The Tucson real estate market has faced an uphill battle thus far in 2016. Home prices, appreciation rates, and the local economy are all below the national average, as Tucson real estate has generated subpar results during the first two quarters of the year. While not as hot as it once was, prices for the Tucson real estate market continue to grow relative to last year. Gains in the last three years have extended the trend of positive price growth after the recession, which bodes well for Tucson real estate investors and homeowners. The saving grace has been home affordability, as the Tucson housing market remained one of the more affordable in the nation during the first-half, and the trend should continue.

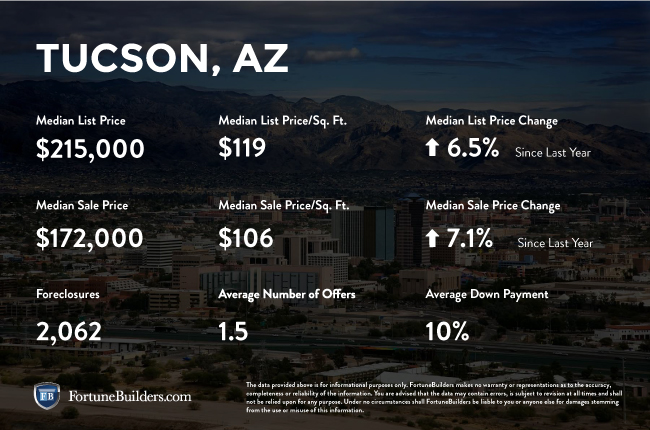

Tucson, AZ Real Estate Market Statistics:

The Tucson real estate market continues to earn minimal appreciation in 2016. The one-year appreciation rate for Tucson real estate was 5.1 percent during the second quarter, compared to the national average of 4.9 percent. Those rates fell behind the rest of the country during the three-year mark, as appreciation rates moved to 12.1 percent, while the national average soared to 17.8 percent.

At the same time, price appreciation and principle payments in the last three years has boosted total equity growth since the recession, which also benefits Tucson real estate investors and homeowners. Additionally, home prices remain low in comparison to total equity gains for Tucson real estate. For those considering Tucson real estate investments, the following provides a breakdown of appreciation rates in previous years:

- Homes purchased in the Tucson, AZ housing market one year ago have appreciated, on average, by $12,324. The national average was $14,963 over the same period.

- Homes purchased in the Tucson, AZ housing market three years ago have appreciated, on average, by $29,833. The national average was $46,878 over the same period.

- Homes purchased in the Tucson, AZ housing market five years ago have appreciated, on average, by $66,750. The national average was $82,353 over the same period.

- Homes purchased in the Tucson, AZ housing market seven years ago have appreciated, on average, by $37,521. The national average was $77,054 over the same period.

- Homes purchased in the Tucson, AZ housing market nine years ago have appreciated, on average, by $26,467. The national average was $31,126 over the same period.

The last seven years have failed to witness total equity appreciation gains surpass the national average. However, first-year gains were only slightly below the national average in the second quarter, which is good news for Tucson real estate investing, including a positive sign for house flipping.

In terms of foreclosures, there are currently 2,326 properties in some stage of foreclosure in the Tucson, Arizona area. According to RealtyTrac, the number of Tucson foreclosures in the month of August was 17 percent higher than the previous month and 137 percent higher than the same period in 2015. Additionally, the number of REO properties reached 17.1 percent from the previous month, while dropping 1.1 percent from the same time last year. If the number of foreclosures and REO properties for Tucson real estate continues to rise, it could potentially create a slew of investment opportunities.

Tucson, AZ: Real Estate Market Summary:

- Current Median Home Price: $192,500

- 1-Year Appreciation Rate: 5.1%

- 3-Year Appreciation Rate: 12.1%

- Unemployment Rate: 5.7%

- 1-Year Job Growth Rate: 3.7%

- Population: 526,116

- Median Household Income: $51,492

Tucson, AZ: Real Estate Market (2016) — Q2 Updates:

The Tucson real estate market continues to exhibit all the traits of an investor-friendly situation. The current median home price for Tucson real estate is $192,500, well below the national average of $239,167. Appreciation rates, on the other hand, continue to produce marginal gains in comparison to the rest of the country. In addition, the number of foreclosures and bank owned properties are beginning to pick up, which could spell opportunity for the well-timed investor.

The current level of construction in Tucson is 10.1 percent, which continues to decline from last year. The percentage of single-family housing permits fell to -3.6 percent in the second quarter, compared to the national average of 10.6 percent. For investing purposes, the decline in new inventory could drive home prices and appreciation rates up for Tucson real estate in the coming months.

Home affordability is another positive for the Tucson real estate market. Homeowners in the Tucson housing market paid 10.6 percent of their income to mortgage payment during the second quarter, in comparison to the national average which paid almost 16 percent. The Tucson housing market is one of the more affordable markets in the country. In addition, the local economy in Tucson continues to see improvements. Tucson experienced a one-year job growth of 3.7 percent during the second quarter, compared to the national average of 1.9 percent. Although unemployment is higher than the rest of the country, 5.7 percent compared to 4.9 percent, Tucson’s unemployment has improved relative to the second period last year.

The National Association of Realtors (NAR) has forecasted the Tucson real estate market to grow consistent with the national average in the second-half of 2016. The Tucson area is expected to see lower price growth than the U.S. in the next 12 months, with price expectations for Tucson real estate predicted to grow by 3.0 percent in the second-half, compared to the national average of 3.6 percent. Overall, the Tucson real estate market is shaping up to become a haven for investment activity, which should begin to gain momentum in the second-half of 2016 and beyond.