Jump To Another Year In The Columbia Real Estate Market:

The Columbia real estate market in South Carolina has been hit hard by the pandemic and its resulting foreclosures. While the local economy has made great improvements in recent years, there’s still plenty of ground to be made up in the wake of COVID-19. As a result, a larger percentage of homeowners have found themselves underwater compared to a majority of markets across the country. Despite the city’s foreclosure rate, however, real estate in Columbia has become a commodity for today’s budget-conscious investors. Both traditional sales and distressed properties appear to offer investors a lot of potential. There’s no doubt about it: the Columbia housing market represents an opportunity for those who know how to translate what the market is telling them.

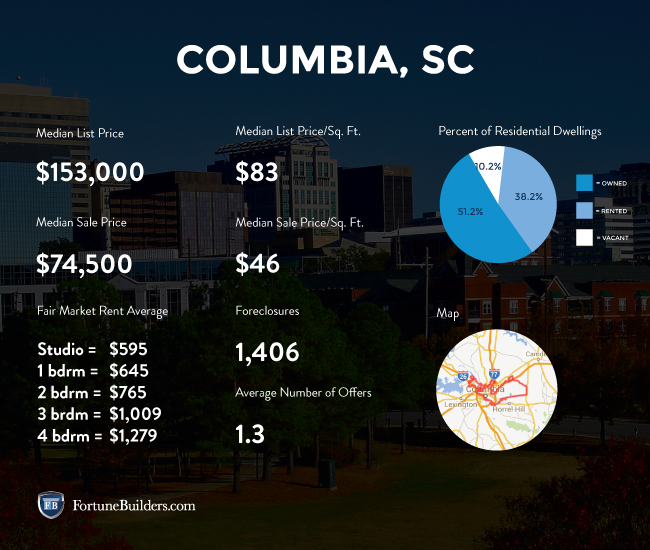

Columbia Real Estate Market 2021 Overview

-

Median Home Value: $164,679

-

1-Year Appreciation Rate: +11.9%

-

Median Home Value (1-Year Forecast): N/A

-

Median Rent Price: $1,175

-

Price-To-Rent Ratio: 11.67

-

Unemployment Rate: 4.5% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 131,674 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $47,286 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 12.25%

-

Foreclosure Rate: 1 in every 3,790 (2.6%)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Columbia Real Estate Investing

Home prices in Columbia have increased year-over-year for the better part of a decade. As a result, profit margins for traditional “flips” are growing thinner and thinner. That’s not to say rehabbing isn’t still a viable exit strategy in the Columbia real estate market, but rather that new indicators created in the wake of COVID-19 seem to favor long-term investment strategies. Rental property portfolios, in particular, are more attractive than they have been in years because of the new landscape created by the Coronavirus. Here are some of the most prominent indicators working in favor of real estate investors in 2021:

-

Interest rates on traditional loans are historically low

-

Cash flow from operations will increase in a lower interest rate environment

-

Years of cash flow can easily justify today’s higher acquisition costs

-

Inventory shortages will increase rental demand

As of April, the average rate on a 30-year fixed-rate loan was 3.06%, according to Freddie Mac. While 2021 has seen rates increase year-to-date, they are still low enough to be more attractive than in year past. That said, today’s borrowing rates have brought down acquisition costs for those looking to add to their passive income portfolio. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to pad their bottom lines.

In any other market, Columbia’s 11.67 price-to-rent ratio would work against rental property owners. If for nothing else, it is unequivocally more affordable to buy than rent in Columbia. However, inventory levels in Columbia are lacking. Even a great deal of potential buyers will be relegated to the renter pool because of insufficient listings. Therefore, landlords will be able to simultaneously increase asking prices and mitigate the risk of vacancies.

Investors are lucky to have several viable exit strategies at their disposal. Still, none appear more attractive than building a proper rental property portfolio in the wake of new Columbia real estate trends. Simply put, too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

2021 Foreclosure Statistics In Columbia

According to RealtyTrac, a nationally recognized real estate information company specializing in distressed properties, Columbia has a very high distribution of distressed properties. With approximately one out of every 3,790 homes in some stage of distress (default, auction, or bank-owned), the South Carolina city boasts a foreclosure rate of about 2.6%. At that rate, it boasts one of the highest foreclosure rates in the country. The country as a whole, for that matter, has an average foreclosure rate of 0.8%.

Investors looking to take advantage of distressed inventory levels should pay special considerations to the areas with higher distributions of distressed inventory. To narrow the search, here’s a list of the neighborhoods with the highest distribution of foreclosures:

-

29203: 1 in every 2,895 homes is currently distressed

-

29209: 1 in every 3,043 homes is currently distressed

-

29206: 1 in every 3,089 homes is currently distressed

-

29229: 1 in every 3,138 homes is currently distressed

-

29223: 1 in every 3,301 homes is currently distressed

The pandemic is expected to create an influx of foreclosure filings over the course of 2021. The financial burden created by the pandemic and government-mandated quarantines has already proven difficult for many homeowners to keep up with mortgage obligations. As a result, it is safe to assume more homeowners will file for foreclosure in the Columbia real estate market as the year progresses. Consequently, investors who line up financing and position themselves for success at this time could be in line for a busy second half of 2021.

2021 Median Home Prices In Columbia

The median home value in Columbia is approximately $164,679. While well below the national average, real estate prices in Columbia have made up a lot of ground over the course of a decade. Since the beginning of January 2016, in fact, home prices have increased 33.8%. In the last year (alone), median home prices have jumped 11.9%. The increase is most likely the result of three specific indicators: demand, supply, and the city’s strengthening economy. Stronger economic fundamentals have enabled more people to actively participate in the market. However, available inventory levels have restricted the number of buyers that can actually follow through with a purchase. Competition for housing has jumped, along with home prices. There doesn’t appear to be an answer to the inventory shortage coming soon, which will push prices higher for the foreseeable future. Therefore, it’s safe to assume prices will continue to rise for the foreseeable future.

