Key Takeaways

What are real estate taxes? |What are property taxes? |Wholesaling | How to calculate real estate tax | How to calculate property tax | Real estate tax tips |

What are real estate taxes, and how are they different from property taxes? Learning how to calculate your taxes can be intimidating, but it’s important nonetheless. Whether you’re a homeowner or a property investor, accurately calculating your real estate taxes is a crucial aspect of understanding your expenses. In this guide, you’ll learn whether there’s a difference between real estate taxes and property taxes and everything you need to know about calculating them.

What Are Real Estate Taxes?

Real estate taxes are essentially the same thing as property taxes. They are levied by state and local governments as a way to generate revenue. Real estate taxes are often calculated based on property value, with high-value properties often paying more in real estate taxes. It can be helpful to think of real estate taxes as a sub-category within the property tax umbrella. Before we get into that, let’s first define property taxes and then get into any differentiation between them.

What Are Property Taxes?

Property taxes are levied on both real and personal property. The category of personal property, also called tangible property, includes vehicles such as cars, boats, and trailers.

The taxes on real property are based on the property’s value and any land that the property sits on. Additional units, such as detached garages and mother-in-law units, are also included in the assessed value.

It’s worth noting that property taxes aren’t universal across the states. They’re measured and assessed by local and municipal governments, which causes variation by region. Property taxes are compulsory, meaning they’re required by law. Property owners are required to pay property taxes each year. However, the rate they are expected to pay is dependent on how their local government appraises the value of their asset.

Now, you may be wondering how these tax dollars are used. Local governments use property taxes to fund public service projects. Examples include road repairs, building new schools, protecting local areas from fires, removing snow, etc. Simply put, property taxes make it possible for governments to improve and maintain local infrastructure.

[ Do you have what it takes to run your own real estate business? Register for a FREE webinar, where you can learn from experts how to replicate successful business systems. ]

Difference Between Real Estate Taxes & Property Taxes

The terms real estate taxes and property taxes are often used interchangeably, and that’s correct to a certain degree. However, technically speaking property taxes include both real estate property and personal property. Real estate taxes are taxes assessed explicitly on the value of residential or commercial property. For example, real estate taxes might include taxes levied on a condo, house, or apartment building. Property taxes would include these, along with taxes on personal property such as boats, cars, or other vehicles.

Why Are Real Estate Taxes & Property Taxes Separate?

Real estate and property taxes are separate in how they are calculated and how much is owed. Real estate taxes are based on the property’s value, and therefore tend to be much higher than personal property taxes. Personal property taxes, such as car registrations, are typically flat costs determined by the type of asset. For example, in Colorado, a passenger car can be registered for $75. A single-family home valued at $500,000 in Colorado would owe roughly $2,600 in real estate property taxes.

This difference becomes important during tax season, as property taxes can count as deductions. If you pay a significant amount in real estate property taxes, this can significantly impact your total amount owed.

How To Calculate Real Estate Tax

Real estate tax calculations rely on three main components: the value of the property, the assessment rate, and the tax rate. Both the assessment rate and tax rate are set by state and local municipalities. Let’s take a closer look at the above example. In Denver County, the assessment rate is 7.15 percent, and the tax rate is about .074 for every $1 of assessed value. If you own a home valued at $500,000, the following formula could be used to calculate the real estate tax:

Keep reading for a more in depth look at how property taxes are calculated.

How Is Property Tax Calculated?

Property taxes are assessed differently from state to state, and even from municipality to municipality. The way one city assesses taxes could be different even from its neighboring city. However, there are general guidelines for calculating property taxes that you can use to get a general estimate:

-

Find the assessed value of the subject property.

-

Add the value of the land and any subsequent improvements to determine the true value.

-

Locate and talk to the area’s tax assessor to learn the local tax rate.

-

Account for any additional taxes levied by subsequent local agencies.

-

Add up all of the taxes from steps three and four.

-

Multiply all the taxes you are aware of by the property value (again, accounting for the land and improvements).

To calculate your property tax rate, there’s one thing you must do before anything else: determine the current market value of your property. While you may have an idea of how much your home is worth, it’s the number determined by the tax assessor that matters. Therefore, it’s best to consult them to get an accurate assessment.

Don’t rely on an assessment you may have already received. According to Realtor.com, tax assessments take place “every time a property is sold, bought, built, or renovated by examining the permits and paperwork filed with the local municipality.” You’ll need the most updated number based on your property’s current value. You can do so by checking your local tax assessor’s website or giving them a phone call.

Once you have your property’s current market value, you’ll need the mill levy. The mill levy is a fancy word for your local real estate tax rate. The rate is likely higher in luxurious neighborhoods with elevated amenities, such as nice roads and schools. You can find the mill levy on your local tax assessor’s website as well.

Once you have both of these numbers, simply multiply your home’s assessed value by the mill levy. The resulting number will be the amount of property taxes you are expected to pay each year.

How Long Do You Have To Pay Property Taxes?

The amount of time you have to pay property taxes depends on your local government’s tax collection schedule. Many homeowners find that their lender rolls property taxes into their mortgage payments. In this case, property taxes are paid on a monthly basis.

In other cases, property tax collection schedules vary from state to state. Most often, property taxes are billed annually, but the length of time you are given to pay these taxes vary. For example, some states may provide the option to split up payments into a few installments. However, delinquency or penalty fees can be assessed if payments are late for up to a certain amount of days after the final installment due date.

When Are Property Taxes Due?

The date by which property taxes are due varies based on the location of your property. It falls on the taxpayer to obtain their tax bill and make payments on time. You can find out your property tax due dates by checking your local tax assessor’s website.

For example, the San Diego County tax collection website provides a schedule for installment payments. The first installment is due November 1 and is late after December 10. The second installment is due February 1 and is late after April 10. This shows that taxpayers are given an ample window of time to make either installment payment. They also have the option of paying both installments when the first one is due.

Can You Deduct Property Taxes?

Property taxes are deductible, but the Tax Cuts and Jobs Act of 2017 put a cap on how much you can deduct. You may wonder how the new administration may change property taxes, but nothing has changed for now. According to QuickenLoans.com, you can deduct up to $10,000 if you’re married filing jointly, or up to $5,000 if you’re filing separately or you’re single. It’s always best to consult a tax professional.

Are Property Taxes Included In Mortgage Payments?

Property taxes are often included in mortgage payments. Lenders will often roll property taxes into monthly mortgage payments to protect themselves. If the homeowner fails to make their mortgage payments, and thus the property tax, the lender can foreclose upon the property. This way, lenders can protect themselves against any delinquencies.

Property Tax Calculator

Again, there is no universal equation for calculating property taxes that will give you the exact amount you can expect to pay each year. The variance between state to state and even city to city is too significant. Each region will have its own tax rate to deal with. However, SmartAsset happens to have a property tax calculator that will provide you with a reasonable estimate.

Real Estate Tax Tips For Business Owners

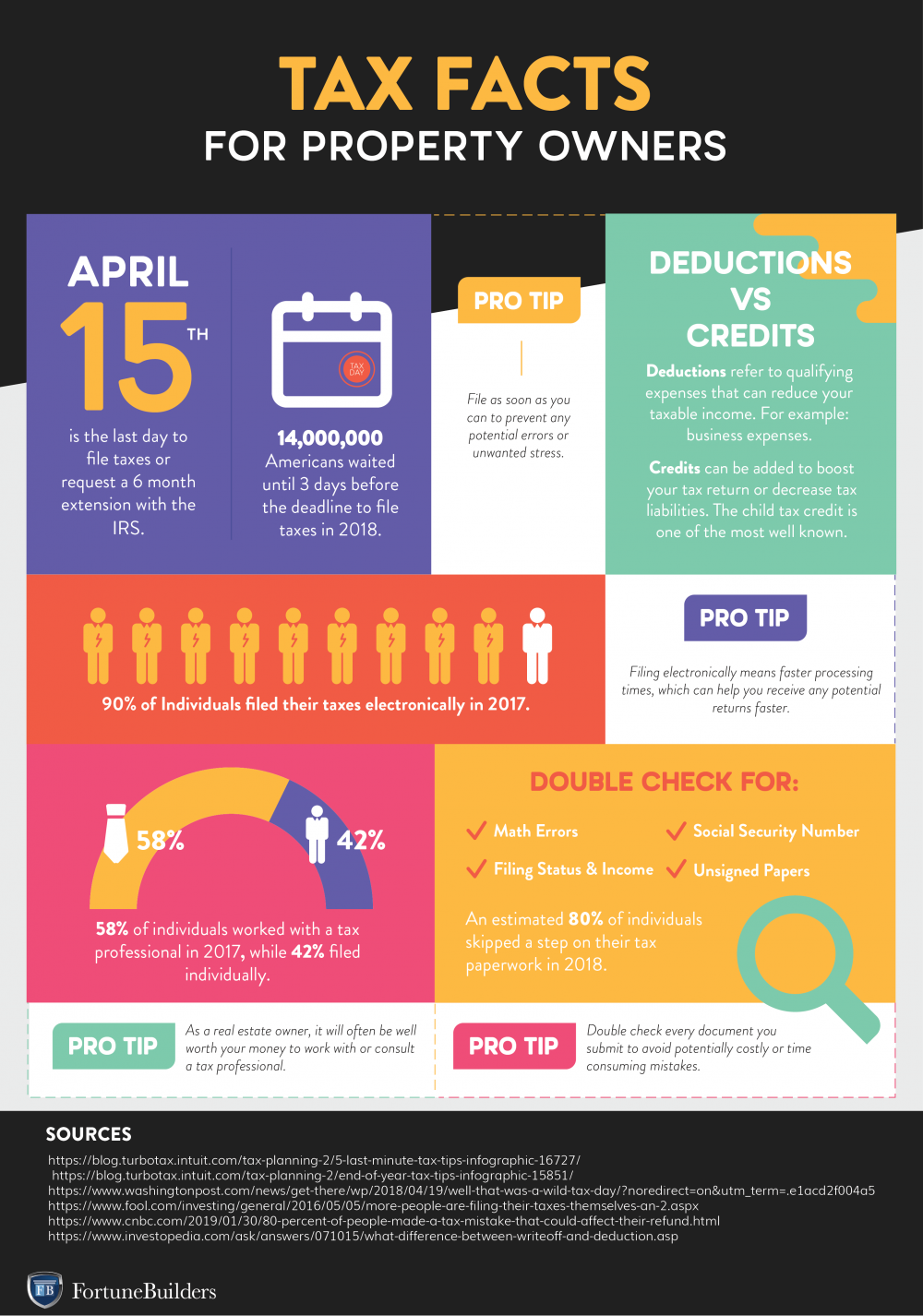

One of the first things real estate investors can do to prepare for tax season is to familiarize themselves with the tax filing process. This includes learning common terminology as well as how to file. The infographic below shares real estate tax tips for business owners:

Use a CPA

A certified public accountant (CPA) is a trained financial advisor who can help you during tax season. CPAs provide a variety of services that include investment planning, acquisitions, and more. You should seek out a CPA specializing in real estate, as they have a better understanding of which forms and deductions apply. There will be fees to work with a CPA, though these costs are often nominal compared to the amount of money you can save in the long run. Professionals help you file your taxes correctly to maximize your returns.

Reinvest In Another Passive Income Property

Given the benefits of real estate investing, it only makes sense to build your portfolio over time. A great way to do that is by reinvesting profits into passive income properties, which can generate long-term cash flow. Through passive income properties, you can benefit from depreciation deductions, stable income, and more.

This strategy relates back to taxes because many investors will be subject to the capital gains tax after the sale of a property. This is a tax on the profits made from the sale of an asset. If you had a particularly successful year investing, it might be beneficial to look into investing in another property. To learn more about how to reinvest real estate returns, be sure to read this article.

Consider IRAs

While direct real estate investing carries many tax benefits by itself, do not sell yourself short by forgoing the advantages offered by regular contributions to a self-directed IRA. A self-directed IRA is an individual retirement account that allows an individual to make all of their own investment decisions. Investors have the opportunity to invest in stocks, bonds, and even real estate. IRA investments are often allowed tax-free or tax-deferred growth, though the funds are inaccessible until investors reach retirement age.

Get Organized

Organization is a key trait of any successful entrepreneur, and it is essential when tax season comes around. If you work from home or even have your own office, focus on setting up a space that allows you and your team to thrive. An organized office will allow you to increase productivity and organization, making for an efficient filing process. If you are interested in learning more about working from home effectively, check out this guide.

Differentiate Between Short And Long-Term Investments

As you prepare for tax season, start by separating your short and long-term investments. Short-term investments are those you’ve held for one year or less, while long term is anything over that time period. For example, wholesaling, prehabbing, and flipping typically fall under short-term investments, while buy-and-hold properties are typically long-term. The difference will be important in determining the tax rates on each investment. Ask your CPA to help you figure out which entity structures are right for you and your investments.

Be Wary Of Travel & Entertainment

As you track your operating expenses and deductions, be careful not to forget about travel and entertainment costs. Property managers and landlords will be able to deduct any travel associated with property viewings, lease signings, or maintenance from their overall taxable income. Many investors fail to realize how travel costs can be beneficial during tax season.

Entertainment costs can refer to anything from attending real estate conferences to hotel and airfare fees to hosting business-related client events. To take full advantage of these write-offs, always keep clean records and double-check which business expenses are eligible.

Track Your Expenses

There are a number of tax deductions real estate investors are eligible for. However, they must keep well-maintained records in order to make those deductions. Track each and every business expense, and keep proper records throughout the year. Some examples are the cost of appraisal fees, business cards, commissions, advertising, escrow fees, insurance, vehicle expenses, and more.

It might seem trivial, but keeping your paperwork and accounts organized year-round will make a huge difference come tax season.

Go Digital

When people think of tax season, they often picture business owners scrambling through disorganized paper receipts and files. Avoid this trap by using digital programs to organize your paperwork. Tools like MileIQ, Evernote, and Mint are great for bookkeeping, as they allow users to categorize expenses and even take notes on specific inputs. Using a digital organization system year-round can save you time, money, and endless stress when tax season rolls around.

Think Green

Some often-overlooked tax deductions come from installing environmentally friendly features throughout your rental properties and rehabs. While these deductions may not be as abundant as they were in years past, there are still a few tax breaks for energy-efficient improvements. For example, there are deductions available for the cost of solar panel installations and solar water heaters. Property owners should consider how these tax deductions can help them over time.

Summary

What are real estate taxes, and what are property taxes? This guide should have answered these burning questions that become a hot topic for property owners come tax seasons. Learning how to calculate real estate taxes may not sound like a lot of fun, but knowing how to do so will help you pinpoint your expenses and make budgeting a lot easier. It’s always recommended that you use a tax professional, especially one that works with property owners and investors. Not only can they help inform and educate you on what you need to know, but they can also help you stay organized and maximize your tax deductions and returns.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!