Jump To Another Year In The Little Rock Real Estate Market:

The Little Rock real estate market has had difficulty maintaining the same pace as its nationwide counterparts. Whereas median home values across the United States have increased for the better part of a decade, real estate in Little Rock has had to overcome a few more additional obstacles. Due mainly to an economy that still has plenty of ground to make up from the last recession, Little Rock real estate trends are on the right path, but not exactly where many people would have liked to have seen them at this point in the year. Nonetheless, things appear to be heading in the right direction. While inventory shortages in the wake of the pandemic have led to exorbitant prices across the country, relative affordability in Little Rock now looks like an advantage.

Little Rock Real Estate Market 2021 Overview

-

Median Home Value: $171,459

-

Median List Price: $233,233

-

1-Year Appreciation Rate: +5.5%

-

Median Home Value (1-Year Forecast): +10.4%

-

Weeks Of Supply: 7.9 (-2.3 year over year)

-

New Listings: 264.4 (-1.7% year over year)

-

Active Listings: 2,026 (-33.33% year over year)

-

Homes Sold: 344.8 (+14.9% year over year)

-

Median Days On Market: 32 (-12 year over year)

-

Median Rent: $978

-

Price-To-Rent Ratio: 14.60

-

Unemployment Rate (Little Rock-North Little Rock-Conway): 4.7% (latest estimate by the Bureau Of Labor Statistics)

-

Population (Metro): 197,312 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $51,485 (latest estimate by the U.S. Census Bureau)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Little Rock Real Estate Investing

The Little Rock real estate investing community has enjoyed quite a lucrative run over the last decade. Home prices have increased 23.3% since bottoming out during the Great Recession. Perhaps even more importantly, demand never tempered in the face of appreciation. A strengthening economy allowed prospective buyers to continue shopping, despite price increases. It is worth noting, however, that supply and demand issues, in conjunction with the current pandemic, continue to increase prices, so much so that homes are finally starting to appear “expensive.”

While the Little Rock real estate market is relatively cheap compared to the national average, price margins for investors are growing thinner and thinner. As a result, home values are near historic highs, and rehabbers are finding less room for profits. That’s not to say rehabbing can’t still be done in Little Rock, but rather that the new marketplace created in the wake of COVID-19 favors another exit strategy: building a rental property portfolio.

The pandemic ushered in a period of historically low interest rates, which are now somewhere in the neighborhood of 2.84%. Today’s borrowing costs have made it easier for investors to transition from rehabs to rental properties. In particular, low borrowing costs can simultaneously offset higher home prices and increase monthly cash flow from operations. If for nothing else, lower mortgage payments mean landlords can collect and retain more profits.

In addition to lower interest rates increasing cash flow potential, Little Rock’s 14.60 price-to-rent ratio (PTR) suggests landlords will have plenty of suitors for their units. While a 14.60 PTR would typically suggest more people want to buy, there isn’t enough supply to meet demand. While on the surface, it would appear that more people will favor buying over renting, there isn’t any inventory to buy. As a result, landlords will inherently benefit from anyone who can’t find a place to buy. If there are no places to buy, the renter pool will grow, effectively increasing rental demand.

Rehabbing remains a viable exit strategy in the Little Rock real estate market, but the new landscape created by the Coronavirus appears to prop of rental property owners. As a result, real estate investors in Little Rock have started exercising their optionality and are now better positioned to realize long-term gains.

2021 Foreclosure Statistics In Little Rock

According to ATTOM Data Solutions’ Midyear 2021 U.S. Foreclosure Market Report, “a total of 65,082 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2021. That figure is down 61 percent from the same period a year ago and down 78 percent from the same period two years ago.” There’s no doubt that foreclosures are down on a national level, and the Little Rock real estate market is no exception.

Thanks—primarily—to government intervention, the entire state of Arkansas has seen foreclosures decline 53.8% from the first six months of 2020 to the first six months of 2021. As the largest city in the state, there’s a good chance the Little Rock real estate market contributed a great deal to the decline.

“The foreclosure moratorium on government-backed loans has virtually stopped foreclosure activity over the past year,” said Rick Sharga, executive vice president of RealtyTrac, an ATTOM Data Solutions company. “But mortgage servicers have been able to begin foreclosure actions on vacant and abandoned properties, which benefits neighborhoods and communities. So it’s likely that these foreclosures are causing the slight uptick we’ve seen over the past few months.”

Despite recent declines, however, it’s expected that foreclosures will increase sooner rather than later. Arkansas cities, in particular, may see foreclosures rise sooner than in other states because of the shortened foreclosure timeline. According to ATTOm Data Solutions, “States with the shortest average foreclosure timelines for foreclosures completed in Q2 2021 were Wyoming (173 days), Arkansas (253 days), Tennessee (270 days), Virginia (280 days), and Mississippi (292 days).” The shortened foreclosure timeline suggests more foreclosures will be filed in a shorter period.

