Jump To Another Year In The Columbus Real Estate Market:

The Columbus real estate market in Ohio has been hit hard by the Coronavirus pandemic. That said, it appears as if real estate in Columbus was relatively insulated from the impact of COVID-19. While “shelter-in-place” orders have certainly impeded economic progress, Columbus appears to have fared better than many major metropolitans across the country. Unemployment numbers—while historically high—remain below the national average and home values remain strong. Additionally, demand remains intact, which should bode well for the market’s recovery. All things considered, the Columbus real estate market may have taken a single step back in the face of a pandemic, but it appears poised to take two steps forward sooner rather than later.

Columbus Real Estate Market 2021 Overview

-

Median Home Value: $197,152

-

1-Year Appreciation Rate: +13.5%

-

Median Home Value (1-Year Forecast): N/A

-

Median Rent Price: $1,250

-

Price-To-Rent Ratio: 13.14

-

Unemployment Rate: 5.0% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 898,553 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $53,745 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 14.05%

-

Foreclosure Rate: 1 in every 7,224 (1.3%)

2021 Columbus Real Estate Investing

The Columbus real estate investing community should take solace in the fact that their market fared better than many of its national counterparts. That’s not to say real estate in Columbus was unscathed, but rather that it appears slightly more insulated from the national catastrophe. Most notably, unemployment numbers and home values weren’t hit as badly as their national counterparts. However, it is worth noting that the retraction of the Columbus real estate market may have actually created some attractive investment opportunities. In particular, some of today’s leading indicators suggest now may be a great time to invest in a rental property.

The new real estate landscape resulting from the wake of the pandemic isn’t as bad as people would assume; it’s just different. As a result, Columbus real estate investors will need to listen to what the market tells them and translate it into action. The real estate industry is certainly different after the arrival of the Coronavirus, but the emergence of three indicators has made buy-and-hold investment strategies more attractive:

-

Interest rates on traditional loans are historically low

-

Years of cash flow can easily justify today’s higher acquisition costs

-

The price-to-rent ratio suggests high home prices will increase rental demand

For years, rehabbing was the most prevalent exit strategy implemented by Columbus real estate investors, but we are starting to see a new trend. Now is the time to start adding to a passive income portfolio.

As of April, the average rate on a 30-year fixed-rate loan was 3.06%, according to Freddie Mac. While April’s rate is up slightly year-to-date, it’s still considered relatively low. As a result, the cost basis for real estate in Columbus is lower than what median home prices suggest. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to pad their bottom line. At the very least, investors will be able to justify the latest bout of appreciation with much lower borrowing costs.

More importantly, the average rent in the Columbus real estate market is about $1,250 or $295 more than the median mortgage. The average Columbus real estate investor could conceivably buy a home for the median value and rent it out for a profit each month. That, of course, is a very average example, and savvy investors may be able to lower their cost basis considerably by acquiring a cheaper home. However, the fact remains: Investors able to rent out their assets will be able to pay down their mortgage with other people’s money. The cash flow generated from renting their home could easily justify today’s higher acquisition costs.

With a price-to-rent ratio of 13.14, it is currently more affordable to buy a home in the Columbus real estate market. Typically, a 13.14 ratio would work against landlords, as more people would be looking to buy, but today’s insufficient inventory levels are actually forcing more people to rent. The lack of available housing is actually driving up rental demand, which bodes well for today’s rental property owners. Not only will rental demand reduce vacancies, but it will simultaneously drive up rent prices, making profit margins more attractive.

Local investors are lucky to have several viable exit strategies at their disposal, but none appear more attractive than building a proper rental property portfolio. Too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Foreclosure Statistics In Columbus

Nearly halfway through 2021, Columbus’ foreclosure rate sits somewhere around 1.3%. With one in every 7,224 homes in some stage of foreclosure, Columbus has a relatively high distribution of distressed homes. Of the homes that identify as distressed, 54.2% are either up for auction, or will be at some point in the near future, according to Realtytrac.

Year-over-year auction homes are actually down 17.4%, but the latest fallout from the Coronavirus suggests more foreclosures are on the way. In the last month, auction homes increased 111.1% and may be in line to continue increasing throughout the year. As a result, the Columbus real estate investing community should pay special considerations to local auctions. In doing so, investors may gain access to undervalued homes at a time when median home prices are constantly increasing.

