Jump To Another Year In The St. Louis Real Estate Market:

- 2021 St. Louis Real Estate

- 2020 St. Louis Real Estate

- 2016 St. Louis Real Estate

- 2015 St. Louis Real Estate

The St. Louis real estate market has experienced many of the same setbacks onset by the COVID-19 pandemic as the rest of the country. New listings, pending sales, inventory, and general sentiment has dropped since local governments issued ” shelter-in-place” orders. As a result, the local housing sector stalled in the first part of 2020. However, it is worth noting that real estate in St.Louis was strong heading into last year, and it’s even stronger today. At the moment, it would appear as if the momentum generated in 2020 will not only help real estate in St. Louis weather the storm but actually come out on the other end even stronger. Thanks, in large part, to relatively strong unemployment numbers, historically low interest rates, and pent-up demand, the St.Louis real estate market could be at the forefront of a national recovery. Those investors who position themselves well in 2021 could benefit sooner rather than later.

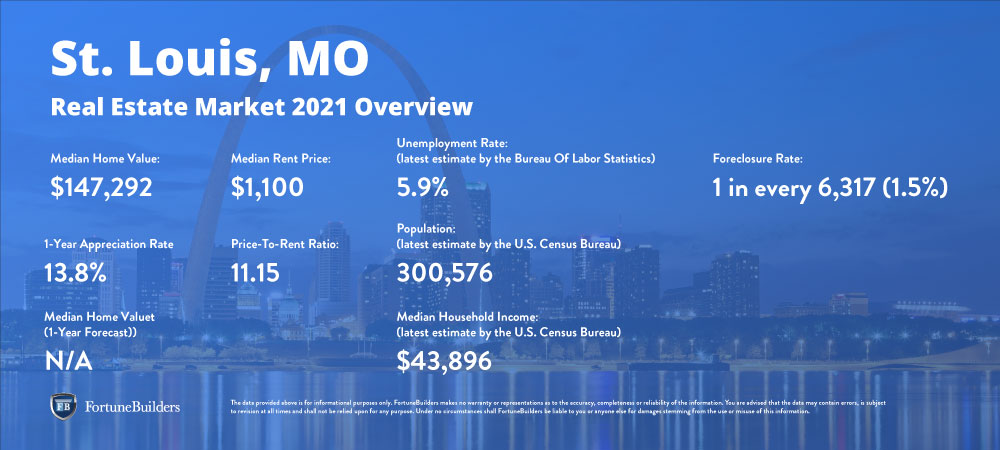

St. Louis Real Estate Market 2021 Overview

- Median Home Value: $147,292

- 1-Year Appreciation Rate: 13.8%

- Median Home Value (1-Year Forecast): N/A

- Median Rent Price: $1,100

- Price-To-Rent Ratio: 11.15

- Unemployment Rate: 5.9% (latest estimate by the Bureau Of Labor Statistics)

- Population: 300,576 (latest estimate by the U.S. Census Bureau)

- Median Household Income: $43,896 (latest estimate by the U.S. Census Bureau)

- Foreclosure Rate: 1 in every 6,317 (1.5%)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 St. Louis Real Estate Investing

The local market has been through a lot over the course of a decade, which begs the question: Is St. Louis real estate a good investment? The answer is a resounding yes (if done correctly). Few markets, for that matter, are hotter than the St. Louis housing market at the moment. The area’s unique combination of affordability, demand, foreclosure rate, and employment makes it a great location for investors to consider acquiring deals. Rehabbing, in particular, has served the local investing community well in recent history.

According to Attom Data Solutions’ first-quarter 2020 U.S. Home Flipping Report, the St. Louis real estate market was home to one of the country’s busiest flipping markets no more than a year ago.

“Among 639 counties with at least 10 home flips in the first quarter of 2020, there were 113 counties whose home flipping rate was at least 10 percent of all home sales. The top five were Marion County, IL, outside of St. Louis, MO, (28.6 percent home flipping rate); Hampton City/County, VA, in the Virginia Beach metro area (27.3 percent); Macon County, TN, in the Nashville metro area (17.9 percent); Smith County, TN, in the Nashville metro area (16.4 percent) and Paulding County, GA, in the Atlanta metro area (16.4 percent).”

Despite the city’s relative affordability, profit margins have taken a hit in the face of appreciation. The median home value has increased year-over-year since 2014, which has eaten into profit margins. While rehabs remain a great investment strategy, today’s market indicators suggest a new strategy may be more viable: building a passive income portfolio.

In fact, the presence of the Coronavirus has actually created a window of opportunity for long-term investors. Today, building or adding to a rental property portfolio makes more sense with the new real estate landscape. These St. Louis real estate market trends should tip the scales in favor of rental property owners:

- Interest rates on traditional loans are historically low

- Years of cash flow can easily justify today’s higher acquisition costs

- The price-to-rent ratio suggests high home prices will increase rental demand

As of February, the average rate on a 30-year fixed-rate loan was 2.81%, according to Freddie Mac. February also represented one of the lowest average mortgage rates ever, and the Fed announced its intentions to keep rates low for the foreseeable future. As a result, lower borrowing costs have brought down acquisition costs for those looking to add to their passive income portfolio. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to pad their bottom line. The St. Louis real estate market currently boasts an opportunity for rental property owners to generate cash flow. The indicators resulting from the current pandemic have actually made the prospect of owning a rental property more attractive than in years past.

With a price-to-rent ratio of 11.15, which suggests it is much more affordable to buy than rent, it’s easy to assume rental demand would be hurt by those looking to buy. However, the Coronavirus has detracted from already low levels of available inventory. Even those who are ready and willing to buy have to remain on the sidelines because of a lack of options. Consequently, those who can’t buy are relegated to rent. Therefore, rental property owners are in line to benefit from increased occupancy rates. The demand for rental units will not only keep vacancies to a minimum, but it may also allow landlords to increase rents and cash flow.

The St. Louis real estate investing community was already thriving before the Coronavirus. However, the new landscape created in the wake of the pandemic has opened up a new window of opportunity: buy-and-hold exit strategies. Lower borrowing costs, attractive cash flow, and increasing demand are all working in favor of today’s investors.

Impact Of COVID-19 On The St. Lous Housing Market

The Coronavirus took a significant toll on real estate markets worldwide in the first quarter of 2020, and St. Louis was no exception. Once the virus was officially declared a pandemic, in fact, homeowners took their listings off the market, buyers refused to tour homes, understaffed lenders couldn’t process loans, and uncertainty prevented just about any housing activity from taking place. The pandemic was the worst news the national housing sector could have heard for all intents and purposes. That said, the setback was temporary, and real estate markets across the country have taken off.

Real estate prospects in St. Louis declined by March, threatening nearly a decade’s worth of momentum. However, it appears as if the disruption onset by the pandemic is almost entirely behind us. If anything, real estate in St. Louis took one step back in March and three steps forward over the course of 2020. Thanks, in large part, to several tailwinds, St. Louis has gotten its legs back underneath it and performed well, even as the pandemic continues.

The catalyst for St. Louis’ hot real estate market was the government’s decision to keep interest rates low. Halfway through 2020, rates were the lowest they have ever been, and they are only getting lower. As a result, it’s never been cheaper to borrow money, which has spurred more buyers to get off the fence and take action. In addition to low rates, unemployment has improved. Today, more people have confidence in the local housing market than in the first half of 2020. Market sentiment has also driven more people to buy in recent history.

For the time being, the activity resulting from government-induced interest outweighs local inventory. In a year when inventory was already lacking, “inventory decreased 37.3 percent for residential homes and 6.6 percent for townhouse/condo homes” month-over-month in November, according to the St. Louis Realtors Association. With demand far outweighing supply, prices have increased by 6.8% in the latter half of 2020. Over the next 12 months, prices are expected to continue rising, to the tune of 9.1%. Appreciation should remain strong until more inventory is brought to the market, which will happen incrementally as the light at the end of the tunnel continues to grow on vaccine hopes.

