Creating a personal budget is one thing, actually sticking to is entirely different – and usually, much harder.

Especially during the holidays, it can be difficult to commit to saving money. With parties to attend and gifts to gives, it can be near to impossible to accomplish those long-desired financial goals.

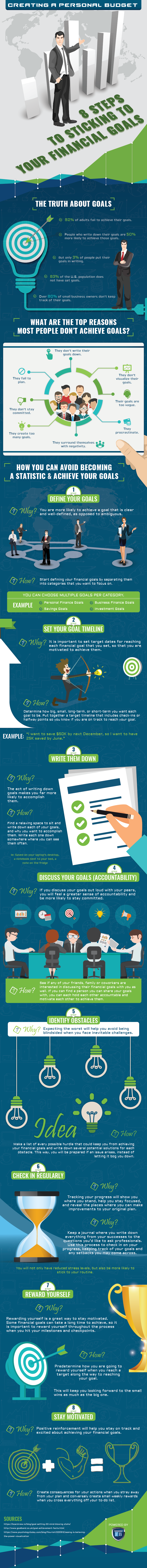

Achieving goals can be so burdensome, 83 percent of the U.S. population doesn’t even set them, and of the people who do, 92 percent don’t achieve the ones they set. That is a sad statistic to be a part of, particularly if you strive to be an entrepreneur. Fortunately, there are plenty of online tools and resources available for those who seek help creating and managing a budget.

How To Acheive Your Personal Budget Goals

The first step in achieving your goals is to specifically define the goal and give it a fixed set of terms. You should outline a plan, a timeline, and image of what your life will look like after achieving your objective – this is to give you something to aim for.

It is also important to reward yourself along the way so that you stay committed when trying to develop healthy financial habits. Designate “mini milestones” throughout the process and get excited when you achieve those. For example, if your goal is to save $10,000 in 6 months, present yourself with a small prize every time you save up another $500. Before you know it, you’ll have enough money for that trip you’ve been dying to take, or that new car you wanted.

Commit to our 8 step guide, and you’ll becoming a personal budgeting master in no time: