Investing in real estate is a great way to build wealth. Commercial real estate investing, in particular, is known to provide some of the highest income streams. If you’ve been investing in residential real estate for a few years and have been wondering how to invest in commercial real estate, this guide serves to break down everything you need to know to get started.

Commercial Real Estate Investing Trends

Offices, hotels, retail stores, and other commercial real estate investments suffered heavily during the COVID-19 pandemic. Since the return to normal started, commercial real estate has started its return and trend upward and is projected to continue as the current economy continues to rise. Many commercial real estate investors are optimistic as the industry continues to adapt to changes.

While the start of 2021 did not promise a positive outlook, experts suggested commercial real estate would stabilize by the end of the year. According to Kathy Feucht, global real estate leader at Deloitte, commercial real estate investors planned to reduce costs by around 25% in 2021. However, there were many surprises over the last year, including increased demand for industrial properties.

Julian Goldie, CEO of Goldie Agency, states that “given the prospect for outsized profits, consistent yields, volatility hedges, and unique tax benefits, more quants are expected to enter the market this year. Tailwinds are blowing across the market as a result of the post-Covid rebound and infrastructure spending, and smart investors should pay attention”.

With that in mind, there are several predicted trends for 2022 depending on the type of commercial real estate investment. Let’s look at how these difference properties are expected to perform:

-

Retail Stores: Several retail and department went bankrupt in 2020 and 2021 as the economy adapted to quarantines and high COVID-19 transmission rates. As more and more consumers shop online, experts predict up to 25% fewer retail stores by 2025. Retail stores in urban areas, like New York and San Francisco, are expected to be replaced with healthcare, grocery, and other alternative stores.

-

Offices: According to CBRE, office demand could be permanently cut by 15% as more companies shift to work-from-home policies. As a result, office building supply will continue to increase. However, we have seen the emergence of “hybrid” office policies over the last year, requiring workers to come in only on certain days of the week. This trend may stabilize office spaces as businesses look for ways to maintain some in-person workdays.

-

Hotels: Hotels are predicted to struggle all throughout the year ahead, despite some eased regulations on traveling. Many are not expected to recover until 2023, and upscale hotels that offer amenities for travelers won’t stabilize until 2025. Hotels in more populated cities will suffer the most as many try to steer away from densely populated areas.

-

Warehouses: Warehouses are expected to be the leading performer among commercial real estate investments. Their success is due to companies trying to keep up with the growing demand for e-commerce orders. Real estate experts predicted an additional demand of 250 million square feet for warehouse space in 2021.

-

Apartments: Initially, apartments were expected to struggle during the pandemic as many would be unable to pay rent. However, multifamily properties are performing well as the demand for housing has not decreased. With apartments at more attainable prices and historically low-interest rates, they are expected to remain stable in the year ahead.

-

Rental Property Upgrades: Multifamily property owners may notice an influx in applications for larger units as renters adapt to work-from-home lifestyles. Upgraded units may also become more desirable in competitive markets throughout 2022 as renters seek to improve their living arrangements.

-

Commercial Development: New development projects are expected to rise as housing markets across the country attempt to meet growing demands for housing. Commercial investors skilled in development projects may find ample opportunities for new builds in the year ahead.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

What Qualifies As “Commercial Real Estate?”

Commercial real estate is a property that is typically leased out for business and retail purposes. Investing in commercial real estate involves the purchase or development of properties that have been designed with the intent of housing commercial tenants. Unlike a residential real estate investor, commercial real estate investors lease out and collect rent from the businesses that occupy their properties rather than from residential tenants. It should also be noted that raw land purchased for commercial property developments is also included in this definition. Commercial properties can generally be categorized into five main types. Keep reading to learn more about each one.

The 5 Types Of Commercial Real Estate

Before we get into the mechanics of how to invest in commercial real estate, it’s important to understand the various types of commercial properties. This way, you can start thinking about the commercial asset type in which you want to specialize. Commercial properties serve a broad range of purposes but are generally grouped into the following types:

-

Office

-

Retail

-

Industrial

-

Multifamily

-

Special Purpose

1. Office

The most common commercial real estate type is office space. These buildings, which can range from single-tenant offices to skyscrapers, are defined by one of three categories: Class A, Class B, or Class C.

-

Class A commercial real estate properties are typically newly built or extensively renovated buildings in excellent areas with easy access to major amenities. Professional real estate management companies typically manage them.

-

Class B commercial real estate properties are often older buildings requiring capital investment. Although they are well-maintained and managed, these properties require minor repairs and upgrades—making them a popular target for investors.

-

Class C commercial real estate properties are typically used for redevelopment opportunities. They are generally poorly located, require major capital investments to improve out-of-date infrastructure, and their high vacancy rates are much higher than higher-classed buildings.

2. Retail

Another popular commercial real estate type is retail buildings. These properties, ranging from strip malls and community retail centers to banks and restaurants, are often located in urban areas. The size of these real estate properties can extend anywhere from 5,000 square feet to 350,000 square feet.

3. Industrial

From warehouses to large manufacturing sites, industrial buildings are typically geared towards manufacturing industries, as they offer spaces with height specifications and docking availability. Also, these commercial properties generally lend themselves more to investment opportunities.

4. Multifamily

Multifamily properties are comprised of apartment complexes, high-rise condominium units, and smaller multifamily units. Property is qualified as multifamily real estate any time it has more than one unit, but can also be considered a commercial property if it has more than four units. Many residential investors get their start in commercial properties by expanding into larger multifamily properties. Residential tenants tend to have shorter lease terms than office and retail tenants, so tenant turnover is a factor that should be considered.

5. Special Purpose

In general, special purpose properties are designed for a specific use, so much so that it would be difficult to repurpose the property for another use. Car washes, self-storage facilities, and schools are all examples of special-purpose properties. The leisure and tourism industries represent a large proportion of special purpose real estate as well. Common examples within the industry include hotels, airports and sports stadiums, and amusement parks.

Mixed-use development properties are also prevalent in the commercial real estate sector and continue to grow in demand. These properties represent different uses, such as residential, retail, and even the public sector. A mixed-use building could have shopping and services on the first floor with apartment units on the upper floors. Read our guide to mixed-use developments to find out why they have become so popular in recent years.

What Is Owner Occupied Commercial Real Estate?

Owner-occupied commercial real estate (OOCRE) is when investors purchase commercial real estate to utilize the building for their own purposes. This strategy can be applied to any of the five commercial real estate types discussed above.

The option to occupy the commercial real estate you invest in is just one of the many benefits of commercial investing. Keep reading to find out some of the other benefits that may pique your interest.

The Many Benefits Of Commercial Real Estate Investing

Investing in commercial real estate can be very rewarding, both personally and financially. For many, the objective of investing in commercial real estate is for future wealth and security; others utilize it for tax benefits and investment portfolio diversification.

A commercial redeveloper can also take advantage of the following benefits:

-

Higher Income: The hallmark benefit of investing in commercial real estate is a higher potential income. Generally speaking, commercial properties have a better return on investment, an average of six to twelve percent, while single-family properties fetch between one and four percent. Secondly, commercial real estate provides a lower vacancy risk, as properties tend to have more available units. (Consider this: one vacancy in an office building with 25 commercial spaces will negatively impact an investor’s bottom line more than one vacancy in a residential duplex.) Also, commercial leases are generally longer than those you will find in residential real estate. This means that commercial real estate owners have to deal with far less tenant turnover.

-

Cash Flow: Commercial real estate has one very distinct advantage: a relatively consistent stream of income due to longer lease periods. In addition, commercial properties often have more units than residential properties, which means you can achieve economies of scale and multiply your income streams much more quickly. Known in the industry as a triple net lease, many commercial tenants also pay the building’s real estate taxes, property insurance, and maintenance costs, thus increasing your owner benefits.

-

Less Competition: Another advantage associated with commercial real estate is relatively less competition. Because of the perceived difficulty of commercial investing, the commercial space tends to be less saturated with other investors.

-

Longer Leases: Perhaps one of the biggest perks of commercial real estate is the attractive leasing contracts. Commercial buildings generally have longer lease agreements with tenants compared to residential properties, which, as previously stated, offer investors impressive returns and significant monthly cash flow. In many cases, lease agreements for commercial properties are signed for multiple years.

-

Business Relationships: The world of commercial real estate offers investors the unique opportunity to participate in business-to-business relationships. This can lead to more professional, neighborly interactions with your tenants when compared to residential real estate. In some cases, you may even be able to build relationships with the business owners renting in your building. This can be great for expanding your network and getting involved in the community you are investing in.

-

Limited Operational Hours: One of the lesser-known perks of operating commercial real estate is that, for the most part, you share working hours with your tenants. While business hours can vary slightly, commercial property owners typically won’t find themselves answering around-the-clock maintenance requests or other tenants’ communications. On the other hand, residential real estate can demand an on-call staff member to deal with issues 24/7. Many commercial investors who choose to manage their own properties enjoy this benefit, as it helps allow for a sense of separation between property ownership and regular life.

Commercial real estate investing offers investors an array of opportunities and advantages that other investment strategies do not. Once the benefits of commercial real estate investing are recognized, the next step is to dive in. Read the following to receive tips on how to get started in commercial real estate.

[ Learning how to invest in real estate doesn’t have to be hard! Our online real estate investing class has everything you need to shorten the learning curve and start investing in real estate in your area. ]

How To Invest In Commercial Real Estate: Getting Started

The question of ‘how to invest in commercial real estate’ has only one answer: due diligence. Regardless of what sector or niche you’re in, doing your homework and minding your due diligence is critical in ensuring your success in real estate. Besides learning the ins and outs of commercial investing, make sure you understand the commercial real estate market and how it can differ from the residential real estate market. If you’re ready to embark on your first commercial endeavor, be sure to abide by the following tips:

1. Understand How Commercial Real Estate Is Different

The first step as a commercial investor is understanding that commercial real estate is valued differently from residential properties. Unlike residential real estate, the income from commercial real estate is typically related to usable square footage. Also, commercial property leases typically last longer than residential leases. These two factors help illustrate why a commercial real estate investor has a better potential to earn a higher income.

Matt Woodley from Mover Focus advises “start by doing your research. Make sure you understand the risks and rewards of commercial real estate investing. Also, be prepared to invest a significant amount of money upfront, and be willing to weather some tough market conditions”.

Location is an important factor regardless of your investing niche, with commercial investing as no exception. However, commercial investors also need to pay close attention to their tenant type. The location and intended tenant type are two factors that intersect closely when determining demand. For example, a space intended for corporate offices will likely perform better in an urban center than a primarily residential neighborhood. Analyzing recent comparables can provide you with a better clue of how your property of interest might perform.

2. Analyze Comparables

The next step is to analyze comparables in the area and research future developments. Otherwise known as “comps,” these assets refer to prices paid for recently sold properties that are similar in location, size, and style. Analyzing comps will help you determine the current market value of a property. When determining comps, a general rule of thumb is to choose a property where the square footage does not go beyond 10 percent higher or lower than that of the property being evaluated. This will allow for the most accurate comparables possible. Read more on tips for pulling the most accurate comparable sales.

3. Use The Right Success Metric

Commercial real estate investing involves a wide array of calculations and an understanding of real estate finance. To be a player in commercial real estate, there are several formulas you should know.

-

Net Operating Income: This is a calculation that equals all revenue and costs from a particular property. Configured before taxes, this number gives investors an idea of how much they’ll make from an investment minus all necessary operating expenses. Operating costs typically consist of insurance, property management fees, utilities, repairs, janitorial fees, and property tax.

-

Cap Rate: Used to calculate the value of income-producing properties, the “cap rate” — short for capitalization rate — will provide investors with an estimate of future profits or cash flow. This is essentially the ratio of net operating income to the property asset value.

-

Cash On Cash: Cash on cash is a metric that provides investors with a rate of return on their commercial real estate transactions. It’s typically used by investors who rely on financing to purchase their properties. Cash on cash measures the return on out-of-pocket cash invested relative to the portion that was financed. This will provide an accurate analysis of an investment’s performance.

The above formulas serve as an introduction to complement our complete guide to real estate calculators that every investor should know.

4. Reserve Cost Contingencies

Cost contingencies are essentially rainy day funds that are set aside to cover unexpected acquisition expenses. This portion of your budget can be used to cover lost cash flow due to early vacancies, renovations, and other upfront costs. For example, the property may need to be rezoned or you may need to hire a new property manager. These costs can often be incurred before you have stable cash flow.

By working cost contingencies into your budget early on, you can ensure you have the funds to make up for these expenses. A typical cost contingency budget in commercial investing is between 5 and 15 percent. To determine the right number for your investment, analyze your expected cash flow in the first few months. Will that number cover early loan expenses? What about changes to the property? Even if you expect cash flow to be sustainable early on, it is always a good idea to have extra funds just in case.

In addition to cost contingencies, many investors will set aside a capital reserves fund which essentially serves the same purpose later on. These funds can be used for unexpected expenses and are built into the operating budget. Overall, by planning for these costs throughout the investment process you can avoid situations where you are strapped for cash. When it comes to commercial investing, cost contingencies and cash reserves are a crucial component of the process.

