market 2022 Overview

- Pittsburgh Real Estate Market Trends 2022

- Pittsburgh Foreclosure Statistics

- Pittsburgh Median Home Prices

- Should You Invest In Pittsburgh Real Estate?

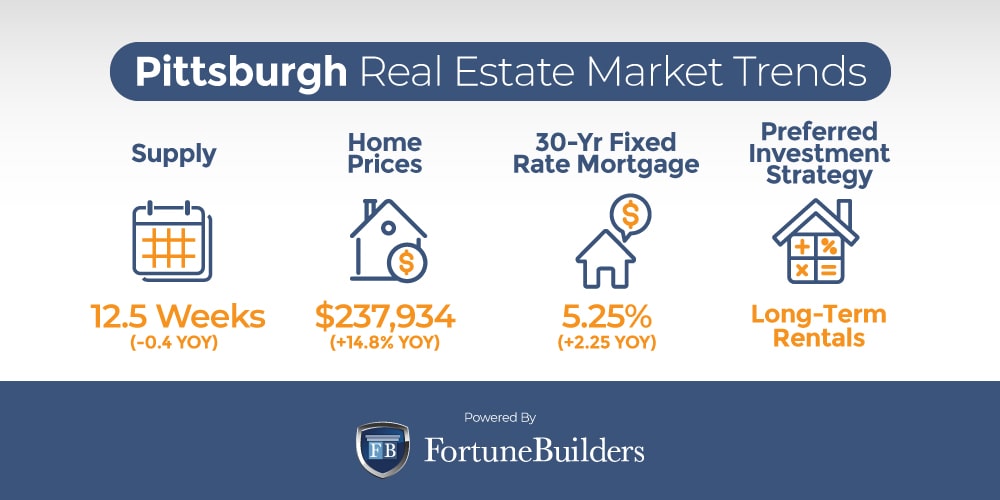

The Pittsburgh real estate market has ebbed and flowed along with the rest of the country for the better part of a decade. Even as the pandemic drastically altered the residential housing landscape, real estate in Pittsburgh has managed to mimic national trends; that is to say, prices continue to head higher while demand remains intact. It is worth noting that while Pittsburgh trend lines are marching in the same direction as their national counterparts, they are doing so at a slower pace. Relatively higher unemployment and foreclosure rates are weighing on the local housing sector and contributing to a higher rental population. As a result, the Pittsburgh real estate investing community has turned to long-term exit strategies in the wake of new dynamics.

Pittsburgh Real Estate Market 2022 Overview

-

Median Home Value: $237,934

-

Median List Price: $211,967 (-18.3% year over year)

-

1-Year Appreciation Rate: +14.8%

-

Median Home Value (1-Year Forecast): +8.3%

-

Weeks Of Supply: 12.5 (-0.4 year over year)

-

New Listings: 749.3 (-2.8% year over year)

-

Active Listings: 6,352 (-12.1% year over year)

-

Homes Sold: 531.7 (-6.4% year over year)

-

Median Days On Market: 43.7 (-6.5% year over year)

-

Median Rent Price: $826 (-14.5% year over year)

-

Price-To-Rent Ratio: 24.00

-

Unemployment Rate: 4.7% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 302,971 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $50,536 (latest estimate by the U.S. Census Bureau)

-

Total Foreclosures: 1 in every 1,056

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Pittsburgh Real Estate Market Trends 2022 – 2023

The Pittsburgh real estate market has been shaped primarily by the pandemic and its lasting impact on the housing sector. Most notably, the effects of COVID-19 on the Pittsburgh real estate market can be summed up in one metric: supply and demand. When the Fed lowered mortgage rates to soften the blow of the Coronavirus, activity picked up significantly. However, there are not nearly enough homes in the Pittsburgh housing market to satiate demand. As a result, both prices and competition are increasing simultaneously. This unique environment has created the following Pittsburgh real estate market trends:

-

Supply Trends: The housing market in Pittsburgh has about 6,352 active listings. Today’s listings will last about 12.5 weeks if the market continues its sales pace; that’s a far cry from a balanced market. If for nothing else, balanced markets usually have about six months of inventory. As a result, Pittsburgh is running incredibly low on listings when demand is running hot. Additionally, inventory is expected to remain low for the foreseeable future, which will push prices even higher than they already are.

-

Home Price Trends: The Pittsburgh housing market has followed the same trend line as the rest of the country. Since the start of the pandemic, Pittsburgh housing prices have proceeded to test new highs each month. In that time, the median home value has increased by nearly $56,000. Moving forward, the previously discussed lack of inventory and high levels of demand are expected to increase Pittsburgh home prices another 8.3%.

-

Interest Rate Trends: Borrowing costs have taken buyers on a rollercoaster over the last two years. When the pandemic was officially declared a global emergency, the average commitment rate on a 30-year fixed-rate mortgage dropped to its lowest point ever. However, with inflation running rampant, the Federal Reserve has increased rates to their highest point over the last few years. Now over five percent, rates will start to impact demand. Mortgage applications have already declined and should continue to do so as long as rates and home values rise.

-

Investor Trends: The Pittsburgh real estate market has a relatively high distribution of foreclosures. With about 1,056 foreclosures on the market, the local real estate investing community has continued to make flips a viable exit strategy. However, despite the ability to flip distressed homes, Pittsburgh home prices are higher than ever. The resulting profit margins have turned many investors towards long-term strategies like rental properties. With borrowing costs still low, rental properties allow investors to simultaneously take advantage of low borrowing costs, more rental demand, and increasing cash flow opportunities.

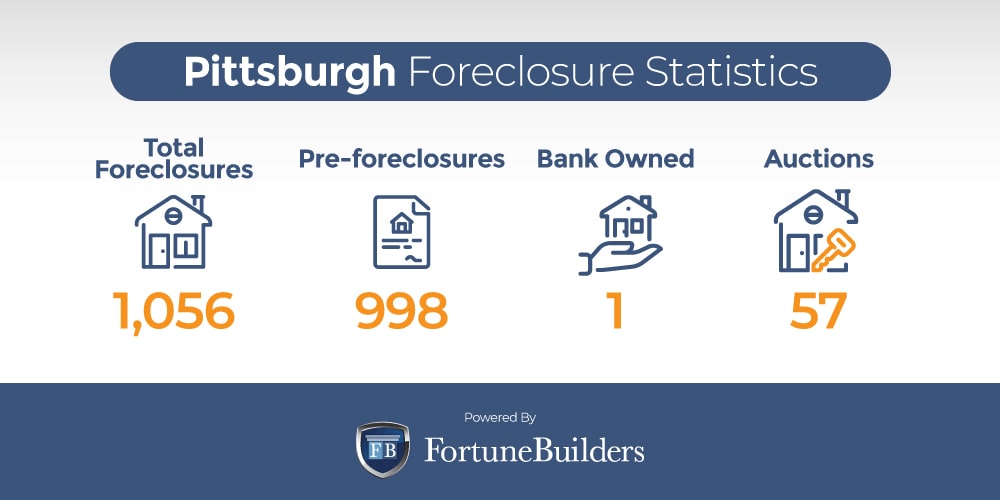

Pittsburgh Foreclosure Statistics 2022

Throughout the pandemic, foreclosures declined due to government-imposed moratoriums and assistance. Many distressed homeowners couldn’t be foreclosed on to prevent another housing crisis as we saw in 2008. The end of the pandemic is getting closer, and assistance is expiring. Foreclosures are increasing on a national level, as evidenced by the first quarter of this year.

According to ATTOM Data Solutions’ Q1 2022 U.S. Foreclosure Market Report, “a total of 78,271 U.S. properties with a foreclosure filing during the first quarter of 2022, up 39 percent from the previous quarter and up 132 percent from a year ago.”

Foreclosures are rising, and the Pittsburgh real estate market is no exception. RealtyTrac has identified a total of 1,056 foreclosures in Pittsburgh. The distribution of Pittsburgh’s foreclosures can be broken down into the following categories:

Foreclosures in the Pittsburgh real estate market have remained largely in check for the better part of two years. Nonetheless, the removal and expiration of certain government assistance programs will inevitably lead to more distressed homeowners in the future. While it’s too soon to say just how many foreclosures will occur in the Pittsburgh real estate market, it’s safe to assume they will get closer to pre-pandemic levels.

Pittsburgh Median Home Prices 2022

The median home value in Pittsburgh is $237,934. However, it is worth noting that the median home value has come a long way over the last two years. At the beginning of the pandemic (March 2020), Pittsburgh home prices sat somewhere around $182,000. However, outside of a brief drop in the first quarter of 2020, local home prices have done nothing but go up. Since the start of the pandemic, home values have increased by 30.7%. The increase is due mainly to record levels of demand onset by lower interest rates and a lack of inventory.

To put things into perspective, the median home value in the United States is $344,141. Since the beginning of the pandemic, the average price of a home in the United States has jumped 36.0%. Over the last two years, national price appreciation has outpaced real estate in Pittsburgh. The difference may be due to Pittsburgh’s relatively high unemployment rate. With fewer employees in the local workforce, competition in the Pittsburgh real estate market may not be as competitive as in other metropolitan areas. As a result, bidding wars have imposed less upward pressure on prices.

Pittsburgh home prices are expected to continue rising over the rest of 2022 and well into 2023. Supply and demand constraints are expected to continue, leading many forecasts to call for a modest 8.3% increase over the next 12 months.

Should You Invest In Pittsburgh Real Estate?

Investors should place a priority on building out their rental property portfolios, or perhaps even starting one altogether. If for nothing else, several of today’s most prominent market indicators suggest the best local exit strategy may have finally transitioned from rehabbing to longer-term buy-and-hold strategies. Here are some of the reasons today’s investors should look into becoming rental property owners in the Pittsburgh housing market:

-

Interest rates on traditional loans are relatively low and rising

-

Years of cash flow can easily justify today’s higher acquisition costs

-

Lower borrowing costs will increase monthly cash flow from properties placed in operation

-

The price-to-rent ratio suggests high home prices will increase rental demand

Investors have made very attractive returns by rehabbing properties over the last decade, and there’s no reason they can’t continue to do so moving forward. However, the market indicators which made rehabbing so attractive in the past are shifting. In particular, home prices have increased dramatically, effectively reducing profit margins on many homes.

Long-term investors, however, are awarded the ability to navigate today’s higher prices with lower interest rates. As of March, the average rate on a 30-year fixed-rate loan has exceeded five percent, according to Freddie Mac. While up year-to-date, interest rates are still near record lows. More importantly, mortgage rates are bringing down the cost basis of today’s properties. Investors who take advantage of today’s mortgage rates could easily detract thousands of dollars from the overall cost of their purchase. At the same time, lower rates reduce monthly mortgage obligations, allowing rental property owners to increase cash flow from operations.

With a price-to-rent ratio of 24.00, renting a house is much more affordable than buying one. Consequently, rentals are in high demand in the Pittsburgh real estate market. The added attention will most likely help landlords avoid vacancies and increase rents.

The Pittsburgh real estate investing community is lucky to have several viable exit strategies at its disposal. Still, none appear more attractive than building a proper rental property portfolio at the moment. There are too many important market indicators pointing towards becoming a buy-and-hold investor to ignore, not the least of which include:

-

Affordable Real Estate

-

A Large Rental Market

-

Landlord-Friendly Laws

Affordable Real Estate

The Pittsburgh real estate market boasts a median home value of $237,934, which is well below the $344,141 bar set by the rest of the country. As a result, the average home in Pittsburgh can be purchased for about $106,207 less than its national counterparts. It is also worth pointing out that real estate in Pittsburgh is expected to appreciate at a lower rate moving forward. The price difference—now and in the future— poses less of a barrier to entry for new investors and can make acquiring a rental property more of a reality for more real estate entrepreneurs.

A Large Rental Market

Pittsburgh’s 4.7% unemployment rate trails the national average. Consequently, fewer employees in the workforce may be responsible for a larger rental market; that, combined with rentals being more affordable than buying, suggest landlords will find themselves with a lot of opportunities.

Landlord-Friendly Laws

Located in Pennsylvania, the Pittsburgh real estate market awards investors several attractive laws which work in their favor. Most notably, the eviction process in Pennsylvania is easier to deal with than in most other states. If the tenant fails to pay rent or violates the lease terms, the landlord can issue a 10-day notice to pay or move out. After ten days, the landlord can begin the legal eviction process. Real estate laws are constantly in flux, so be sure to research these regulations before investing in Pennsylvania.

Summary

Pittsburgh real estate investing is firing on all cylinders, and nothing seems to suggest that things won’t continue going well for the foreseeable future. Increases in median home values will continue, and demand remains intact. More importantly, the Pittsburgh real estate market appears perfectly capable of weathering the current storm. As a result, investors who can stay on top of Pittsburgh real estate market trends may be able to increase their odds of realizing success.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/pittsburgh-pa/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

https://www.freddiemac.com/pmms/pmms30

https://www.redfin.com/news/data-center/

https://www.bls.gov/eag/eag.pa_pittsburgh_msa.htm

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.census.gov/quickfacts/pittsburghcitypennsylvania

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.attomdata.com/news/market-trends/foreclosures/attom-q1-2022-u-s-foreclosure-market-report/

https://www.realtytrac.com/homes/pa/allegheny/pittsburgh/