The Richmond real estate market continues to experience pedestrian gains in 2016. The first quarter witnessed a combination of slowing price growth and appreciation gains. Conversely, the first quarter of 2016 saw home prices surpass the national average, as the median home price for Richmond real estate was $217,000. Home affordability, which remains near the top for the Richmond housing market, continued to improve in the first quarter, as the onslaught of new housing construction is expected to enhance the Richmond real estate market moving forward.

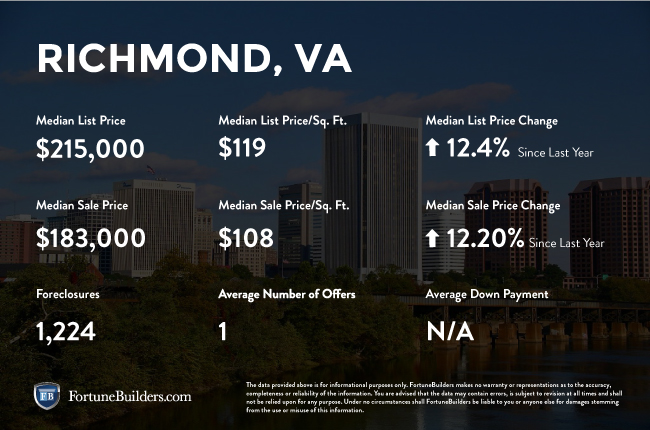

Richmond, VA Real Estate Market Statistics:

In terms of home equity, the Richmond real estate market has achieved limited gains so far in 2016. Richmond real estate appreciated at a one-year rate of 2.1 percent during the first quarter, almost three times lower than the national average of 6.1 percent. Those numbers weren’t much better when viewing the three-year appreciation rate, which saw Richmond real estate appreciate at a rate of 16.5 percent, compared to the national average of 22.6 percent. Although home prices are up, price growth for Richmond is slowing, which doesn’t bode well for Richmond real estate investors or homeowners. For those considering Richmond real estate investments, the following provides a breakdown of appreciation rates in previous years:

- Homes purchased in the Richmond, VA housing market one year ago have appreciated, on average, by $8,067. The national average was $15,781 over the same period.

- Homes purchased in the Richmond, VA housing market three years ago have appreciated, on average, by $40,878. The national average was $49,356 over the same period.

- Homes purchased in the Richmond, VA housing market five years ago have appreciated, on average, by N/A. The national average was $68,727 over the same period.

- Homes purchased in the Richmond, VA housing market seven years ago have appreciated, on average, by N/A. The national average was $59,758 over the same period.

- Homes purchased in the Richmond, VA housing market nine years ago have appreciated, on average, by $16,281. The national average was $16,435 over the same period.

As shown above, appreciation rates for the Richmond real estate market remain below with the national average from year one to year seven. That said, price appreciation and principle payments in the last three years have boosted total equity growth since the recession.

As of July 2016, there are currently 1,208 properties in the Richmond area in some stage of foreclosure. According to RealtyTrac, the number of Richmond foreclosures in the month of July was 11 percent lower than the previous month and seven percent lower than the same period in 2015. In addition, the number of REO properties fell 43.8 percent from the previous month and 28.6 percent from the same time last year. That said, the decline in foreclosures should should benefit Richmond real estate investors and homeowners, as well as help to ignite appreciation rates in the area going forward.

Richmond, VA: Real Estate Market Summary:

- Current Median Home Price: $217,000

- 1-Year Appreciation Rate: 2.1%

- 3-Year Appreciation Rate: 16.5%

- Unemployment Rate: 4.2%

- 1-Year Job Growth Rate: 4.7%

- Population: 223,585

- Median Household Income: $60,936

Richmond, VA: Real Estate Market (2016) — Q1 Updates:

Although the Richmond real estate market continues to underperform in regards to home prices and appreciation rates, there are still encouraging aspects to consider in 2016. For example, home affordability for the Richmond housing market continued to improve, as homeowners paid 9.5 percent of their income to mortgage payments in Q1, compared to the rest of the country which paid 14.5 percent. That number is even better than Richmond’s historical average of 12.4 percent. As of the first-half of 2016, Richmond is one of the more affordable markets in the nation.

The outlook of the Richmond real estate market remains positive due to its economic activity. The unemployment rate for Richmond was 4.2 percent during the first quarter of 2016, compared to the national average of 5.0 percent. From a year ago, unemployment in Richmond has improved by 0.7 percent, faster than the national average. In addition, one-year job growth continues to surpass the rest of the country, as Richmond saw new jobs grow at 4.7 percent in Q1, compared to the national average of 2.0 percent. That said, employment in Richmond has held up and is on an upward trend, while unemployment is better than the national average and improving.

New housing construction in the Richmond area is also expected to have a positive impact. The current level of construction for the Richmond real estate market is 17.2 percent above the long-term average, while single-family housing permits are increasing by 13.2 percent, compared to the national average of 11.3 percent. Relative to last year, construction in Richmond is on the rise and suggests that local inventory is stabilizing.

Looking forward, the Richmond real estate market isn’t expected to see much growth in the second-half of 2016. The National Association of Realtors (NAR) forecasts weaker price growth in Virginia than in the rest of the U.S. over the next 12 months, with price growth for Virginia real estate currently somewhere in the neighborhood of 3.2 percent, compared to the national average of 3.8 percent. The Richmond real estate market is forecasted to remain in recovery mode, as home prices and appreciation rates look to rebound in the second-half of 2016.