It’s tax season, and it’s to your advantage to know about the taxes and deductions that apply to you. The capital gains tax on real estate investment property is something you want to be familiar with if you own any real estate, whether it’s your home or another type of investment property. This is especially true if you recently sold, or plan to sell, your property, which is when capital gains tax goes into effect. While understanding capital gains tax on real estate may seem overwhelming at times, having a firm grasp of capital gains and respective tax requirements ensures that investors and property owners can properly benefit from their investments and be squared away with the IRS.

In this article, we will explore the real estate capital gains tax, short-term vs. long-term capital gain tax rate, as well as how to avoid capital gains tax as much as possible if you believe your assets will be subjected to it. With FortuneBuilders’ helpful guide, real estate investors and property owners can feel confident heading into the tax season.

What Is Capital Gains Tax On Real Estate?

-

A capital gains tax on real estate is a fee levied on profits made from the sale of a property.

-

Capital gains taxes can be applied to both securities (such as stocks and bonds) and as well as real estate and other tangible assets.

-

The difference between what you paid for an asset or property and what you sell it for is what the IRS uses to assess capital gains tax.

The name says it all: capital gains tax on real estate simply refers to the tax levied on any gains made from a real estate sale. To clarify, capital gains are only realized when an asset is sold for more than it is purchased. Therefore, you may not be taxed on capital gains if you sell a property for less than you bought it for.

Generally, it’s rare to sell an asset for more than it was purchased for due to depreciation, but if an individual does sell their asset for more than they acquired it, the asset would then be classified as a capital gain. Capital gain can be applied for more than just real estate gains. It can also apply to a car, boat, or even rare piece of artwork that is sold for more than it was initially purchased.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

How Much Is A Capital Gains Tax On Real Estate?

Now that we understand what capital gains tax is, let’s explore how much capital gains taxes typically are so that taxpayers can properly anticipate any payments that will need to be made. The tax rate for these capital gains isn’t an umbrella percentage but is based on numerous factors that affect the percentage of taxable gain. Within the context of real estate, if you were to sell a property, the capital gains tax you would owe depends on three main factors:

-

Duration of time in which the property was owned

-

The cost of owning the property, including any fees paid

-

Income tax bracket

-

Tax filing status

According to Nate Tsang, the Founder and CEO of Wall Street Zen, “tax on a long-term capital gain in 2021 is 0%, 15%, or 20% based on the investor’s taxable income and filing status, excluding any state or local taxes on capital gains. On the other hand, short-term gains (assets held less than a year) are taxed on ordinary income rates and can go as high as 34%, depending on the income level. This is why it is advisable to hold an investment longer than a year so that you can take advantage of lower long-term capital gains tax rates.” We’ll explore short-term and long-term capital gains tax rates a bit further later on in the article.

When Do You Pay Capital Gains Tax On A Home?

There are certain circumstances where a home sale may be fully taxable. In these cases, capital gains taxes are often unavoidable, though you should always speak with a tax planning advisor to confirm. For example, if you have used the capital gains exclusion on a home sale within the last two years you may not qualify for the exclusion.

Other circumstances include properties that are the seller’s primary residence, if the property was recently acquired through a 1031 exchange, or if the seller pays expatriate taxes. Each of these situations may open up complex tax questions, so again be sure to consult with a professional before filing.

Generally, if any of the following conditions are met, you must pay tax on the entire gain from the sale of a home.

-

You didn’t live in the house as your primary residence.

-

You owned the property for less than two years out of the five years before selling it.

-

You are subject to expatriate tax.

-

You did not live in the house for at least two years before selling it in the five-year period preceding the sale. Consult IRS Publication 523 if you are disabled, in the military, Foreign Service, or intelligence community for tax breaks.

-

You used the $250,000 or $500,000 exclusion on another property in the two years preceding the sale.

-

You acquired the residence in the last five years through a 1031 or “like-kind,” exchange where you trade one investment property for another.

The 2-In-5 Rule

The capital gains tax is levied differently between investment properties and primary residences. As you might expect, the IRS has specific requirements on what qualifies as a primary residence. The 2-in-5 rule states that you must live in a property for two out of the last five years for that property to qualify as your primary residence. Note that the two years do not have to be consecutive, but if you are married and filing jointly both spouses need to meet the requirement. With the 2-in-5 rule, you can qualify for certain tax deductions and avoid the same level of taxation as an investment property.

How To Calculate Capital Gains Tax

We’ve explored how capital gains tax on real estate works, let’s dive into how capital gains tax is calculated. If you’re unfamiliar with capital gains, here are some basics you should know.

Capital gains are simply the profit you make when selling an asset, such as stocks, real estate, and other investments. The formula for calculating capital gains tax for real estate will work similarly for any other asset, with slight intricacies that will be covered later. The formula for capital gains tax is:

The IRS (Internal Revenue Service) taxes investors on these capital gains, thus the name “capital gains tax.” Any time you make income from employment, the government will take a cut. Any income earned from selling assets is no different.

