Key Takeaways

- Buying a rental property can be a great investment, as long as you have a clear business strategy.

- Follow our “buying a rental property checklist,” which can help get you started in 10 steps.

- You won’t want to miss some of the best pieces of advice the pros wish they knew before buying their first rental property.

Buying a rental property can be an exciting prospect for a multitude of reasons; it can bring in a solid revenue of income, it can help secure your retirement, it symbolizes a certain financial or investing milestone you have reached, and perhaps you have always wanted to try your hand at “landlording.” You may be wondering what to know before buying a rental property, so that you may head into your investment with some advance knowledge. Below you will find an extensive guide to help answer any questions you may have, including some advice from the pros.

Is Buying A Rental Property A Good Investment?

Buying a rental property can be a good investment, even great, as long as you have a solid strategy in place. This includes knowing what to look for when buying a rental property, as well as having the right mindset going into the investment. Moreover, it includes having a clear vision of your personal goals and finances, as well as understanding that buying a rental property should be treated like a business. You may have voiced to yourself “should I buy a rental property,” or perhaps with confidence, “I want to buy a rental property!” Regardless of what your current mindset might be, taking a carefully researched approach will help lead you to a good investment.

[ Thinking about investing in real estate? Learn how to get started by registering to attend a FREE real estate class offered in your area. ]

Buying A Rental Property Calculator

When researching how to buy a rental property, one of the very first tools that you should add to your arsenal is a good rental property calculator, like the one offered on SparkRental. Whenever giving serious consideration to a rental property, it is of utmost importance to perform a financial analysis to ensure that buying the property would make for a smart investing decision. Some indicators to measure include your potential monthly cash flow, return on investment, capitalization rate, and cash-on-cash return. Although performing a proper financial analysis can be complicated, making it a routine part of your rental property searches will not only help you develop a good instinct when it comes to picking out good deals from bad ones, it will in some sense force you to mind your due diligence. The purchase price, renovation costs, estimated rent, mortgage payments, taxes, insurance and vacancy rate are all examples of things to know before buying a rental property, and that are needed in order to be able to perform your calculations.

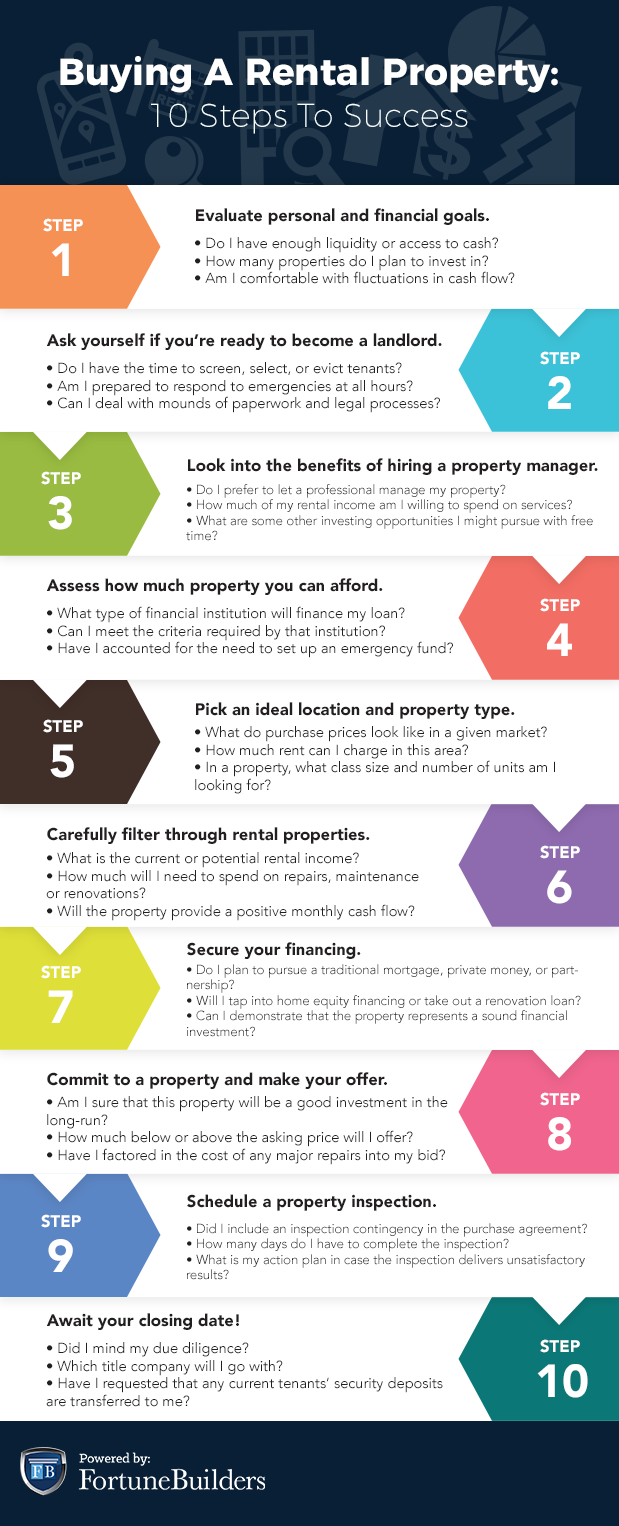

Buying A Rental Property Checklist: 10 Steps To Success

- Evaluate your personal and financial goals.

- Ask yourself if you’re ready to become a landlord.

- Look into the benefits of hiring a property manager.

- Assess how much property you can afford.

- Pick an ideal location and property type.

- Carefully filter through rental properties.

- Secure your financing.

- Commit to a property and make your offer.

- Schedule a professional property inspection.

- Await your closing date!

