Crowdfunding is more than just a 21st-century buzzword; it’s a new, exciting way for real estate investors to raise capital. But how does real estate crowdfunding work? What are the benefits of crowdfunding real estate deals? What do you need to know about looking for real estate investment loans from the masses? And what returns could you get by investing in another investor’s crowdfunding project?

Though real estate crowdfunding is not a traditional means of raising capital, investors need to understand this powerful form of real estate financing.

What Is Real Estate Crowdfunding?

Crowdfunding is a way for business owners to raise money, not by asking one investor for a huge investment, but by reaching out to a large pool of investors who each contribute a small amount of money. A key difference between crowdfunding and more traditional methods of raising money is in the platform used, as crowdfunding is usually done online.

Along with crowdfunding websites, business owners turn to social media platforms such as Facebook or Twitter to market their ventures directly to wider audiences of interested investors.

Real estate investors have adopted crowdfunding as an alternative to more traditional means of financing investments. For example, large developers use crowdfunding platforms to solicit investments from groups of accredited investors, while small business owners have launched campaigns to raise funds for smaller investment deals. The section below illustrates why real estate crowdfunding has grown in popularity among investors in recent years.

How Is Crowdfunding Regulated?

Crowdfunding regulations changed in 2012 under the JOBS Act. Previously, investors’ ability to advertise their crowdfunding efforts was limited.

The JOBS Act now allows investors to directly advertise to a larger audience through social media and online. The change in regulation opened doors that allowed investors to gain access to more funding sources for their real estate deals.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

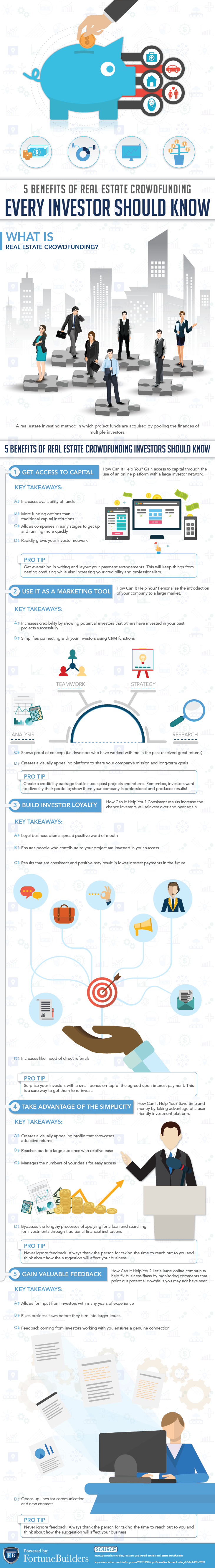

Benefits Of Real Estate Crowdfunding

Whether you’re just beginning your real estate investing journey or you’re a seasoned pro, locking down the necessary financing to fund a deal can be a challenge. With its advent in the real estate sector, many investors have taken advantage of crowdfunding as an alternative way of funding their deals. Furthermore, crowdfunding has become associated with several other notable benefits, including:

-

Crowdfunding real estate increases your funding options while growing your investor network.

-

Direct marketing through crowdfunding also doubles as a tool to promote your business.

-

Successful projects will lead to positive word of mouth and client loyalty over time.

-

Save time and money by taking advantage of a user-friendly investment platform.

-

Gain access to valuable feedback from your online community so you may address any business flaws.

1. Easy Access To Capital

Crowdfunding offers easy access to credit and capital without all of the hassles of getting a loan and is used for virtually any type of fundraising effort you can think of: personal, familial, business, and real estate investing. Investors can benefit from real estate crowdfunding by keeping their personal credit free and available for other uses while keeping their credit scores intact. This allows small business owners to get their companies up and running more quickly and also helps secure funding for deals when more traditional options are limited.

2. Great Marketing Tool

Aside from the direct benefit of funding, crowdfunding lends itself as an excellent marketing tool for business owners who would like to promote their brand. By promoting fundraising campaigns through social media and directly on crowdfunding platforms, real estate investors have an opportunity to grow their investor network rapidly. A best practice is to provide a credibility package on your website, showing past projects and returns, along with your company’s mission and goals. This helps to demonstrate your credibility and professionality to interested investors.

3. Builds Investor Loyalty

A crowdfunding campaign is a smart way to prove the appeal and financial viability of an idea or project. By providing compelling information through the campaigning process, you can attract potential investors and garner support. Once you’ve secured your funding, your contributors will become invested in your success and will go the extra mile to help you succeed. By providing consistent results, your investors will develop a sense of loyalty, which can lead to positive word-of-mouth marketing, repeated business, and direct referrals.

4. User Friendly Platforms Available

Many real estate crowdfunding sites make it easy for investors to launch their fundraising campaigns, thus saving them time and money. These platforms are designed to showcase campaigns in a visually appealing manner while allowing fundraisers to reach a large audience without excessive effort. Be sure to keep reading to discover some of the best real estate crowdfunding platforms available today.

5. Way To Gain Valuable Feedback

Due to crowdfunding’s public nature, campaigns will be subject to reactions, with or without invitation. However, this is a great opportunity for business owners to monitor user comments and gain valuable feedback. For example, pay attention to input left by other experienced investors or even criticism as a way to identify and fix business flaws. Responding and thanking users for leaving the time to reach out can help you open up lines of communication and develop genuine connections with new contacts.

It is also important to recognize the learning curve for those who have not yet participated in crowdfunding. When launching your first campaign, some of this feedback can be a great way to learn how to improve your campaigns in the future. It can also be an opportunity to introduce the concept of crowdfunding to those who are not yet familiar.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Disadvantages Of Real Estate Crowdfunding

While crowdfunding may seem like an attractive strategy, it is important to know the disadvantages that investors face when funding your deal.

-

Investment limits

-

Uncertainty

-

Rate of return

-

Lack of control

1. Crowdfunding Investment Limits

The US Securities and Exchange Commission has put regulations in place for non-accredited lenders to account for the risk involved with crowdfunded deals. Depending on a lender’s income, there are limits to the amount of money you can contribute to these deals. If your annual income is less than $107,000, you can make a yearly investment of 5% of your income with $2200 as the maximum investment allowed. If your annual income is greater than $107,000, you can invest up to 10% of your income or a maximum investment no greater than $107,000.

2. Uncertainty

One of the biggest challenges that you will face when recruiting investors for your crowdfunded deal is that investors may be unfamiliar with you or your business. This can lead them to hesitate before trusting an investment in the hands of a borrower that they are not familiar with. There is a risk of losing their investment, and although you will be confident your deal will succeed, investors may need more convincing before agreeing to get in business with you.

3. Rate Of Return

It is common for crowdfunded real estate deals to have an investment period of up to 5 to 7 years, meaning that investors will not see an immediate return on their investment. While there is long-term potential for a large profit, some investors may see the holding period of a crowdfunded deal as a drawback.

4. Lack Of Control

Investors also do not have decision-making control of the property they are investing in. Some investors may be wary of contributing to your crowdfunding campaign if they are not completely confident in placing the future of their investment in your hands. You may find that a more detailed presentation of your project’s trajectory will help alleviate investors’ hesitations before they are convinced that the project will be worth their investment.

The Two Types Of Real Estate Crowdfunding

If you are a real estate investor who has built up some capital, you may now be looking for ways to grow your wealth a bit more passively. For this type of investor, real estate crowdfunding essentially has two options: equity investments and debt investing.

Equity Investments

This is the route most real estate crowdfunding investors take, mainly because it provides a higher return than debt investing. However, this also presents a risk. Equity investments give investors an equity stake in a residential or commercial property, effectively turning them into shareholders.

If you choose to invest this way, your return will be based on the rental income of the property, minus fees needed for the crowdsourcing platform. In the event the property is sold, you will also earn a share of its appreciation value. Payouts are typically sent every quarter.

Pros Of Equity Investments

-

The sky is the limit on returns: You can see (at times) an 18 to 25 percent annual return, with the possibility for more, since equity investments do not have caps on them.

-

Lower fees: You have the option to pay an annual fee to maintain your shares on the property, instead of upfront fees and monthly fees.

-

Tax benefits: Since you own a share of the property, you can deduct expenses on it from your annual income tax (e.g. depreciation, repairs).

Cons Of Equity Investments

-

Riskier: You will be second in line for payouts. If the property does not attain a profit, you will not get any return on your investment.

-

Longer hold period: If you want more liquidity in your portfolio, equity investing is probably not for you. The holding period usually lasts for five to ten years.

Debt Investments

On the other hand, debt investing means the investor (you) are basically the lender to the property owner. You receive a fixed return based on the interest rate of the owner’s mortgage loan, as well as the amount you have invested.

Payments are usually given every month or every quarter. And since you are in debt investing, you will have priority during property payout.

Pros Of Debt Investments

-

Steady returns: You are more likely to predict how much and when you will receive your payout, thanks to how the investment is structured. You may be looking at a potential of an 8 to 12 percent annual return.

-

Less risk: You have less risk with debt investments, since the property owner will be the one to secure the mortgage loan. If the owner fails to pay the loan, you can recover your loss via a foreclosure action.

-

Shorter hold time: Since debt investments are usually done with development projects, the holding period only stretches from six to 24 months.

Cons Of Debt Investments

-

Higher fees: Once you decide to invest, the crowdfunding platform may take a percentage off of your payout.

-

Capped returns: Debt investments are calculated based on the interest rate of the owner’s mortgage loan. As such, your yields will be limited.

How To Get Started With Real Estate Crowdfunding Platforms

With many crowdfunding platforms available, it’s easy to get lost in a sea of options and features. It is recommended that you pick a platform based on site functionality, credibility, documentation, and customer service quality. For starters, you want to stay away from sites that function as nothing more than listing services. Go for platforms that act as a broker-dealer. Additionally, aim to pick a platform with previous experience handling the kind of investments you’re looking for.

Next, you’ll want to look for a site with solid venture capital backing. Since your investment could be locked up for a certain amount of time, make sure you are using a credible platform that will be up and running for a long time. Also, inspect how the platform conducts its due diligence. Be sure to ask the important questions: What kind of documentation does the platform collect for potential deals? Do they ask companies to provide liabilities or indemnities to investors should something go wrong?

Finally, verify that the platform provides quality customer service. As you’re researching different platforms and asking them your set of questions, you should be able to get a sense of their customer service quality by their willingness to provide the information and assurance you need.

10 Best Real Estate Crowdfunding Sites Of 2024

Now that you’ve got a primer on crowdfunding for real estate deals, you might be wondering which real estate crowdfunding platform you should go with. Here are a few to consider:

-

1031 Crowdfunding: Specializing in 1031 exchanges, this platform offers vetted DST investments for tax-deferred real estate transitions, catering to accredited investors with various minimum investment options. Ideal for those looking to defer capital gains taxes, the platform provides a streamlined process for reinvesting in like-kind, pre-vetted real estate opportunities.

-

CrowdStreet: You may enjoy CrowdStreet if you’re an accredited investor. Although the minimum investment varies, most offerings on this platform is $25,000 or more. This is a great marketplace for commercial, institutional-like investment opportunities.

-

DiversyFund: DiversyFund acquires, develops, and maintains a portfolio of properties. It also collects cash flow and divides earnings among its investors, rather than acting as a broker that links investors with projects. It does not charge any administration or broker fees, unlike some other crowdfunding sites. You can currently invest a minimum of $500 in the DiversyFund Growth REIT.

-

RealtyShares: With a minimum requirement of only $5,000, RealtyShares is a tech-enabled platform that allows borrowers to present their projects to accredited investors. For investors, on the other hand, you can look into a market of pre-screened residential, commercial, retail, and mix-use properties.

-

RealtyMogul: Catering to both debt and equity investors, RealtyMogul also features a $5,000 minimum investment. They put investor protection at the top of their priorities, making sure all investment opportunities are vetted.

