The prospect of owning a rental property can be overwhelming to every investor, from the most seasoned real estate entrepreneurs to those who have never even bought a home. The sheer amount of due diligence required is intimidating, as the performance of each asset coincides with countless variables. As a result, several tools have been created to make the process easier for everyone involved. However, one tool in particular doesn’t get enough credit: the rent ledger. Rent ledgers have become a necessary component of every rental property, which begs the question: What is a rent ledger? More importantly, how can investors use them to their advantage?

What Is A Rent Ledger?

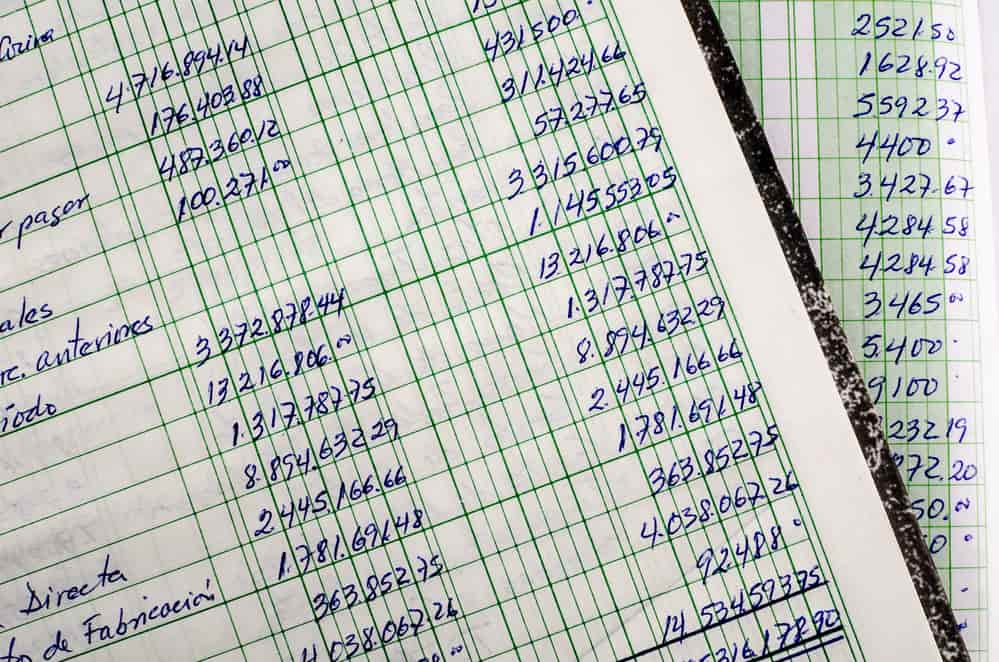

Not unlike a traditional ledger, a rent ledger is a collection of financial accounts landlords use to keep track of transactions (past, present and future). In its simplest form, a rent ledger is a record of payments; it’s either a physical book or digital account of the money being generated (or lost) by a rental property. A proper rent ledger will record and document the complete payment history of each tenant and property. It should be noted, however, that rent ledgers are only as detailed as their owners. While some are used to detail everything from the payments to the tenants themselves, others are void of intricate details. That said, most rent ledgers will serve two specific purposes: showing the amount of rent collected (and expected) and serving as a reference in the event of discrepancies (with tenants or the Internal Revenue Service).

Why Do You Need A Rent Ledger Report?

The single most important reason for a rental property owner to create a rent ledger template is to remain organized. If for nothing else, owning a rental property is akin to running a business: In order to operate at maximum efficiency, landlords must be organized. Consequently, rent ledgers are tools that enable landlords to keep careful records of their income and expenses simultaneously. Doing so will keep a detailed account of important financial figures and serve as a reference point in the event discrepancies arise in the future. Outside of the obvious, however, a good rent ledger will also allow landlords to reflect on their past and present strategies and use what they have learned to alter their strategies moving forward.

[ Learning how to invest in real estate doesn’t have to be hard! Our online real estate investing class has everything you need to shorten the learning curve and start investing in real estate in your area. ]

What Information Is On A Rent Ledger?

Not all rent ledgers are created equal, and the information contained within a ledger is only as insightful as the investor is willing to make it. As a result, the information contained within most rent ledgers will vary significantly from landlord to landlord. While some investors are comfortable including rental rates and collections (and nothing more), more precise investors will want to make sure they include a detailed account of everything that may be of use to them in the future. For those who are looking to cover all of their corners, here’s a comprehensive list of the important items to include on a rent ledger template:

-

Your name (or the owner of the property)

-

The address of the subject property

-

Specify the type of property (single-family, multifamily, condo, etc.)

