Key Takeaways:

- What is a short sale?

- What is a foreclosure?

- Short sale vs. foreclosure pros and cons

- REO vs. foreclosure properties

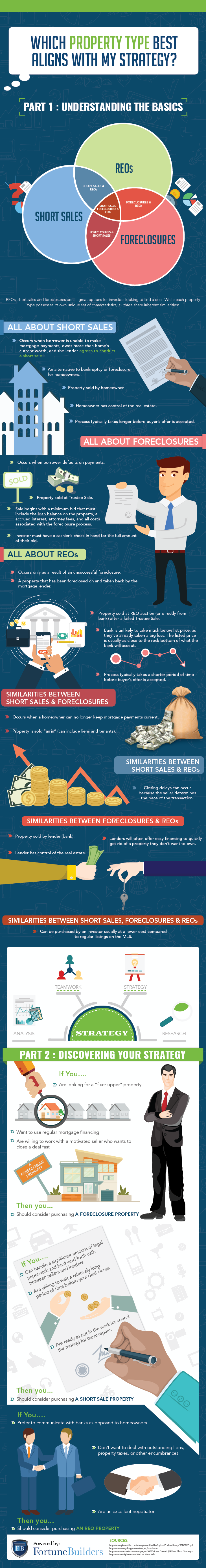

- Short sale vs. foreclosure vs. REO

Real estate investors are constantly looking for new ways to find great deals. Whether it be an original marketing strategy, a trending lead generation tool, or a negotiation technique to help you move forward, the most successful investors are consistently up to date on the industry’s current workings.

The best deals come from motivated sellers who are willing to sell properties below market value. As it turns out, there are several options for investors looking to get ahead of the competition, including short sales, foreclosures, and REO properties. While these properties can offer some of the same attractive benefits, there are a few differences to keep in mind as you search for deals. Keep reading to compare short sale vs foreclosure vs REO properties and decide which exit strategy is right for you.

What Is A Short Sale?

The term “short sale” is a colloquialism that is frequently used to describe the process of selling a home for less than is owed on its outstanding mortgage. Short sales are common amongst distressed homeowners who exhibit a propensity not to pay their mortgage obligations. The more clear it becomes that a homeowner won’t pay their mortgage, the more likely a lender is to allow the owner to conduct a short sale. In allowing the short sale, the lender is granted the opportunity to recoup any of the potential losses they would suffer in the event of delinquency. The homeowner, on the other hand, avoids foreclosure and any resulting blemishes on their credit report. Neither homeowners nor banks look forward to short sales, but the fact remains: at some point, they are the best option for both parties.

What Is A Foreclosure?

A foreclosure is the direct result of a homeowner’s inability to keep up with their mortgage obligations. In its simplest form, however, a foreclosure is a severe “penalty” levied on delinquent homeowners who do not abide by the contract they originally signed. Once a borrower breaks a contract, the lender has the right to foreclose on the property, seize the asset, and evict the homeowner. Not unlike short sales, foreclosures are not optimal for either party involved. Homeowners who experience a foreclosure will suffer severe financial ramifications. On the other hand, lenders will miss out on the money they were promised in the original mortgage underwriting. However, to avoid further losses, the lender will attempt to sell the home at auction once it has been repossessed.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Investing In Short Sale Vs Foreclosure Properties: Pros & Cons

Both short sale and foreclosure properties result from homeowners who either fail to repay their mortgage or may not be able to in the future, creating a scenario in which the sellers are motivated to sell quickly. There are a few differences to keep in mind, however. Foreclosures occur when the bank takes over the property and often happens after homeowners have abandoned the home. On the other hand, short sales are sold by the property owner—though they are often sold for less than the outstanding mortgage balance.

Due to the differences, there are unique advantages and disadvantages to each property type. Here are some of the pros of foreclosure properties:

- They are often sold below market value, meaning investors can often secure better deals when compared to properties listed on the MLS.

- After taking control of the property, banks often want to liquidate the asset as quickly as possible.

- Cash buyers can increase their likelihood of walking away with a deal, as most foreclosure properties are sold at auction.

While the benefits of foreclosure properties are impressive, there are a few cons:

- Many foreclosures are sold at a real estate auction, which can be intimidating to some investors. Brush up on our guide to real estate auctions to ensure you are prepared.

- Foreclosures are often sold “as is,” meaning they can be distressed or require immediate maintenance. However, foreclosures are often sold at a lower price, so the profit margins may still be large.

While foreclosures can present a unique opportunity for real estate investors, the benefits of short sale properties are not to be ignored. Here are just some of the pros of finding short sale properties:

- The biggest advantage of a short sale property is its price; they are sold for much lower than the house’s market value, allowing investors to secure potentially large profit margins.

- The selling process will play out similarly to a traditional sale. While there are negotiations and meetings, investors will often find the short sale process to be straightforward.

- Short sales can also have some benefits for the homeowner. By going through a short sale rather than a foreclosure, the homeowner can save money in legal fees and prevent extensive credit damage.

There are also a few cons to keep in mind when looking for short sale properties:

- Short sales are only profitable for patient investors: getting an offer approved from the lender that is selling the property can take up to a few months.

- The extended time frame of the short sale approval process can also be intimidating because investors are not guaranteed to be approved by the lender. It is important to avoid missing out on other investment opportunities while waiting for a short sale.

Is Short Sale Better Than Foreclosure For Homeowners?

When purchasing a home, no one imagines that they will fall behind on their mortgage payments and one day lose the property. That’s why, at least when it comes to choosing between foreclosure vs. short sale for homeowners, the best option is the one that minimizes the negative impact: short sales. A short sale enables homeowners to sell the property to pay back the bank for the missed payments. This also allows them to be in charge of the selling process, and prevents banks from repossessing the property, benefiting both parties.

Foreclosures can also result in lengthy legal proceedings for both the bank and homeowner, costing thousands of dollars over time. There are a few types of short sales, depending on your mortgage, that can provide homeowners with more control over the selling process. As a whole, short sales offer homeowners the chance to avoid the severe effects on their savings and credit that can happen due to a foreclosure.

Tips For Buying Short Sale Properties

Short sale homes can represent an attractive opportunity for investors if they know what they’re doing. Follow these tips for buying short sale properties:

- Work With The Right Team: Find an experienced real estate agent in your area who can help you identify short sales in the area. It is also beneficial to find a title officer who can search for all the liens attached to a potential property.

- Do Your Research: Check the home’s market value, so you don’t make an offer that is significantly less than market value. Short sales can represent a good deal; however, owners may still reject offers that are dramatically lower than the value.

- Be Patient: Lender approvals can take anywhere from a few weeks to a few months when it comes to short sales. Investors should be prepared for a longer time frame when compared to a typical real estate transaction.

- Secure Your Finances: Make sure you go in having already secured financing to ensure your offer is accepted. Investors who are pre-approved for a mortgage and/or have a large down payment are more likely to be approved than those who do not.

If you are interested in finding these types of deals in your market, be sure to read our five-step guide to finding short sale properties.

Tips For Buying Foreclosure Properties

The foreclosure process can have a lot of moving parts, which is why it’s important for real estate investors to familiarize themselves with the process beforehand. Read these tips on buying foreclosure properties:

- Estimate Renovation Costs: When buying a foreclosure, it is crucial to estimate how much the potential renovation costs will be and what price the finished property will likely sell for. Read our guide to learn how to estimate the after rehab value and determine the profitability of the deal.

- Be Ready For Competition: Foreclosed properties are public record, making them easy to find. However, this can also mean more competition from other real estate investors.

- Go Online To Find Properties: There are a few websites that list foreclosure properties, including RealtyTrac.com and Zillow. Investors can also check county records online, but doing so can take longer than searching more specialized websites.

- Find The Right Financing: Look into the different types of funding available for foreclosures. Investors may find success with commercial loans, FHA loans and more.

Read our guide to finding foreclosure properties to help identify these deals in your area.

Investing In REO Vs Foreclosure Properties

A real estate owned property (REO) refers to a property that has been foreclosed on and taken back by the mortgage lender. There are a few similarities in foreclosure vs. REO property, though REOs can only occur due to a foreclosure.

There are several pros and cons to buying a foreclosure property, and REOs are no exception. Some of the advantages of buying REOs are even quite similar to those of foreclosures. The biggest perk being that REOs are sold below market value, allowing investors to secure good deals. One difference is that REOs are thought of as a great opportunity for beginner real estate investors, while foreclosures can be intimidating to those who don’t know what to expect. The reason REOs are thought of as easy to break into because the purchase process is as straightforward as possible. Lenders are often searching for a quick sale, and the property will be unoccupied and free of any liens.

There are also a few cons to working with REOs that investors should be prepared for. Just like with foreclosure properties, REOs will be sold “as is,” meaning investors should be prepared to negotiate during the sale process to ensure they receive good purchase terms. REOs are also challenging for some because lenders require their own time table for the sale. This usually translates to a fast sale and closing process, which may be challenging to investors who are not prepared to move quickly. Overall, there are numerous pros and cons that can influence an investor’s decision between a short sale vs. REO, or even a foreclosure vs. REO.

Tips For Buying REO Properties

The following tips can help anyone interested in buying REO properties:

- Learn To Negotiate: Negotiations will be a key part of securing a deal when buying REO properties. Investors should brush up on their negotiating skills before approaching a bank about an REO property.

- Write An Offer Letter: When submitting an offer on an REO property, be clear that you are willing to accept the property “as is,” but do not forget to include an escape clause. This will protect you in the event the property has extensive damage.

- Hire Experts: You will benefit from working with the right team when buying an REO property. Consider working with a real estate attorney, contractor, and a real estate agent—all of whom can help make sure you land a good deal.

- Learn The Property Value: REOs are always going to be priced attractively, but that does not always guarantee a good deal. While you may not inspect the property before submitting an offer, do as much research as you can to ensure it is not overpriced.

Check out our guide to finding REO properties in your area, here.

Short Sale Vs Foreclosure Vs REO: How Should An Investor Choose?

While REOs, short sales, and foreclosures have many similarities, they also have inherent differences. Whether you invest in wholesale properties, rehab properties, or rental properties, understanding the differences between distressed property types will surely give you an edge. Use our triple Venn diagram to discover how these three property types are related, and use our tips to find the strategy that will suit you best:

Summary

A real estate investor’s ability to find and secure deals will determine their success within the industry. That’s why it is crucial to familiarize yourself with a wide variety of properties on the market. When it comes to short sale vs. foreclosure vs. REOs, there are several differences to consider, but the fact of the matter remains. These properties can offer attractive profit margins. Investors willing to learn the ins-and-outs of each property type may find themselves in the midst of more lucrative opportunities.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!