Alternative investments are asset types that don’t typically come to mind when you first start investing. However, with the right management, these assets can be just as profitable as popular investment types such as stocks and bonds. Keep reading to learn more about alternative investments and how they can benefit your finances.

What Are Alternative Investments?

Alternative investments are asset types that fall outside the realm of traditional investment opportunities. Some examples include hedge funds, private equity, intellectual property, patents or song rights, and tangible assets such as real estate or collectibles. Many investors turn to these investments because they offer the chance to diversify. Over time, a diverse portfolio can help minimize overall risk and increase long-term income.

It is important to understand that alternative investments are typically more complex when compared to more common investment types. Similarly, alternative investments are not regulated by the Securities and Exchange Commission (SEC). This means they generally have a less clear legal structure when compared to traditional investments, such as stocks. In some cases, alternative investments will even require investors to be accredited or have high net worths; however, they are becoming increasingly accessible for investors of all types.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Key Characteristics Of Alternative Investments

There are several characteristics of alternative investments that stand out when compared to mainstream investments:

-

High fees

-

Minimum investments

-

Lower transaction costs

-

Less liquid

Major investment platforms often allow investors to open accounts with low fees and no minimums to start investing. In contrast, alternative investments tend to have higher fees and investment minimums. Because they typically have lower transaction costs, you can also encounter difficulty obtaining verifiable financial data. Last but not least, alternative investments can be less liquid relative to their traditional counterparts, and because they are thinly traded, they can be difficult to value.

However, don’t let these characteristics scare you off. It’s because of these characteristics that make alternative investments an untapped market. Keep reading to find out different types of alternative investments and their benefits.

How Do Alternative Investments Work?

Alternative investments work differently depending on the asset type but generally involve high minimum investments and fee structures. Researching these investments can be tricky — as there is less public information verified about the long-term performance. Look into the specific asset type when considering alternative investments for more information on how they work.

In the case of collectibles or other tangible items, alternative investments typically involve a buy-and-hold strategy. This allows the asset to appreciate and the investor to sell for a profit. For example, if you purchased a rare painting, held onto it for years as it increased in value, and then identified a buyer, you could earn money from this alternative investment. One great benefit to this turnaround process is lower transaction fees when compared to other traditional investments.

What Are The Regulations On Alternative Investments?

As I mentioned before, alternative investments are not regulated by the SEC like stocks and mutual funds are. However, they are subject to some oversight under the Dodd-Frank Wall Street Reform and Consumer Protection Act that was enacted after the financial crisis of 2008. That being said, there is still a risk of fraud when looking at certain alternative investments.

The best way to protect yourself as someone considering alternative investments is to mind your due diligence. Rely on your network for leads, ask a lot of questions, and don’t be afraid to double-check the information you receive. Many investors can find financial success through alternative investments if they are willing to research each asset and its respective regulations.

Strategy For Alternative Investments

Alternative investments are a great way to diversify your portfolio and hedge against risk. For instance, these investments have a low correlation with popular or mainstream asset classes. In other words, they don’t usually move with stock and bond markets and protect you against inflation and dips in the market.

For this reason, large institutional funds dedicate a fraction of their portfolios to alternative investments such as hedge funds. Non-accredited investors can also invest in alternative markets. For instance, alternative mutual funds and exchange-traded funds (ETFs) make it much easier for individual investors, even beginners, to invest in alternative assets. (Previously, they were difficult and costly.) Further, these alt funds are regulated by the Securities Exchange Commission (SEC).

Suppose you’re relatively new to alternative investments and are worried about cost or difficulty. In that case, alt funds are a relatively safe place to start while reaping the benefits of diversifying your portfolio and hedging against inflation.

Example Of Alternative Investments

Note that regulation by the SEC does not equate to absolute safety. Alternative mutual funds have limited performance histories and they’re also subject to the risks of their assets. Although you might add an alt fund to hedge against risk brought on by your traditional investments, they act independently from one another and are subject to their own sets of risks.

For instance, let’s look at the SPDR Dow Jones Global Real Estate ETF. In January 2022, it had a five-year return of just over 6 percent. In contrast, SPDR S&P Oil & Gas Exploration & Production ETF posted a return of over negative 6 percent for the same amount of time. These are both examples of alternative class exchange-traded funds managed by State Street Global Advisors. Both examples demonstrate how alternative funds can provide both strong and poor performances. It’s critical to conduct your own research and look at historical performance data (when available) before you make any investment decisions.

