As 2013 draws closer to an end, analysts familiar with the market admit that the U.S. economy and the housing sector have both shown encouraging signs of improvement. On a national level, we have every reason to be optimistic heading into the New Year. The progression of the housing sector recovery is forecasted to increase economic growth by approximately 2.5 to 3.0 percent, more than a 0.5 percentage point better than 2013 is expected to finish at.

In addition to economic growth, the recovery pace appears primed to generate more jobs. If the housing sector recovery is in fact sustainable, and every indicator suggests it is, the unemployment rate could drop below 7 percent by mid-2014.

Analysts at Freddie Mac expect single-family home sales and housing starts to be at their highest level since 2007. That is to say, 2014 should witness the most active participation in the housing market since the bubble crisis. However, in addition to the positive outlook surrounding home sales and starts, multifamily transactions and construction rates are expected to post gains.

Despite the recent increase in both mortgage rates and property-value appreciation, most parts of the country will benefit from affordable housing. There are, however, exceptions. California, in particular, continues to harbor four of the five least affordable housing markets. This trend should continue into 2014.

According to Freddie Mac’s Economic & Housing Market Outlook for November 2013, “The big shift ahead will occur as the single-family mortgage market begins transitioning from a rate-and-term refinance dominated market, to the first purchase-dominated market we’ve seen since 2000. The emerging purchase market should gather momentum in the coming year.”

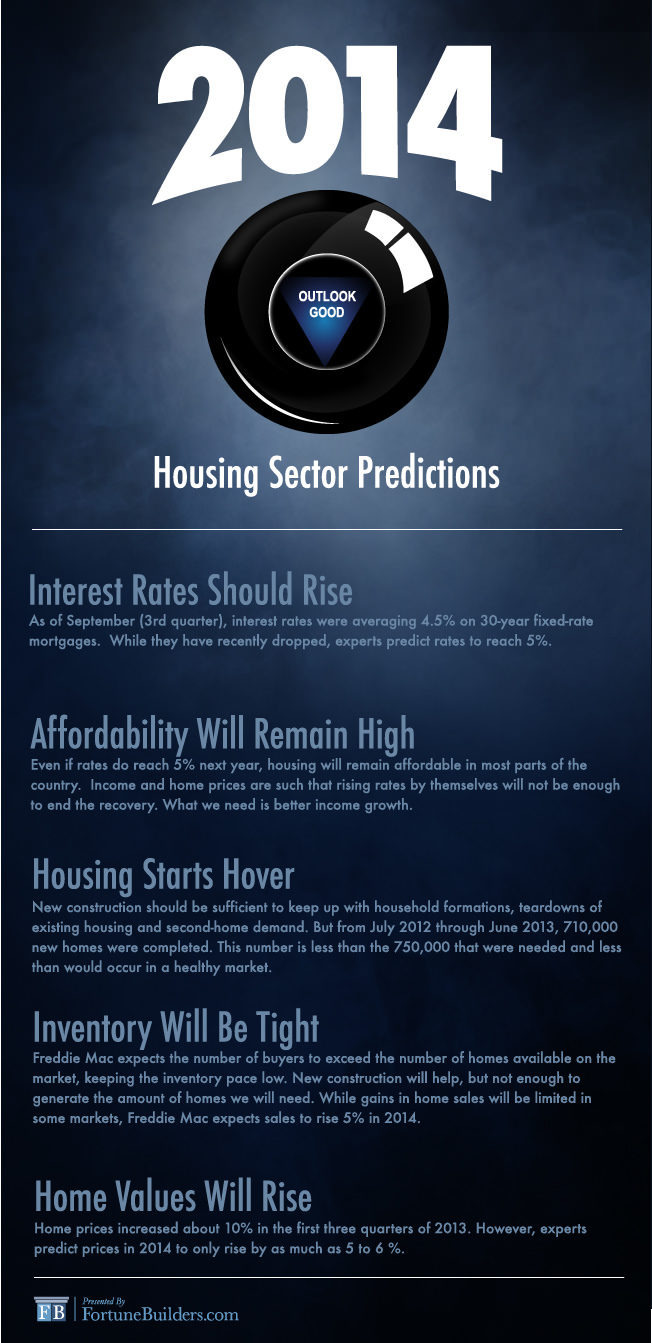

The following is a prediction of 2014’s market conditions:

Interest Rates Rise

While interest rates on a standard 30-year fixed-rate mortgage have increased a full percentage point since May, they are still relatively low at 4.5 percent in the third quarter of 2013. Though rates have since decreased, experts predict them to increase in 2014. As of now, it is looking like rates will gradually increase throughout 2014, finally settling around five percent.

Affordability Remains High

Even if interest rates do top out at five percent, they are still well below historical trends. Housing would remain affordable in most parts of the country. On a national level, incomes and home prices are such that rising rates by themselves will not be enough to end the recovery or make houses unaffordable.

Housing Starts Hover

Housing construction continues to remain stagnant, despite picking up in recent months. Accordingly, new construction should be sufficient to keep up with household formations, teardowns of existing housing and second-home demand. However, in the period between July 2012 and June 2013, 710,000 new homes were completed. These starts were less than the 750,000 net household formations and far less than what would occur in a healthy market.

As 2013 comes to an end, new starts have climbed to 900,000 units. New buildings are expected to increase to 1.15 million in 2014. This projected increase alone should be enough to further economic growth.

Inventories Remain Tight

According to the recent Freddie Mac report, prospective homebuyers are expected to match or exceed increase in the supply of homes, keeping inventory relatively tight. New construction starts are projected to increase, but not at a rate that can keep pace with the rising demand. As a result, analysts anticipate home sales to increase by five percent in 2014.

Home Values Rise

The first three quarters of 2013 saw significant home appreciation rates, as home prices increased by as much as 10 percent. However, rising mortgage rates will temper this trend in 2014. Experts believe home values will rise at a less robust pace of 5-6 percent in the upcoming year. The strongest gains are likely to be realized in those markets that were hit the hardest during the decline.