The median home price in the Milwaukee real estate market is approximately $219,500. Milwaukee homes are, therefore, very close to the national average of $216,567. As it has with so many other cities, appreciation rates in the last three years have helped to pull the local market out of the depths of the previous recession. In fact, prices for the Milwaukee real estate market are continuing to grow relative to last year. Over the course of 2014, Milwaukee homes have appreciated 3.6 percent. Over three years, however, homes in the region have appreciated by as much as 14.1 percent. The average price per square foot in Milwaukee was $98, an increase of 2.1% compared to the same period last year.

While sales in the first eight months of 2014 were down approximately 10% from the previous year, a lot of ground was made up in the closing months of 2014, making it a more traditional market. Existing home sales in the city rose almost 2% in November,making it the third consecutive month with an increase. While existing home sales have yet to reach the likes of San Diego or Miami, Milwaukee’s outlook remains positive.

Three years of positive price growth have boosted equity in the area. Milwaukee real estate investing has seen encouraging price gains. The following highlights how much equity has been gained relative to the year of purchase:

- Homes purchased in the Milwaukee housing market one year ago have appreciated by an average of $10,856, whereas the national average was $12,783 over the same period.

- Homes purchased in the Milwaukee housing market three years ago have appreciated by an average of $36,373, whereas the national average was $55,406 over the same period.

- Homes purchased in the Milwaukee housing market five years ago have appreciated by an average of $34,581, whereas the national average was $49,675 over the same period.

- Homes purchased in the Milwaukee housing market seven years ago have appreciated by an average of $8,772, whereas the national average increased $9,474 over the same period.

- Homes purchased in the Milwaukee housing market nine years ago have appreciated by an average of $29,468, whereas the national average increased $3,419 over the same period.

The job sector continues to serve as a prominent driving force of both local supply and demand. The Milwaukee housing market boasts an unemployment rate bellow the national average, 5.4% and 5.9% respectively. To get to where it is today, Milwaukee increased its unemployment rate by a whopping 1.4 percent. And while employment growth has recently eased, it still remains positive. Compared to markets like Indianapolis, Milwaukee’s employment growth is strong. For all intents and purposes, the job sector will provide an encouraging boost to real estate in the area. In fact, Wisconsin’s economy as a whole is stronger than the rest of the nation, despite a recent 3.66 percent drop.

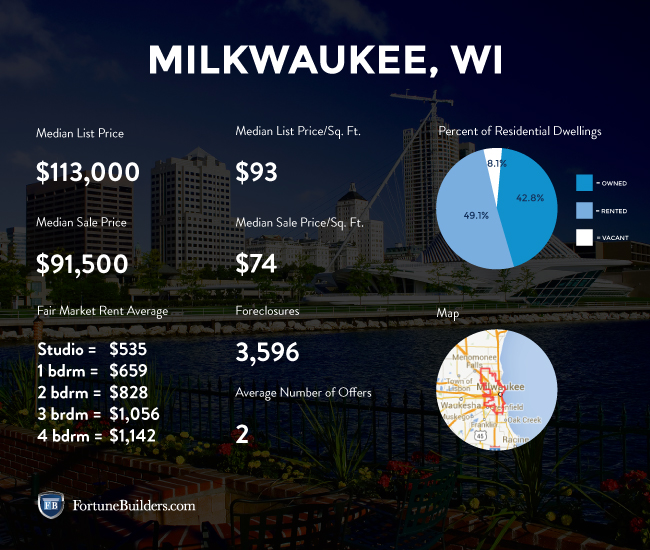

With the job sector providing a boost to the entire state, new housing construction is starting to come around. Compared to last year, construction rates are on the rise and inventory levels have begun to stabilize. In fact, over the course of a year, single-family housing permits increased 4.4 percent. Milwaukee nearly doubled the national average of 2.3 percent. While new construction typically represents the driver of supply, foreclosures and short sales now have a stronger impact on the Milwaukee housing market than they have in the past. Foreclosures, therefore, will be a factor impacting home values for the foreseeable future. In Milwaukee about 12 homes out of every 10,000 have entered into the foreclosure process. At that rate, Milwaukee foreclosures are greater than the national average. Rising inventories have, therefore, placed downward pressure on the median home price of the region.

According to Zillow, “the percent of delinquent mortgages in Milwaukee is 6.8 percent, which is higher than the national value of 6.4 percent. The percent of Milwaukee homeowners underwater on their mortgage is 37.6 percent, which is higher than Milwaukee Metro at 19.9 percent.”

Trulia has acknowledged that Lower East Side and Bay View, with average listing prices of $319,954 and $176,840, are the most popular neighborhoods in Milwaukee at themoment. However, investors may want to keep an eye out for Riverwest, Upper East Side, Jackson Park, and Historic Third Ward. Each of these neighborhoods is believed to have a bright foture for investors.

While affordability in the Milwaukee housing market has seen a slight decline, it is still better than that of the national average. In fact, Milwaukee residents allocate approximately 10.2 percent of their income to mortgage payments, whereas the average U.S. homeowner dedicates 16.3 percent of their income to the mortgage.

Milwaukee homeowners will soon be able to tap into $1 million in partially-forgivable loans, thanks to Mayor Tom Barrett’s STRONG Homes Loan program. The STRONG Homes Loan program could be just what the city needs to support homeownership and promote neighborhood stability, as it will permit owners to make essential upgrades to the property. As we enter 2015, owner-occupants can apply for loans of up to $20,000 to pay for emergency repairs, essential rehabilitation and code correction orders. This program should allow people to make more improvements to their home, essentially driving up prices. Perhaps even more importantly, interest rates will remain low, making the prospect of homeownership more appealing to some.

Milwaukee Housing Market Summary:

- Current Median Home Price: $219,500

- 1-Year Appreciation Rate: 3.6%

- Unemployment Rate: 5.4%

- 1-Year Job Growth Rate: 2.2%

- Population: 599,164

- Percent of Underwater Homes: 37.6%

- Median Income: $51,957

Milwaukee Housing Market Q1 Update:

The local housing market, and Milwaukee real estate investing in particular, have witnessed an impressive surge in home values over the first quarter of the year. No more than four months ago, Milwaukee real estate was appreciating at a rate of 3.6 percent. Today’s appreciation rate is more than double that, with homes increasing by as much as 8.6 percent in the last year. On top of appreciation, the unemployment rate has dropped and affordability continues to climb.

Affordability is readily apparent in the Milwaukee real estate investing market. Foreclosures, in particular, will provide investors with a great source of deals. According to RealtyTrac, Milwaukee has about 3,063 properties in some stage of foreclosure, or at risk of being repossessed. Surprisingly, that number is actually down 43 percent from the previous year. Nonetheless, those interested in Milwaukee real estate investing will find that distressed properties come at a very discounted rate. Non-distressed properties are selling for an average of $118,180, whereas distressed properties are selling for an average of 68.4 percent less, or $81,300 per property.

Milwaukee real estate investing will benefit from the large amount of bank-owned properties – or those that have been repossessed by lenders. Representing 84.4 percent of the foreclosure market, bank-owned properties will continue to serve as a great source of deals for investors. The remaining foreclosures consist of those going up for auction.

The Milwaukee housing market has seen a lot of growth in the early parts of the new year. Experts expect the positive trend to continue for the foreseeable future.