Jump To Another Year In The Salt Lake City Real Estate Market:

Salt Lake City, often referred to as Salt Lake or simply SLC, is the capital and the most populous city in Utah. As such, it has become an extremely hot real estate market. Along with Seattle, Denver, and several California cities, SLC has one of the fastest moving housing markets, with equally aggressive price gains.

The Salt Lake City real estate market has enjoyed a great run for the better part of a decade. In the nine years real estate in Salt Lake City has taken to recover from the Great Recession, home values have nearly doubled without sacrificing demand. Perhaps even more importantly, however, is the momentum being leveraged in 2021.

While the Coronavirus has hampered every major metropolitan area, SLC appears to be slightly more resilient. Demand remains intact, home values are still healthy, and unemployment levels have remained below their national counterparts. The Salt Lake City housing market experienced a brief setback in the first quarter of 2020 when the pandemic was declared but has since improved. In fact, real estate has improved dramatically, which begs the question: Is it a good time to buy a house in Salt Lake City?

With the right exit strategy, now is the perfect time to invest in the SLC housing market. Specifically, the new market landscape looks to lean heavily in favor of long-term investors, and those who position themselves well now will be glad they did in just a few short years.

Salt Lake City Real Estate Market 2021 Overview

-

Median Home Value: $538,601

-

Median List Price: N/A

-

1-Year Appreciation Rate: +23.3%

-

Median Home Value (1-Year Forecast): +18.7%

-

Weeks Of Supply: 3.3 (-2.9 year over year)

-

New Listings: 211 (-54.8% year over year)

-

Active Listings: 1,119 (-62.6% year over year)

-

Homes Sold: 344 (-29.7% year over year)

-

Median Days On Market: 8.1 (-12.2 year over year)

-

Median Rent: $1,488 (+10.9% year over year)

-

Rental Vacancy Rate: 6.0% (+0.2% year over year)

-

Price-To-Rent Ratio: 30.16

-

Delinquency Rate: 2.9% (-1.6% year over year)

-

Unemployment Rate: 3.2% (latest estimate by the Bureau Of Labor Statistics)

-

Population (city): 200,567 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $60,676 (latest estimate by the U.S. Census Bureau)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Salt Lake City Real Estate Investing

The Salt Lake City real estate market has resided at the forefront of the national housing recovery since it began around the first quarter of 2012. Few markets, for that matter, have recovered at the same pace, which begs the question: Is Salt Lake City real estate a good investment? While the answer will vary from investor to investor (depending on their exit strategy and intentions), the answer is a resounding yes. It is worth noting, however, that how entrepreneurs invest has changed over time.

Before the pandemic, the SLC housing market was among the metros with the highest home selling returns. According to Attom Data Solutions, qualifying “cities with the highest average home seller returns in Q1 2019 were San Jose, California (84.1 percent); San Francisco, California (70.9 percent); Seattle, Washington (63.1 percent); Modesto, California (59.7 percent); and Salt Lake City, Utah (56.5 percent).”

To put things into perspective, “the average home seller gain of $57,500 in Q1 2019 represented an average 31.5 percent return as a percentage of the original purchase price,” said the report. That means owners in the SLC housing market who sold in the first quarter of 2019 saw—on average—a return of 25.0% more than the rest of the country.

In the midst of the pandemic, the story remains unchanged. As recently as the second quarter of this year, “the typical single-family home and condo sale across the United States during the second quarter of 2021 generated a profit of $94,500. That was up from $90,000 in the first quarter of 2021 and from $60,572 in the second quarter of 2020,” according to Attom Data Solutions’ second-quarter 2021 U.S. Home Sales Report.

With the average home in Salt Lake City appreciating 23.3% in the last year, it’s fair to assume local profit margins are growing slimmer and slimmer. As a result, more investors are turning to long-term strategies. In particular, the new real estate landscape created by the pandemic has catered to rental property owners. Now, perhaps more than ever, is the best time to start building a passive income real estate portfolio.

The real estate industry is certainly different after the arrival of the Coronavirus, but the emergence of three indicators has made buy-and-hold investment strategies more attractive:

-

Interest rates on traditional loans are historically low

-

Years of cash flow can simultaneously justify today’s higher acquisition costs

-

The price-to-rent ratio suggests high home prices will increase rental demand

For years, rehabbing was the most prevalent exit strategy used by Salt Lake City real estate investors, but we are starting to see a new trend. Now is the time to start adding to a passive income portfolio because borrowing costs are historically low.

