- What is House Flipping?

- House Flipping Pros And Cons

- The 70% Rule In Real Estate

- How To Find Houses To Flip

- How To Start Flipping Houses

- House Flipping Mistakes To Avoid

- Misconceptions in Flipping Homes

When you hear the term “house flipping” you might envision a dramatic before-and-after scenario that unfolds on a home improvement show. However, flipping houses is more than just a visual transformation—it’s a strategic real estate investment tactic that has gained popularity for its potential to generate significant income. In this beginner’s guide, you’ll be walked through the essentials of flipping houses, from understanding the basics to mastering the art of the sale, all designed to help you succeed in this lucrative venture.

What Is House Flipping?

At its core, flipping houses involves purchasing a property, usually one that requires repair or renovation, and then selling it at a higher price to make a profit. This process isn’t just about slapping on a coat of paint and changing the carpets; it’s a thorough overhaul that requires market savvy, a good sense of budgeting, and an eye for properties that have potential. The ultimate goal? To increase the home’s value and sell it for a profit in a relatively short period, which can be especially rewarding in a booming real estate market.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

House Flipping Pros And Cons

Flipping homes, like any investment, comes with its own set of advantages and disadvantages. It’s a hands-on investment strategy that can yield high returns, but it’s not without its challenges.

Pros

- Profit Potential: Flipping houses can lead to significant profits, especially if you’ve accurately estimated costs and timed the market well.

- Valuable Experience: Each flip can sharpen your real estate and renovation knowledge, potentially benefiting future investments.

- Increase Neighborhood Property Value: Successful flips can improve neighborhoods by turning dilapidated properties into desirable homes.

Cons

- Financial Risks: The unpredictability of flipping a house might result in financial loss. Also, if you don’t have the correct team, mentality, and discipline in place, it may be emotionally exhausting.

- Time Commitment: Flipping houses can be time-consuming, from finding the right property to managing renovations. Having the right systems and teams in place can help you take a more hands-off approach.

- Unexpected Issues: Renovations often uncover additional problems, leading to unforeseen expenses and delays.

- Legal Ramifications Are Possible: There’s always the possibility of a lawsuit if you sell a property with problems you didn’t fix or address properly or you purchase a property with a title that isn’t clear.

The 70% Rule In Real Estate

The most important rule of home flipping is to keep your financial risk as low as possible while maximizing your potential return. Don’t overpay for a property and make sure you know to calculate the cost of repairs and renovations before you make a purchase.

The 70 percent rule suggests that an investor should not spend more than 70% of a property’s after-repair value (ARV) minus any necessary repairs. The ARV is the value of a house once all repairs have been made.

For example, if the property’s ARV is $100,000 and it needs $20,000 in repairs, then the 70% rule suggests that you should pay no more than $50,000 for the property in question:

$100,000 (ARV) x 0.70 (70% Rule) = $70,000 – $20,000 (Cost of Repairs) = $50,000

This rule is a safeguard to help ensure you maintain a profit margin after all the expenses of flipping the house.

How To Find Houses To Flip

- Look on foreclosure sites: If you are wondering how to find houses to flip, as well as how to find cheap houses to flip, one of the best starting points is to look on foreclosure listing sites, such as Foreclosures.com. Many banks and lenders also provide their own real estate owned listings. It should be noted that some of these listing sites require paid memberships.

- Attend auctions: A great place to look for properties being sold at deep discounts is at probate and foreclosure auctions. However, be ready for bidding wars, where offering all-cash might be the most compelling bid. Check your local county’s website for scheduled property auctions.

- Drive around: An orthodox method of finding your first fix and flip investment property is to hop in the car and drive around your target neighborhood. Look for signs of properties in distress, such boarded-up windows, overgrown yards, or piles of mail and newspapers. If you spot a property, write down the address and do some online research to find the owner or seller so that you can make an offer.

- Join your local REI group: Joining your local real estate investment club or association is a great idea regardless of your investing niche. Networking with other real estate professionals could connect you with potential deals and partnerships. LinkedIn.com, online forums and local meet-ups are also great ways to connect with others.

- Network with wholesalers: Wholesalers need house flippers like you in order for their business to be successful. Their sole focus is in finding undervalued properties and reselling it to a third party. House flippers can get a great wholesale price and resell the property for a retail price.

- Work with an agent: You may want to consider adding a real estate agent to your team, especially if you lack experience or are unfamiliar with the real estate market. In addition, licensed real estate agents have access to the MLS (multiple listing service) which will allow you to locate undervalued properties more effectively.

How To Flip Houses

Starting in the flipping houses industry requires a structured approach. Here’s a step-by-step process to guide you through your first flip.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

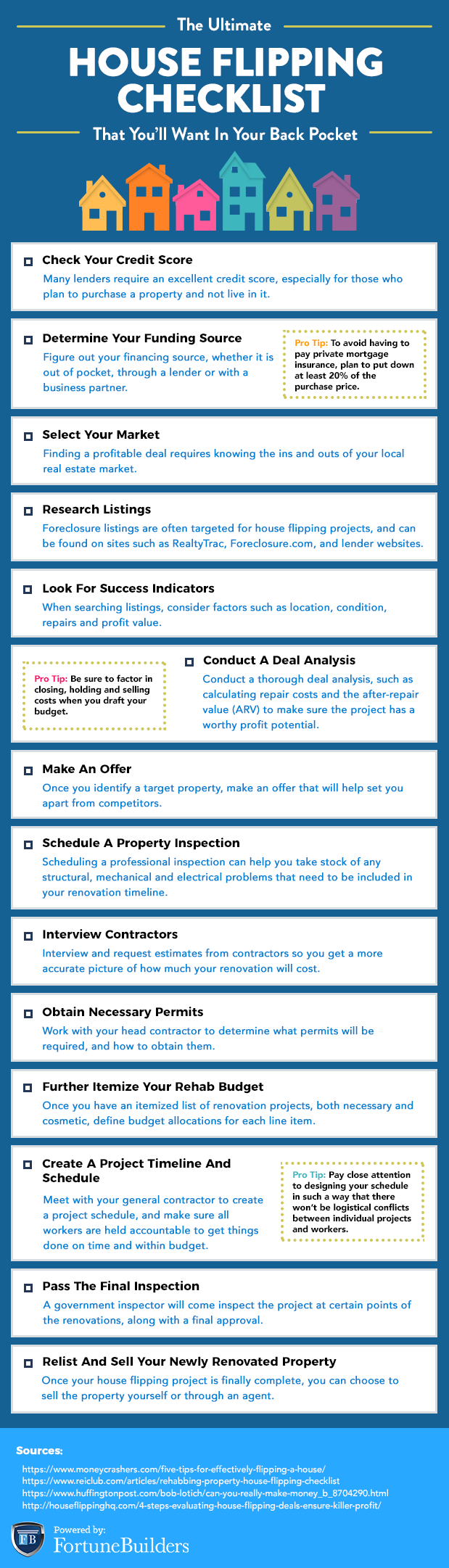

1. Check Your Credit Score

Before investors begin searching for funding, it is important to assess their current financial situation. It is not uncommon for lenders to run a credit check, but it is a good idea for investors to know where they stand ahead of time. Keep in mind that there are plenty of options for those with a low credit score, at this step it is simply important to know where you stand.

2. Determine Your Funding Source

Now is the time to start looking into ways to finance your deals. There are several options available including traditional financing, private lenders, crowdsourcing or even personal funding. Review each of the options available to you and compare interest rates and loan terms to make the best choice.

3. Select Your Market

The right market is crucial to the success of any house-flipping business. When choosing an area be sure to research the housing demand, median home prices, average property type and neighborhood resources.

4. Research Listings

After investors choose the right market, it is time to begin searching property listings. Websites like Zillow.com and Realtor.com are great places to start. Investors should also search public records and newspapers for foreclosure listings, which can represent profitable flips. To learn more about finding foreclosure properties, be sure to read this article.

5. Look For Successful Indicators

Investors should look at several key factors like location, property condition, and potential rehab costs when searching through property listings. Each of these factors will influence how much the flip will cost, and how much it could potentially earn once completed.

6. Conduct A Deal Analysis

There are several numbers investors can use to predict the potential of a given property. For example, the after rehab value (ARV) can help determine whether or not a deal will be profitable. To calculate the ARV, simply add the renovation value to the property purchase price.

7. Make An Offer

The offer price is crucial to the success of any rehab property. Securing the right purchase price will significantly influence the profits investors can make on a deal. That being said, investors hoping to secure a property will not want to undermine the existing sellers. Determine the right purchase price for your ARV and make a strong offer on the property.

