The underlying story behind the Tampa housing market in Florida is the same as the rest of the country. Real estate in Tampa has grown more expensive for the better part of a decade. More recently, the introduction of the pandemic saw the convergence of historically low interest rates, pent-up demand, and a lack of available inventory increase local home values at a pace nobody had ever seen. It is worth noting, however, that the Tampa housing market appears to have reached a tipping point. With interest rates rising to combat inflation and mortgage applications dropping, pending home sales are down and more price drops are occurring. Despite tempering activity, prices are still up considerably year-over-year, which begs the question: Is Tampa a good place to invest in real estate? Let’s take a look at today’s most prominent market indicators to find out.

Tampa Real Estate Market Overview 2022

-

Median Home Value: $415,484

-

Median List Price: $450,633 (+16.4% year over year)

-

1-Year Appreciation Rate: +34.8%

-

Median Home Value (1-Year Forecast): +12.5%

-

Weeks Of Supply: 8.0 (+3.3 year over year)

-

New Listings: 1,867.1 (+12.9% year over year)

-

Active Listings: 9,680 (+34.1% year over year)

-

Homes Sold: 1,314.2 (-18.4% year over year)

-

Median Days On Market: 7.5 (+1.5 year over year)

-

Median Rent: $1,702 (+14.2% year over year)

-

Price-To-Rent Ratio: 20.34

-

Unemployment Rate: 2.4% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 387,050 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $55,634 (latest estimate by the U.S. Census Bureau)

-

Total Active Foreclosures: 707

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Tampa Housing Market Trends 2022

Tampa real estate market trends are largely the result of major macroeconomic indicators brought about by the pandemic and the Federal Reserve’s attempts to combat inflation. If for nothing else, the Fed dropped rates to spark housing activity in the first quarter of 2020. Since then, pent-up demand has given way to a flood of activity, but there has yet to be enough inventory to satiate demand. As a result, the following Tampa housing market trends have emerged:

-

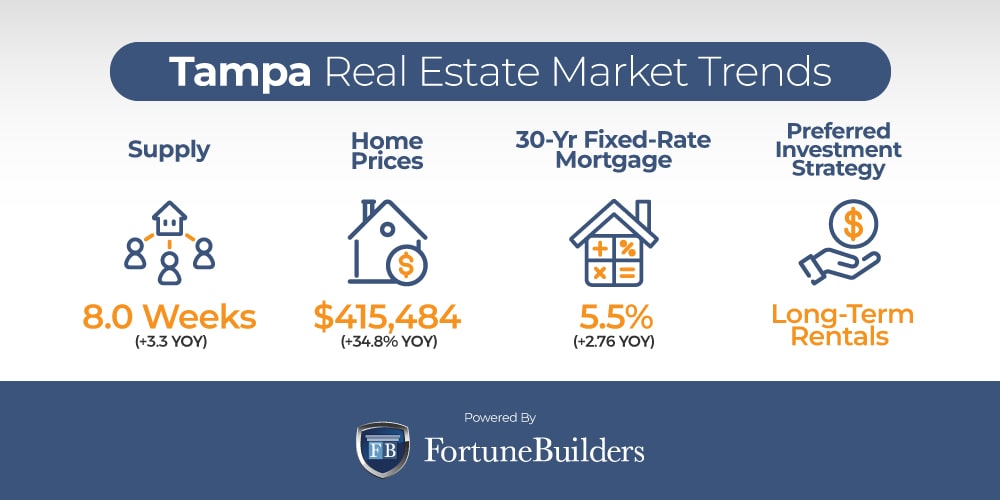

Supply Trends: With about 9,680 active listings and homes spending an average of 7.5 days on the market, the Tampa housing market has about two months of available inventory. Supply is up about 3.3 weeks year-over-year because of higher interest rates and lower mortgage application volume, but inventory levels are coming off historic lows. As a result, Tampa’s inventory is moving closer to a balanced market, but it still has a long way to go.

-

Home Price Trends: The median home value in the Tampa housing market has increased for ten consecutive years. Over the last two years, market indicators brought about by the pandemic have increased home values at a historic pace. Low interest rates, pent-up demand, and a lack of inventory turned demand into competition. As houses started to receive more offers, bidding wars have increased the cost of buying a home significantly—as much as 34.8% in the last year alone. Moving forward, prices will continue to increase. The same indicators responsible for price hikes in the past are still present. Prices may increase as much as 12.5% over the next 12 months; a slower pace than in previous years, but fast nonetheless.

