At some point, you’ll want to explore adding multifamily investing to your portfolio. The reason is simple: Investing in multifamily properties lets you boost your income while reducing vacancy rates.

There’s no question—with regards to real estate investing—that single-family homes will represent the lion’s share of your focus. Learning to acquire, renovate, sell, and even establish a recurring rental property income is a fantastic way to learn the basics of the real estate investing trade.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

What Is A Multifamily Property?

A multifamily property is any residential property that contains more than one housing unit. Duplexes, townhomes, apartment complexes, and condominiums are common examples of multifamily properties. Any property type you can think of that involves multiple units in the same property, even if the owner lives there. For example, if you life on one half of a duplex and your friend on the other, you both live in a multifamily property.

New investors can find great investment opportunities with multifamily properties. Some multifamily choose to live in one of their multifamily units, known as owner-occupied properties. Whatever way you choose to invest in a multifamily property, this investment can be a great wealth-building tool.

3 Tips For Investing In Multifamily Real Estate

Investing in multifamily real estate will prove to be a unique experience when compared to building a portfolio of single-family properties. Keep these tips in mind before you invest in multifamily real estate:

-

Find Your 50%

-

Calculate Your Cash Flow

-

Figure Out Your Cap Rate

1. Find Your 50%

The best way to scan through potential deals is to crunch the numbers and determine (approximately) how much a specific multifamily property can make you as an owner. Calculate the difference between expected income (rent payments, storage fees, parking fees) and expenses (repairs, maintenance, etc.)

If you do not have access to information on neighborhood comps, you can use the 50% rule. Take the expected income and halve it; this then becomes your estimated expense number. The difference between your estimated monthly income and estimated monthly expense is your net operating income (NOI).

2. Calculate Your Cash Flow

The estimated mortgage payments are brought into the equation in this next step by calculating your estimated monthly cash flow. Find out how much money you’ll be putting into your wallet by subtracting the monthly mortgage from the property’s NOI. This calculation will provide you with your cash flow estimate. It will also help you determine whether or not the investment will be worthwhile.

3. Figure Out Your Cap Rate

A third critical calculation to memorize is the capitalization rate, or cap rate for short, which indicates how quickly you will get a return on your investment. It’s important to remember two things. First, the cap rate for a “safe” investment, Like a certificate of deposit (CD), is usually between 1-2%. Second, this cap rate you’re about to calculate doesn’t account for many factors. You should also consider property value increases, monthly NOI boosts, or the tax breaks afforded to owners of multifamily properties.

To calculate the cap rate, take your monthly NOI, and multiply it by 12 to get the annual number. Then, divide that number by the property’s current market value. The key thing to understand about the cap rate is that higher is not always better. A higher cap rate generally denotes higher risk and higher returns. While a lower cap rate, conversely, indicates a lower risk and lower return.

A good rule-of-thumb is to shoot for a cap rate in the 5%-10% range. Anything lower, and the investment may not have enough yield. Anything higher, and you want to be sure you understand all the risks associated with the investment.

What To Look For When Investing In Multifamily Properties

Casual window shopping for real estate is nice to do on a Sunday afternoon, but multifamily investing requires much more than browsing your local open house. Investors should conduct their due diligence. This will include locating a property below market value and commencing efforts to analyze and assess its financial sensibility.

Along with the actual hustle of finding so-called property, it takes a combination of things to ensure a quality real estate deal. In most cases, the search will begin by locating a potential property. Then, compare purchase prices, short-and-long-term costs, and rental estimates. While this will generally forecast a ballpark figure of what investors can expect, it’s up to them to continue their due diligence and refine those numbers to ensure success. Because investing in multifamily properties requires a little more attention than other real estate deals, an investor’s first concern should always be on the numbers. These financial figures will not only expose the true value of an investment property but reveal its bottom line. In addition to the numbers, there is a selection of underlying factors that can influence multifamily investing.