5. Commercial Real Estate Investing Mistakes To Avoid

As a commercial real estate investor, it’s just as important to know what not to do as it is to know what to do. Today’s best investors already know it, and it’s about time you did too: mitigating risk is the single greatest thing a real estate entrepreneur can do for the success of their business. Mitigating risk exposure is the best way to increase the likelihood of success. That said, here’s a list of some of the most common mistakes commercial real estate investors need to avoid:

-

Improper Valuations: Every single commercial property is unique, and investors need to be able to account for variances that may be found in each asset. Failure to account for every detail involved in an asset’s valuation could lead to financial ruin. Therefore, commercial real estate investors must be fully aware of what they are buying and for how much. The inability to account for the true value of a property will impact nearly every step moving forward, so it’s important to get things right at the time of acquisition.

-

Financial Ignorance: Failing to understand the financial intricacies of commercial real estate investing can be devastating. IF for nothing else, commercial deals are not the same as residential ones. Investors will need to learn the differences, not the least of which include the loan-to-value (LTV) or debt service coverage ratio (DSCR).

-

Neglecting Due Diligence: While today’s market requires decisive decision making, it’s important to mind due diligence. It’s better to lose a deal to someone else than to buy into a deal you aren’t prepared for. As a result, more investors need to take the appropriate time to learn as much about a property as they can before they buy it.

-

Not Working With a Team: Far too many investors want to save money by doing everything themselves. However, working with a team is unequivocally better than working alone. While you may appear to save money on the surface, chances are you are losing both money and time by working alone. That said, align your services with a competent team and trust them to do the job you hired them for. There’s a good chance they know more about every process than you do.

In this next section, we will discuss how to obtain different types of commercial investment loans. Being well-versed in the above formulas and calculations is critical when presenting your case to commercial lenders.

Types Of Commercial Real Estate Loans

Now that you’ve received an overview of commercial real estate investing, including its benefits and ideas on how to get started, you’ll need to start thinking about an important aspect: How will you go about financing these investments?

There is a wide range of commercial investment loan types, and it is up to the investor to decide which financing option best fits their needs. Each type of loan has unique eligibility requirements, such as a minimum credit score, experience level, and down payment requirement. These loans also have varying terms, including the loan term, interest rate, and loan-to-value (LTV) ratio. For example, one investor may be in search of a loan that offers lower interest rates over a longer loan term, while another investor’s priority might be finding a short-term loan as a means of bridging a financial gap. Be sure to visit our comprehensive guide to the different types of commercial real estate loans shown below:

-

Small Business Administration (SBA) 7(a) Loan

-

Certified Development Company (CDC) / SBA 504 Loan

-

Conventional Loan

-

Commercial Bridge Loan

-

Hard Money Loan

-

Conduit Loan

How To Get A Commercial Real Estate Loan

The idea of obtaining commercial real estate financing may seem intimidating at first. Still, investors who learn about the process and the different types of commercial real estate loans will find that they are completely attainable. Below are the main steps involved in obtaining a commercial investment property loan:

-

Individual Vs Entity: Step one is to determine whether to finance a commercial property as an individual, or as an entity. Although most commercial real estate is purchased by business entities such as corporations, developers, and business partnerships, it can easily be completed as an individual investor. The lender essentially wants to make certain the borrower can repay the loan, thus requiring borrowers to provide financial track records to secure a loan. The lender will typically require the investor(s) to guarantee the loan for newer businesses with no credit history.

-

Mortgage Options: It is important for investors to recognize that residential and commercial mortgages are not the same. First, unlike residential mortgages, commercial loans are not backed by government agencies such as Freddie Mac and Fannie Mae. Secondly, commercial loan terms differ from those of residential properties. Commercial loans range from five to 20 years, whereas residential loans typically range from 15 to 30 years. Lenders will typically make their decisions based on an investor’s financial and credit history.

-

Loan To Value Ratio: An important metric lenders consider when financing commercial real estate is a property’s loan-to-value ratio (LTV). This figure measures the value of a loan against the value of the property. It is calculated by dividing the loan amount by the property’s appraisal value or purchase price. The LTV will range from 65 to 80 percent for commercial loans, with lower LTVs qualifying for more favorable financing rates.

-

Debt Service Coverage Ratio: Lenders also look at debt-service coverage ratio (DSCR). This metric measures a property’s ability to service debt. It compares a property’s annual net operating income to its annual mortgage debt service, including principal and interest. A DSCR of less than one percent reveals a negative cash flow. Commercial lenders generally look for DSCRs of at least 1.25 to ensure proper cash flow.

Once you’ve secured your financing, you are ready to start searching through listings. However, this is a lot of information to process at once. Keep reading to have some of your most burning questions answered.

Commercial Real Estate For Beginners

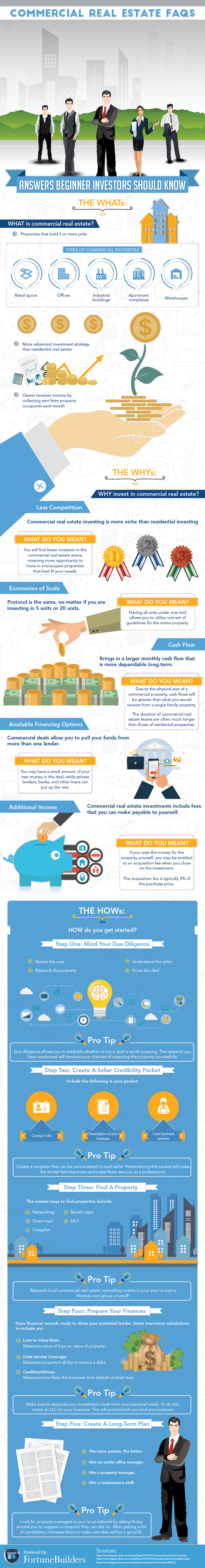

A successful commercial real estate investor has the potential to have a very lucrative career. Many beginner investors use multifamily properties as a gateway to get into commercial real estate investing. Regardless, it is imperative that you have a proper business plan before getting started. Here are the answers to a few commonly asked commercial real estate questions every beginner investor should know:

How Do I Know If I’m Ready For A Career In Commercial Real Estate Investing?

Are you interested in commercial real estate investing but still feeling a little hesitant to take the leap? The following three questions were designed to help you gain more clarity on whether or not commercial real estate is for you:

Do you have the ability to think big?

Investing in commercial real estate requires individuals to think big and have an open mind. When investing in residential real estate, the properties under consideration are much smaller in scale. With a commercial property, you must visualize a finished product even in the beginning stages of redevelopment. If you are debating whether to purchase a five-unit apartment versus a property with ten or more units, it is probably more beneficial to choose the 10. If the five-unit complex requires nearly the same commercial financing as the 10, it makes sense to think big and do what it takes to boost your bottom line.

Are you an expert relationship builder?

Networking and building relationships as a residential real estate investor are important, but it is an absolute must for commercial investors. The biggest reason to build relationships with other commercial investors and private lenders is for financing purposes. When facing a one million dollars or more purchase price, you will likely need funding. What better way to find capital than to contact one of your personal private lenders with whom you’ve already built a relationship. Once you’ve built a network, you can rely on other individuals who have made and learned from their mistakes.

Can you successfully execute your due diligence?

Arguably the most important task beginner investors can do before jumping into commercial real estate investing is to perform their due diligence. After you’ve chosen your niche, you must research everything you can regarding that specific sector. Ask questions from like-minded individuals at your local REI club, find information about different types of financing options online, reach out to private lenders in advance. Hence, you know exactly what information to present them with when the time comes. Once you’ve carried out thorough due diligence, you will be ready to successfully embark on your first commercial real estate deal.

Do You Need A Real Estate License?

You do not need a real estate license to begin investing in commercial real estate, though it can open doors professionally. Obtaining your real estate license and managing transactions on the side can help you build professional connections within the industry — and earn money through commission in the meantime. For many investors, these funds can go directly towards purchasing commercial properties and building their portfolios.

That being said, there are training hours, exams, and more that are required to obtain a real estate license. It will be a time commitment to even start practicing as an agent, which can be tricky if you are already starting to build your investment portfolio. Some investors will opt to build a network with real estate agents rather than pursuing their own license.

Summary

Commercial real estate investing may seem intimidating at first, but you should understand that the core skills and competencies required are the same as residential property investing. They include minding due diligence, having a proper business plan that includes understanding financing options, and building a strong network. Any type of investing is associated with some level of risk, and it’s up to you to find ways to mitigate that risk. If you use the systems that brought you success with residential real estate and seamlessly implement them into your commercial strategy, you will surely find success.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!