You may wonder if you will owe any taxes if an asset you own, whether real estate or stocks, increases in value. The answer is no. You will only owe capital gains tax when your gains are realized, which means you’ve sold the asset and pocketed the cash. When you’re still in possession of the asset, it’s known as an “unrealized gain” regardless of the duration.

Short-Term Capital Gains Tax

As we mentioned previously in the article, the capital gains tax structure varies significantly based on numerous factors. One of the first components of determining how much a capital gains tax will be is the duration of time it was owned. Capital gain taxes for real estate will be determined based on whether your real estate investment was short-term or long-term.

Lily Wili, CEO of Ever Wallpaper says that “Short-term capital gains are usually not subject to a special tax rate. Instead, these earnings are often taxed at the same rate as your regular earnings. The rate you pay is determined by your income and filing status”.

If you’ve owned property and sold it after less than one year, then you’ll be subject to the short-term capital gains tax rate. The rate is the same as the income tax rate based on your income bracket. Due to the rate being determined by your tax bracket, the capital gains tax rate for real estate held for less than a year can be pretty steep. This is why many investors will purchase and hold onto their assets for longer than a year to improve their tax-saving strategy.

Long-Term Capital Gains Tax

As we discussed, it’s more common for those looking to save money on capital gains tax to possess their assets for longer than a year. If you’ve owned property and sold it after a year or longer, then you fall into the long-term capital gains tax rate category. Remember, the long-term capital gains tax rates are 0%, 15%, or 20%, depending on your income and filing status. In the next section, we’ve broken down the tax rate by income bracket. These rates will be much lower than being taxed under the regular income tax rate for short-term capital gains, so most people opt for long-term capital gains tax rates.

Capital Gains Tax Rates 2022

If you are filing your taxes as a single person, your capital gains tax rates in 2022 are as follows:

-

If your income was between $0 and $41,675: 0%

-

If your income was between $41,676 and $449,750: 15%

-

If your income was $459,750 or more: 20%

If you are filing your taxes as married, filing jointly, your capital gains tax rates are as follows:

-

If your income was between $0 and $83,350: 0%

-

If your income was between $83,351 and $517,200: 15%

-

If your income was $517,200 or more: 20%

If you are filing your taxes as the head of household, your capital gains tax rates are as follows:

-

If your income was between $0 and $55,800: 0%

-

If your income was between $55,801 and $488,500: 15%

-

If your income was $488,500 or more: 20%

Last but not least, if you are filing your taxes as married, but filing separately, then your capital gains tax rates are as follows:

-

If your income was between $0 and $41,675: 0%

-

If your income was between $41,676 and $258,600: 15%

-

If your income was $258,600 or more: 20%

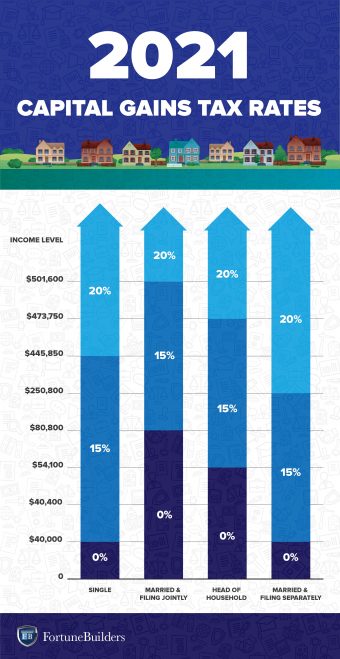

Capital Gains Tax Rate 2021

If you are filing your taxes as a single person, your capital gains tax rates in 2021 are as follows:

-

If your income was between $0 and $40,000: 0%

-

If your income was between $40,000 and $445,850: 15%

-

If your income was $445,850 or more: 20%

If you are filing your taxes as married, filing jointly, your capital gains tax rates are as follows:

-

If your income was between $0 and $80,800: 0%

-

If your income was between $80,801 and $501,600: 15%

-

If your income was $501,600 or more: 20%

If you are filing your taxes as the head of household, your capital gains tax rates are as follows:

-

If your income was between $0 and $54,100: 0%

-

If your income was between $54,100 and $473,750: 15%

-

If your income was $473,750 or more: 20%

Last but not least, if you are filing your taxes as married, but filing separately, then your capital gains tax rates are as follows:

-

If your income was between $0 and $40,400: 0%

-

If your income was between $40,400 and $250,800: 15%

-

If your income was $250,801 or more: 20%

When Is The Sale Of A Home Taxable?

There are times where you will not meet the exemptions for capital gains tax, and you will need to pay taxes on the sale of your home. The first way this could happen is if the home you are selling was not your primary residence for at least 2 of the last 5 years that you owned it. Another reason for your house sale being taxed could be that it was acquired through a 1031 exchange within the last 5 years. When using a 1031 exchange the tax is deferred at the time, and not actually eliminated completely. Selling your home within this small time frame would trigger the sale to once again be eligible for taxation. Another reason that your home sale could be taxed is that you have ended your United States residency and you are now eligible for expatriate taxes. Finally, your sale could be taxed if you sold another home within the last 2 years and you opted to use the capital gains tax exclusion on that property sale.