-

iFunding: If you’re looking to invest in commercial retail and single family residential projects, you may want to check out iFunding. For borrowers, the website has professionals who can lend a hand in raising capital for a project. Minimum investment is also $5,000.

-

Fundrise: Fundrise acts as an online marketplace with some investments available for as low as $5,000. Since its creation in 2012, Fundrise has connected countless property owners with real estate investors.

-

Prodigy Network: For those hoping to get involved in commerical real estate, Prodigy Network is a great option. The minimum investment is $10,000 however their extensive six part vetting process helps provide piece of mind for those ready to get started.

-

PeerStreet: PeerStreet is another platform for accredited investors interested in building a real estate portfolio, without directly buying real estate. The website offers numerous investment options and even automated portfolios for those looking for hands-off opportunities.

-

EquityMultiple: This platform is great for investors ready to break into commercial real estate. Investors can get started with as little as $5,000 and choose from a number of high-yield investments.

Expert Tips For Your Crowdfunding Campaign

Crowdfunding for real estate will require a lot of hard work on your part. However, in an attempt to give you a leg up on the competition, our partners at CT Homes have compiled a list of things entrepreneurs need to know before they even think about crowdfunding their next great idea.

Brand Recognition & Marketing Ability

Crowdfunding, not unlike marketing, is at its best when it coincides with a recognizable brand. Startups must have the appropriate marketing capabilities and fundamental brand elements in place to be able to leverage a crowdfunding campaign. To that end, you shouldn’t even consider crowdfunding unless you have already allocated resources to increasing your brand awareness.

Do people know who you are in your community? Does the crowdfunding platform you are looking at attract investors interested in your niche? Do you have a dedicated social media following to leverage? If you answered yes to these questions, you may be a candidate for crowdfunding. However, consider the following advice before you make the jump.

Hire A Lawyer

It may come as a surprise to many new startup companies, but the prospect of crowdfunding is best approached with a legal representative. I recommend hiring a lawyer to represent you in your fundraising endeavor, as you will undoubtedly have questions along the way. For starters, each state is accompanied by its own unique rules.

At the time of this writing, the SEC wants to keep contributions confined to each state. In other words, to fund a campaign you must live in the same state as the company. If that wasn’t enough, anyone interested in raising money online must be familiar with the aspects of incorporation, protection of intellectual property, regulatory compliance, document preparation, and valuing shares. If you aren’t comfortable doing these things yourself, I highly encourage you to enlist the services of a lawyer.

Choose The Platform Carefully

By now, people are more than aware of the untapped potential lying dormant in crowdfunding portals. It shouldn’t surprise anyone that new ones are being introduced to the public every day. Having said that, the available options to choose from can be overwhelming to anyone who doesn’t know what they are doing.

While each shares the same prerogative, there are small differences that set them apart. It is the minutia, however, that will play the biggest role in helping you decide which portal to pick. Some will have hidden fees, while others may cater specifically to your business. The key is to pick the portal that best suits your needs, and what you hope to accomplish. Start with a portal that will attract investors who are more inclined to be interested in your business, and work from there.

Understanding Investor & Owner Dynamics

Above all else, you must understand what it is you are getting into when it comes to real estate crowdfunding. By no means should you consider investors to be anything less than owners. Unlike online fundraising platforms such as Kickstarter or GoFundMe, which allow individuals to contribute to a project in exchange for a “reward” or good will, investors that contribute to a crowdfunding campaign are buying in as a partner. The extent of ownership will vary, but it is important to remember that you are in a partnership once the campaign goes live.

Summary

Real estate crowdfunding is a rising trend in the investing space, and for good reason. Utilized correctly, it can benefit both those looking to fund investments, and receive funding, alike. As this is a newer trend, be sure to research real estate crowdfunding platforms and mind due diligence when making investments. If you want to try a non-traditional form of real estate investing, it’s possible that crowdfunding could be the key to a new form of investing success.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

The information presented is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing provided shall constitute financial, tax, legal, or accounting advice or individually tailored investment advice. This information is for educational purposes only.