For those looking to invest in a multifamily investment deal, the search begins with the following checklist:

The Location

Location is of the utmost importance for real estate investors, even more so when investing in multifamily properties. With more tenants, every unit will need to appeal to renters; the location is generally the most desired criteria. Investors should look for high-growth, high-yield areas where properties are in high demand, well-maintained neighborhoods when investing in multifamily properties.

The Total Number of Units

The next step is to evaluate the property as a whole. Investors should consider the number of units on the property, including the number of rooms in each unit. Beginner investors should begin their real estate search focused on three types of multifamily properties. These include the duplex (two units), triplex (three units), and four-plex (four units). These properties offer the most upside with the least risk for beginner investors and are generally more affordable.

The Potential Income

The next step is determining the income a property can accrue. Sites like Rentometer.com or Craigslist are helpful sources for verifying rental prices and income, but investors should practice due diligence, taking everything into consideration.

For those looking to remain conservative, the 50 percent rule is a general recommendation. You should spend 50 percent of an investment’s income on expenses rather than the mortgage. While too mild of a strategy for some, it’s a good rule of thumb for beginner investors.

The Costs

Every situation will differ when financing real estate, especially multifamily properties. Investors may choose to live in one unit while renting out the other, allowing them to qualify for owner-occupied financing. Meaning that the second unit’s income will be factored into the lender’s qualifying ratio. Investors also need to consider their credit score when contemplating financing options. This number will greatly influence the qualifying process. In general, lenders will look at three components: credit, debt-to-income ratio, and down payment.

The Seller

There is one more question when evaluating potential multifamily properties is: who’s selling the place? The purchase price can vary greatly depending on the seller and their motivation. Therefore, investors must gain an understanding of who they’re dealing with. Bank-owned properties are dealt with differently than for-sale-by-owner properties. This means there’s potential for cost savings.

Single Family vs Multifamily Investing

Investing in single-family vs. multifamily properties is a great debate in the world of real estate investing. While each offers several compelling advantages, each side represents a very different exit strategy for investors, including management style and income earned. Investors, insurers, and lenders view these properties differently. Comprehending the ins and outs of multifamily and single-family properties is critical for your success.

For those considering taking the plunge and investing in multifamily properties or single-family properties, it’s important to understand which investment vehicles do what. Deciding among single-family or multifamily properties is largely about personal preference and goals. The following will explain the major differences between the two investments, including each strategy’s various advantages and disadvantages. If you are looking for an answer for the single-family vs multifamily debate, I encourage you to keep reading.

Multifamily Investing Benefits

A multifamily property, or multi-dwelling unit (MDU), is a residential building with two or more units under one roof. They can also be several buildings within one complex. The most common examples are duplexes, townhouses, and some types of condos. Each unit tends to have its own living space, a separate kitchen, and a bathroom. A multifamily property will generally consist of owning the property and the land on one recorded deed. In some cases, it can be owned by one or more parties.

While they are the least common type of residential buildings, investing in multifamily properties is an immensely favorable strategy among investors thanks to their additional source of monthly income, along with slow but steady appreciation. As an investor, the advantages of owning a multifamily property include:

-

Bigger Cash Flow: A single-family property generates a single monthly income, and a multifamily property produces multiple forms of monthly income. The allure of investing in multifamily properties is easy to see. These investments represent an innovative opportunity to generate additional income from one investment. Also, investors may decide to live in one unit and rent out the others for income. When it comes to passive income retirement investing, a multifamily property can be used in multiple ways.

-

More Control Over Value: The more income a property receives, the higher the value is. Multifamily properties are comprised of more units, which means earning multiple streams of income. Therefore, these investments are generally valued higher than single-family homes, dependent on comparable sales as rentals.

-

Larger Pool Of Tenants: One of the underlying benefits of investing in multifamily properties is less risk. How, you ask? Because, unlike single-family units, where income is lost when the home is vacant, multifamily properties have numerous units and alleviate the total economic loss for investors.

-

Scalability: Multifamily investments epitomize scalability. Rather than purchasing one property at a time, these investments allow for acquiring multiple properties within one building. They are perfect for those looking to grow their real estate investment portfolio and take their business to the next level with the option for investors to venture into the arena of mixed-use and apartment investing down the road.

