Key Takeaways

- Every real estate loan proposal needs five elements that will help build their case.

- Feel free to use the included loan proposal sample as inspiration for when you write your own.

- The home loan approval process can be easily comprehended by breaking it into six steps.

For real estate investors, writing a compelling loan proposal might be considered a core competency that should be mastered. Not knowing how to format or what to include in your business loan proposal could potentially hinder your ability to obtain funding from lenders. Read on to learn how to ace your next loan proposal so that you can increase the odds that your lender will say “yes.”

What Every Real Estate Loan Proposal Needs

Regardless of whether you are putting together a business loan proposal or a home loan proposal, forming a strategy before sitting down with your lender will only increase your chances of getting approved. Some elements that can help build your case include self-assurance, presentation, incisiveness, organization and originality; elements that can all be applied to entrepreneurship in general. The following expands on each of these elements, which should be coupled with a truly great investment opportunity:

- Self-assurance: If you were to put yourself in the shoes of a lender, would you rather lend a large sum to someone who appears completely confident throughout the loan application process, or someone who seems very unsure of their deal? Investors should always be confident in the deals or business opportunities for which they apply for funding.

- Presentation: Whether you plan to present your case verbally, or something more formal, make sure that your presentation is easy to follow and understand. Try practicing your pitch on a friend or a mentor, who can help make improvements or anticipate potential questions you did not think of before.

- Incisiveness: It can be easy to get lost in the numbers and paperwork, but making a crystal clear case to your lender is crucial. Practice your key talking points before your meeting, and be prepared to answer questions concisely. Stammering and stuttering might signal to the lender that you do not know your numbers or have absolute confidence in your deal.

- Organization: Keep in mind that lenders are busy professionals, with many different loan proposals to consider. Make their job easier by presenting information in such a way that makes it easy for them to say “yes.” Whether that be compelling data visualizations, or a stellar presentation, help them make their decision in your favor.

- Originality: Again, lenders have seen many a loan proposal template and business loan proposal sample come across their desk. Making an effort to stand out from a stack of uniform proposals will only help build your case.

Loan Proposal Sample

If you want to learn how to write a loan proposal, or are looking to make improvements on the loan proposal template you keep on file, perhaps a polished loan proposal sample for a real estate deal would prove helpful. The following is a loan proposal example that may help inspire how you will structure your own in the future. As a note, the phrases encircled by brackets should be changed to comprise your own specific information or data. The various sections can be changed in order and content, and data visualization can be inserted where applicable.

Proposal For Funding: [Property Type] in [City, State]

[Company Name] has identified a [Property Type] in [City, State] that presents itself as an investment opportunity. We seek funding and guidance from [Lender Name] for the growth of our business. Our market, property and financial analyses are included in this funding request.

Funding Objective

The purchase and rehabilitation of [Property Type] at [Property Address]. Requested funds to be used for property purchase, less twenty five percent for the down payment. Remaining funds to be used for renovation, construction, marketing and advertising.

Opportunity

To establish [Company Name] as an owner of income properties in [City, State], where the rental market increases in popularity. Invest in and renovate single and multifamily income properties while maintaining local architectural and atmospheric aspects.

Market Analysis

With home prices and population growth on the rise, [Property City, State] poses a promising income property location. With a median property price of [$XXX,XXX] and a median monthly rent of [$X,XXX], [City] boasts a rental yield of [X.X%] showing strong year-over-year growth. In addition, home values have increased [XX.X%] year over year. The continued job growth rate, coupled with a growing [Industry] sector, leads [Company Name] to have confidence in the sustained growth of the income property market in [City, State]. [Property Address] is situated in the primary location of [Neighborhood Name], which is easily accessible by [Highway or Roadway] or [Highway or Roadway] and is just a [X] minute drive from [Name of Urban Center.] Featuring an award-winning school district, a convenient public transportation system, and just a few minutes’ walking from a district featuring local shops and restaurants, [Neighborhood Name] is expected to increase in popularity due to the recent relocation of [Name of Company or Industry driving job and population growth] to [City, State.] For these reasons, [Company Name] is confident in the opportunity presented by investing in single and multifamily income properties in this area.

Property Analysis

The [Property Type] at [Property Address] features [Number Of Units] across [X] stories and [X] buildings in the primary location of [Neighborhood Name]. The property is [Square Footage] in size, and features [X] parking lots. Built in [Year], the property features some original [List of Features], but requires updated electrical and plumbing to be brought up to code. Some water damage to the ceilings and roof of the [Floor, Unit or Building Number] have been identified. We also plan to replace kitchen appliances and countertops in all units, which have not been updated since [Year].

Financial Analysis

[Company Name] requests [$X,XXX,XXX] as an initial loan for the [$X,XXX,XXX] purchase price, with a [XX%] down payment of [$XXX,XXX]. We request the remaining as an open line of credit for the renovation and construction, scheduled for [Date Range]. Repayment details to be determined by [Lender Name.] Please find attached our detailed financial and return on investment (ROI) analysis, which includes projections for construction costs, after repair value, rental income, expenses, cash flow, and additional projects based on annual rent hikes.

I appreciate having had the opportunity to meet with you last week, and look forward to moving this investment forward. We at [Company Name] deeply appreciate your insights and expertise that you have provided throughout this process, and look forward to strengthening our relationship in the coming years. As we discussed over the phone, my partners and I at [Company Name] have been in business for [X] years and have been involved with [X] succesful investment projects over those years. We are confident that the advice and experience you offer will help guide our future investment projects, including [Property Address]. We look forward to meeting with you in person as soon as possible, after which together we can commence negotiations on the property in question.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

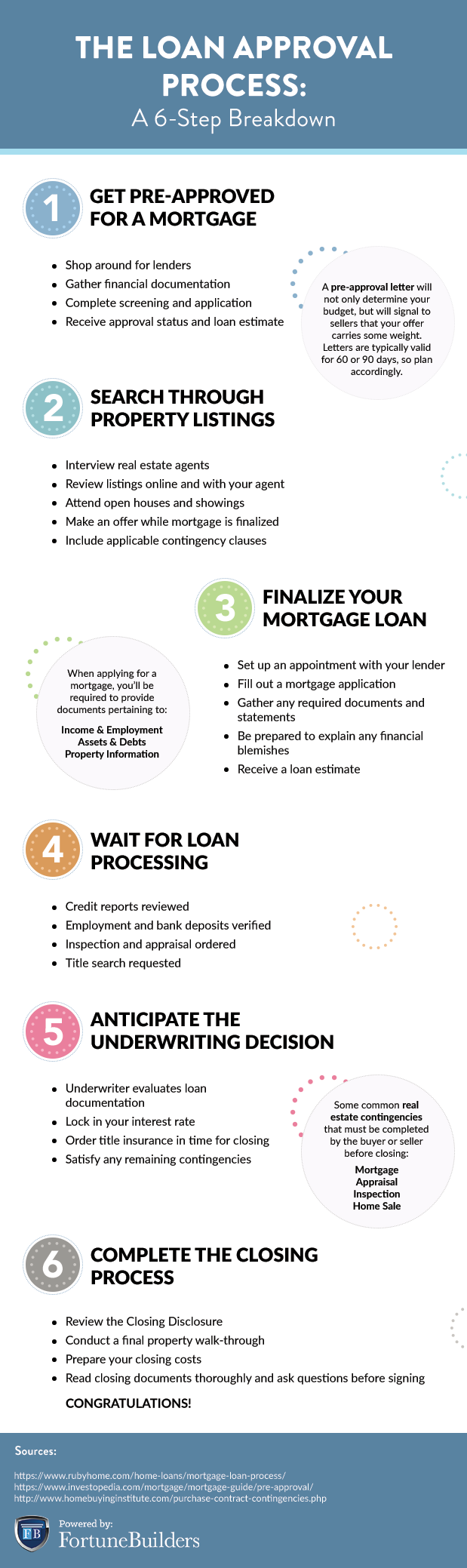

A 6-Step Breakdown Of The Loan Approval Process

The home loan application process is one that many real estate investors will become familiar with, especially if they elect to obtain traditional financing over creative financing to help fund their investment deals. According to Realtor.com, the home loan approval process can take roughly 30 days, sometimes even longer, so plan accordingly. The following are 6 steps that help break down the loan approval process:

- Get pre-approved for a mortgage.

- Search through property listings.

- Finalize your mortgage loan.

- Wait for loan processing.

- Anticipate the underwriting decision.

- Complete the closing process.

The very first step of the loan approval process is not required, but highly recommended. Getting pre-approved for a mortgage will help not only help you pinpoint how large of a budget you will have when purchasing property, but can help signal to sellers that you are a serious buyer who will likely get approved for a loan. To get pre-approved, shop around for lenders while you gather the financial documentation that will be required during the application process.

Once you have been pre-approved and you have your loan estimate, you can search through property listings, either online or in partnership with a real estate agent who will have access to the Multiple Listing Service (MLS). Once you have identified a target property, submit a purchase offer to the seller, and be sure to include your pre-approval. If the seller accepts your offer, be sure to negotiate the placement of contingency clauses that will help provide any protections. Upon acceptance, you will want to finalize your mortgage loan with your lender as soon as possible. If you have already been pre-approved, you will likely not have to fill out a mortgage application again. Your lender will advise you on any outside documents and statements you will need to provide, before receiving a more finalized loan estimate. At this juncture, be prepared to answer any questions about and explain any financial blemishes your have in your history.

Next, your responsibility will involve satisfying real estate contingencies, such as a property inspection and walk-through before your closing date while you await your mortgage to be approved. During this time, your loan application will go to a loan processor, and then to an underwriter who will make the final decision. During this process, your financial and employment history will be reviewed in detail, and the lender will order a property appraisal and title search. You will also use this waiting time to lock in your interest rate, order title insurance, and prepare for the closing meeting. By the time of the meeting, you will have reviewed the closing disclosure document in detail, conducted your final property walk-through and prepared the method of paying the closing costs. At the meeting, be prepared to read through a large stack of paperwork, and do not hesitate to ask questions. When you and the seller have finished signing all the paperwork, the property will officially be in your name!

At the end of the day, the most important factor influencing the success of your loan proposal is whether or not you truly have a great investment opportunity at your hands. If you forgot to mind your due diligence and did not crunch your numbers, you will have a weak foundation to build your proposal upon. Keep in mind that lenders are experts, and will be able to pick your proposal apart. Having complete confidence in the investment deal at hand, and knowing your numbers, will help you write a killer proposal.

Do you have any tips and tricks that have helped make your loan proposal jump out from the crowd? Feel free to share below:

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!