Key Takeaways

- Now is the perfect time to think through your investment goals and the steps needed to achieve them.

- Break down your new year financial goals to ensure you stay on track throughout the year.

- Wealth goals can serve to guide investors as they make financial decisions.

Whether you’re new to investing or have years of experience, setting goals should be a task performed regularly.

The problem with many goals, however, is that they are often forgotten as quickly as they are created. That’s why it is crucial for investors to set specific investment goals and write out the exact steps required to achieve each one. That said, there are several things to keep in mind before putting your real estate goals on paper.

How To Set Real Estate Investment Goals In 2020

The beginning of a new year can serve as a clean slate for many investors as it offers the chance to set new financial resolutions and plan for success. By taking the time to think through each goal and strategize what it will take to get there, investors can ensure they reach their main objectives.

Setting “SMART” goals has proven to be a useful technique for creating financial commitments. “SMART” is an acronym for specific, measurable, attainable, relevant and time-bound goals. This methodology is commonly used by businesses to identify actionable goals and set achievement deadlines. Rather than working aimlessly, creating SMART investment goals can help you zero in on your target while simultaneously carving out the optimal path to achieve it. SMART goals enable investors to leverage their resources and time productively, creating more focused efforts overall.

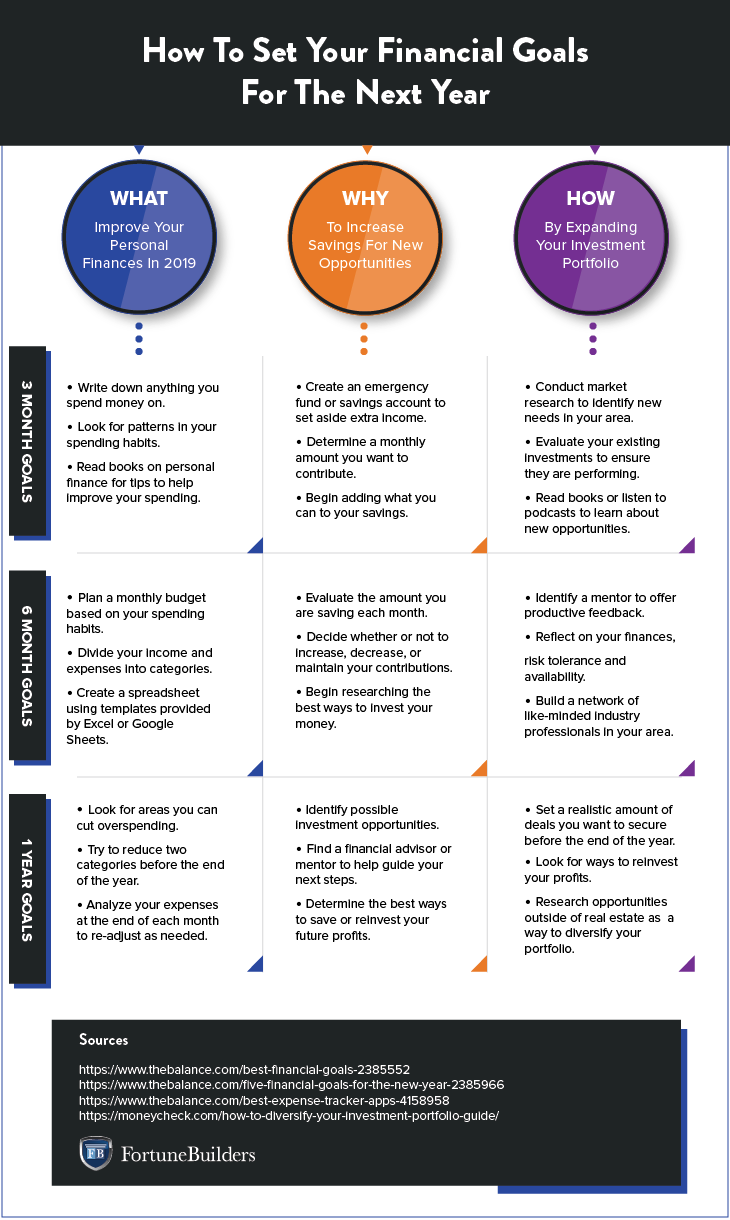

A key component of SMART goals is creating a time frame for each objective. It is a good idea for investors to create short-term goals that lead up to their main goals for the year. For example, as you think about your long-term financial resolutions, look for incremental habits you can implement throughout the year to ensure you get there. One way to do this is by breaking down each goal into different terms: three months, six months, and year-end goals. To learn more about SMART real estate goals, be sure to read this article.

Here are a few financial resolutions to consider as you curate the rest of your 2020 goals:

6 Factors To Consider Before Setting Your Real Estate Goals

It is important to understand that goal setting will look different for every investor. While there are financial tips that can be applied to everyone, the specifics will be entirely up to you. At the end of the day, your ability to set goals will come down to you individual preferences and market area. Here are six factors to consider when planning your real estate goals:

-

Conduct a thorough market analysis to determine the right investments for you.

-

Assess which investing niche aligns with your goals and market.

-

Determine your ideal time commitment when it comes to investing.

-

Ask what type of returns you are looking for.

-

Strategize which marketing strategies will help you achieve your investing goals.

-

Review your financial situation and whether or not you will need access to alternate funding.

Your Market

The first component to developing real estate goals is a strong comprehension of your market, which will require doing your homework. It’s important that you conduct a market analysis in order to identify an opportunity, as well as trends and changes that are occurring. Investors should also look at factors like median home price, appreciation rates, gains in total home equity, home affordability, the health of the local economy, and new housing construction. Doing so will provide a snapshot of where the market stands and how you can add value as an investor. This information will not only assist in forming your goals, but also detailing where you should invest and how. To learn more about completing a thorough market analysis, be sure to read this article.

Your Niche

The next factor to consider when setting real estate goals is your investing niche. Because there are endless investment avenues within real estate, it’s critical to identify a starting point. Finding your real estate niche will not only help refine your approach moving forward, but it will assist in distinguishing yourself from the competition. The right real estate niche will guide your investing strategy and therefore, all of your wealth-building goals.

Tips for discovering your real estate niche include defining your purpose, identifying what you’re good at (and what you enjoy most), understanding how you can add value, and uncovering the needs of your market area. Instead of focusing on the best investments for 2019, consider how identifying the right niche can help you find success in the new year.

Your Availability

Another important factor to think about when setting real estate goals is time. How much of your time do you want to dedicate to investing in real estate? Better yet, how much time do you actually have available to focus on real estate? Identifying availability will help investors align their efforts with the right investment goals. For example, rehabbing houses can take investors a significant amount of time to complete from start to finish. While this strategy may be right for some, investors who are hard pressed for time may find better luck with alternate investment goals such as wholesaling or REIT investing.

Your Profitability

Profitability is the name of the game as a real estate investor. However, every investment avenue will differ, including the average potential profits it will produce. It’s critical for investors to examine the exact dollar amount they’re seeking to obtain with their investment business. Similar to determining the amount of time you’ll dedicate to real estate, it’s essential to calculate the profitability you want to make from various real estate investment deals.

The best advantage real estate has to offer over other investment opportunities is the freedom of choice. From rental properties to house flipping, the type of income you wish to earn will be dependent on your investment vehicle. If you’re looking to earn residual income, your approach to investing will differ from those seeking to obtain one large lump sum. Investors’ preferred level of profitability can help shape your investment goals throughout the year.

Your Marketing

Investors will also want to consider their marketing efforts when developing their real estate goals. This is important for a variety of reasons; most notably, marketing encompasses a combination of time, money and strategy. In order to transform a business from an idea into reality, investors will have to rely on different marketing strategies. The reason it is important to review your existing marketing when setting investment goals is because the success of your marketing has a direct impact on the success of a business. By evaluating old marketing strategies and surveying the industry for new ideas, investors can determine which of their efforts should carry into 2019. Regardless of the strategy you choose to pursue, it is important to continually monitor the success of all marketing efforts and be prepared to make adjustments.

Your Finances

Lastly, you’ll want to examine your financial situation before setting real estate goals. This will ultimately dictate your approach moving forward, including whether or not the assistance of additional financial backing will be needed. If what you’re seeking from real estate is unattainable with your current financial situation, the need to locate a partner or develop a joint venture may be necessary. The use of a self-directed IRA may also be required. The collaboration of resources and talents can be beneficial for investors, especially those lacking the monetary means to get started on their own. Use your current finances as a guide when determining your investment goals for the year ahead. Doing so will ensure you are ready for any opportunity that comes your way.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

How To (Actually) Achieve Your 2020 Goals

The hallmark of a successful real estate investor is their ability to not only accurately plan and set goals, but also to accomplish them. As you craft your investment goals for the upcoming year, it is important to think about what you need to do to get there. Here are a few tips to help you (actually) achieve your investment goals:

-

Plan Out Your End Game: To stay on track with goal planning, it is important to have your final destination in mind. The right endgame could take the form of a financial achievement, number of deals, or specific business venture. The idea behind this strategy is that investors should be able to summon the willpower to complete each goal by picturing the final reward.

-

Find A Source Of Accountability: It is important to find an accountability partner with whom you can share your goals. Telling others about your goals can create an added sense of pressure and responsibility that hopefully inspires you to complete whatever task you set out to do. Potential accountability buddies could be a business partner, friend or even spouse.

-

Don’t Be Afraid To Think Small: As mentioned previously, it is helpful to break your goals into set timeframes. The idea behind short-term goals is that they will put you on track to achieving more long term ones. Don’t be worried if your short-term goals seem small; they are acting as stepping stones to set yourself up for success in the future.

-

Follow Your Own Goals: When you write out your goals for the year ahead, take a look at your motivations for each one. Are they your goals or are they someone else’s? If you let others influence or determine your goals, you will be hard pressed to achieve them. Make sure your motivation is your own; after all, you will be the one doing the work.

-

Boost Your Mindset: As an entrepreneur, there are few things more important than your mindset. The right attitude, as small as it may seem, will impact every decision you make and every goal you set for yourself. Take time to develop the right mindset and ensure you are willing to put in the work to achieve your goals.

-

Track Each Goal: Tracking your performance is a great way to keep yourself focused on your goals. Create a spreadsheet, phone reminders, or even a journal to track how you do throughout the year. By monitoring your progress, you can help stay on task and maintain your motivation throughout the year.

-

Celebrate Your Achievements: While it may sound trivial, it is important to acknowledge each milestone you achieve throughout the year. It is perfectly okay to reward yourself or feel proud when you achieve a goal you have been working towards. Take a moment to celebrate your victories, and get back on track to accomplish even more.

Summary

As a real estate investor, entrepreneur or business owner, the importance of setting goals is undeniable. Investors should consider a variety of factors when creating financial goals for the year ahead, and they should be careful to think in terms of action. As well-known psychologist and author Carl Jung once said, “You are what you do, not what you say you’ll do.” Remember, success as an investor will not be found in investment goals alone, but in the habitual effort to achieve them.

What are your investment goals for the year ahead? Leave a comment below and let us know: