The residents of Fort Lauderdale have recently become the beneficiaries of an overdue boost in home equity. Accordingly, home values have increased significantly since they last bottomed out in 2011. The increase in property values helped to remove many homeowners from underwater mortgages, as the rate of delinquent mortgages dropped 12% since this time last year. More homeowners in South Florida still owe more than what their homes are currently valued compared to the national average; however, the Fort Lauderdale housing market received a positive outlook thanks to increased home sales for the last three years. For what it is worth, the Fort Lauderdale housing market is heading in the right direction.

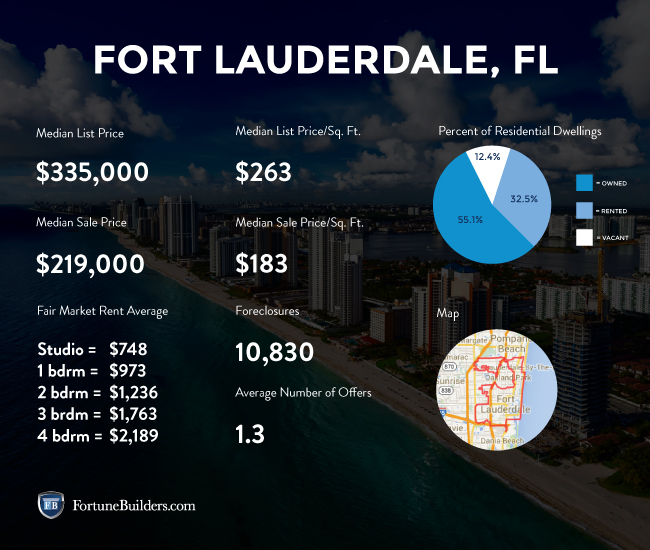

The current median home price in Fort Lauderdale is $270,000, which is the same as Miami. Over the last year, homes in Fort Lauderdale have appreciated at a rate of 7.6%, which is 3% higher than the national average. More impressively, houses in the region have appreciated 44.9% in the last three years, nearly doubling the national average of 25.8%. The gains witnessed in the last three years have played a major role in removing Fort Lauderdale from the post-recession price weakness.

Owners that were fortunate enough to have purchased three years ago experienced the largest gains in equity. Accordingly, the average equity accrued by those who purchased in 2011 is $92,099. Fort Lauderdale homeowners accrued nearly $40,000 in equity more than the rest of the country in the same period. Even homes that were purchased within the last year have gained an average of $23,243 in Fort Lauderdale. That number is almost double the national average of $12,731.

Unfortunately, like New Orleans, the job market is not in a position to currently boost the housing market. With an unemployment rate of 6.3%, Fort Lauderdale trails behind the national average. On a more encouraging note, however, the unemployment rate is trending in a good direction (it is lower than last year’s 7.9%). Job growth should continue for the foreseeable future, as experts predict the job market to increase by 3% in the next year. In fact, the rate in which jobs are being made is higher than the majority of markets on a national level. At its current rate, job growth should continue to drive local supply and demand.

Fortunately for the Fort Lauderdale housing market, construction starts have risen since last year. As a result, local inventory has begun to show signs of stabilization. However, stabilization may be due to increased foreclosures and short sales, as their presence has added more homes to the market. In the past, it was new construction that padded the market with new inventory. As we enter 2015, it appears as if foreclosures and short sales wall have a bigger impact.

Housing affordability in the Fort Lauderdale market is strong from a historical standpoint, but slightly weaker than the first quarter of 2014. Fort Lauderdale is more affordable than most markets, as homeowners allocate an average of 12.1% of their income to mortgage payments, whereas the rest of the nation spends about 14.9% of their income on principle payments

According to Zillow, “the percent of delinquent mortgages in Fort Lauderdale is 16.0%, which is higher than the national value of 6.9%. The percent of Fort Lauderdale homeowners underwater on their mortgage is 19.8%, which is lower than Miami-Fort Lauderdale Metro at 21.9%.”

Victoria Park and Imperial Point are two of the most popular neighborhoods in Fort Lauderdale, with average listing prices of $569,866 and $249,457.

Fort Lauderdale Housing Market Summary:

- Current Median Home Price: $270,000

- 1-Year Appreciation Rate: 7.6%

- 3-Year Appreciation Rate: 44.9%

- Unemployment Rate: 6.3%

- 1-Year Job Growth Rate: 3.0%

- Population: 172,389

- Percent Of Underwater Homes: 19.8%

- Median Household Income: $50,191

Fort Lauderdale Housing Market Q1 Update:

Fort Lauderdale has come a long way since the recession. Due largely in part to Miami’s construction boom, Fort Lauderdale’s location (just 30 miles south) has allowed it to be come the beneficiary of excess real estate investor dollars. It is attracting investors willing to pay large sums of money to acquire or develop commercial real estate or land for new residential development. Perhaps even more importantly, experts agree that the Fort Lauderdale housing market is backed by strong economic and demographic fundamentals.