-

The size of the lot

-

Indicate zoning rules

-

The tenant’s name

-

How many square feet the unit is

-

The number of bedrooms and bathrooms

-

Include the lease start and end dates

-

Confirm the monthly rental rate

-

Include any additional rental prices

-

The date rent is due yeah month

-

Include a column for the dates tenants pay

-

Keep track of the security deposit

-

Maintain detailed notes one anything you may find useful

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

How To Use A Rent Ledger

Rent ledgers have already proven they belong amongst investors’ most valuable tools, but the degree by which most people use them can vary. Some investors are completely comfortable using a rent ledger to record rental transactions. Others, however, may find more opportunities in the utility offered by a detailed rent ledger.

Property managers, tenants, mortgage lenders, and buyers also all have various uses for a rent ledger. The report can reveal important information such as rental payment history, lengths of tenant occupancies, vacancy rates, late fees, cash flow, and opportunities to increase cash flow.

Let’s examine how different people may use rent ledgers to their own advantage.

Owners & Property Managers

Owners and property managers will use rent ledgers in the more traditional sense; that is, they will use their tenants’ payment history to keep proper records of past and future transactions. With a detailed account of rental payments, owners and property managers may simultaneously keep track of individual payments and use the records as a future reference.

Perhaps even more importantly, however, an accurate rent ledger may help owners and property managers navigate the eviction process. If, for example, a rent ledger can help prove a tenant hasn’t kept up with their lease obligations, the records may help turn a slow and painful process into something more manageable.

Rent ledgers may also be used to keep track of security deposits. Since owners and property managers may have to give the security deposit back at some point, it’s a good idea to keep detailed records of how much was paid by each individual tenant, and how much they are due to receive at the time the lease is over. By keeping careful records, landlords may avoid unnecessary complications.

Last, but certainly not least, a properly kept rent ledger can serve as an invaluable tool when it comes time to sell a property. At the very least, a rent ledger can demonstrate the rental income potential of a subject property. In reviewing the ledger itself, a buyer may confirm whether or not the impending rental income justifies the purchase of the property. Provided the ledger identifies attractive cash flow, there’s no reason it couldn’t help sell a home quicker and for more money.

Buyers & Lenders

In the event a buyer is looking to acquire a rental property, a rent ledger will help identify the cash flow potential. Sine ledgers provide a detailed account of past rental payments, buyers will gain insight into what they can expect from upcoming payments. While past ledgers shouldn’t be taken as testament, they can serve as a good reference point for how much rental income they can expect.

Lenders, on the other hand, will take into account a property’s cash flow potential before underwriting a loan. Lenders may use rent ledgers to determine a property’s debt service coverage ratio (DSCR). The DSCR is a ratio which compares the NOI (net operating income) to the incurred debt the buyer will be taking on. In other words, the banks will want to see how much risk they are taking on by lending to someone with the intention of renting the property out. If the cash flow appears secure and steady, the banks may be more inclined to offer more attractive underwriting.

Tenants

It may surprise many to learn that rent ledgers aren’t only for buyers, lenders, and property owners. In fact, the same people rent ledgers document may have a use for the information contained within. More specifically, tenants may use rent ledgers to prove their payment history. In the event a tenant has aspirations of homeownership, they may request a copy of the landlord’s rent ledger to serve as a concise history of their past payments. Provided the tenant paid in full and on time each month, a lender may be inclined to consider the promising track record when underwriting a loan.

In addition to helping out with a new loan, a rent ledger may be of assistance when a landlord incorrectly accuses a tenant of not paying on time (or at all). Not unlike how a landlord may use a rent ledger to make the eviction process easier, a tenant may use their history as proof of payment. If, in fact, the rent ledger is correct and up to date, it may be used to dispute rent payments or an unlawful eviction. If, for example, a tenant can cross-reference their own bank statements with a rent ledger, they may be able to identify inconsistencies in their favor.

Benefits Of Having A Rent Ledger

The benefits of having a rent ledger extend to everyone. Buyers, owners, and renters may all benefit—in one way or another—from a well-kept rent ledger. That said, here’s a look at just some of the many ways a rent ledger may be of assistance:

-

Improved financial efficiency & performance

-

Uncover opportunities that would have otherwise been overlooked

-

Document tenant performances & identify patterns

-

Aid in the eviction process

-

Justify a home’s selling price

Summary

In its simplest form, a rent ledger is nothing more than the documentation associated with rental income. At its pinnacle, however, a rent ledger can be an invaluable tool that enables landlords to optimize their efficiency and cash flow. However, it is worth noting that it’s not enough to simply document transactions; landlords will need to be able to translate the information into a more profitable, time-saving process. If for nothing else, it’s not the information itself that’s invaluable; it’s what owners do with it to improve the rental process for everyone involved.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!