Key Takeaways

- Tax saving strategies are just as important to an investor’s bottom line as the exit strategies they execute on a daily basis.

- There are countless real estate tax strategies investors must implement if they hope to realize their full potential.

- The best tax strategies for real estate investors will offset the majority go their income taxes.

Does the thought of filing your taxes this year overwhelm you with anxiety? Are your business receipts unorganized and sparse? Not to worry, these tax saving strategies will help you get back the money you deserve this year.

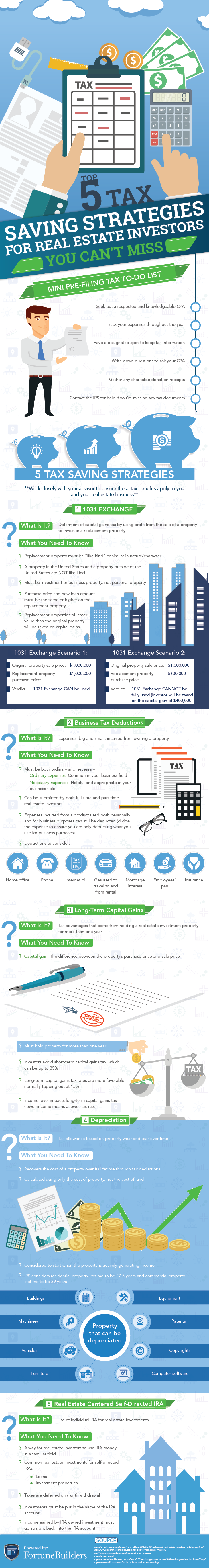

The key to a successful tax season is preparation. Make an appointment with a CPA, collect your documentation (including expenses and any charitable donation receipts) from throughout the year, write down any questions you have for you CPA, and contact the IRS if you are missing any important paperwork.

Remember, having as many records of transactions that you can find will help you increase your return.

The Top 5 Tax Strategies For Real Estate Investors

There are countless tax saving strategies real estate investors may implement each and every year, not the least of which may help offset income taxes. However, not all tax saving strategies are created equal; some are inherently more valuable to real estate investors than others. In particular, these five tax savings strategies have become the most coveted:

- The 1031 Exchange

- The Business Tax Deduction

- Long-Term Capital Gains

- Depreciation Losses

- Self-Directed IRAs

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Learn more about these tax saving strategies, and more, by reviewing our infographic:

What Is A 1031 Exchange?

The 1031 Exchange strategy gets its name from IRS code Section 1031, and helps investors postpone paying taxes in the event they sell al property for a profit and buy a similar one immediately after. Or, as the IRS describes it “Whenever you sell business or investment property and you have a gain, you generally have to pay tax on the gain at the time of sale. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange.” The 1031 makes it possible for investors to sell assets without being penalized immediately, which bodes well for those trying to offset any resulting capital gains from the sale.

What Are Business Tax Deductions?

The IRS allows real estate business owners to write off many of the costs of doing business. In the event the business operates to make a profit, real estate investors may write off several business expenses. That said, investors can’t simply write everything off; the expenses must be both ordinary and necessary in order to be written off. According to the IRS, “An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business.” The idea is to promote business, but investors may use these write-offs to offset income tax each and every year. While business tax deductions may not amount to the same savings as other tax saving strategies on this list, the more deductions investors are able to add each year, the better their bottom line will look.

What Are Long-Term Capital Gains?

The capital gains tax, as its name suggests, is a tax levied on the profits realized when an investor sells their assets for more than the original purchase price. The profits, however, are taxed differently, depending on how long the asset was held. Specifically, assets held for less than a year and sold for a profit will have short-term capital gains levied in their direction. Homes sold for a profit after a year of ownership, however, will be taxed as long-term capital gains, which are considerably cheaper. As a result, it may prove beneficial for investors to hold onto their assets for a least a year under the right circumstance.

What Is Depreciation?

Depreciation is perhaps the most significant tax saving strategy awarded to real estate investors. However, depreciation is reserved for rental property owners, and it allows them to offset the inherent loss in value of a property overtime.

The I.R.S. defines rental property depreciation — otherwise known as depreciation losses — as “allowances for exhaustion, wear and tear (including obsolescence) of property.” According to their website, “You begin to depreciate your rental property when you place it in service. You can recover some or all of your original acquisition cost and the cost of improvements by usingForm 4562, Depreciation and Amortization, (to report depreciation) beginning in the year your rental property is first placed in service, and beginning in any year you make improvements or add furnishings.”

What Is A Self-Directed IRA?

Traditionally, retirement account holders are penalized for withdrawing funds from their IRA before they turn 65. However, the IRS has made some exceptions; namely for the purchasing of real estate. More specifically, IRA holders may fund a real estate purchases with the funds from their IRAs without being penalized if the profits are returned to the same account from which they came. That provides two major benefits for investors: For starters, it gives them the money they need to secure a rental property. Secondly, the money returned to the IRA gets the same tax differential treatment that has become synonymous with IRAs.

Summary

Tax saving strategies are nothing short of instrumental over the course of any wealth-building strategy. The ability to offset income taxes, or at least a large percentage of them, awards investors the ability to shelter a great deal of their profits from taxes that threaten to cut into their bottom line. In doing so, investors are not only able to make more money, but also save more money, both of which are necessary to realize financial freedom.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!