As of July, the average rate on a 30-year fixed-rate loan was 2.87%, according to Freddie Mac. Consequently, While up slightly year to date, the cost of borrowing institutional money is attractively low. As a result, the cost basis for real estate in Salt Lake City is lower than what median home prices suggest. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to pad their bottom line. At the very least, investors will be able to justify the latest bout of appreciation with much lower borrowing costs. Additionally, lower monthly mortgage payments mean landlords will be able to increase cash flow from properties placed in operation. If for nothing else, lower mortgage obligations allow investors to pocket more of their profits each month.

Whereas rehabbers and flippers need to acquire homes below market value to pad profit margins, rental property investors can stand to acquire homes at today’s high prices to pay their mortgages down with other people’s money each month. The cash flow can help offset the higher acquisition costs in as little as a few years while building equity in a physical asset.

Salt Lake City real estate investors should take solace in the city’s 30.16 price-to-rent ratio, as it is currently much more affordable to rent than own. As a result, vacancies will be easier to avoid due to the affordability of renting. Not only that, but listings are harder to come by in today’s market, too. The unique combination of affordability and a lack of listings suggest rental property owners will see plenty of demand for the foreseeable future, at least until more homes are constructed.

Local investors are lucky to have several viable exit strategies at their disposal, but none appear more attractive than building a proper rental property portfolio. Too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

[ Learning how to invest in real estate doesn’t have to be hard! Our online real estate investing class has everything you need to shorten the learning curve and start investing in real estate in your area. ]

2021 Foreclosure Statistics In Salt Lake City

According to Attom Data Solutions’ Midyear 2021 U.S. Foreclosure Market Report, a total of 65,082 U.S. properties received a foreclosure filing (default notices, scheduled auctions, or bank repossessions) in the first six months of the year. “That figure is down 61 percent from the same time period a year ago and down 78 percent from the same time period two years ago,” according to the report.

Over the same period of time, a total of 447 properties in Utah filed for foreclosure. Year to date, foreclosures in Utah are down 60.79% from last year and 73.60% from 2019. While foreclosures are down, it’s important to note that the latest numbers are more the result of government intervention than the actual financial standing of homeowners. If for nothing else, foreclosure moratoriums and forbearance programs brought about by the Coronavirus kept many homeowners from losing their homes. Unfortunately, however, those safety nets are being taken down.

“The foreclosure moratorium on government-backed loans has virtually stopped foreclosure activity over the past year,” said Rick Sharga, executive vice president of RealtyTrac, an ATTOM Data Solutions company. “But mortgage servicers have been able to begin foreclosure actions on vacant and abandoned properties, which benefits neighborhoods and communities. So it’s likely that these foreclosures are causing the slight uptick we’ve seen over the past few months.”

The presence of the Coronavirus is expected to cause a spike in foreclosures in the future. While forbearance programs are expected to keep people in their homes for the foreseeable future, homeowners will be expected to become current on their mortgages sooner or later. When that time comes, those who can’t comply may find themselves distressed, and well-positioned investors in Salt Lake City may be able to offer a helping hand.

2021 Median Home Prices In Salt Lake City

At this time last year (August 2020), the median home value in the Salt Lake City housing market sat somewhere around $440,000. However, having benefited from an appreciation rate that exceeds the national average, the median home value in the Salt Lake City real estate market has reached $538,601; that’s a 23.3% increase. To put the last year into perspective, the median home value in the United States is now $298,933 after appreciating by as much as 16.7% in one year.

Since the Great Recession, or at least when real estate in Salt Lake City hit its lowest point (around July 2011), home values have appreciated more than 147%. At that rate, Salt Lake City easily outpaced the national average over the last decade, and certain neighborhoods have benefited more than others. Years of historic appreciation have made these the most expensive neighborhoods in Salt Lake City (according to NeighborhoodScout):

-

Foothill

-

Foothill Village

-

S 1300 E / E 900 S

-

S 1300 E / E 3300 S

-

Fort Douglas / U of Utah

-

Mount Aire / Pinecrest

-

Beck St / Davis St

-

Foothill Dr / E 1300 S

-

Chandler Dr / Tomahawk Dr

-

S 2200 E / Stringham Ave

Moving forward, prices are expected to increase in the wake of three prominent indicators: less than a month of available inventory, historically low interest rates, and more competition. Prices will remain high and perhaps even test new highs soon. If for nothing else, the same inventory shortage that served to increase prices for the better part of a decade may be magnified by home builders sitting on the sidelines during the pandemic. Without new builds being brought to the market, it is safe to assume competition will remain high, driving prices up as much as 18.7% over the next 12 months.

Salt Lake City Real Estate Market Trends

Today’s Salt Lake City real estate market conditions are the result of evolving trends. In fact, the strength of today’s market can be tied to a few important trends that are currently taking place:

-

Passive income prevails: Home values have gotten incredibly high in recent history, which has eaten into investor profit margins. As a result, more investors are turning to buying rental properties. Doing so may offset high acquisition costs and provide years of cash flow.

-

Demand remains intact: Demand in the Salt Lake City real estate market appears to be tied to local unemployment, which has fared better than the national average. As a result, it appears as if there are still plenty of willing-and-able buyers. More importantly, their activity is expected to help the SLC housing market return to normal sooner rather than later.

-

Competition remains high: People who were looking to buy before the pandemic appear more eager to buy than ever. It doesn’t look as if the pandemic is going to prevent buyers from looking. If anything, they may appear more eager to buy now than they were in the past, as appreciation has tempered and opened a window of opportunity. As a result, the few homes that are on the market are receiving more activity.

-

Low interest rates are proving advantageous: In an attempt to stimulate housing markets across the country, the Fed announced it would keep interest rates near historical lows for at least a couple of years. The announcement has prompted many would-be buyers to take action.

Salt Lake City Housing Market Predictions

While it is still too soon to predict the extent to which the Coronavirus will impact the Salt Lake City real estate market, we are starting to see trends emerge, suggesting the direction the market is heading. As a result, investors need to listen to what the market is telling them at this critical juncture. Here’s a look at some of the Salt Lake City housing market predictions that are most likely to come true over the course of 2021:

-

Salt Lake City home prices will increase: Prices are expected to increase sooner rather than later. The lack of housing alone should increase competition. However, record low interest rates and the threat of higher prices have gotten even more people to look into buying. As a result, today’s competition will drive up prices more so than in recent history. Of all the Salt Lake City housing market predictions being made, this one already appears to be happening.

-

Existing inventory will prove insufficient: Inventory levels, or lack thereof, has driven prices up in the local market for nearly 10 years. Competition, in particular, has enabled sellers to increase asking prices for years. Inventory levels will remain tight, as builders haven’t been able to work with “shelter-in-place” orders stalling their operations. Therefore, any inventory easement we were expecting in 2021 will most likely be delayed.

-

Builders will begin to add inventory: Demand for housing is so big that builders will need to get back to work. News of a vaccine being ready by next spring could mean builders will get back to work soon. If homebuilders can get back to work in Salt Lake City, expect the inventory crunch to alleviate slightly. While the lack of housing won’t be fixed overnight, adding inventory now will help combat today’s higher prices.

Salt Lake City Housing Market: 2020 Summary

-

Median Home Value: $440,150

-

1-Year Appreciation Rate: +7.8%

-

Median Home Value (1-Year Forecast): +7.3%

-

Median Rent Price: $1,595

-

Price-To-Rent Ratio: 22.99

-

Unemployment Rate: 5.2% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 200,567 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $56,370 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 8.55%

-

Foreclosure Rate: 1 in every 8,036 (1.2%)

Salt Lake City Real Estate Investing 2020

Every real estate market across the country experienced a setback in the first quarter of 2020. Serving as no exception to the rule, real estate in Salt Lake City came to a standstill once the pandemic was declared a global emergency. Uncertainty and fear, in particular, all but brought the local housing sector to a standstill. Activity was almost nonexistent, which threatened nearly 10 consecutive years of growth in the Salt Lake City real estate market. For a brief moment, it looked as if real estate would take a significant step back, but the disruption actually appears to have catalyzed buyers and investors.

While certainly unwelcome, the Coronavirus may have actually disrupted the Salt Lake City real estate market to a point where it became a catalyst for progression. For starters, the Fed instantly lowered rates in response to the pandemic. The idea was to pique buyers’ interest, and the plan worked. Historically low interest rates persuaded more people to buy than in recent history. The resulting activity brought confidence back to the Salt Lake City real estate market in a matter of months.

In addition to low interest rates, Salt Lake City’s unemployment rate appears (at least for the moment) to have been more resilient than most cities across the country. Now less than half of where it peaked in April, local unemployment looks poised to support the housing sector. As a result, not only are more people able to buy in Salt Lake City, subsequent interest rates make the prospect of owning that much more attractive.

As more people turned to buying, demand turned into competition. Listings began receiving multiple offers, driving up asking prices and home values in the process. Escalating prices forced the Salt Lake City real estate investing community to rethink its best exit strategies in 2020. Instead of rehabbing, more investors turned to long-term strategies like rental properties. If for nothing else, low borrowing costs simultaneously justified higher acquisition prices and increased monthly cash flow potential. The new market created in the wake of COVIF-19 appears to tilt in favor of long-term strategies, and rental properties came out on top in 2020.

Salt Lake City Housing Market: 2019 Summary

-

Median Home Value: $401,500

-

1-Year Appreciation Rate: 13.9%

-

Median Home Value (1-Year Forecast): 6.4%

-

Median Rent Price: $1,595

-

Average Days On Market: 60

Salt Lake City Real Estate Investing 2019

According to Salt Lake City real estate news, 2019 was a great year for SLC. For starters, demand remained largely intact, despite the area’s above-average appreciation rate. Meanwhile, the population continued to grow, but the number of owner-occupied housing units lagged behind trends. While the population continued to increase, owner-occupied homes remained low. In fact, renter occupants increased. As a result, real estate in Salt Lake City largely benefited from passive income investors.

The Salt Lake City housing market found itself the beneficiary of an appreciation rate that more than doubled the national average in 2019. Despite increases in home values, more and more people chose to call the SLC housing market home from the previous year. As the city’s population grew, the addition of new renters was outpacing new owners at the time. All things considered, the city was more geared towards renters, and the same momentum continues today.

Salt Lake City Housing Market: 2016 Summary

-

Median Home Price: $276,900

-

1-Year Appreciation Rate: 5.7%

-

3-Year Appreciation Rate: 17.3%

-

Unemployment Rate: 3.9%

-

1-Year Job Growth Rate: 3.2%

-

Population: 191,180

-

Median Household Income: $45,833

Salt Lake City Real Estate Investing 2016

Home prices and values continued to climb in 2016, according to Salt Lake City real estate news. The first half of the year witnessed a combination of growth in both prices and appreciation rates for real estate in the area. The pair surpassed the national average in the second quarter, with home prices continuing to grow relative to the previous year. In contrast, price appreciation and principle payments in the previous three years boosted total equity growth since the recession.

Home prices continued to grow in the second quarter as well. The median home price was $276,900, compared to the national average of $239,167. For homeowners and investors, gains in the previous three years extended the trend of positive price growth since the recession. One-year appreciation rates reached 5.7% during the second quarter, while three-year rates climbed to 17.3%.

Three indicators contributed to a healthy Salt Lake City housing market in 2016: the local economy, new housing construction, and even home affordability. Employment continued an upward trend, as one-year job growth reached 3.2% during the second quarter, compared to 1.9% by the rest of the nation. The city experienced an unemployment rate of 3.9% in the second quarter versus the national average of 4.9%.

Homeowners in Salt Lake City paid 13.3% of their income on mortgage payments during the second quarter, whereas the national average paid 15.8%. At the time, affordability was a major draw to the local real estate market.

Salt Lake City Housing Market: 2015 Summary

-

Median Home Price: $243,300

-

1-Year Appreciation Rate: 4%

-

Unemployment Rate: 3.5%

-

1-Year Job Growth Rate: 3.6%

-

Population: 1,160,217

-

Median Household Income: $61,381

Salt Lake City Real Estate Investing 2015

The Salt Lake City real estate market had a median home price of $243,300 at one point in 2015. In getting to that point, homes in the area appreciated at a rate of 4.0% year-over-year. The national appreciation rate, on the other hand, was slightly higher (6.7%). Despite appreciating at a higher rate, however, the country’s average home price was approximately $40,000 less than the average in the SLC housing market.

The area’s economic outlook received a lot of support from the job sector, as employment held up and was on an upward trend. In fact, unemployment was better than the national average and improving. Unemployment topped out at 4.2% in the previous year. In 2015, however, unemployment dropped to 3.5%. The improvement was enough to get excited about the area’s potential, and the Salt Lake City real estate investing community capitalized immediately.

At the time, Salt Lake City real estate news suggested one important indicator working in the market’s favor: affordability. Salt Lake City homes were more affordable than most other markets despite average home prices being above the national average. Not only that, but affordability was historically strong. Homeowners in Salt Lake City spent an average of 12.1% of their income on monthly mortgage obligations, whereas the average homeowner in the U.S. spent about 14.3% at the time.

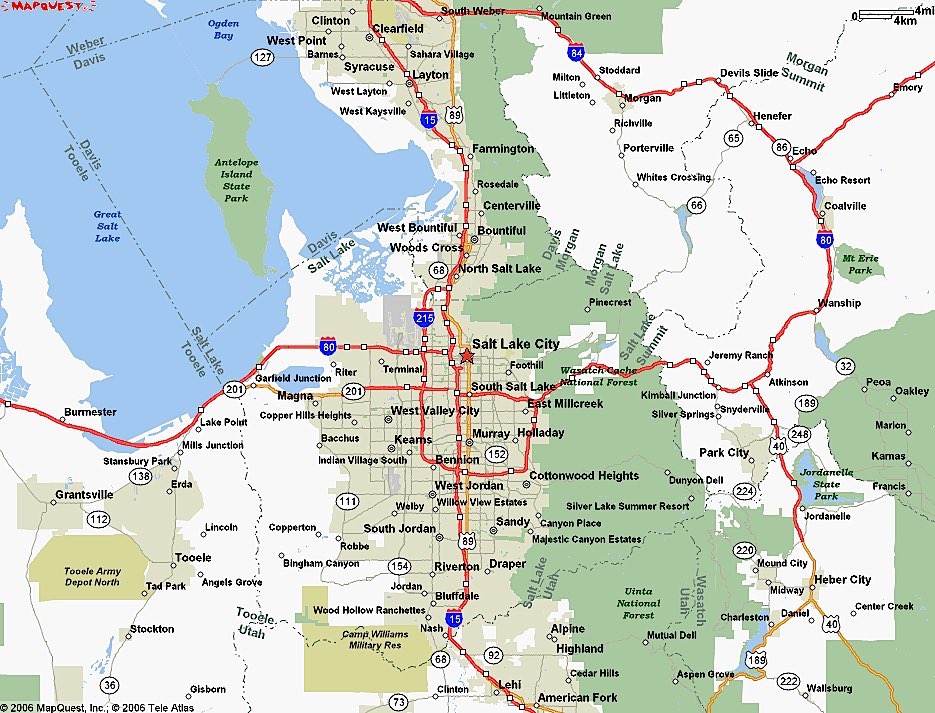

Salt Lake City County Map:

Salt Lake City Real Estate Market Summary

The Salt Lake City real estate market was strong heading into 2020. Nearly a decade’s worth of growth to just about every indicator that matters has helped place the local real estate market at the forefront of a national recovery. However, much like every other major metropolitan area, Salt Lake City was hampered by the presence of “stay-at-home” orders and the Coronavirus. The pandemic was an obstacle (and continues to impede progress), but it appears as if Salt Lake City was more prepared to weather this storm than many cities across the country. The city’s relatively strong unemployment numbers are a testament to its strength and should help things return to normal sooner than later.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/salt-lake-city-ut/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

https://www.redfin.com/news/data-center/

https://theenergylogic.com/housing-tides/housing-tides-interface/

https://www.bls.gov/eag/eag.ut_saltlakecity_msa.htm

https://www.census.gov/quickfacts/fact/table/saltlakecitycityutah,US/PST045219

https://www.attomdata.com/news/market-trends/q1-2019-u-s-home-sales-report/

https://www.attomdata.com/news/most-recent/attom-q2-2021-u-s-home-sales-report/

https://www.attomdata.com/news/most-recent/attom-mid-year-2021-u-s-foreclosure-market-report/

http://www.freddiemac.com/pmms/pmms30.html

https://www.neighborhoodscout.com/ut/salt-lake-city/real-estate