The Columbia real estate market has been hampered by foreclosures, more so than most cities across the country, which bodes well for the whole Columbia real estate investing community. In fact, only a handful of cities have a higher foreclosure rate than Columbia. However, recent progress has fostered optimism for buyers, sellers. Investors, in particular, have found real estate in Columbia to be particularly attractive. The city’s foreclosure activity suggests below-market deals are more abundant, which is great for profit margins. Not only that, but demand for houses is on the rise. Those investors who can meet that demand could find Columbia to be a great city to invest in.

Columbia Real Estate Market: 2020 Summary

-

Median Home Value: $138,100

-

1-Year Appreciation Rate: +6.1%

-

Median Home Value (1-Year Forecast): +2.8%

-

Median Rent Price: $1,175

-

Price-To-Rent Ratio: 9.79

-

Average Days On Market: 66

-

Percent With Negative Equity: 14.6%

-

Unemployment Rate: 2.8% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 133,451 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $43,650 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 12.25%

-

Foreclosure Rate: 1 in every 1,216

Columbia Real Estate Investing 2020

Columbia real estate market trends diverged from traditional, cyclical trends in 2020. Much like the rest of the country, real estate in Columbia was doing really well heading into the year, carrying over years of momentum. The trends were expected to continue for all intents and purposes, but the Coronavirus had other ideas. Once COVID-19 was officially declared a pandemic, activity ended abruptly. Mortgage underwriters stayed home from work, homeowners took listings off the market, and buyers refused to tour homes. Fear and uncertainty ran rampant, and the local real estate market took one step back.

In taking a single step back, however, the Columbia real estate market gathered itself and took several steps forward. The pandemic’s impact on real estate may have been misinterpreted. Thanks, in large part, to low interest rates introduced by the Fed, pent-up demand, and larger savings accounts from stimuli (and less spending), more people were looking to buy a home than in years past.

Demand turned into competition, seemingly overnight. With interest rates well below three percent, it was simply too attractive not to at least look at buying a new home. The resulting competition drove up prices in just a few short weeks. In fact, prices rose over the rest of 2020, to the tune of 6.1%. Therein lies the most prominent trend which influenced the Columbia real estate investing community: High prices drove investors to consider long-term strategies. Appreciation rates, combined with low borrowing costs, made becoming a landlord more attractive. Low rates simultaneously help justify higher prices and increase monthly cash flow from operations. That’s not to say investors didn’t flip, but rather that becoming a landlord was simply more attractive over the course of 2020.

Columbia Real Estate Market: 2016 Summary

-

Current Median Home Price: $165,500

-

1-Year Appreciation Rate: 5.2%

-

3-Year Appreciation Rate: 11.7%

-

Unemployment Rate: 5.9%

-

1-Year Job Growth Rate: 2.7%

-

Population: 133,358

-

Median Household Income: $40,550

Columbia Real Estate Investing 2016

Columbia real estate news was relatively encouraging in 2016. The median home price was $165,500 during the second quarter, compared to the national average of $239,167. Although price growth was slowing down at the time, home prices were up from the previous year. Unfortunately, the Columbia housing market also witnessed minimal gains in terms of total equity during the first half, which saw properties appreciate at a much slower rate than the rest of the country.

Approximately halfway through 2016, there were 1,873 properties in some stage of foreclosure. The number of foreclosures at the time was 13.0% lower than the previous month and 5.0% lower than the same period in 2015. The number of REO properties fell 4.3% from the previous month but skyrocketed 187% from last year.

The Columbia real estate investing community and homeowners paid 8.7% of their income to mortgage payments in the second quarter of 2016, while the national average was upwards of 15.8%. At that rate, the Columbia housing market was one of the most affordable in the country.

The level of construction at the time was 26.1% above the long-term average, and single-family housing permits grew at a rate of 8.5%. Construction was on the rise relative to the previous year, suggesting the local inventory had begun to stabilize.

Unemployment in the Columbia housing market trailed the national average, as the city’s unemployment rate was 5.3% versus the national average of 4.9%. On the bright side, however, one-year job growth outpaced the rest of the country.

Columbia Real Estate Market: 2015 Summary

-

Current Median Home Price: $152,800

-

1-Year Appreciation Rate: 3.2%

-

Unemployment Rate: 6.3%

-

1-Year Job Growth Rate: 1.3%

-

Population: 133,358

-

Median Household Income: $48,672

Columbia Real Estate Investing 2015

In 2015, sales were up nearly 31.0% from when the recovery really started to take off. Like most markets at the time, the Columbia housing market was the beneficiary of historically high appreciation rates. In fact, appreciation rates in the previous three years were responsible for extending the trend of price growth since the downturn, which brought the median home price to $152,800.

Despite the appreciation in 2015, homes were considerably below that of the national average ($216,567). Over the previous three years, Columbia and the national average saw home prices rise, 9.4% and 28.0% respectively. Consequently, home prices were not able to keep pace with the rest of the country.

According to Columbia real estate news at the time, the local economic outlook was not as encouraging as one would have liked to see. While the unemployment rate improved year-over-year, it was left behind by the national average. However, the city improved its unemployment rate to 6.3%.

Columbia Real Estate Investing Statistics In 2015

Columbia County Map:

Have you thought about investing in the Columbia real estate market? Do you want to become a part of the Columbia real estate investing community? If so, what are you waiting for? We would love to know your thoughts on real estate in Columbia in the comments below.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!