Types Of Alternative Investments

Investors hoping to work with alternative investments should familiarize themselves with the different options available. The following are some of the best alternative investments:

-

Real Estate

-

Private Equity

-

Hedge Funds

-

Venture Capital

-

Tangible Assets

-

Collectables

-

Cryptocurrency

1. Alternative Real Estate Investments

Real estate is considered an alternative asset among investors who purchase investment properties such as office buildings, residential apartments, or vacation housing. Money may be gained from rental income, wholesaling, or house flipping. If an investor is not interested in being a landlord, they can use a broker to invest in real estate investment trusts or REITs.

While these are the most common forms of real estate investments, there are several other alternative real estate investments that may be a better choice depending on the type of investor you are. Here are other alternatives if you want to invest in real estate:

-

Real Estate Partnerships: Real estate partnerships or joint ventures are when two or more investors combine their resources in pursuit of the same goal. Each partner typically offers an existing property, capital, experience, or anything of value to the other partner. As a partnership, investors have the benefit of spreading risk collectively, distributing work, and improving potential outcomes compared to working by themselves. For example, one investor can be responsible for capital while the other provides extensive real estate expertise. This is an alternative investment option that provides passive income to the investor strictly responsible for capital.

-

Impact Investments: Impact investments are alternative real estate investments that produce high returns alongside positive social and environmental impacts. As an investor, you provide capital for sustainable agriculture, renewable energy, or basic services such as education and healthcare.

-

Hard Money Loans: Hard money lending is also an alternative real estate investment which offers passive income. When a property needs to be renovated, investors can obtain a hard money loan. This is a loan issued from a private investor rather than a bank. The hard money lender will use an “after repair value” or ARV estimation before issuing the loan to determine if their investment will be profitable. The property in question will serve as collateral as this is an asset-based loan. As a hard money lender, you can gain passive income that has more yield than bonds or dividend stocks.

-

Private Notes: Similarly to hard money loans, private notes involve taking on the role of banker. Private notes are loan agreements between two individuals, where the financing requirements may be more beneficial than a traditional bank. As the lender, you can set the interest rate and earn cash flow from repayments over time. There is an inherent level of risk involved, so it’s crucial to work with investors you trust before issuing private notes.

-

Real Estate Crowdfunding Websites: Real estate crowdfunding websites are becoming increasingly common. They offer the opportunity to contribute funds to a collective pool for real estate investing and earn dividends from the subsequent cash flow. The arrangement is similar to investing in REITs, though they are not regulated in the same way. Note that with crowdfunded websites, the investment is not liquid. Investors will need to wait for minimum investment periods to withdraw from the pool.

-

Real Estate Syndications: A real estate syndication is essentially a business partnership, where ownership is split between investors. Typically, one investor acts as a silent partner and funds the investment deals. The other investor manages the investment and does more of the groundwork to make the deals successful. Ownership is split between the two partners, and profits are divided. Investors can opt for either end of the partnership, depending on their goals.

-

Investing In Yourself: Improving your education, expanding your skillset, and pursuing professional licenses are all great ways to invest in the future. Whether you decide to gain a real estate license or simply enroll in online courses to expand your real estate know-how, this is a great way to boost your knowledge. Investing in yourself is also a great way to expand your network and boost your overall credibility within the industry.

