By definition, real estate exit strategies are a means for investors to profit on a subject property. While there are several strategies that may be used, each is intended to facilitate a timely and profitable transaction. Essentially, they are a preemptive consideration as to what will be done with the property. Determining the appropriate real estate exit strategy will not only provide investors with a plan of action, but it will mitigate impending risks as well.

Assuming you have found a property that meets your criteria, there are several strategies that must be considered. The two most popular real estate exit strategies are rehabbing and wholesaling. As an investor, you are probably familiar with these terms. However, understanding their importance and the intricacies that accompany them will ultimately reflect how successful you may become in your real estate endeavors.

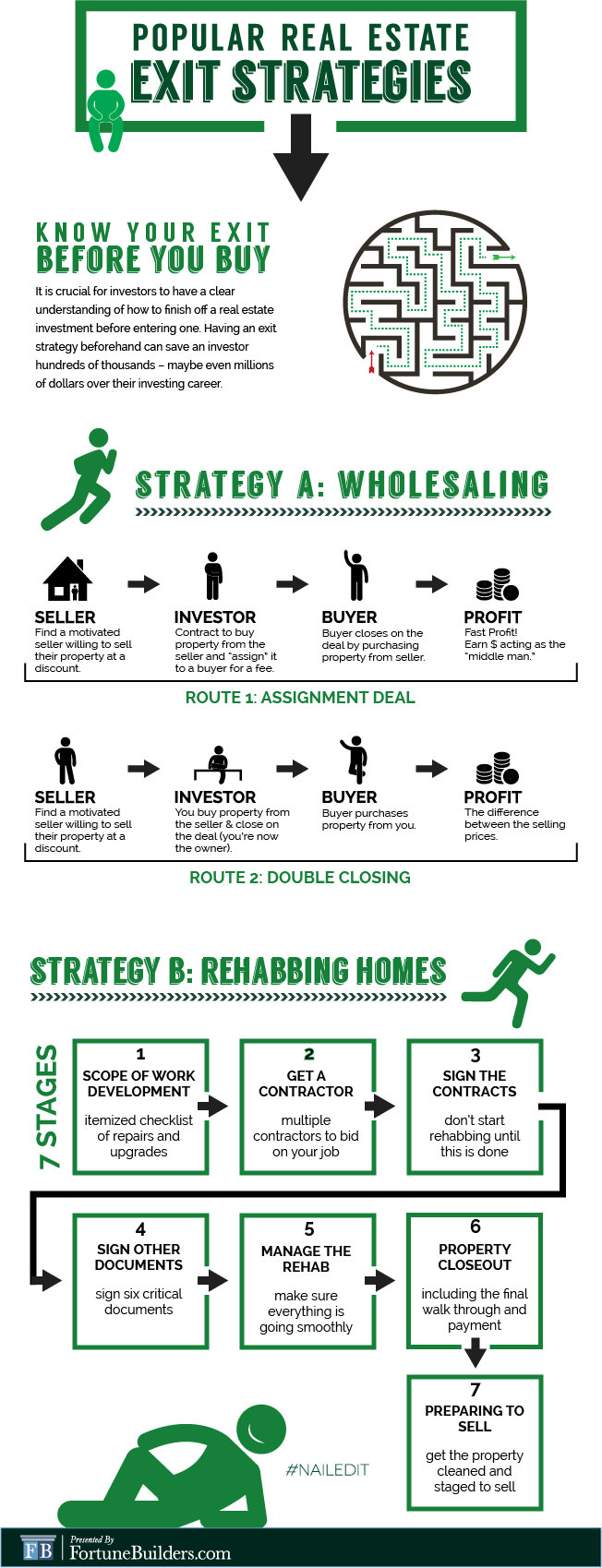

To help you better understand the process associated with these real estate exit strategies, we have provided a quick snapshot of what they encompass.

Simply put, a wholesale deal will witness the investor act as the middleman between a seller and an end buyer. Essentially, the investor will find and quickly sell a property for a respectable profit margin. There are two methods in which an investor can wholesale: They can either sell or “assign” their purchase contract to an end buyer, or they actually close on the property and immediately resell the property to another investor in the form of a “double close.”

Rehabbing allows for the largest profit margins, as it allows an investor to sell the subject property at full market value. A rehab involves purchasing a house, renovating it and selling it for more than the original investment costs (purchase price and repair costs).