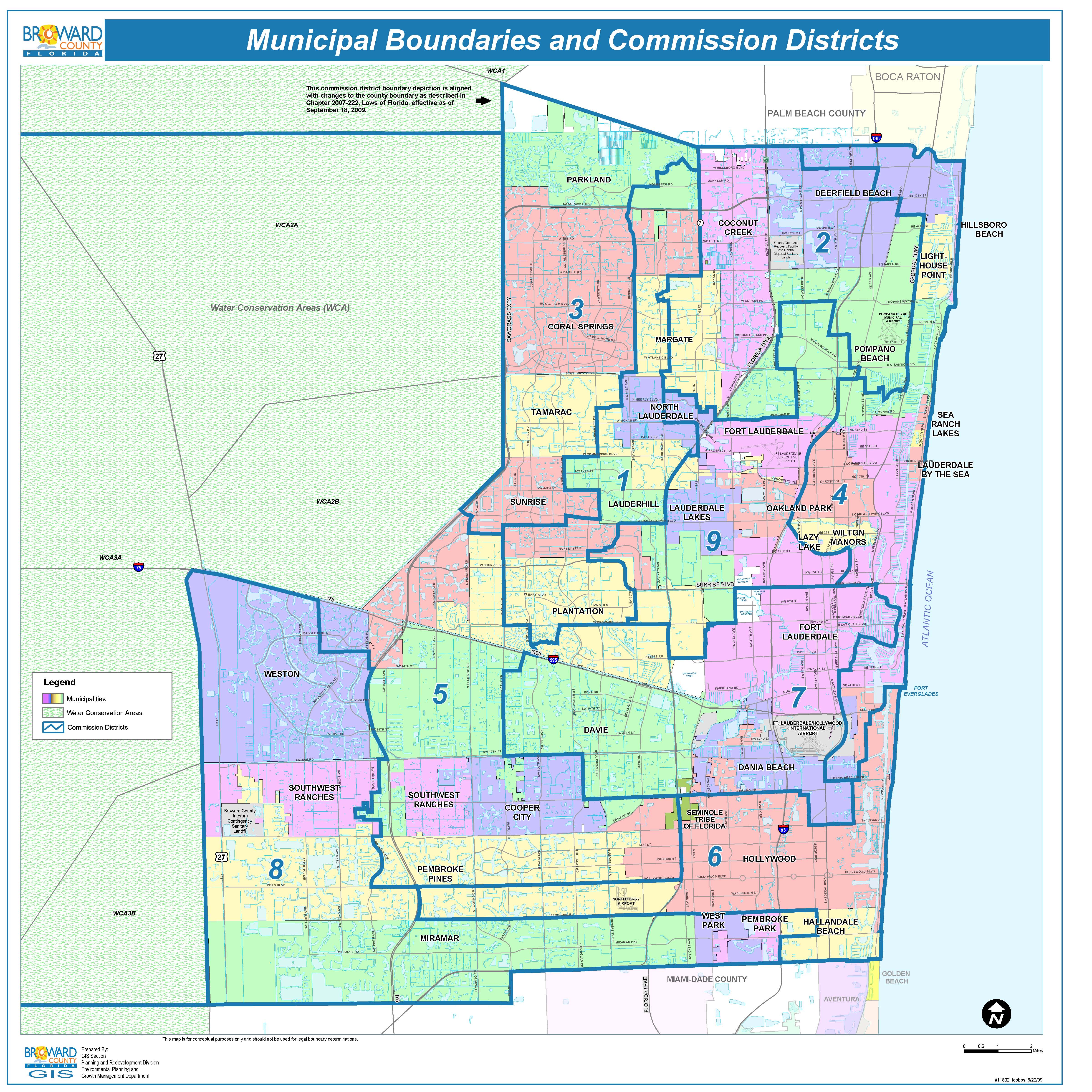

Economists suggest that the city has strong economic fundamentals, including robust job growth and an influx of new residents. The unemployment rate in Broward County, which includes Fort Lauderdale, was 4.8 percent at the end of last year, according to the Bureau of Labor Statistics. That is a whole point below the national average. Moreover, investors are seeking alternatives to high prices in primary real estate markets like New York, Chicago, San Francisco and, now, Miami.

The Fort Lauderdale housing market has about 2,125 homes for sale. Perhaps even more encouraging, however, is the amount of homes that recently sold: 9,400. Those numbers suggest a high level of healthy activity. There is certainly demand in this particular real estate market.

Fort Lauderdale real estate investing should see a lot of activity. In particular, foreclosures should serve as a steady source of homes for those investing in Fort Lauderdale. According to RealtyTrac, the southern Florida city has approximately 10,479 homes entering into some stage of the foreclosure process. That is to say that these properties are either in default, up for auction, or bank-owned. As high as that number may seem, foreclosures are actually down 4 percent from the previous month. However, the amount of foreclosures has climbed 2 percent over the course of a year.

Again, Fort Lauderdale real estate investing should see a lot of purchasing activity in the form of foreclosures. Active investors will find the discounts on distressed properties very promising. The median sales price of a non-distressed home was $175,000. The median sales price of a foreclosure home was $138,000, or 21% lower than non-distressed home sales. That is an average of $37,000 in savings. Those investing in Fort Lauderdale real estate would be wise to consider the spreads offered by these properties.

Of those homes in some stage of foreclosure, the largest percentage make up homes to be auctioned off. In fact, 54 percent of the foreclosures in Fort Lauderdale’s market are of the auction variety. The remaining foreclosures are either in pre-foreclosure or bank-owned, 21.7 percent and 24.3 percent respectively.