Distressed homes represent the best opportunity to buy a discounted property, which has many people asking one, simple question: Where should I invest in Columbus? It makes sense to invest in the neighborhoods with the highest distributions of foreclosures, which include:

-

43215: 1 in every 1,406 homes is currently distressed

-

43222: 1 in every 1,753 homes is currently distressed

-

43207: 1 in every 3,378 homes is currently distressed

-

43223: 1 in every 3,600 homes is currently distressed

-

43211: 1 in every 5,207 homes is currently distressed

The Columbus real estate market is expected to see a surge in foreclosures sooner rather than later. The introduction of the Coronavirus will most likely put a significant financial strain on many homeowners. When forbearance programs run out later in the year, an influx of foreclosures will most likely ensue. There’s no telling how much foreclosures will rise, but it is safe to assume they will increase by the end of the year.

2021 Median Home Prices In Columbus

At this time last year (March 2020), Columbus’ median home value was around $173,000. However, few markets have appreciated at the same rate as Columbus, which begs the question: How much does it cost to live in Columbus, Ohio?

Following an impressive year of appreciation, the median home value in the Columbus real estate market is now $197,152. To say the last year was impressive is an understatement. Over the last 12 months, real estate has appreciated 13.5%. To put the last year into perspective, the median home value in the United States is now $276,717 after appreciating by as much as 10.6% in one year’s time.

Since the Great Recession, or at least when real estate in Columbus hit its lowest point (around February 2013), home values have appreciated 100.0%. At that rate, Columbus easily outpaced the national average over the last decade. However, over the same period, the median home value in the United States increased a more modest 63.7%.

Over the last 20 years, certain neighborhoods have contributed to the appreciation rate in Columbus more than others. Years of historic appreciation, in fact, have made these the most expensive neighborhoods in Columbus (according to NeighborhoodScout):

-

W Dublin Granville Rd / Olentangy River Rd

-

Hard Rd / Riverside Dr

-

City Center / Franklin U

-

Neil Ave / W 2nd Ave

-

Mount Air

-

Indianola Ave / Fallis Rd

-

S High St / E Whittier St

-

W 5th Ave / Neil Ave

-

W Spring St / Neil Ave

-

Mckinley Ave / Grandview Ave

The same inventory shortage that served to increase prices for the better part of a decade may be magnified by home builders sitting on the sidelines during the pandemic. Without new builds being brought to the market, it is safe to assume competition will remain high, driving prices up even higher than they are now.

Columbus Real Estate Market: 2020 Summary

-

Median Home Value: $174,109

-

1-Year Appreciation Rate: +8.4%

-

Median Home Value (1-Year Forecast): -0.6%

-

Median Rent Price: $1,250

-

Price-To-Rent Ratio: 11.60

-

Unemployment Rate: 13.7% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 898,553 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $51,612 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 14.05%

-

Foreclosure Rate: 1 in every 10,452 (0.9%)

Columbus Real Estate Investing 2020

Columbus real estate market trends in 2020 were largely the result of the pandemic. The impact of COVID-19 on the real estate market reverberated throughout the year, beginning at the end of the first quarter. At the time, real estate in Columbus worked with a lot of the momentum built in the previous year. Demand was increasing in the face of rising prices, and rehabbers were reaping the rewards. It is worth noting, however, that momentum was brought to a standstill by March. Activity shuttered, as buyers and sellers were fearful of uncertainty.

In a matter of weeks, the housing market went from a hotbed of activity to being completely void of activity altogether. Nobody saw the setback coming just a few months earlier, and the market suffered as a result. That said, in taking one step back, the Columbus real estate market used the lull to take two steps forward. Thanks, in large part, to the Fed’s decision to lower borrowing costs, more people were interested in buying. In fact, interest rates were so low that demand quickly gave way to feverish competition. Listings started receiving more offers, and prices began to skyrocket. Over the last three quarters of 2020, local home prices increased an average of 4.3%; that’s in addition to the previous eight years of appreciation.

All things considered, the median home value in Columbus forced real estate investors to reevaluate their exit strategies. While flipping was once the most popular strategy, home prices and borrowing costs suggested 2020 was better suited for long-term strategies. Rental properties, in particular, became the preferred investing strategy, as investors could finally justify higher acquisition costs. In addition, low interest rates meant investors could increase monthly cash flow and pay down a mortgage with someone else’s money. That’s not to say nobody was flipping, but rather that 2020’s indicators were better for landlords.

Columbus Real Estate Market: 2019 Summary

-

Median Home Value:$156,200

-

1-Year Appreciation Rate: 9.7%

-

Median Home Value (1-Year Forecast): 5.8%

-

Median Rent Price: $1,300

-

Median Days On Market:40

Columbus Real Estate Investing 2019

The Columbus real estate market was recognized by Realtor.com as the hottest real estate market in the country in 2019. Thanks, largely in part, to a unique combination of supply, demand, job growth, and pricing, real estate in Columbus garnered the momentum it needed to elevate to where it is today. As a result, Columbus real estate investors have been able to take favorable market conditions and use them to their advantage.

The median home value in the Columbus real estate market realized upwards momentum for the better part of a decade. Since the first quarter of 2013, in fact, the median home value has served to increase year-over-year. Over the previous year (February 2018 to March 2019), Columbus’s median home value increased by as much as 9.7%, easily outpacing the national average by 3.1%.

The foundation of the entire Columbus real estate investing industry is centered on two critical indicators: price and demand. Strong job growth and relatively low interest rates, in particular, fueled an incredibly high level of demand, while a distinct lack of inventory sent prices soaring. The combination sent buyers scrambling, particularly millennial buyers looking to take advantage of the area’s growing job market. As a result, Columbus real estate investors had no issues finding buyers for their rehabbed properties.

Columbus Real Estate Market: 2016 Summary

-

Median Home Price: $181,700

-

1-Year Appreciation Rate: 5.6%

-

3-Year Appreciation Rate: 22.3%

-

Unemployment Rate: 4.2%

-

1-Year Job Growth Rate: 4.3%

-

Population: 822,553

-

Median Household Income: $43,844

Columbus Real Estate Investing 2016

The Columbus housing market was blossoming into an investor’s market in 2016, as home prices fell below the national average. The median home price was $181,700 during the second quarter, compared to the national average of $239,167. Although home prices for Columbus real estate were up from the previous year, price growth was unhurried. However, in the eyes of investors, appreciation rates were red-hot, with homes appreciating faster than the national average.

As of July 2016, there were about 3,972 properties in some stage of foreclosure. In July, the number of Columbus foreclosures was 42.0% higher than the previous month and 43.0% lower than the same period in the previous year. Additionally, the number of REO properties in Columbus fell 41.8% from the previous month and 53.8% from the same time the year before.

Columbus Real Estate Market: 2014 Summary

-

Median Home Price: $165,700

-

1-Year Appreciation Rate: 8.9%

-

Unemployment Rate: 4.3%

-

1-Year Job Growth Rate: -0.7%

-

Population: 822,553

-

Percent of Underwater Homes: 28.3%

-

Median Income: $54,079

Columbus Real Estate Investing 2014

Individual Ohio housing markets were the beneficiaries of a great 2014. Central Ohio, in particular, exhibited moderate increases in terms of volume and price. Developments created an environment that favored neither buyers nor sellers. Columbus, as a result, demonstrated a propensity for favorable market conditions.

Over the course of 2014, sales prices jumped in the face of elevated demand. With that in mind, experts projected that sales prices would hold steady for the rest of the year, even with appreciation expected to last into 2015. As a result, the Columbus housing market currently boasted a median home price of $165,700. Considering that the national average price of a home was approximately $216,567, Columbus was considerably less expensive than the rest of the country in 2014.

Perhaps the most encouraging factor supporting the Columbus housing market was the promising job sector. As a strong driver of local supply and demand, Columbus’ job sector was better than the national average. The city’s unemployment rate was 4.3%, about a whole point and a half below the national average. At 4.3%, Columbus improved its unemployment rate by a staggering 2.0% in just one year.

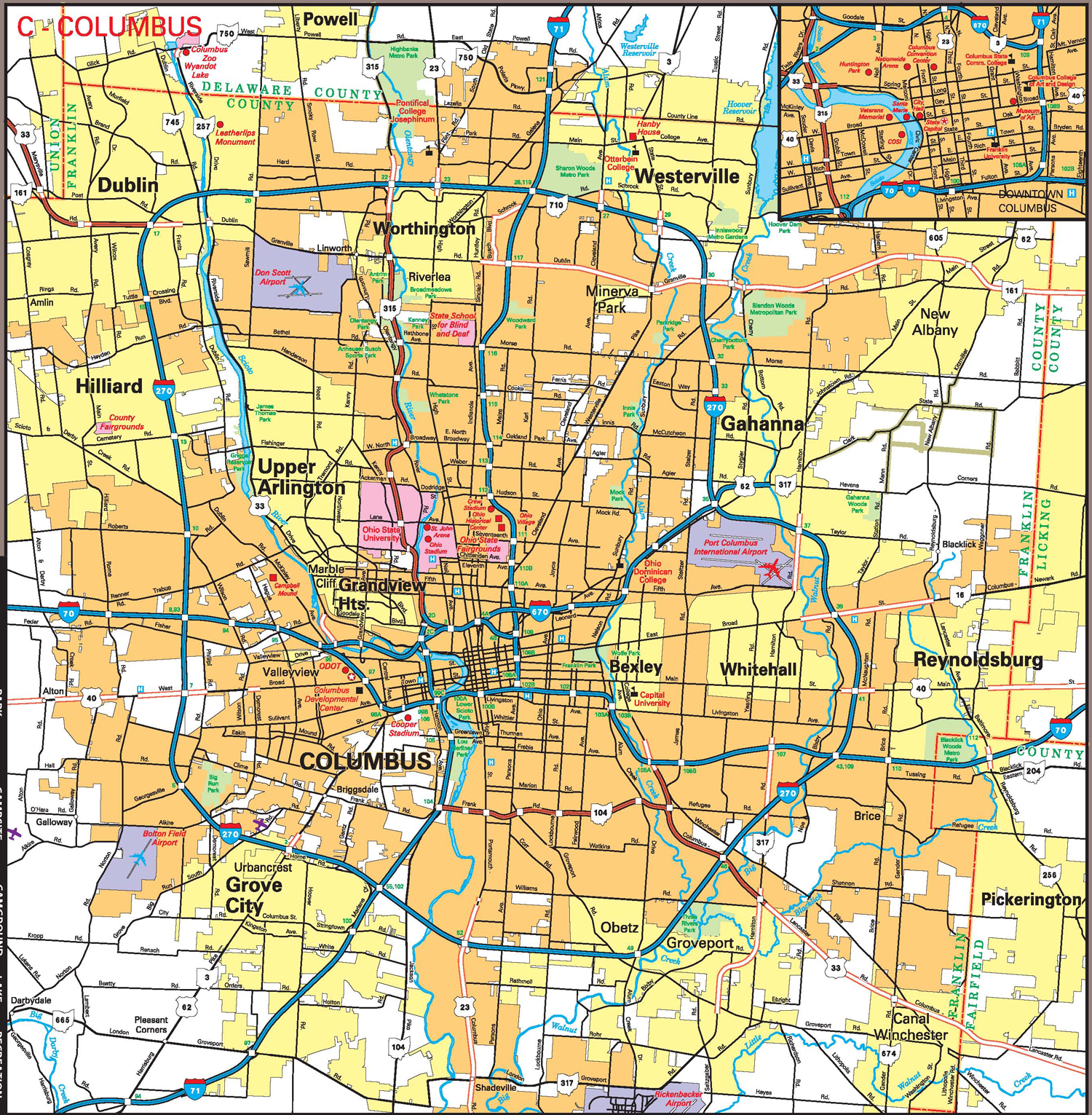

Columbus County Map:

Columbus Real Estate Market Summary

The Columbus real estate market appears to have weathered the Coronavirus storm slightly better than many of its national counterparts. For starters, the city’s unemployment rate remains below the national average, and home values have yet to be hit as hard as most of the country. As a result, there’s a good chance real estate in Columbus recovers sooner rather than later. Moreover, current Columbus real estate trends suggest the local market is slightly healthier than most others, which bodes well for every active participant: buyers, sellers, and investors.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!