The state of Florida continues to churn out prosperous real estate markets, and Tampa is no exception. The first-half of 2016 has given way to a stronger-than-expected Tampa real estate market, with home prices, appreciation rates and the local economy on an upward trajectory. For Tampa real estate investors and homeowners, home prices are up from a year ago, and gains in the last three years have extended the trend of positive price growth after the recession. In addition, home affordability and new housing construction are better than the national average, as the Tampa housing market has become one of the more affordable markets in the country. That said, the second-half of 2016 should welcome new growth and stronger gains for the Tampa real estate market.

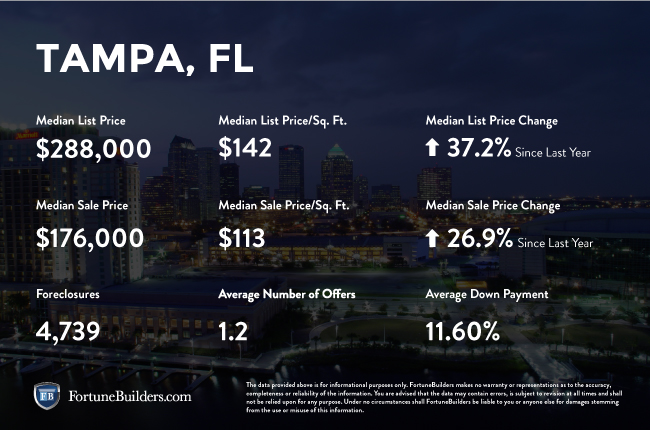

Tampa, FL Real Estate Market Statistics:

Like Miami, the Tampa real estate market is firing on all cylinders. The second quarter of 2016 witnessed one-year appreciation rates of 14.2 percent for Tampa real estate, in comparison to the national average of 4.9 percent. Three-year rates, on the other hand, reached 29.8 percent. For Tampa real estate investing, price appreciation and principle payments in the last three years have boosted total equity growth since the recession. For those considering Tampa real estate investments, the following provides a breakdown of appreciation rates in previous years:

- Homes purchased in the Tampa, FL housing market one year ago have appreciated, on average, by $27,789. The national average was $14,963 over the same period.

- Homes purchased in the Tampa, FL housing market three years ago have appreciated, on average, by $54,002. The national average was $46,878 over the same period.

- Homes purchased in the Tampa, FL housing market five years ago have appreciated, on average, by $80,507. The national average was $82,353 over the same period.

- Homes purchased in the Tampa, FL housing market seven years ago have appreciated, on average, by $74,475. The national average was $77,054 over the same period.

- Homes purchased in the Tampa, FL housing market nine years ago have appreciated, on average, by $4,923. The national average was $31,126 over the same period.

The last seven years has witnessed total equity for Tampa real estate reach new heights, and in some cases, surpass the national average by large amounts. For Tampa real estate investors and homeowners, total equity gains reached their largest edge over the national average in year one and three, which saw equity gains of $27,789 and $54,002 respectively. In fact, equity gains for Tampa real estate remained competitive in year five and seven, although gains dropped off significantly in year nine. However, Tampa real estate investing is expected to garner attention in coming months if appreciation rates continue like they have in 2016.

The Tampa, Florida area currently has 4,531 properties in some stage of foreclosure, as of August 2016. According to RealtyTrac, the number of Tampa foreclosures in the month of August was nine percent lower than the previous month and 25 percent lower than the same period in 2015. That said, the number of REO properties in Tampa fell 23.5 percent from the previous month and 45.3 percent from the same time last year.

Tampa, FL: Real Estate Market Summary:

- Current Median Home Price: $199,900

- 1-Year Appreciation Rate: 14.2%

- 3-Year Appreciation Rate: 29.8%

- Unemployment Rate: 4.6%

- 1-Year Job Growth Rate: 3.6%

- Population: 352,957

- Median Household Income: $43,514

Tampa, FL: Real Estate Market (2016) — Q2 Updates:

Tampa, Florida is a wonderful place to visit, and an even better place to invest in real estate. The median home price for the Tampa real estate market was a modest $199,900 during the second quarter, compared to the rest of the country at $239,167. However, one-year and three-year appreciation rates for Tampa real estate continued to impress, almost doubling the national average in comparison, which bodes well for investment purposes. Furthermore, total equity gains in the past five years have remained competitive with the rest of the nation, despite more affordable home prices.

The local economy is another component benefiting the Tampa real estate market in 2016. The one-year job growth in Tampa is 3.6 percent, compared to the national average of 1.9 percent. Unemployment in Tampa is better than expected and improving, as the current unemployment rate is 4.6 percent, as opposed to the rest of the country at 4.9 percent. Overall, local employment growth in Tampa is strong and should continue in the second-half of 2016.

With a growing economy and thriving real estate market, new housing construction in Tampa is also on the rise. The current level of construction is 66.6 percent above the long-term average, while the ratio of single-family housing permits reached 18.5 percent, compared to the rest of the U.S. at 10.6 percent. Construction is on the rise relative to last year, suggesting the local inventory has stabilized. That said, the Tampa housing market continues to be one of the more affordable in the country. Homeowners paid 9.9 percent of their income to mortgage payments, whereas the national average paid 15.8 percent.

Looking forward, the Tampa real estate market is expected to surpass the national average in the second-half of 2016, according to the National Association of Realtors (NAR). The NAR has forecasted higher price growth in Tampa in the next 12 months, with prices for Tampa real estate predicted to grow by 4.3 percent in the second-half, compared to the national average of 3.6 percent. With home prices low and mortgage rates lower, now is the time to consider investing in the Tampa real estate market.