-

Interest Rate Trends: Interest rates are on the rise as the Federal Reserve attempts to bring inflation under control. Today, the average commitment rate on a 30-year fixed-rate mortgage is 5.51%, up 2.63 points year-over-year. Despite being at their highest rate in nearly 15 years, however, rates are expected to continue climbing. If for nothing else, the latest Consumer Price Index report highlights that inflation increased at its fastest pace in nearly 40 years. Increasing mortgage rates even more is the Fed’s greatest weapon against inflation, so it is safe to assume more increases are on the way.

-

Investor Trends: Tampa real estate investors have increasingly turned to rental properties in the face of relatively low interest rates and high home prices. Rehabs and flips simply don’t have the same profit margins that they used to. That isn’t to say local investors aren’t flipping homes (they are), but rather that the economics of the Tampa housing market are currently leaning in favor of long-term rentals with traditional mortgages.

Tampa Foreclosure Statistics

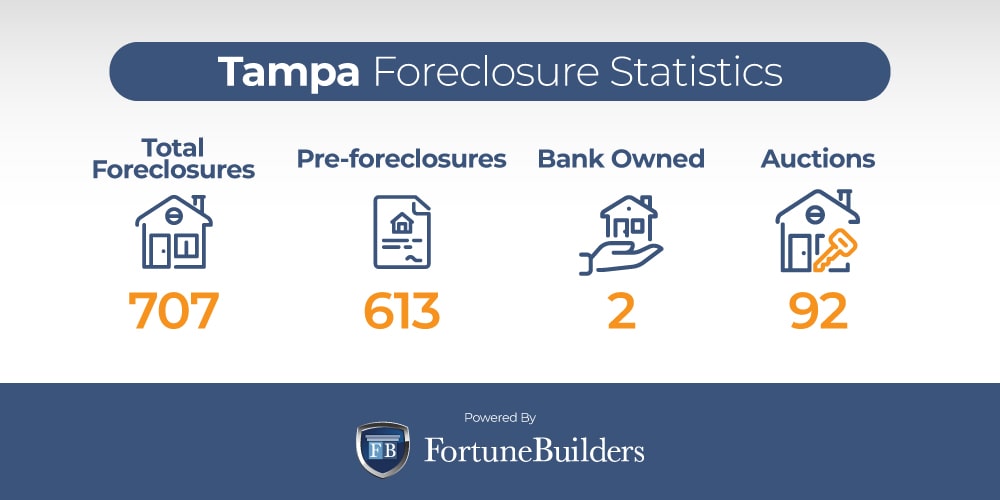

Nationwide, “there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022,” according to ATTOM Data Solutions’ Midyear 2022 U.S. Foreclosure Market Report. Compared to the first six months of last year, foreclosures are up 153.0%, bringing the national foreclosure rate more in line with two years ago.

“Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “While overall foreclosure activity is still running significantly below historical averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023.”

The Florida real estate market saw the second most foreclosure starts over the first half of the year, trailing only California. The entire state saw foreclosures increase, and the Tampa housing market was no exception. As government moratoriums expire and the economy starts to cool off, Tampa foreclosures continue to rise. According to RealtyTrac, Tampa is home to 707 foreclosures, the majority of which are pre-foreclosures (613). Another 92 foreclosed homes are either up for auction or will be at some point in the near future. Lastly, only two foreclosures are currently bank-owned.

The Tampa real estate investing community should pay special consideration to distressed homeowners if they are interested in acquiring a foreclosure below market value. Representing the overwhelming majority of the distressed market, local investors will increase their chances of landing a deal if they seek to help distressed homeowners who can’t keep up with their mortgage obligations.

Tampa Median Home Prices 2022

The median home price in the Tampa housing market is about $415,484, a far cry from where prices were ten years ago. A decade ago, in fact, real estate in Tampa bottomed out around $120,000 after the housing bubble burst. After The Great Recession, home values in Tampa increased for ten consecutive years—to the tune of 246%. Few markets have seen a greater rate of appreciation over the last ten years than Tampa.

To be clear, the fastest rates of appreciation have taken place over the last two and a half years. Since the pandemic started, local home values have increased 64.9%, easily outpacing the national average. In the last year alone, the Tampa housing market has seen its average home price increase 34.8%, whereas the median home value in the United States managed to increase a more modest 19.8%.

