Key Takeaways

- A lack of capital should never get in the way of your real estate investing dreams.

- Private and hard money loans are perfect for investors looking for specific lending terms and who expect high returns on a deal.

- Home values are high and interest rates still remain relatively low, which means that now is a great time to purchase and invest in real estate.

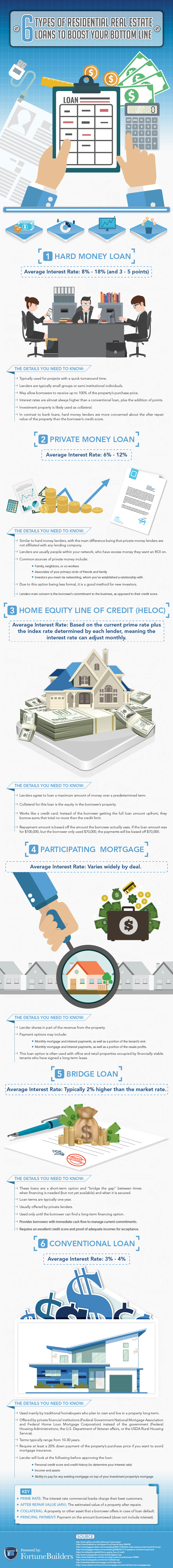

Have you ever dreamed of becoming a high-powered real estate investor but feel like you don’t have the proper funds? Is a lack of capital getting in the way of your financial freedom dreams? If yes, worry no more! Because these residential real estate loans will be the answers to your prayers.

Home values are high and interest rates still remain relatively low, meaning that now is a great time to start (or take to the next level) your investing career. While this is a fact, securing a loan in the traditional fashion – i.e. with big banks – is not as easy as it used to be. Luckily there are more creative ways to finance real estate deals that you’ve probably never thought of. So without further adieu, here are a few options.

Residential Real Estate Loans To Take To The Bank

While your credit score isn’t the only thing banks look at when deciding whether or not you are worthy for a loan, good borrowing history plays an important factor with traditional lenders.

So if your credit score is less than ideal, hard or private money lenders are the people to talk to. Already have some equity built up in your home or investment property? Then a HELOC could be your answer. The point is, there are plenty of residential real estate loans that will boost your business bottom line and help you invest even more!

Which are your favorite? Share in the comments below: