The progressive trends of our current market have resulted in a sizable housing sector recovery. However, home prices are rising at a rate we have not seen since the last bubble crisis. Homeowners are therefore weary that the current direction is not sustainable and another housing bubble may be on the horizon.

To better understand our current situation, it is important to familiarize yourself with what a “bubble” really is. The term bubble is used loosely and refers to circumstances in which prices increase beyond their fundamental value. Drastic increases in price, which are currently the result of low inventory levels, are the root of speculation and further demand. However, exponential growth is typically unsustainable, causing the bubble burst. As the market begins to trend downward, homeowners proceed to sell to avoid significant losses. A massive exodus of homeownership then facilitates the creation of a market with houses well below their fundamental value.

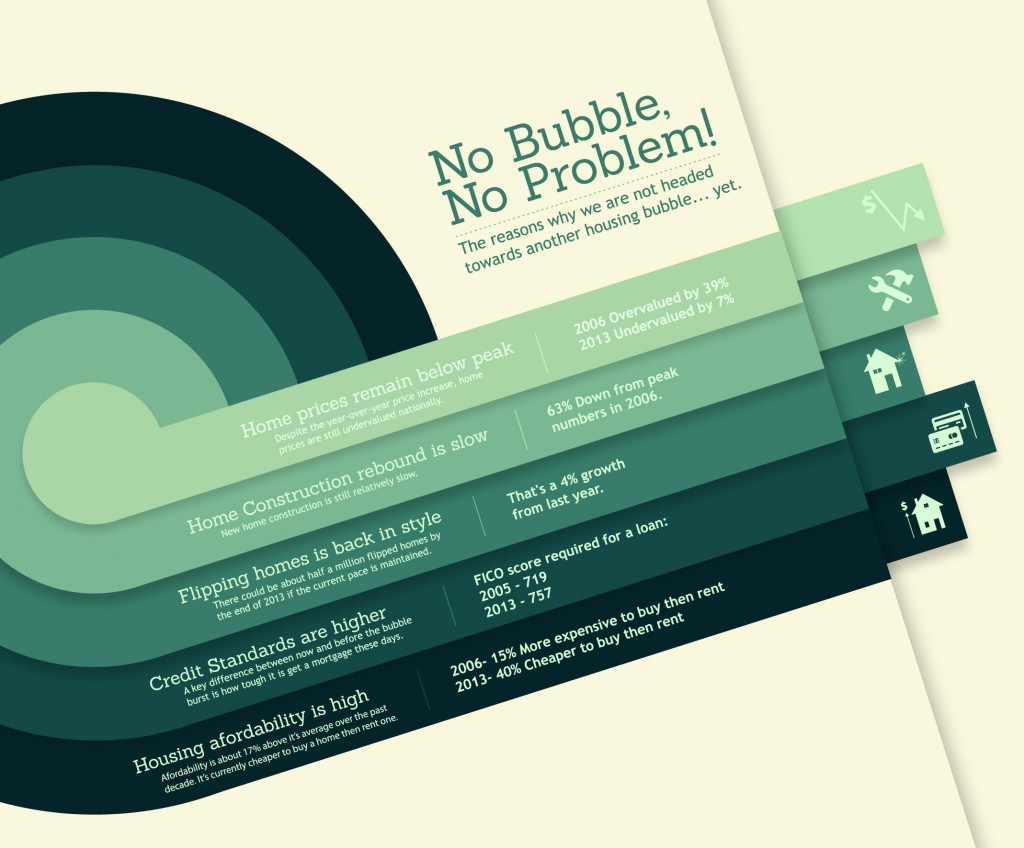

While the threat of a new housing bubble remains possible, it is important to familiarize yourself with the differences between this year and the previous financial crisis. According to Gary Thomas, the Realtors’ president, “the boom period was marked by easy credit and overbuilding, but today we have tight mortgage credit and widespread shortages of homes for sale.” This year the average FICO score for loans acquired by Fannie Mae is 757, up from 719 in 2005. Over that same period, FICO scores for Freddie Mac-acquired loans rose to 752 from 711.

Conversely, if price increases continue at their current pace, we would be pushing the boundaries of another bubble crisis. However, several factors will likely prevent prices from growing the way they are now:

- Expanding Inventory: Tight inventory has boosted prices, as buyers bid up prices on scarce homes. However, as prices continue to rise, more people will sell as they get back above water or decide to cash out, and more new construction will add to inventory.

- Rising Mortgage Rates: Rates are likely to rise as a result of the strengthening economy, either through market forces or Fed actions, which – along with more inventory – should slow down price gains.

- Fading Investor Interest: Investor interest will fade as prices increase, allowing more homeowners to enter the market.

The following graphic illustrates the differences between the most recent bubble and our current market conditions: