Boulder, Colorado, is frequently recognized as one of the best places to live concerning health, well-being, quality of life, education, and art. However, in a more recent turn of events, Boulder has established itself among the best in something else: real estate markets. Most of Colorado is experiencing a real estate boom, and Boulder is no exception. Having benefited from its close proximity to Denver, the progress made by the Boulder real estate market appears to be real.

It is worth noting, however, that expectations should be tempered. While the future still appears bright, real estate in Boulder is still reeling from the lasting impact of the pandemic. In particular, supply and demand are completely off balance, with the former falling well behind. There aren’t enough homes to keep up with demand, and prices have skyrocketed as a result. Appreciation has priced many buyers out of the market, which begs the question: Is Boulder a good place to invest in real estate?

The Boulder housing market looks like a great place to invest in real estate, as long as investors listen to what the market is saying. With interest rates relatively low and home prices historically high, today may be a good time to consider long-term rental properties; let’s take a look why.

Boulder Real Estate Market 2022 Overview

-

Median Home Value: $1,113,629

-

Median List Price: $1,100,000

-

1-Year Appreciation Rate: +17.2%

-

Median Home Value (1-Year Forecast): -0.3%

-

Weeks Of Supply: 12.8 (+5.9 year over year)

-

New Listings: 129 (-6.6% year over year)

-

Active Listings: 1,193 (+22.9% year over year)

-

Homes Sold: 97 (-31.4% year over year)

-

Median Days On Market: 30.6 (+4.4 year over year)

-

Median Rent: $1,837 (+5.5% year over year)

-

Price-To-Rent Ratio: 50.61

-

Unemployment Rate: 2.8% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 329,543 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $87,476 (latest estimate by the U.S. Census Bureau)

-

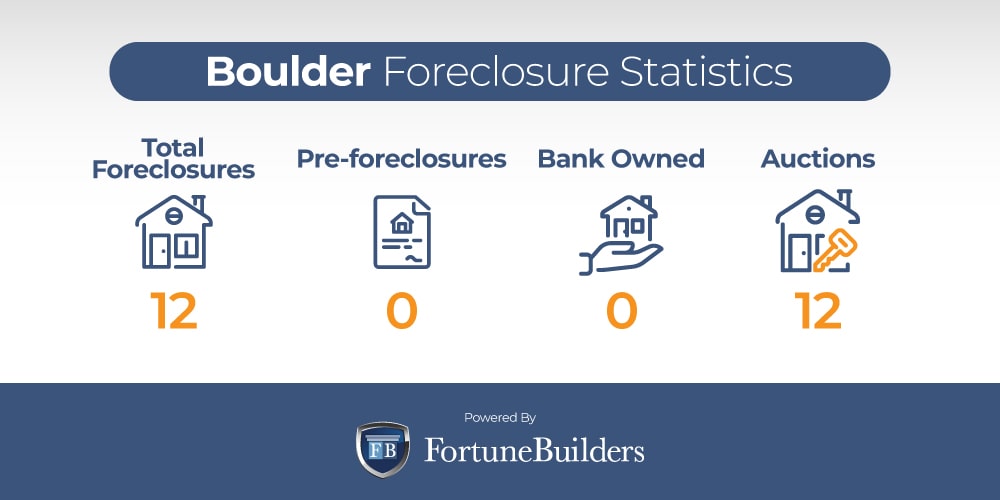

Total Active Foreclosures: 12

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Boulder Housing Market Trends 2022

The Boulder real estate market has followed national trends for the better part of a decade, and 2022 is no exception. It is worth noting, however, that real estate in Boulder is starting to deviate from the norm. As the economy braces for a slowdown, Boulder housing market trends are starting to take shape. Let’s take a look at what real estate investors in Boulder can expect over the next year:

-

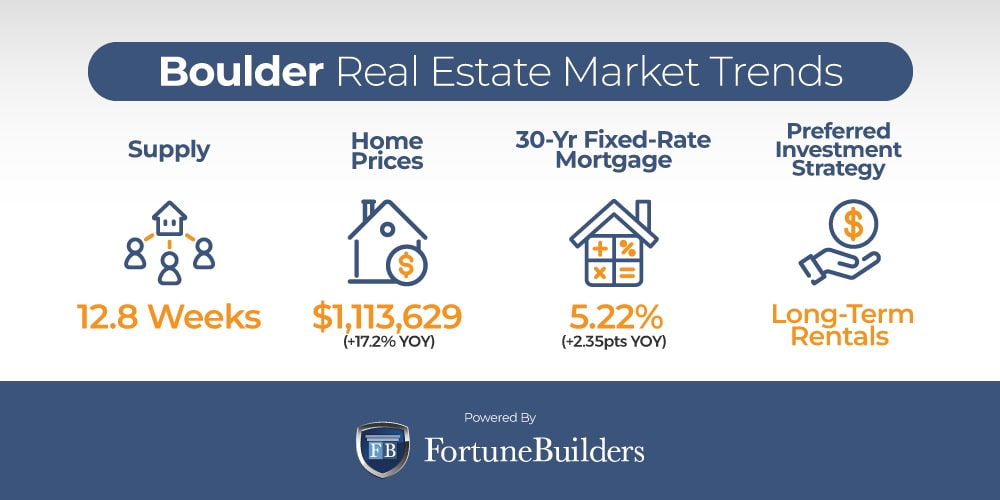

Supply Trends: Long-term supply trends suggest inventory is increasing in the Boulder real estate market. That said, it needs to be noted that any increase in inventory is coming off historic lows. While up year-over-year, Boulder’s 1,193 active listings only amount to about 12.8 weeks of inventory; that means the Boulder real estate market has a little over three months of inventory if sales continue at their current pace. A balanced market is closer to six months, which means Boulder is improving its inventory levels, but also has a long way to go.

-

Home Price Trends:With a median home value of $1,113,629, real estate in Boulder is priced well above the national average. In the last year alone, the average home in the Boulder housing market has appreciated by 17.2%. Much like everywhere else, price increases were directly correlated to unbalanced supply and demand. High levels of competition made the little inventory that was available appreciated at a historic pace. That said, home prices have run so much that Boulder is expecting homes to depreciate in value over the next year.

-

Interest Rate Trends: The Federal Reserve was forced to increase interest rates to combat inflation onset by the pandemic and years of government stimuli. As a result, the average commitment rate on today’s 30-year fixed-rate mortgages (30-Yr FRM) has increased 2.35 points year-over-year. Due to the highest inflation rate the United States has seen in about 40 years, the average rate on a 30-Yr FRM is about 5.22%. The increase has nearly doubled borrowing costs in the last year and reduced mortgage application activity in the Boulder real estate market.

-

Investor Trends: Boulder has one of the highest median home values in the country, making attractive profit margins on flips more difficult to find. As a result, the Boulder real estate investing community has turned towards long-term strategies like rental properties. While mortgage rates are up year-to-date, they are still relatively low and can help offset acquisition costs. The money low rates save investors can increase cash flow from rental properties put in operation.

Boulder Foreclosure Statistics 2022

On a national level, “there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022,” according to ATTOM Data Solutions’ Midyear 2022 U.S. Foreclosure Market Report. Comparatively, foreclosures are up more than 153% from the same period last year and inching closer to pre-pandemic levels.

“Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “While overall foreclosure activity is still running significantly below historical averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023.”

For context, the Colorado real estate market was responsible for contributing 2,322 foreclosures to the national numbers in the first half of 2022. One in every 1,073 homes filed for foreclosure in the first half of the year, bringing the state’s foreclosure rate up to 0.09%.

Foreclosures are up across the entire state, and the Boulder real estate market is no exception. That said, Boulder only has about 12 foreclosures, according to RealtyTrac. All of the city’s foreclosures are either up for auction or expected to be at some point in the near future. As a result, Boulder real estate investors looking to acquire a deal below market value may have the best chance of doing so at a local auction.

Boulder Median Home Prices 2022

The median home value in Boulder real estate has experienced every end of the spectrum in as little as 10 years. In the third quarter of 2012, the median home value in Boulder was around $468,000 and just starting to recover from The Great Recession. Fast forward to today, and the city’s median home value is $1,113,629, or 137.9% higher.

Home prices in the Boulder real estate market have increased for ten consecutive years. However, the fastest rates of appreciation have taken place over the last two and a half years, when the pandemic took hold of the global economy. Since March 2020, when COVID-19 was officially declared a pandemic, the median home value in the Boulder real estate market has increased by 37.8%. For some perspective, the median home value in the United States increased by 40.6%.

Moving forward, high prices in the Boulder real estate market are expected to lead to a drop in home values over the next 12 months. For the first time in ten years, prices are expected to fall year-over-year. While the median home value in the United States is expected to increase a modest 2.7%, the median home value in Boulder may drop 0.3%. The decline is small but suggests local home values may have peaked for now.

Boulder Housing Market Forecast 2022-2023

The Boulder real estate market is in the midst of a changing macroeconomic environment. Most notably, the Fed has increased interest rates to combat inflation. As a result, supply and demand are both under pressure. At the very least, the market is working with different indicators than in years past, which begs the question: What does a Boulder housing market forecast look like over the rest of 2022 and into next year? Let’s take a look:

-

Home Values Will Drop: With most metropolitan areas around the country expected to appreciate over the next 12 months, the Boulder real estate market is one of the few locations analysts expect real estate to depreciate. While not much, the forecasted 0.3% drop is a sign the market may attempt to normalize. Prices have run too high for too long. Now, with the economy expected to slow, competition may cool off and force sellers to drop their prices.

-

Rents Will Rise: Despite Boulder housing market forecasts calling for a drop in home values, rents are expected to keep climbing. If for nothing else, demand for rental units is increasing with each person who is priced out of the buying market. As long as inventory remains low on the buyers’ side, demand for rentals will remain high, and so will rents.

-

Interest Rates Will Rise: The latest consumer price index report suggests inflation is coming down but still remains higher than the economy would like to see. As a result, the Fed may need to increase interest rates further. There’s no telling how high interest rates will go or if they will even happen, but as long as inflation is at a historic high, there’s a good chance mortgage rates will increase.

Should You Invest In The Boulder Real Estate Market?

The Boulder real estate market was the beneficiary of several years of unprecedented economic growth. Few markets across the country, for that matter, have had a better decade than Boulder. Nearly 10 years’ worth of year-over-year appreciation has elevated home prices to historic levels.

Even the Coronavirus, which took the world by storm in the first quarter of 2020, couldn’t keep local appreciation rats in check for too long. While the pandemic did temper price increases temporarily, the Fed’s safety measures to drop interest rates resulted in a dramatic increase in demand in the Boulder housing market. Prospective buyers came out in droves to take advantage of lower borrowing costs, and the resulting competition increased prices almost overnight.

Boulder real estate market trends saw competition simultaneously increase home values and lower profit margins for investors who wanted to flip properties. As a result, real estate investors in Boulder have turned to rental properties. While up year-to-date, relatively low interest rates solved two growing problems for investors: Lower borrowing costs helped offset the city’s high prices and increased monthly cash flow from properties put into service.

Low inventory levels have increased home prices and competition in Boulder. Moving forward, it will be hard to find affordable housing for sale. Many people will be forced to rent—even those intent on buying soon will be relegated to renters as long as inventory remains tight. As a result, rental property investors should see demand for living spaces increase, and perhaps even the amount they can charge in rent.

Investors looking to flip and rehab properties, on the other hand, aren’t necessarily out of luck. While today’s high prices make it hard to find deals with attractive profit margins, there’s a good chance we’ll see an influx of foreclosures hit the market after the dust has settled from the Coronavirus, and perhaps an impending recession. In the event the economy slows, foreclosures will rise, creating a great opportunity for investors to help distressed homeowners.

The chances of more foreclosures hitting the market sooner rather than later are increasing, and those who prepare now could find themselves in a great position to make acquisitions in the Boulder housing market.

Summary

The Boulder real estate market has certainly cooled off from the blistering pace it exercised in years past. Most notably, higher home prices and mortgage rates have slowed down activity. With fewer people looking to buy the little inventory that is available, prices are expected to come down—albeit slightly. That said, the slowdown in activity isn’t an indictment on the Boulder housing market, but rather a return to normalcy.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/boulder-co/home-values/

https://www.zillow.com/co/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

https://www.freddiemac.com/pmms

https://www.redfin.com/news/data-center/

https://www.bls.gov/eag/eag.co_boulder_msa.htm

https://www.census.gov/quickfacts/bouldercountycolorado

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.realtor.com/realestateandhomes-search/Boulder_CO/overview

https://www.realtytrac.com/homes/co/boulder

https://www.attomdata.com/news/market-trends/foreclosures/attom-midyear-2022