Buying a rental property is no easy feat, but a property checklist can make your life much easier. Below you will find a checklist that will not only prepare you with what to know before buying a rental property, as well as steps to buying a rental property, but questions to ask when buying a rental property. Be sure to bookmark the buying a rental property checklist below:

9 Pieces Of Advice On Buying A Rental Property (From The Pros)

- “It’s all about the location.”

- “Consider a property manager.”

- “Save up for unexpected costs.”

- “Property taxes will go up.”

- “Compare insurance rates.”

- “Prepare for the costs of renter damage.”

- “Set rules and stick to them.”

- “Always go for an inspection.”

- “Use the one percent rule.”

Any advice on buying a rental property, and then managing it thereafter, is worth its weight in gold. Below you will find advice that seasoned rental property owners would wish they had known before buying a rental property.

Location And Neighborhood

If you interviewed successful rental owners and asked how they pick their properties, most likely they will tell you, “location, location, location!” Some may even argue that the market and neighborhood you select is almost, possibly even more, important than the rental property itself. Choosing your area wisely will help you gain access to rental unit demand, as well as ensure good tenants. For example, choosing properties that are close to universities or school districts can help ensure that you will have ample demand.

Property Management

Although the idea of becoming a landlord may be exciting to some investors, anyone preparing to purchase a rental property should give careful consideration to the option of hiring a property manager or property management company. Being a landlord is a serious responsibility and commitment, and investors should make absolutely sure it is the right fit. For example, being a landlord could mean responding to emergencies at all hours, dealing with bad tenants, and not having any time to pursue other investment opportunities. Of course, these are worst-case scenarios, but are often unavoidable when choosing a career as a landlord. For a proportion of your monthly rental income, you can hire a property manager to serve as the landlord on your behalf.

Unexpected Costs

Many green property owners fail to factor in an emergency fund when figuring out their rental property finances. If you have a major plumbing disaster, have a roof deteriorate, or have appliances break down, how will you pay for it? One would be naive to think that none of these unexpected costs will percolate from time to time. Many landlords will put away a set percentage of the monthly operating income into an emergency fund to help cover for these often untimely, unexpected and expensive repairs.

Property Taxes

Similar to insurance premiums below, property taxes often take the back-burner in investors’ minds when they perform a quick deal analysis. However, this could be a grave mistake. Property tax rates vary by location, so be sure to become familiar with the tax rates in your local area. In addition, keep in mind that while primary residences may benefits from tax breaks, first-time investors are often shocked to find out the magnitude of property tax costs when they begin to increase their portfolio. Make sure to consult a tax professional to make sure that you will be able to afford your property taxes.

Insurance Premiums

Before purchasing any type of investment property, oft-forgotten costs such as insurance and taxes should always be factored in. Make sure to spend plenty of time how much of your budget you would like to spend on an insurance premium, how much coverage you would like, and what type of coverage you would like. For example, what type of natural disasters are common in your market? If your rental property is located in an area commonly susceptible to, for example, tornadoes or sinkholes, you may want to consider a higher-cost insurance package that provides more coverage. Regardless of your decision, make sure to answer these questions carefully so that you can compare insurance policies and pick the best plan for your property based on your needs.

Screening Tenants

New landlords might be shocked at just how much renters can cause in property damage. At times, there are nightmare tenants that leave behind a lot of damage. However, even the best of tenants can still cause damage over time. If you have ever been a renter before, you may recall that your landlord or property manager will usually not hold “normal wear and tear” against you during the move-out process. However, the costs to replace or repair normal wear and tear has to come out of the landlord’s pocket. This is the reason for which good tenants are worth their weight in gold. Be sure to thoroughly check potential tenants’ financial, work and rental history, and try to pick out tenants who you can trust to take immaculate care of your property.

Setting Rules

Do not be afraid to set certain rules and stick to them. Whether it be your policy on pets or rent that is paid late, it will be to your benefit to be up-front about any rules and set any precedents early on. For example, let us say that you charge twenty dollars per day when rent is paid late. You have a tenant who is consistently late in paying their rent. Perhaps out of kindness, let us say that you did not assess the late fees. This creates a pattern in which you allow your tenants to take advantage of you. If you were to choose to enforce your policy late in the game, it could create uncomfortable conflict that could have been avoided if you had stuck to your own rules from the get-go.

Property Inspection

Scheduling a property inspection as a part of minding due diligence should be an absolute must on any investor’s checklist. An inspection can help you get an accurate estimate of any repairs you will want to make, as well as address any serious issues that were not detected at first glance. The cost of repairs, as well as the length of time repairs will take may make or break your investment deal. Including an inspection clause into your purchase agreement can help protect you in the case that you need to back out.

The 1% Rule

Many industry veterans abide by a rule that is simple in concept: the 1% rule. This rule help provides a rough benchmark for what the net operating income should be in order to make the investment worth considering. For example, if a property costs $150,000 to acquire, it should bring in at least $1,500 per month (one percent of $150,000) in order to be deemed a good candidate. This rule comes in handy when investors are still filtering through volumes of property listings, allowing them to quickly sort promising deals from bad ones. Of course, once an investor has narrowed down their search to just a few listings, it is imperative that they perform a deep financial analysis for each.

The process of buying a rental property can be met with excitement, but should also be met with plenty of caution and respect. If absorbed anything from the sections above, it should be that the most successful rental property owners are ones that have spent a lot of time performing deal analyses, minding their due diligence, and developing a sound business plan. However, by making use of helpful checklists and advice from seasoned industry professionals, even the greenest of investors can buy their first rental property like a pro.

Have you ever considered buying a rental property? If so, do you think you would serve as your own landlord, or hire a property manager? Feel free to start a discussion below: