The Raleigh real estate market is developing into an investor’s paradise, as home prices and appreciation rates continue to surge pass the national average. The median home price for Raleigh real estate was $258,800 during the second quarter of 2016, compared to the national average of $239,167. As a result, appreciation rates in the City of Oaks grew faster than the rest of the country. Furthermore, the local economy in Raleigh is strong, with unemployment and job growth rates better than the national average. The Raleigh real estate market is poised for an exciting and profitable second-half of 2016.

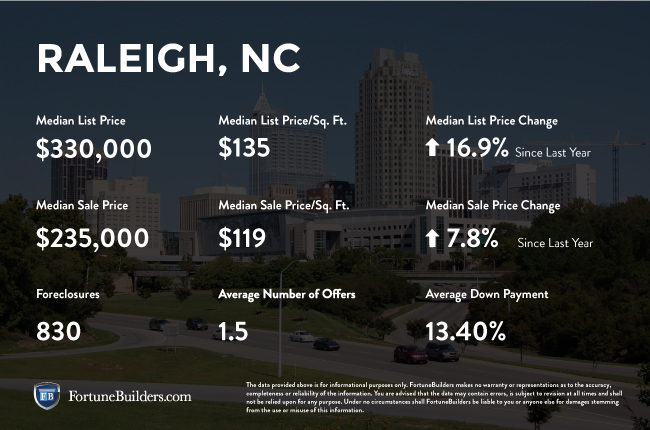

Raleigh, NC Real Estate Market Statistics:

Along with home prices outpacing the national average, homes in the Raleigh area continuing to enjoy healthy equity returns. The second quarter of 2016 saw Raleigh real estate appreciate at a one-year rate of 4.4 percent, compared to the national average of 4.9 percent, while the three-year rate skyrocketed to 30.2 percent. That said, price appreciation and principle payments in the last three years have boosted total equity growth, which is great news for Raleigh real estate investors and homeowners. For those considering Raleigh estate investments, the following provides a breakdown of appreciation rates in previous years:

- Homes purchased in the Raleigh, NC housing market one year ago have appreciated, on average, by $14,992. The national average was $14,963 over the same period.

- Homes purchased in the Raleigh, NC housing market three years ago have appreciated, on average, by $70,459. The national average was $46,878 over the same period.

- Homes purchased in the Raleigh, NC housing market five years ago have appreciated, on average, by $75,933. The national average was $82,353 over the same period.

- Homes purchased in the Raleigh, NC housing market seven years ago have appreciated, on average, by $98,035. The national average was $77,054 over the same period.

- Homes purchased in the Raleigh, NC housing market nine years ago have appreciated, on average, by $84,222. The national average was $31,126 over the same period.

In term of equity gains, it doesn’t get much better than the Raleigh real estate market. Not only are homes appreciating at record speeds, but long-term growth is also strong. In fact, Raleigh real estate investors and homeowners should be licking their chops when viewing total equity gains, especially during the seven and nine-year mark, as appreciation rates for the area continue to exceed the national average.

As of July 2016, there are currently 801 properties in the Raleigh area in some stage of foreclosure. According to RealtyTrac, the number of Raleigh foreclosures in the month of July was 34 percent lower than the previous month and 54 percent higher than the same period in 2015. Additionally, the number of REO properties in Raleigh fell 3.7 percent from the previous month and 60 percent from the same time last year.

Raleigh, NC: Real Estate Market Summary:

- Current Median Home Price: $258,800

- 1-Year Appreciation Rate: 4.4%

- 3-Year Appreciation Rate: 30.2%

- Unemployment Rate: 4.4%

- 1-Year Job Growth Rate: 3.1%

- Population: 431,746

- Median Household Income: $53,699

Raleigh, NC: Real Estate Market (2016) — Q2 Updates:

The Raleigh real estate market is enjoying a positive first-half of 2016. In addition to growth in home prices and appreciation rates, the Raleigh real estate market continues to boast one of the more affordable housing markets in the nation, including one of the top housing markets for residential redevelopment. In the second quarter of 2016, homeowners paid 11.3 percent of their income to mortgage payments — which is actually better than Raleigh’s historical average of 11.4 percent — while the national average paid 15.8 percent.

Another component benefiting the Raleigh housing market in 2016 is the local economy. The unemployment rate is currently at 4.4 percent, better than the national average of 4.9 percent, and lower than a year ago. In addition, the one-year job growth rate is 3.1 percent compared to the national average of 1.9 percent. Employment in Raleigh continues to hold up and is on an upward trend, while unemployment is better than the national average and improving. Another factor to consider is new housing construction. The current level of construction in Raleigh is 39.6 percent above the long-term average, with single-family housing permits increasing 11.0 percent, compared to the national average of 10.6 percent. That said, construction is on the rise relative to last year, which suggests the local inventory has stabilized.

Moving forward, the Raleigh real estate market is expected to see modest gains in the second-half of 2016, despite the National Association of Realtors (NAR) forecasting weaker price growth in North Carolina than in the U.S. in the next 12 months. As of July, price expectations for North Carolina real estate is currently at 3.4 percent, compared to the national average of 3.6 percent. That said, the Raleigh real estate market is blossoming in the right direction, and the trend should continue for the rest of the year.