8. Schedule A Property Inspection

By hiring a property inspector, investors can help make sure they are aware of any potential issues with a home. Inspectors will look for any structural issues, and point out and mechanical or electrical problems.

9. Interview Contractors

Finding the right team can take time as a real estate investor. Interview multiple contractors to get an accurate estimate of the repair costs and timeline required for your project. Do not be afraid to keep searching until you find the right contractor for the job.

10. Obtain Necessary Permits

More often than not, investors will need to obtain permits for a rehab property. Work with your head contractor to determine which permits you will need to obtain before the start of the project. Consult your state and local government websites for more information on how to file for permits.

11. Further Itemize Your Rehab Budget

Once you have a list of the projects necessary to complete the renovation, review the estimated costs of the flip. This will help you identify any areas that need to be prioritized or changed before the renovation starts.

12. Create A Project Timeline And Schedule

Work with your contractor to finalize a timeline and schedule for the renovation. Always leave extra room in the final estimate in case any unexpected issues arise, like materials shipping late or a project taking extra time.

13. Pass The Final Inspection

After completing the renovation project, the house will need to be inspected again to ensure the changes are up to code. Do a final walk-through with your contractor as the project draws to a close to make sure you did not miss anything.

14. Re-list And Sell Your Newly Renovated Property

The final step in the house flipping process will be to list and sell the renovated property. Decide whether or not to work with an agent and determine how to best market the property. Congratulations, you just completed a house flipping project.

House Flipping Mistakes To Avoid

Even seasoned professionals can stumble when flipping houses. By recognizing the most common pitfalls, you can take proactive steps to sidestep them, ensuring a smoother and more profitable flip.

- Overestimating ARV: It’s easy to fall into the trap of wishful thinking about the potential selling price of your flipped house. To avoid this, conduct thorough market research and consider consulting with a real estate expert to get a realistic estimate. Use comparable sales in the area to ground your expectations.

- Underestimating Costs: To prevent budget overruns, add a contingency of at least 10-20% to your projected renovation costs to cover unexpected expenses. Begin with a detailed project scope and secure comprehensive quotes from contractors. Regularly review and adjust your budget as the project progresses.

- Skipping Inspections: Foregoing a professional inspection might seem like a time and money saver, but it can lead to costly surprises down the road. Invest in a reliable inspector to uncover potential issues early on, so you can either negotiate a lower buying price or prepare for necessary repairs in your budget.

Misconceptions in House Flipping

House flipping may be surrounded by myths that can deter beginners from taking the plunge. Understanding the reality behind these misconceptions can prepare you for success and ensure that false assumptions don’t keep you from exploring the profitable potential of flipping houses.

Need Tons of Your Own Money

The belief that you need a large amount of personal capital to start flipping houses is a common misconception. While having funds readily available can be advantageous, it is by no means a prerequisite. Creative financing options are abundant: You can secure a hard money loan, obtain a traditional mortgage, or work with private lenders. Some flippers also partner with investors, offering equity in the project in exchange for funding. By leveraging these resources, many successful house flippers start with minimal personal investment.

Need Good Credit

Good credit certainly opens many doors in terms of financing options, but it is not the be-all and end-all for flipping houses. Hard money lenders, for instance, are more concerned with the value of the property you’re flipping and the potential profit of the deal rather than your credit score. Additionally, partnering with someone who has strong credit can also be a viable strategy. There are even credit repair services and financial advisors who can help you improve your credit score while you get your real estate investment career off the ground.

Can’t Flip Houses Part-Time

Many people assume that flipping houses requires a full-time commitment. However, it’s quite possible to start flipping houses on a part-time basis. The key is to build a solid team you can rely on when you’re not available. This team might include a trustworthy contractor, a real estate agent with investment property experience, and a real estate attorney. With proper planning, clear scheduling, and effective delegation, flipping houses can be adapted to fit within a part-time schedule, allowing you to grow your flipping business at a pace that suits your lifestyle and availability.

Summary

Flipping houses can be an enriching venture if approached with diligence, research, and realistic expectations. This guide has equipped you with foundational knowledge, from understanding what flipping entails to effectively selling your first flip. Remember, while flipping houses carries risks, the rewards—both financial and personal—can be substantial. Now, with this roadmap in hand, you’re ready to embark on your house-flipping journey, poised to navigate the challenges and capitalize on the opportunities that come your way.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!