Tampa housing prices most likely outpaced its nationwide counterparts because of demand. As more people were allowed to work from home during the pandemic, more people migrated to warmer climates, with Tampa being a primary beneficiary. The added demand created more competition and higher home prices. Even as mortgage applications decrease, the Tampa real estate market doesn’t have enough inventory to keep up with demand, which means prices will continue to increase, perhaps as much as 12.5% over the next 12 months. While there is no predicting exactly how much prices will increase, the decrease in mortgage applications suggests demand is still high enough to increase home values, but at a slower pace than last year.

Tampa Real Estate Market Forecast 2022-2023

Each Tampa real estate market forecast over the past two years was predicated on historically low interest rates, a lot of competition, and very little inventory. In a recent turn of events, however, the Fed’s decision to increase interest rates in order to avoid a recession has changed market dynamics. Today, mortgage applications are down, rates are up and demand is still outpacing supply. The Tampa housing market looks different, which begs the question: what does a Tampa real estate market forecast look like over the rest of 2022 and into next year?

-

Home Values Will Rise: The cost of buying a home in the Tampa housing market will increase over the next 12 months. While lower mortgage applications suggest competition will subside, there’s still not nearly enough supply to keep up with the remaining demand. As a result, homes will continue to receive multiple offers, but not as many as in the past. The slightly lower level of competition will give sellers the power to increase prices, but at a slower pace than in recent history.

-

Rents Will Rise: The Tampa real estate market only has about eight weeks of available inventory and fewer people are able to afford a home than in the past. With buying a home growing more difficult for many, more people will turn to rental units. Rents have already increased 14.2% over the last 12 months, and tenants have every reason to believe the trend will continue.

-

Interest Rates Will Rise: Inflation is rising at its fastest pace since 1981, and the Fed needs to increase interest rates to slow the economy down. Therefore, it’s no longer a matter of if interest rates will rise, but when. While the number of points interest rates will increase is still debatable, it’s only a matter of time until the move is made. As a result, the cost of owning a home in the Tampa real estate market will increasing accordingly.

Should You Invest In The Tampa Housing Market?

Very few cities across the country have been as active as the Tampa housing market over the last couple of years. With a massive influx of buyers brought to the city during the pandemic, Tampa’s already insufficient inventory levels were put to the test. Many homeowners tried to sell in order to take advantage of higher home values, but many more refused to sell for fear of having to participate in the market. Appreciation was all but inevitable, and the cost of buying a home impacted Tampa real estate investors.

Acquisition costs drove down profit margins and made it harder to flip real estate in Tampa, which begs the question: Is Tampa a good place to invest in real estate? The answer is yes, as long as investors listen to what the market is telling them. It is entirely possible to flip homes in Tampa for attractive profits as long as acquisition costs are held in check. However, the new market created in the wake of the pandemic looks more accommodating to long-term rental property investors.

Otherwise known as passive income investors, landlords are the beneficiaries of several positive market indicators in the Tampa real estate market:

-

While inflation may be peaking, interest rates are still relatively low on traditional mortgages

-

Lower borrowing costs increase monthly cash flow from operations

-

Years of cash flow can easily justify today’s higher acquisition costs

-

With a price-to-rent ratio of 20.34, it is more affordable to rent than own in the Tampa housing market

The prospects of building a quality rental property portfolio in the Tampa housing market look more appealing than ever before. Regardless of how high prices are, there’s a viable exit strategy in every market. That said, local investors will want to take advantage of today’s relatively low borrowing costs. While rates are rising, they can still help offset today’s high acquisition costs and increase monthly cash flow.

In addition to low mortgage rates and cash flow potential, Tampa has a price-to-rent ratio that leans heavily in favor of investors. At 20.34, the price-to-rent ratio in the Tampa housing market suggests it is more affordable to rent than own. Naturally, more people will be inclined to rent in a slowing economy if it is the more affordable option. Moreover, those who couldn’t beat out the competition will also be forced to rent. The convergence of these populations will increase demand in the rental market and allow landlords to increase their asking prices.

Summary

The Tampa housing market is helping to set the pace of the national real estate industry. Demand, appreciation, inventory, and almost every other metric characterizing the Tampa real estate market are outpacing their national counterparts. That said, activity is expected to cool off a little. Mortgage applications are expected to drop even further, and home price appreciation will temper. The resulting environment may be the lull investors were waiting for.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/tampa-fl/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

https://www.freddiemac.com/pmms

https://www.redfin.com/news/data-center/

https://www.bls.gov/eag/eag.fl_tampa_msa.htm

https://www.census.gov/quickfacts/tampacityflorida

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.attomdata.com/news/market-trends/foreclosures/attom-midyear-2022-u-s-foreclosure-market-report

https://www.realtytrac.com/homes/fl/hillsborough/tampa