Probate real estate has proven time and time again that it deserves a place amongst today’s best acquisition strategies. At the very least, investors who can acquire houses in probate may find themselves with an attractive deal that’s too good to pass on. However, it is worth noting that the process of acquiring a deal through probate strays from what the average investor is used to. There is a unique process for buying homes in probate, and it could be in your best interest to learn it. If for nothing else, understanding the basic tenants of the probate real estate process could put you on the path to finding your next deal. And what better way to understand the process than to gather as much information as you can from this probate real estate guide.

What Is Probate Real Estate?

Real estate probate is the legal process following a homeowner’s death, where the property either transfers ownership to someone or is sold. It is another way of describing the proceedings by which a decedent’s will is processed in court — a special court, nonetheless. In the case of real estate, it refers to the previous owner’s respective home. Let me explain.

According to the Branch Banking and Trust Company, “An executor of the estate is named to handle the decedent’s affairs and administer the estate throughout the probate process. Assets that are distributed under a will (or all assets in the absence of a will or other ownership forms) go through this process and are subject to probate.” In other words, probate often refers to the administering of a deceased person’s will. More often than not, said administering would include a home — the same one probate real estate investors are eager to get their hands on.

But why would investors be interested in probate properties, especially when they aren’t even on the deceased’s will? The answer is simple: there are great deals to be had. You see, not everyone wants to inherit property from a deceased relative. The recipient may not be able to afford the costs that coincide with the property and are, therefore, may be more willing to quickly part ways with the home; that’s where investors come in.

Investors could turn the new owner’s lack of desire to own a new property into an opportunity. Their lack of interest motivates them to rid themselves of the home, and patient investors may be able to capitalize.

[ Learning how to invest in real estate doesn’t have to be hard! Our online real estate investing class has everything you need to shorten the learning curve and start investing in real estate in your area. ]

Probate Real Estate In 4 Steps

The probate real estate process may seem confusing between the court proceedings and legal documents; however, probate properties will typically follow the same course. In general, there are four main steps to the probate process (though exact proceedings can vary depending on your state). Read through the following list for a better understanding of probate real estate:

-

Executor Of The Estate: For the probate process to begin, an Executor of the estate must be appointed. Typically, the Executor is named in a decedent’s will, but if not, the court will appoint an Administrator to fulfill the role. The will includes whether or not an heir will inherit the property or if it will be sold.

-

Property Appraisal: If the property will be sold, the Executor will then determine a listing price for the property in question. The list price will be determined after an appraisal with the help of a real estate agent experienced in probate sales.

-

Property Listing: After the listing price is established, the property will then be put on the market. The real estate agent working with the property will market it like any other home, using signage, websites, and more to attract a high offer.

-

Approval And Sale: Once an offer is submitted, the real estate agent will negotiate the terms to satisfy both parties. An official notice will be mailed to all heirs of the estate, establishing a 15 day period to object to the property’s sale. If there are no objections, a court date will be scheduled where the sale of the house will be officially executed.

How Long Does Probate Take?

According to Leonard Ang, the CEO of iPropertyManagement, the probate “process can take anywhere from a few months to a year, as there are many different assets and property laws to consider.” On average, however, the process can take as long as two years.

The typical probate process can be affected by the number of heirs, any issues with the execution of the will, and any taxes or debts attached to the property. Additionally, the state and local laws where the property is located could impact the overall timeline. Probate can extend for so long because the various legal proceedings associated with the process take time.

In some cases, probate can take as little as six months, though this is not always the norm. Investors who have worked with probate properties may be aware: but the presence of a will can speed things along greatly. The reason being, a will signals that the property has already been assigned to a specific beneficiary. That heir can then decide how to move forward with the property.

How To Avoid Probate

To avoid probate, homeowners can put all of their assets into a revocable living trust. This is a written document (signed and notarized) that determines who will receive the property when a homeowner dies. To do this, a homeowner must create a trust document and then transfer any assets into said trust. It is not required to make a trust if you own property or other valuable assets, though it can be helpful down the road. While it may seem melancholy, it is not uncommon for individuals to create a living trust (or will) to prepare for the future. You do not need a lawyer to create a trust, though legal help can be invaluable as you navigate the process. When done correctly, a revocable living trust can help homeowners, or more specifically their trustees, avoid probate court after death.

