The Tulsa real estate market is primed for investor activity in 2016. A combination of lagging home prices and appreciations rates for the Oil Capital of the World, which continue to fall below the national average, have created a market ripe for investment opportunity. The median home price for Tulsa real estate was $152,700 during the second quarter, compare to the national average of $239,167. Although home prices are down from a year ago, the trend is improving. Gains in the last three years have extended the trend of positive price growth after the recession. Another positive for the Tulsa housing market is home affordability, which should bode well for investors and homeowners in the second-half of 2016. That said, the Tulsa real estate market has the makings to see big improvements in coming years, including potential for lucrative investments.

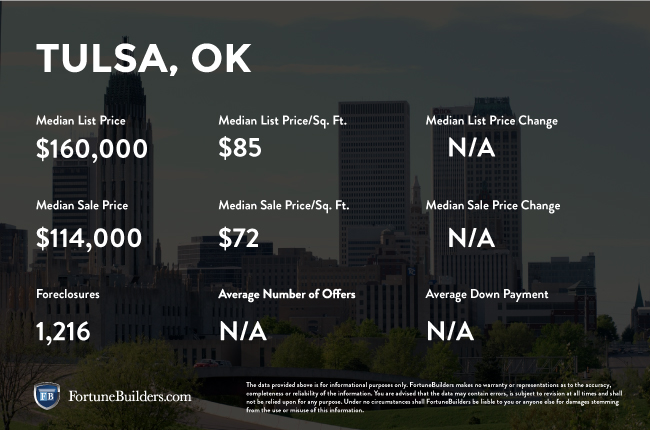

Tulsa, OK Real Estate Market Statistics:

Generally speaking, home appreciation, including total equity gains, are a major indicator of how a real estate market is doing. For the Tulsa real estate market, home appreciation remains far below the national average. One-year appreciation for Tulsa real estate was -2.2 during the second quarter, compared to 4.9 percent achieved by the rest of the country. Furthermore, three-year appreciation rates fared slightly better at 3.9 percent, but still far behind the national average of 17.8 percent. For Tulsa real estate investors and homeowners, the last three years have undercut the steady post-recession home equity growth, despite owners paying down principle. While declining equity gains are never a good thing, it does create a favorable and opportunistic market for Tulsa real estate investing. For those considering Tulsa real estate investments, the following provides a breakdown of appreciation rates in previous years:

- Homes purchased in the Tulsa, OK housing market one year ago have appreciated, on average, by $921. The national average was $14,963 over the same period.

- Homes purchased in the Tulsa, OK housing market three years ago have appreciated, on average, by $13,528. The national average was $46,878 over the same period.

- Homes purchased in the Tulsa, OK housing market five years ago have appreciated, on average, by $32,293. The national average was $82,353 over the same period.

- Homes purchased in the Tulsa, OK housing market seven years ago have appreciated, on average, by $34,129. The national average was $77,054 over the same period.

- Homes purchased in the Tulsa, OK housing market nine years ago have appreciated, on average, by $39,758. The national average was $31,126 over the same period.

In the last seven years, total equity gains for Tulsa real estate have fallen vastly below the national average. However, equity gains surpassed the rest of the country in year nine, as gains in Tulsa totaled $39,758, as opposed to the national average of $31,126. Additionally, homes purchased in 2005, the national price peak, saw equity gains of $50,327, compared to

$34,380.

Another component to pay attention to are foreclosures. As of August 2016, there were 1,172 properties in some stage of foreclosure in the Tulsa, Oklahoma area. According to RealtyTrac, Tulsa foreclosures in the month of August were three percent lower than the previous month and 14 percent lower than the same period in 2015. The number of REO properties in Tulsa also decreased, falling 20.8 percent from the previous month and 27.6 percent from the same time last year.

Tulsa, OK: Real Estate Market Summary:

- Current Median Home Price: $152,700

- 1-Year Appreciation Rate: -2.2%

- 3-Year Appreciation Rate: 3.9%

- Unemployment Rate: 5.4%

- 1-Year Job Growth Rate: -0.2%

- Population: 398,121

- Median Household Income: $40,781

Tulsa, OK: Real Estate Market (2016) — Q2 Updates:

The theme of the Tulsa real estate market so far in 2016 is optimism. Despite disappointing home price and appreciation rates, home affordability remains bright. Tulsa real estate investors and homeowners paid 6.1 percent of their income to mortgage payments, as opposed to the national average of 15.8 percent. In fact, home affordability in Q2 for the Tulsa housing market was better than its historic average of 8.8 percent, which is great news for investment purposes, especially for real estate investors looking for rental properties. All in all, the Tulsa real estate market is one of the more affordable in the country.

Another component Tulsa real estate investors need to be aware of is the local economy. Employment continue to decline in Tulsa, as unemployment rates were 5.4 percent during the second quarter, compared to the national average of 4.9 percent. In addition, Tulsa’s unemployment situation is worse than the national average and weighs on confidence, as one-year job growth fell to -0.2 percent in Q2, whereas the rest of the country saw new jobs grow at 1.9 percent. That said, local employment growth is poor and needs to improve in the second half of 2016.

Lastly, new housing construction for the Tulsa real estate market continues to be hinder by falling prices. The second quarter saw construction levels at 15.1 percent above the long-term average, and single-family housing permits at 5.2 percent. In comparison, the national average saw single-family housing permits increased to 10.6 percent. However, construction in Tulsa has risen relative to last year, suggesting the local inventory has stabilized.

For investors seeking insight on the second-half, the Tulsa real estate market is forecasted to remain below with the national average in the second-half of 2016. According to the National Association of Realtors (NAR), Tulsa real estate is expected to see lower price growth in the next 12 months. Price expectations for Tulsa real estate is anticipated to grow by 2.5 percent in the second-half, as opposed to the national average of 3.6 percent. That said, the second-half of 2016 should see the Tulsa real estate laden with heavy investments.