Capital Gains Tax On Real Estate Example

While we’ve explored what the capital gains tax rates of 2021 look like, let’s further explore how these figures would be applied for an asset that would be classified as a capital gain. There’s nothing better than an example to help pull all of these concepts together.

Let’s say that you are an individual who is filing single this year. Your annual salary is $65,000, which puts you at a tax rate of 22%. You just sold your first home for $15,000 more than the original purchase price. (You got a promotion and are moving to your company’s headquarters in a different city.)

If you owned the home for less than one year, then you’d be subject to short-term capital gains tax. If you recall, the short-term capital gains tax rate is the same as your income tax rate. At 22%, your capital gains tax on this real estate sale would be $3,300. ($15,000 x 22% = $3,300.)

If you owned the home for one year or longer, then you’d be liable for the long-term capital gains tax rate. Your income and filing status make your capital gains tax rate on real estate 15%. Therefore, you would owe $2,250.

Capital Gains Tax On Rental Properties

The capital gains tax on rental properties comes into play when selling said rental. From there, the exact rate will be determined based on your income tax bracket, how long you owned the property, and your marital status. As mentioned above, the capital gains tax on rental properties will be determined on a short-term or long-term basis, with more favorable rates associated with the long term.

Further, the capital gains tax will not be incurred on the entire sale value of the home — only on the difference between the original purchase price. This already reduces the amount you have to be worried about when seeking certain tax advantages. Continue reading to learn more about how to manage capital gains taxes on rental properties.

How To Avoid Capital Gains Tax On Real Estate

Appreciation of real estate is a great thing, depending on how you look at it. However, as a seller, that could translate to thousands, or even hundreds of thousands, of dollars in taxes after a home sale.

Fortunately, there are a few things homeowners and investors can do to offset their capital gains tax on real estate:

-

Offset Gains With Losses

-

1031 Exchange

-

Convert Rental Property To Primary Residence

1. Offset Gains With Losses

One of the simplest ways to reduce your exposure to the capital gains tax is to offset the profits made from selling a home with losses that have been realized from another investment. While the Internal Revenue Service (IRS) taxes profits made from investments, investors can deduct losses from their taxable income. Otherwise known as tax-loss harvesting, this particular strategy reduces exposure to taxes levied on gains. By accounting for both gains and losses, investors can reduce the capital gains they are taxed on.

2. 1031 Exchange

The 1031 Exchange, named after Section 1031 of the IRS tax code, allows investors to put off paying capital gains taxes if they reinvest the proceeds made from selling a rental property into another investment.

The 1031 Exchange is a valuable tool for investors looking to shelter their profits from taxes, and it can be used as many times as necessary. However, taxes will be due the moment profits are realized. In other words, the 1031 exchange merely puts off paying capital gains taxes until sellers hold onto the proceeds from a home sale.

3. Convert Rental Property To Primary Residence

The IRS grants better tax benefits to those who sell a primary residence than investors who sell rental properties. It’s becoming commonplace for rental property owners to convert their investments into primary residences before carrying out the subject property’s sale. That way, they’ll be able to offset some of the capital gains taxes levied in their direction.

To make the deduction, homeowners must meet specific criteria set forth by the IRS. Namely, they must have owned the home for at least five years. Additionally, the homeowner must have lived in the subject property for two of the five years leading up to the sale. That’s an important distinction to make, as the amount of time the investor lives in the home (relative to the time it was placed in service) will help determine the amount allowed to be deducted.

Additional Considerations

When classifying a property as a primary residence, there are a few scenarios with unique rules. For example, military members and government officials on extended duty can defer the five year requirement. In these cases, homeowners and their spouses can defer the requirement for up to ten years while on duty. This scenario essentially turns the 2-in-5 rule to a 2-in-15 requirement.

Another common scenario involves divorce, where one spouse is granted ownership of the house. The homeowner spouse can still use the years the home was jointly owned to count towards the residency requirements. Further, they can use the time spent leading up to the transfer of property if they were living in the house as well. A few other unique situations may demand a closer look when calculating possible capital gains taxes. If you have any questions always be sure to consult with a tax professional.

Lowering Taxes With Installment Sales

If you are selling a rental property or a second home, you may want to look into installment sales. This will defer part of the gain that you made from the sale to a later time, thus reducing your taxable income. You will then receive payments that include principle, gain, and interest. The principle will not be taxed, and the interest will be taxed. Finally, instead of getting taxed on the lump sum, the fractional part of the gain will result in a lower total tax. You will also need to look into if you are going to be taxed for long-term or short-term capital gains, which is determined based on how long you owned the property before selling it.

Summary

If you’ve ever wondered if there is a real estate capital gains tax sold for a profit, the answer is yes. The good news is that these taxes are not that much more complicated than your income tax and are not realized until you’ve sold the property. If you’ve owned the property for less than one year, then you’ll end up owing more capital gains tax than if you’ve held onto it for more than one year. Thus, the tax structure incentivizes you to buy and hold real estate. By understanding the capital gain tax rate of 2022 and how capital gains taxes on real estate work, you can properly anticipate tax season and maximize your profits by strategically selling assets when the time is right.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!