There are other ways to help real estate avoid probate, such as a joint tenancy. A joint tenancy involves adding another property owner to the deed, such as a close family member or other loved one. After you die, the other person named on the deed would become the sole owner of the property. Similarly, a “transfer on death deed” or TOD deed can be used to facilitate a transfer of ownership. To utilize this you would need to name a beneficiary, who would inherit the property upon your passing. During you lifetime, you will remain the sole owner but the property could avoid being stuck in probate after your death.

Another option for helping your real estate avoid probate is to create a life estate deed. This type of deed allows the property to transfer to another named individual after the owner’s death. However, when using a life estate deed you can no longer sell, mortgage, or otherwise change the status of the property without the beneficiary. Keep in mind that there are several methods for avoiding probate, but the right one will vary from situation to situation. These are just a few of many options to consider as you plan for the future.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Probate Investing: How To Buy Probate Real Estate

Real estate investors hoping to find probate deals should take the time to familiarize themselves with how it works. If you want to find probate real estate deals for your investing business, may I recommend the following process:

-

Educate yourself on how it works

-

Get a list of probate properties

-

Create and fulfill a marketing campaign

-

Outsource the entire process

For more information on the process of buying probate real estate, the following section will break down each step and how you should approach a proper probate marketing campaign.

1. Education

If you have made it this far down the article, you have already taken what I believe to be the most important step towards buying probate real estate: educating yourself on the process as a whole. That said, I can’t recommend buying any property that has been deemed a probate until you are confident you know what you are doing. So before you go throwing out offers to every probate property that comes into your field of vision, educate yourself on what’s in store. Only then will you find the entire process to be as lucrative as it has the potential to be.

To expand your knowledge on the probate process, spend some time researching probates in your particular state. A simple Google search will result in a lot of valuable information. There’s no need to buy a book or anything; identify the intricacies that may be unique to your state, and dedicate them to memory. Take note of how probates are filed and how quickly they are filed. The idea is to become so familiar with the process so that you can explain it to someone else that’s less familiar with it. You see, there’s a good chance you will have to explain what probate is to the person you intend to buy your next deal from. And if you can ease their concerns, you stand a better chance at landing the deal.

2. The List

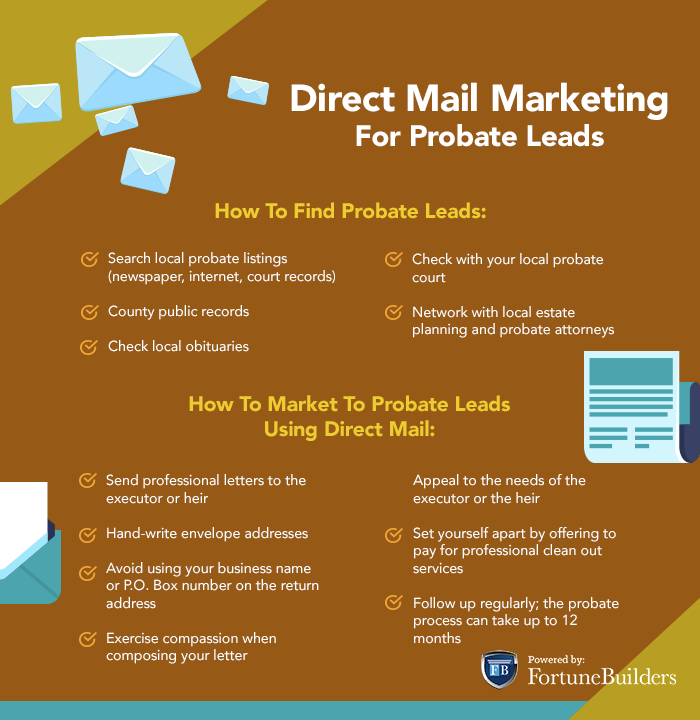

Once you are confident in your knowledge of the process, proceed to procure a probate list. As its name suggests, a probate list is just that: a list of all the homes in probate in a respective area. More often than not, you’ll be able to buy a list, as probate homes are made available to the public. However, some areas don’t sell lists. If you are in an area that doesn’t offer probable lists, or you don’t want to pay for one, all you need to do is take a trip to your local courthouse — again, probates are public record.

I maintain that pulling probate records is unequivocally better, as it’s not only free but also more timely. Lists, on the other hand, while convenient, may contain slightly older probates or even inherited properties (which are slightly different from probates). What’s more, pulling your own list in your neighborhood will most likely result in less competition.

When you arrive at the courthouse, be certain you know what you are looking for. Ask someone where the estate sales or probates are, and they should be able to point you in the right direction. Once you arrive, enter your search criteria into the local database (it could be a computer or even a book) to identify areas and dates you are interested in. The clerk will then take the info you give them and return a pile of information, which you will then proceed to enter into your own spreadsheet. In doing so, you will end up with a list of all the properties in your area that are in probate.

It’s worth noting that all the information isn’t as transparent as many would like to see. Attorneys tend to enter information into the database differently, so it may take some time to get used to knowing what to look for.

By the time you leave the courthouse, you should have a spreadsheet detailing everything — and I mean everything. Not only should you have a list of names, properties, and addresses, but you should also recognize what you have looked at in the courthouse; that way, you will know where to start once you go back.

3. Marketing To Probate Listings

With names and addresses in hand, create a direct mail marketing campaign. The content should be tailor-made for those in control of probate properties and should strike a chord with your specific audience. Some examples of effective direct mail campaigns include postcards, flyers, and even newsletters. Given the nature of your campaign, you may find the most success with more personalized messages such as handwritten letters. The reason being, you want to come across as sincere, not spammy. Depending on the number of owners you are trying to reach out to, taking the time to write a letter (even if the message is the same) can go a long way in reaching potentially motivated sellers.

A key component of any direct mail campaign is reaching out repeatedly. It is well known in the real estate industry that any direct mail campaign’s response rate increases per letter. However, it is important to remember the nature of the situation when contacting probate owners. As I mentioned above, you do not want to come across as spam mail when reaching out. If you send a flyer every other day hoping for a response, your letters are more than likely going to end up in the trash. Find a happy medium and plan out your follow-up attempts every three to five weeks. If you find a motivated seller through your direct mail campaign, you may find yourself with a great deal.

4. Outsource

Now that you have a strong lead generation process, it’s time to automate your hard work. This is where outsourcing comes in. Outsourcing refers to hiring someone outside your company to complete a task. It’s usually done to open up space in your schedule and get more things done. Many real estate investors turn to outsourcing for simple projects to save themselves time. For example, consider hiring a virtual assistant to research public records or compile your mailing lists. Further, you could outsource your finalized direct mail campaign by hiring someone to send your letters on time. While outsourcing does require you to relinquish control over all aspects of a project, it is an invaluable tool for growing your business.

How To Sell Probate Properties

Selling a probate property requires the seller to file a petition to open probate. The seller may also be required to have an inspection and appraisal of the property. Then, the seller should work with a real estate agent who is experienced in marketing probate properties. According to Realtor.com, “Once your offer is accepted by the estate’s representative, that’s not where the negotiations end. From there, the estate attorney has to petition the court to approve the sale. And as you might expect, courts move at their own pace; expect to wait for 30 to 45 days (or even longer) for your day in court when you can claim your home.”

Matt Weidle from Buyer’s Guide states that “even if the representative of the estate decides to accept the highest offer, a confirmation hearing still needs to be held in order for the sale to be legally binding. Scheduling this hearing could take some time. The beneficiaries of the estate need to be informed of the sale in advance of the hearing so that they have the opportunity to provide feedback on the conditions of the transaction”.

This means anyone hoping to sell probate real estate should be prepared for potentially time-consuming court proceedings. Each step, while thorough, must be approached with careful attention to ensure nothing falls through the cracks. Stay on top of deadlines, and make sure you keep up with any documentation necessary for the home’s sale. If you are patient and prepared, you can land a potentially great deal on the home.

Intestate Probate

Intestate is a word used to describe someone who dies without a legal will. If said person were a homeowner, various legal proceedings would follow to determine what happens to the property. This process is called intestate probate, and for the most part, means courts control the selling process of the home in question. Intestate probate is regulated on a state level, though it follows the same basic steps.

After the homeowner passes, the executor of the estate will initiate the sale of the house. This typically involves working with a probate real estate agent or broker. Most executors will choose to work with an experienced agent or team who possess a Certified Probate Real Estate Specialist (CPRES) certification because they will be more familiar with the subsequent court processes. While marketing the property may be similar to a traditional property, the various legal proceedings associated with probate real estate will need to begin once an offer is made.

Summary

If you are interested in probate real estate, know this: it will require time and patience. Probate real estate is not a quick process, and it will require several steps beyond a traditional real estate acquisition. Real estate investors may find it takes weeks to secure strong leads, only for more time to be added once legal proceedings begin. The best way to accommodate this is to account for extra time in your deal analyzer. In time, you will get more comfortable navigating probate real estate, and you may find yourself at the hands of some highly profitable investments.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!