-

Ideal For Property Management: Single-family properties d=typically do not generate enough income to justify hiring a property management company. However, a multifamily property typically generates enough income to allow investors to hire a property manager to handle day-to-day operations and handle required repairs. This can be a great benefit for investors looking to have less involvement in their rental properties.

-

Tax Benefits: Multifamily property offers great tax benefits for investors. Investors can depreciate their multifamily property to offset a great deal of the rental income that they collect from the property each year. JM Littman, Director of web design agencyWebheads suggests that “when utilized in conjunction with cost segregation, investing in multifamily properties provides the benefit of bonus depreciation”.

-

Blanket Insurance Policies: While multifamily properties have more areas to insure overall, investors may find these policies easier to negotiate and secure. Insurance companies are well-versed in multifamily properties and the associated liabilities and will be experienced enough to walk you through different options. As your portfolio grows over time, you will typically be able to group everything under one policy.

New investors should conceptualize multifamily real estate as a hybrid between a single-family home and a condo. Both the structure and the land are owned and on file in one recorded deed. These investments allow for the ability to generate more income than a single-family property. They are ideal for those looking to grow their business and offset risks when generating monthly income.

Single Family Investing Benefits

A single-family property, otherwise referred to as a single-family home (SFH), is defined as a free-standing residential dwelling built on a single lot with no shared walls. Unlike a multi-family home, these properties contain only one unit, neither attached nor built-in unison with any other type of structure. Also, a single-family home will generally include a front and backyard, as well as a garage.

Traditionally used for owner occupancy, single-family homes can also be used as an investment vehicle to generate monthly income. Record-low mortgage rates and fast-rising rental rates offer many advantages compared to multifamily properties, especially for beginner investors. The following examines the benefits of investing in single-family properties:

-

More Affordable: One of the more obvious advantages of investing in a single-family property is cost. The price for these real estate investments is lower than for multifamily properties, including additional expenses like down payments and maintenance. Rather than 25-30 percent down for a multifamily home, investors need up 10-15 percent for the down payment. Also, most rental agreements will require the tenant to pay for the majority of utilities. They may also be required to take responsibility for the landscaping, making long-term maintenance costs much cheaper. Also, insurance rates will be more affordable for single-family homes than multifamily properties.

-

Higher Appreciation: For one reason or another, single-family investments tend to appreciate more than other types of properties. It could be a variety of factors, but it mostly pertains to how lenders value each investment type. Multifamily properties are valued on the rents coming in and the condition of the property. However, single-family homes are valued on the supply and demand of owner-occupied buyers. If well-maintained and situated in a thriving neighborhood, buyers will always be in demand for single-family properties.

-

Easier To Finance: Although banks’ financing guidelines and rules vary, financing a single-family property is typically easier than multifamily properties. Lower interest rates and higher loan-to-value (LTV) ratios are one of the main benefits of financing single-family homes. These properties are typically more affordable than multifamily homes, so many investors forgo financing options and offer a cash payment. It’s important to note that financing a property for rental income intentions (non-owner occupied) will subject borrowers to different mortgage rates than an owner-occupied loan. Investors can expect to pay 0.25 – 0.50 percent more than owner-occupied mortgage rates.

-

Easier To Manage: Managing one unit over four has its appeal. The one aspect many investors fail to consider when investing in real estate is the cost of managing it. This can vary depending on the number of units. With only one tenant, single-family rentals are much easier to manage. Investors can choose to become the landlord and managing the property themselves. They can also choose to hire a professional management company to oversee the investment instead.