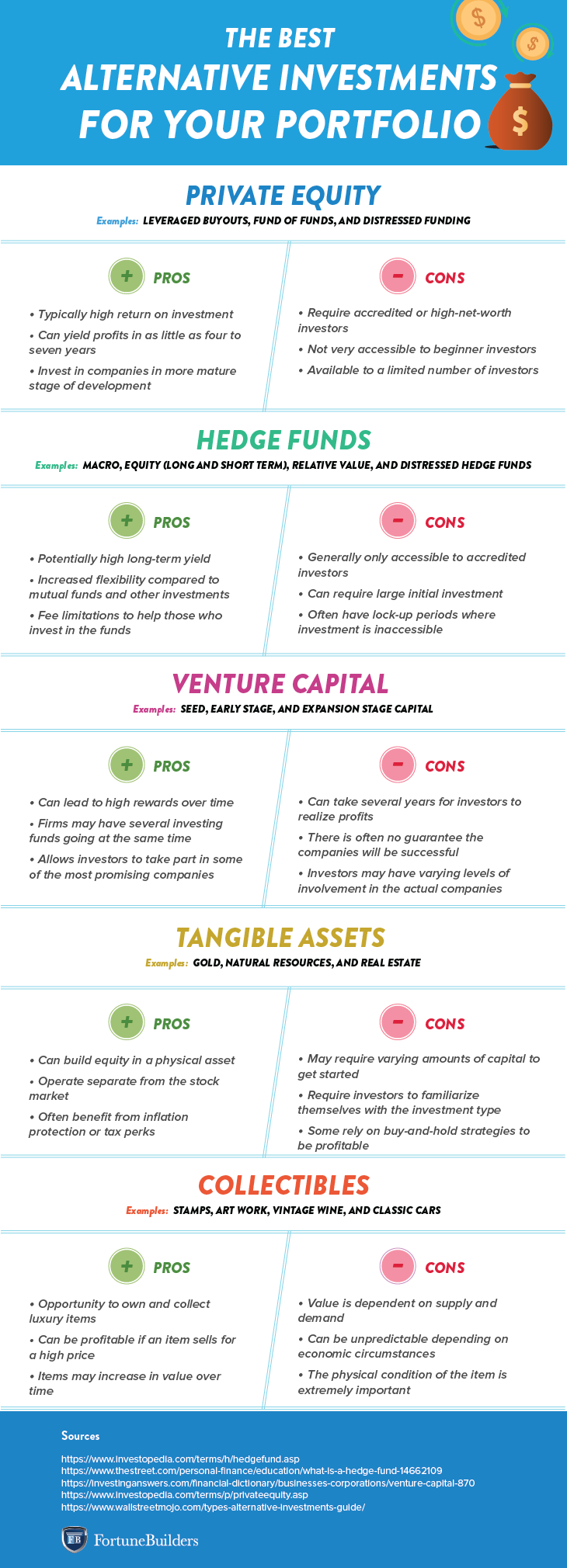

2. Private Equity

Private equity refers to funds that are invested directly into companies rather than publicly traded stocks. Businesses can use this money for expansion, marketing, and acquisitions. Many private equity firms will require long holding periods, and share prices are typically determined through negotiations. Many investors choose to work with private equity firms instead of making direct investments themselves to avoid dealing with the lengthy negotiation process. Private equity firms work by raising money from investors and investing said funds in different businesses.

There are a few types of private equity investments investors should be aware of: distressed funding, leveraged buyouts, and “fund of funds.” Distressed funding refers to the process of investing in an underperforming company with the hope of improving said company’s sales to build equity. On the other hand, leveraged buyouts are a form of private equity that involves completely purchasing an underperforming company and selling it to another business for a profit. Finally, “fund of funds” refers to private equity that is used to invest in other asset types, such as hedge funds or mutual funds. This type of equity allows investors, who would otherwise be unable to invest in hedge funds independently to get started in this field.

3. Hedge Funds

A hedge fund refers to a pooled investment structure that—in theory—allows participants to benefit, regardless of the market. Hedge funds have become increasingly popular in recent years, despite only being open to accredited investors. They are typically available to small groups of investors, usually up to 35 at a time. To learn more about becoming an accredited investor, read this article.

The purpose of hedge funds is to minimize overall risk and maximize returns for investors, although there is still some risk associated with this alternative investment. While hedge funds often invest aggressively, they invest in a wide variety of asset types to mitigate risk during times of market fluctuation. Some examples of hedge funds include macro, equity, relative value, and distressed hedge funds.

4. Venture Capital

This alternative investment involves financing startup companies and businesses. Venture capital refers to equity in private companies that are projected to achieve high growth. While venture capital may sound similar to specific forms of private equity, it is important to understand their differences. Venture capital exclusively refers to equity in recently formed companies, while private equity involves financing more mature companies.

Venture capital is known for its return potential and associated risk. When investors choose the right company, they will see significant returns in about three to seven years. On the other hand, there is an inherent risk involved when predicting the future performance of a company. In some cases, investors will have a say in business operations or take on an active role in the company. The different forms of venture capital include seed, early-stage, and expansion investments.

5. Tangible Assets

Tangible assets are exactly what they sound like: physical investments. These can include real estate, gold, natural resources, and more. Tangible assets are highly sought after because—in many cases—they can avoid the negative effects of market fluctuations that other investment types are not. For example, investors who invest in real estate can benefit from built-in demand, while other investments, like stocks, are more directly impacted by market shifts.

Tangible assets are one of the best alternative investments because they are accessible to investors of all experience levels. While some investment types require accreditation or high initial investments, tangible assets, like real estate, are easier for beginners. For example, many investors hoping to pursue real estate will be happy to know multiple financing methods can make this investment goal a reality. To learn more about securing your first real estate investment, be sure to read this article.

6. Collectibles

Classic cars, fine wines, and vintage art are just a few examples of collectible items that can be sold for a profit. Investors who collect precious items benefit because they typically increase in value over time, and they will receive profits once an item sells.

There can be a few challenges to owning collectibles. For example, items are only valuable if kept in good condition. In many cases, collectibles will require regular maintenance or protection from signs of aging. Additionally, investors must be able to find a buyer to receive profits for these assets. Investors who can keep items in good condition and identify potential buyers will profit from their collectibles.

7. Cryptocurrency

Cryptocurrency has become an increasingly popular alternative investment thanks to its relative accessibility. Cryptocurrency is essentially a virtual currency based on blockchain networks, which are used for security. Due to this, it is almost impossible to double-spend cryptocurrency or for it to be counterfeit. Additionally, cryptocurrency operates entirely independently from the government, making it unaffected by interference.

While cryptocurrency does not encounter the same risks as other alternative investments due to its high security and independent operations, there are still drawbacks. Cryptocurrency is often criticized because its independence has in some cases led to its use in illegal activities. Additionally, while it is thought to be extremely secure, the networks are still subject to some vulnerabilities. The most well-known example of cryptocurrency is Bitcoin, which is also the most valuable today.

Benefits Of Having Alternative Investments

While alternative investments differ from traditional investments, they share a common benefit: the opportunity to build wealth and achieve financial freedom over time. What makes these investments unique is the wide range of benefits offered outside of their high profitability. Here are just some of the benefits offered by alternative investments:

-

Diversification: Alternative investments are beneficial because they represent the chance to diversify. Investors can work with alternative investments to create a well-balanced portfolio and—in turn—minimize their overall risk.

-

Active Investing: Alternative investments can be more complex, especially when compared to assets like bonds or CDs, but this should be viewed as a positive. By requiring more active involvement, investors have a say in what happens to their portfolios.

-

Unique Knowledge: Working with alternative investments can provide investors with the opportunity to learn more about that particular subject while also expanding their networks in a new industry. For example, if you begin investing in commodities (such as wheat or coffee), you could open yourself up to a variety of new information and people. You never know when this information could benefit you or your business.

-

Low Market Influence: Investments such as stocks are known to shift based on various market factors, but alternative investments are often shielded from the same effects. While alternative investments are not immune to risk, their low market correlation can benefit investors searching for decreased volatility.

-

Good Conditions: Market conditions fluctuate no matter what investment type you are considering, but this can work to your advantage if you play your cards right. An example we are seeing right now is the effects of COVID-19 on the real estate market. Many investors are using this time to take advantage of lower interest rates and purchase prices on real estate.

-

Tax Benefits: There are a number of tax benefits that accompany alternative investment types. The specific perks will vary with every investment, but many alternative investments benefit from lower capital gains taxes.

-

Collector’s Items: Many individuals are drawn to alternative investments simply by beginning a collection. Let’s say you inherit a bunch of gold coins and begin acquiring more. This collection, or alternative investment, could one day bring you significant capital should you decide to sell it.

Risks & Drawbacks Of Alternative Investments

There are certain risks associated with alternative investments to be aware of. These are not meant to scare you, but instead leave you more equipped to research potential investment opportunities. Mind your due diligence and consider the following drawbacks before working with an alternative investment:

-

Hidden Risks: Due to the unregulated nature of alternative investments, it can be hard to assess the risk involved initially. After the financial crisis of 2008, many investment banks were found to be manipulating numbers and providing a false sense of security to investors.

-

Illiquidity: If you are working with collectibles or other rare goods, be aware that they are not typically bought and sold very quickly. Even if you purchase an alternative investment, such as a bottle of aged wine, with plans to sell it down the line, you must still search for a buyer when the time comes.

-

Potential Negative Tax Consequences: In some cases, alternative investments could result in high taxes or increased complexity when filing. Learn about the legal structure of any alternative investments you consider, particularly when it comes to partnerships or retirement funds.

Tips For Getting Started With Alternative Investments

Anyone interested in alternative investments should carefully consider the pros and cons. These investment types are often not as straightforward as other assets and require more research before getting started. Here are some tips for those who plan to pursue alternative investments:

-

Alternative investments are often less regulated than traditional investing options. According to Investopedia, this can make them more prone to scams or fraud. Keeping this in mind, investors must mind their due diligence when making any investment decision to avoid potential risk.

-

Investors may notice that some alternative investments have high up-front fees; however, it is important to understand that they can also result in higher returns in the long run. As you consider different alternative investments, pay close attention to initial investment fees, transaction costs, and ROI to make an informed decision.

-

For many alternative investments, there are financial advisors or fund managers prepared to do the heavy lifting. Do not let the idea of a learning curve intimidate you from choosing a profitable alternative investment. Instead, research opportunities to better understand the required level of involvement.

-

While alternative investments are different from traditional assets, investors should still evaluate several key factors when making a decision: risk level and liquidity.

Summary

It should come as no surprise that alternative investments offer investors several benefits. After all, the strongest investment portfolios are those that are most diverse. Alternative investments present a broad range of opportunities from increased cash flow to specialized skills and knowledge.

By paying careful attention to different asset types, investors can help increase their profits while minimizing overall risk. Alternative investments are another opportunity to build financial wealth and achieve long-term success.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!