The Little Rock real estate investing community should be prepared to help those in need. By lining up financing now, investors may simultaneously help distressed owners and land their next deal.

2021 Median Home Prices In Little Rock

Is Little Rock, Arkansas a good place to invest in real estate? The median home value is $171,459, according to Zillow’s Home Value Index. Despite benefiting from nearly a decade’s worth of appreciation, median home values in Little Rock are considerably lower than the national average. At $303,288, the median home value in the United States is approximately 76.8% higher than the median home value in Little Rock. The relative affordability alone is a great reason to invest in the Little Rock real estate market.

The disparity in price has become more apparent over the last decade. Real estate in Little Rock has appreciated at a modest rate of 23.3% since the market bottomed out in January 2012. Over the same period, the median home value in the United States appreciated at a rate of 86.0%. In the last year (alone), median home values across the United States increased more than three times those in Little Rock—17.7% and 5.5%, respectively. Not surprisingly, the trend looks like it’ll continue into next year.

While home values in the Little Rock real estate market are expected to increase an average of 10.4%, the median home value in the United States could increase by as much as 12.1%. It is safe to assume real estate in Little Rock will continue to trail national averages. That said, it’s the city’s relative affordability that makes it a good investment opportunity. Local inventory levels remain historically low, which suggests demand is high, and prices are still “affordable.” The unique convergence of these factors makes Little Rock a prime candidate for real estate investors. When all is said and done, it could be the city’s low cost of living should stimulate more housing activity, which bodes well for local investors.

Little Rock Real Estate Market:2020 Summary

-

Median Home Value: $141,500

-

1-Year Appreciation Rate: +1.4%

-

Median Home Value (1-Year Forecast): +0.8%

-

Average Days On Market: 76

-

Median Rent Price: $995

-

Price-To-Rent Ratio: 11.85

-

Unemployment Rate: 3.1% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 197,881 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $49,957 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 11.77

-

Foreclosure Rate: 1 in every 1,462 (6.8%)

Little Rock Real Estate Investing 2020

Little Rock real estate market trends took a significant turn in the first quarter of 2020. Not unlike everywhere else, the introduction of the Coronavirus interrupted what was looking to be an excellent year for local real estate. In a matter of weeks, fear and uncertainty onset by the pandemic completely derailed all of the momentum created in previous years. Little Rock immediately saw a decline in activity once the impact of COVID-19 was felt. Sellers took their listings off the market, buyers refused to look at new homes, and mortgage underwriters were unavailable due to government-mandated “stay-at-home” orders.

The pandemic forced the Little Rock real estate market to take a step backward, but not for long. As soon as the market was brought to a standstill, the Fed dropped interest rates well below three percent. The move sparked more activity than anyone could have imagined, and buyers came out in droves to capitalize on attractive borrowing costs. The influx of buyers was too much for local inventory levels to handle, and demand quickly turned into competition. Lacking supply, sellers in the market held all the power, and they priced their assets accordingly. From March (when the Fed increased rates) through the end of the year, the median home value in Little Rock increased 2.5%. Not much in its own, 2020’s rate of appreciation was in addition to eight consecutive years of price growth, which helped local real estate values test new highs each month.

All things considered, real estate became more expensive than ever in Little Rock. As a result, real estate investors were forced to rethink their exit strategies. Whereas rehabbing had been the most popular exit strategy since the Great Recession, higher home prices all but eliminated attractive price margins. To combat higher home prices, investors started taking a long-term approach. In particular, most investors turned to rental properties. Historically low borrowing costs allowed investors to increase monthly cash flow from operations. At the same time, interest rates made it easier to justify higher acquisition costs.

When all was said and done, Little Rock had affordable inventory for rehabbers in 2020. Still, the new market indicators created by the pandemic made long-term investment strategies more attractive than ever.

Little Rock Real Estate Market:2016 Summary

-

Current Median Home Price: $140,700

-

1-Year Appreciation Rate: 0.8%

-

3-Year Appreciation Rate: -2.4%

-

Unemployment Rate: 3.7%

-

1-Year Job Growth Rate: 2.3%

-

Population: 197,357

-

Median Household Income: $46,409

Little Rock Real Estate Investing 2016

The first half of 2016 witnessed minimal traction in home prices and appreciation rates, as prices for the city were underwhelmed compared to the national average. Nonetheless, home prices in the second quarter continued to grow relative to the previous year. The Little Rock housing market also saw improvements in home affordability during the first half. Arkansas’s capital was among the most affordable areas in the country, benefitting a trifecta of renters, homeowners, and investors alike.

Despite lagging home prices and meager appreciation gains, the Little Rock real estate market pushed forward. The median home price grew to $140,700 during the second quarter, compared to the national average of $239,167. Although minimal, one-year appreciation rates crossed into positive territory, rising to 0.8% in Q2. Thankfully, the Little Rock real estate market had other factors working in its favor.

One component responsible for enhancing local real estate was the economy. Employment held up, while unemployment was better than the national average. The second quarter saw an unemployment rate of 3.9%, compared to the rest of the rest at 4.9%. Furthermore, one-year job growth reached 2.3%, whereas the national average saw new jobs grow at a rate of 1.9%. In comparison to other markets, local employment growth was strong.

Little Rock Real Estate Market:2015 Summary

-

Median Home Price: $131,800

-

1-Year Appreciation Rate: 6%

-

Unemployment Rate: 5.1%

-

1-Year Job Growth Rate: 0.9%

-

Population: 197,357

-

Median Household Income: $48,304

Little Rock Real Estate Investing 2015

Little Rock real estate news was optimistic throughout 2015. The real estate market benefited from several progressive indicators: increased equity, high affordability, well-developed infrastructures, low business costs, and a high per-capita income rate. Due primarily, in part, to these factors, the city’s recovery accelerated over previous years.

The median home price for the Little Rock real estate market was $131,800 in 2015. The national average, on the other hand, was around $203,867. With such a significant difference in home values, it may surprise some to find out that appreciation rates across the country were very similar, 6.0% and 6.7%, respectively. Both saw encouraging rises in home prices at the time.

While integral to the city’s growth, the influx of equity into the Little Rock housing market wasn’t the only positive indicator for the area. In fact, Little Rock real estate was very affordable in the face of rising prices. The city found a sweet spot between affordability and growing home values. Real estate investors grew to love the prospects of their careers.

On average, homeowners across the U.S. spent 14.4% of their income on monthly mortgage obligations in 2015. However, residents spent considerably less on housing, 6.3% to be exact. As a result, affordability in the Little Rock housing market was higher than most markets across the country.

Many believe that the city avoided the most volatile parts of the recession because of its business infrastructure. In addition, experts attributed the strength of the city’s nationally recognized economy to several diverse businesses. Low business costs brought in several large companies, which generated a high per-capita income compared to the rest of Arkansas.

Little Rock real estate investing is benefiting from a healthy economy, just like individual homeowners. However, investors were attracted to an entirely different part of the Little Rock housing market: distressed properties. At the time, there were about 200 homes in some stage of foreclosure: default, bank-owned, or foreclosure.

Of course, the availability of distressed properties was one thing, but the discount offered was another. Distressed properties in the area sold for about $87,000 less than non-distressed ones. That was a savings of 56.2% per home.

Not only did the city avoid the recession for the most part, but it also improved its economic standing in the wake of it. In association with high per capita incomes and affordability, a robust business infrastructure made the Little Rock housing market a very attractive area for both investors and homeowners.

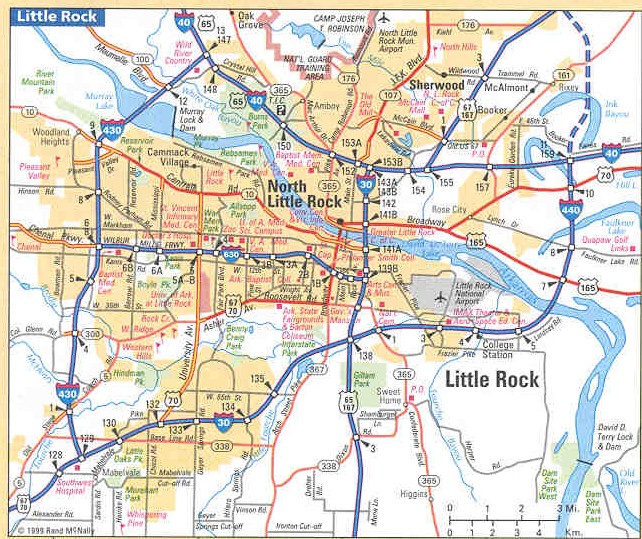

Little Rock County Map:

Little Rock Real Estate Market Summary:

Little Rock real estate market trends have followed their national counterparts throughout 2021. In particular, prices increased despite the pandemic, economic stimuli, and a lack of inventory. That said, most buyers have been priced out of many cities across the country. Little Rock, on the other hand, still looks relatively affordable. While prices are historically high, they still look attractive compared to other cities. As a result, more buyers may look to Little Rock in the future, which bodes well for everyone.

Have you thought about investing in the Little Rock real estate market? If so, what are you waiting for? We would love to know your thoughts on real estate in Little Rock in the comments below.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/little-rock-ar/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

http://www.freddiemac.com/pmms/pmms30.html

https://www.redfin.com/news/data-center/

https://www.bls.gov/eag/eag.ar_littlerock_msa.htm

https://www.census.gov/quickfacts/littlerockcityarkansas

https://www.attomdata.com/news/market-trends/foreclosures/attom-mid-year-2021-u-s-foreclosure-market-report/