[ Learning how to invest in real estate doesn’t have to be hard! Our online real estate investing class has everything you need to shorten the learning curve and start investing in real estate in your area. ]

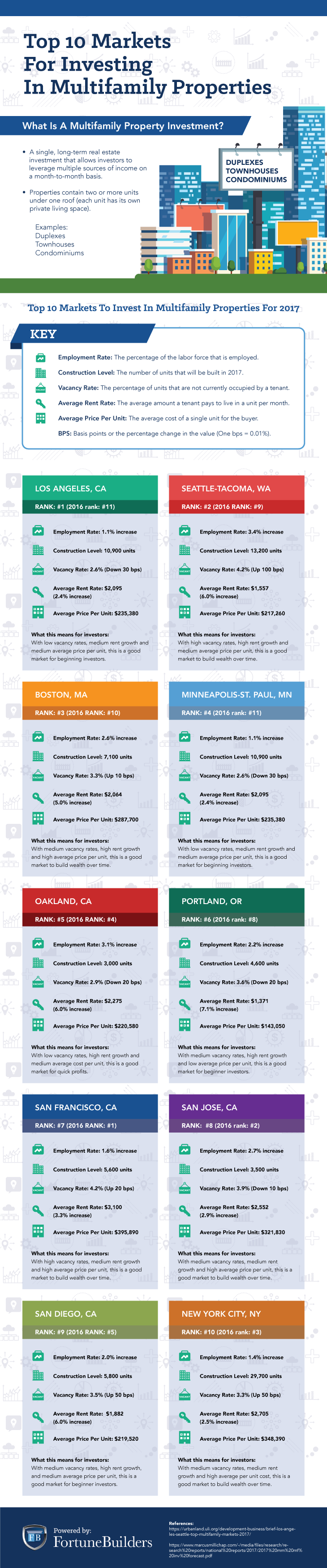

The Top 10 Markets For Multifamily Real Estate Investing

As with any real estate purchase, your success is directly related to one thing: location. You can have a great property that you rehabbed with the latest and greatest appliances. Still, if it resides in an undesirable location, you will have a difficult time finding tenants.

If you are ready to get your start in multifamily real estate investing, check out these top 10 markets:

-

Minneapolis-St. Paul, MN

-

Portland, OR

-

New York City, NY

Financing Multifamily Real Estate

There are numerous loan types available when buying a multifamily property. Depending on your investment goals, the size of the property, and your financial situation the right form of financing can vary dramatically. A common form of financing is a private or hard money loan. These are loans distributed by another investor, rather than a traditional financial institution. While they can have higher interest rates than regular mortgages, they are often more flexible in other areas.

Financing multifamily real estate can also be accomplished with conventional mortgages, HUD loans, and other government-backed loans for homeownership. for example, if you plan to live in one of the units for at least one year your financing options will open up tremendously. Investors can also consider a portfolio loan, provided by a smaller bank in the area. A great first step is to research all of the options available to you and compare the various application periods and costs.

If you do not find a financing method you particularly like, don’t be afraid to get creative. Some real estate investors find the best way to finance a multifamily property is through real estate crowdfunding or a solid business partnership. Remember, there are a multitude of options available to you.

Managing Multifamily Properties

It may be obvious, but multifamily properties require more attention than single-family rentals. There are more units, tenants, and square footage to maintain. For this reason, many multifamily property owners opt to work with a property management company. While this will come at a cost, having the extra help can make your investment run more smoothly. Property managers can help rent out new units, facilitate lease signings, manage maintenance requests, and oversee workers.

If you decide to manage a multifamily property alone, there are ways to increase efficiency. At the very least, research online tools to help you keep tenant communications, important documents, and rent collection streamlined. The responsibility of managing a multifamily property can be significant, but there are numerous ways to make the job easier for investors.

Summary

Multifamily investing requires a considerable amount of time and effort to get started. Done right, multifamily properties can be an excellence source for passive income retirement investing. However, it’s important to understand the ins and outs of multifamily investments first, including how to find and obtain them. Using math to inform your multifamily investment property decisions takes the emotion out of the process. Instead of being influenced by extraneous factors, crunching the numbers on a multifamily property will quickly give insight into project. Does the property show enough ROI potential for you, or is something that should be avoided at all costs? Knowing which deals to walk away from can be as important as knowing which deals to pull the trigger on.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!