As prices rise and more people continue to work from home, the St. Louis real estate market may see more people trade their metropolitan homes for suburban counterparts. Currently, cities are hotbeds for the pandemic, and small apartment spaces are growing more confining as the pandemic stretches to a tenth month. As a result, more people have moved from the city to the suburbs, and there’s nothing to suggest the trend won’t continue.

The St. Louis real estate market is doing quite well, considering the circumstances. However, the lack of available inventory remains a significant obstacle. For now, a lack of housing will continue to drive prices up, but once things return to “normal,” new listings should even things out. Until then, expect the torrid pace to continue.

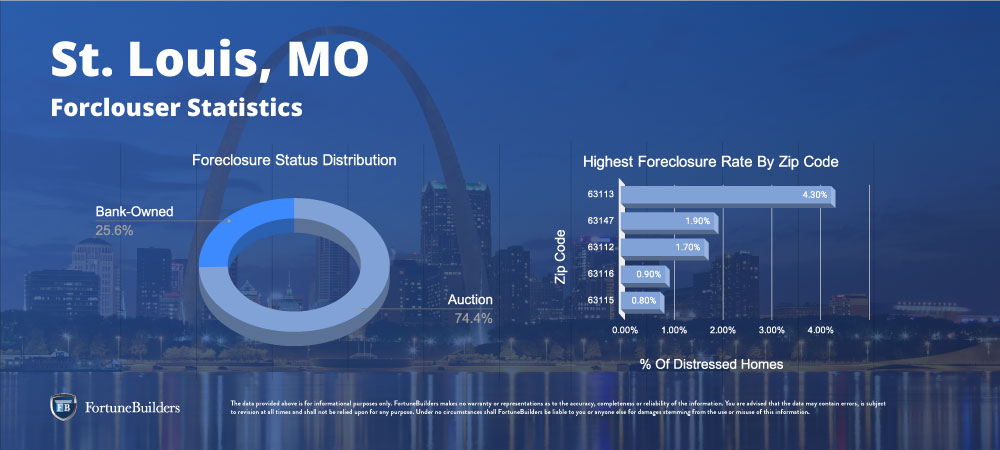

2021 Foreclosure Statistics In St. Louis

The foreclosure rate in St. Louis is above the national average. In fact, the city’s foreclosure rate is more than twice that of the country as a whole. With one in every 6,317 homes in St. Louis distressed (default, auction or bank owned), the city’s foreclosure rate is 1.5%. The United States’ foreclosure rate, on the other hand, is 0.7%.

In the first quarter of last year, St. Louis had one of the country’s highest distributions of underwater homes.

“Among 8,248 U.S. zip codes with at least 2,000 properties with mortgages in the first quarter of 2020, there were 157 zip codes where at least a quarter of all properties with a mortgage were seriously underwater. The largest number of those zip codes were in the Cleveland, OH; Philadelphia, PA; St. Louis, MO; Chicago, IL, and Rockford, IL, metropolitan statistical areas,” according to Attom Data Solutions’ first-quarter 2020 U.S. Home Equity & Underwater Report.

Today, the neighborhoods with the highest distributions of foreclosures include:

- 63113: 1 in every 2,276 homes is currently distressed

- 63147: 1 in every 5,031 homes is currently distressed

- 63112: 1 in every 5,729 homes is currently distressed

- 63116: 1 in every 10,907 homes is currently distressed

- 63115: 1 in every 11,721 homes is currently distressed

The St. Louis real estate investing community may want to consider marketing for deals in these neighborhoods, as distressed homes are not only more likely to result in a deal but also come with a higher likelihood of being acquired below market value.

It is worth noting, however, that the improvements to the local foreclosure rate may be short-lived. After all, the Coronavirus is expected to take a significant financial toll on homeowners and perhaps even cause an influx in foreclosures in the coming months. While it is too soon to tell just how much foreclosures will increase, investors who line up financing and position themselves for success at this time could be in line for a busy second half of 2021.

2021 Median Home Prices In St. Louis

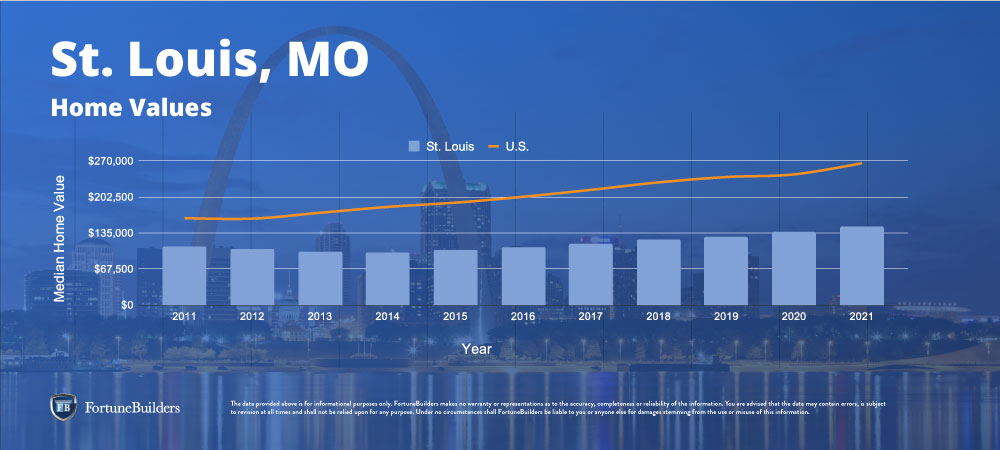

The median home value in St. Louis is $147,292, according to Zillow’s Home Value Index. That said, today’s home value represents more than six consecutive years of appreciation. In March of 2014, in fact, the median home value had bottomed out from the Great Recession around $92,700. That means the median home value has increased 58.8% in a little over six years. To put things into perspective, the median home value in the United States has appreciated 47.0% since March 2014, and now sits at $269,039.

The increase may be attributed to many factors, but three in particular: an improving national economy, positive sentiment, and (ironically) a distinct lack of available inventory. In association with the end of the Great Recession, these three indicators helped boost the St. Louis real estate market from one of the worst recession in American history and into nearly a decade’s worth of positive growth.

Years of historic appreciation have made these the most expensive neighborhoods in St. Louis (according to NeighborhoodScout):

- Starhill Dr / Schmussler Rd

- Childrens Pl / S Euclid Ave

- Oakville

- Oakland Ave / Lawn Pl

- Southhampton

- S Skinker Blvd / Clayton Rd

- Barnes-Jewish College Goldfarb School of Nursing / Forest Park Ave

- Saint Louis U-Main Campus / N Grand Blvd

- Lafayette Ave / S Tucker Blvd

- Delmar Blvd / N Newstead Ave

Moving forward, home values in the St. Louis housing market appear more capable of weathering the storm onset by the Coronavirus. If for nothing else, the local unemployment seems to have fared better than the national average in this time of crisis. More people with jobs should prop up real estate in St. Louis, as more buying activity should stimulate pricing activity. When numbers spiked, unemployment went from 3.5% in March to 11.0% in April. As of December, however, unemployment in St. Louis was 5.9%.

St. Louis Real Estate Market: 2020 Summary

- Median Home Value: $131,350

- 1-Year Appreciation Rate: 3.8%

- Median Home Value (1-Year Forecast): -0.5%

- Median Rent Price: $1,100

- Price-To-Rent Ratio: 9.95

- Unemployment Rate: 11.2% (latest estimate by the Bureau Of Labor Statistics)

- Population: 300,576 (latest estimate by the U.S. Census Bureau)

- Median Household Income: $41,107 (latest estimate by the U.S. Census Bureau)

- Foreclosure Rate: 1 in every 6,731 (1.4%)

St. Louis Real Estate Investing 2020

St. Louis real estate market trends took an unexpected turn in 2020. The year started like any other, with the real state sector continuing a torrid uptrend, but the market retracted once the Coronavirus was officially declared a pandemic. At the end of the first quarter, the pandemic’s fear and uncertainty brought the market to a halt. It is worth noting, however, that the market only stalled for a couple of weeks. Not far into the second quarter, in fact, things picked up on news of the Fed reducing interest rates (and keep ing them low). News of lower rates catalyzed at a time when home prices were prohibitively high for the area. The drop in rates helped prospective buyers offset historically high prices, and buyers came out in droves.

The St. Louis real estate investing community took advantage of the stagnant market in the first quarter of 2020, as it was the first time appreciation rates resembled anything close to a pullback in years. However, as low rates spurred more activity, home prices marched higher. Demand, in conjunction with a lack of inventory, facilitated more activity than the market could handle. In response, prices increased over the course of 2020, despite the pandemic.

Rising home prices and low interest rates set the tone for the St. Louis real estate investing community in 2020. As it turns out, appreciation ruined profit margins for short-term rehabs, so investors turned their sights on long-term strategies. In particular, many investors turned to building rental property portfolios in the St. Louis real estate market. Low borrowing costs helped offset acquisition costs and boosted the prospects of monthly cash flow. Additionally, low inventory levels forced many people to rent in 2020, even if they wanted to buy. All things considered, 2020 was the perfect year to own rental property, or at least start a rental property portfolio of your own.

St. Louis Real Estate Market: 2016 Summary

- Median Home Price: $170,300

- 1-Year Appreciation Rate: 4.1%

- 3-Year Appreciation Rate: 14.4%

- Unemployment Rate: 4.9%

- 1-Year Job Growth Rate: 2.4%

- Population: 318,416

- Median Household Income: $52,343

St. Louis Real Estate Investing 2016

The St. Louis real estate market was in rebound mode for the better part of 2016. According to St. Louis real estate news, home prices gradually improved for the Gateway to the West in 2016. Appreciation rates, total equity, and home affordability all continued their return to normalcy. The median home price was $170,300 during the second quarter, compared to the national average of $239,167. Gains in the previous three years extended the trend of positive price growth after the recession. However, it appears that price growth is slowing for St. Louis real estate, despite home prices being up from 2015. At the time, the city was primed for major investment activity.

The many bright spots for the St. Louis housing market in 2016 included its growing economy and continual improvements to home affordability. During the second quarter, homeowners paid 7.2% of their income to mortgage payments, whereas the national average paid more than double—15.8% to be exact. Affordability in the second quarter was less than its historical average of 9.5%, which is always great for homeowners and renters. However, new housing construction, or lack thereof, detracted from home affordability for the second-half of 2016.

St. Louis Real Estate Market: 2015 Summary

- Median Home Price: $149,900

- 1-Year Appreciation Rate: 4.9%

- Unemployment Rate: 7%

- 1-Year Job Growth Rate: 1.3%

- Population: 318,416

- Median Household Income: $54,449

St. Louis Real Estate Investing 2015

According to St. Louis real estate news at the time, the local housing market was appreciating at a fast rate. Over the course of three years, homes in the St. Louis area gained enough value to pull them out of a period of post-recession price weakness. Even though appreciation began to taper, the market boasted a median home price of $149,900. The rest of the country, however, had a median home price of $212,267. The price was a result of a 25.8% appreciation rate over the previous three years. Here’s a closer look at some of the St. Louis real estate trends at the time:

St. Louis Real Estate Market Summary

The St. Louis real estate market in Missouri is doing particularly well, at least considering the circumstances. While the Coronavirus has certainly served as an obstacle, several indicators suggest buyers, sellers, and investors should express optimism. The local unemployment rate seems to have fared better than the national average, which should help the city get back to normal sooner rather than later. Pent-up demand will do its best to catalyze activity. Foreclosures remain an issue, and there may be more coming, but investors who position themselves to take advantage of them could find this summer to be the perfect time to buy.

Ready to start taking advantage of the current opportunities in the real estate market?

Maybe you have plenty of capital, an extensive real estate network, or great construction skills— but you still aren’t sure how to find opportunistic deals. Our new online real estate class, hosted by expert investor Than Merrill, can help you learn how to acquire the best properties and find success in real estate.