Tax season is the subject of much debate for passive income real estate investors. Different taxes can have several implications for asset performance. Rental income—in particular—is a big one, which begs the question: How is rental income taxed? It is a simple question, but the answer carries a lot of weight for today’s investors. Amid new tax policies, changing news cycles, and common misconceptions regarding rental income taxes, it is easy to get confused. Fortunately, there are several tips you can follow to stay on track during tax time.

One of the biggest mistakes investors and business owners make during tax season is believing in misinformation. It is crucial to understand tax rates, deductions, and how the filing process works to be successful during tax season. Don’t worry—the approach is not as confusing as it sounds. The guide below outlines taxes on rental income and how investors can prepare to file next year.

[ Want to invest in rental properties but don't know where to start? Click here to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience. ]

What Rental Income Is Taxable?

Any rental income you received as a property owner is taxable and should be reported. As a general rule, rental income can include rent payments, security deposits, leasing fees, and any other cash flow generated from a given property.

While most income from a property may come from rent payments, it is important to include any other income-generating sources. For example, if a tenant pays the first and last month’s rent at move-in, both payments will be taxable—even if the lease does not end until the next year. Commercial property owners should pay careful attention to this practice, known as advance rent, as leases tend to last for multiple years.

Security deposits are also relevant for rental income taxes, particularly when applied as last month’s rent. For example, if a property owner and tenant come to this agreement, those funds will need to be reported as rental income for the year they were received. On the other hand, if investors have no intention of using the security deposit for last month’s rent, it will not be taxed the same as rental income.

Another gray area for many real estate investors is tenant-paid expenses, such as water or power. If the tenant pays for any utilities, it is required for the property owner to include these funds in rental income. While utility costs are often eligible tax deductions, landlords must report the initial income generated from tenant payments. To learn more about taxable rental income, be sure to consult a tax professional or information provided by the IRS.

What is the Tax Rate on Rental Income?

The tax rate on rental income will vary depending on whether your rental business is classified as passive or non-passive. In most cases, rental properties will be classified as passive income and taxed accordingly. A non-passive rental business involves property development, construction, operation, management, or leading activities.

A further distinction necessary to determine the rental property income tax rate is whether or not the property owner is an active participant. This refers to the type of management decisions being made. If an investor is the one handling property management responsibilities, they may be considered an active participant. Each of these qualifiers is important because they can also impact the deductions a property owner may be eligible for in addition to determining the tax rate.

How To Calculate Rental Income & Tax Rate

To calculate rental income, investors must first learn to classify what it is. To be clear, rental income is “any payment you receive for the use or occupation of property,” according to the Internal Revenue Service (IRS). That means rental income includes payments received from tenants (obviously), but also the following:

-

Rent paid in advance

-

Partial interest (for co-owners)

-

Portions of the security deposit which were kept

-

Non-obligated tenant expenses, such as a water bill paid by the tenant

-

Services received from tenants instead of rent payments

-

Lease termination fees

-

Lease option tenant payments

Once all of an investor’s rental income has been accounted for, it’s time to calculate its total and tax rate. That said, rental income isn’t taxed the same way as ordinary income. Instead, rental income is treated as qualified business income (QBI) in some cases; that means investors may qualify for deductions upwards of 20.0%. According to LendingHome, ” You’ll need to have a taxable income threshold of $157,500 as a single filer. That threshold gets pushed up to $315,000 if you’re married and filing jointly.”

Investors will then be able to deduct both expenses and depreciation from their rental revenue to come up with their taxable income.

Calculating Tax On Rental Income Example

Here is a basic example of how to calculate rental income tax. First, calculate your annual rental income. If your rental income is $1,000 per month, your annual rental income will be $12,000.

Next, calculate your property basis used for depreciation. This can be calculated by taking the purchase price, adding nondeductible fees, and then subtracting the lot value. For example, if you purchased the property for $100,000 and spent $1,000 in nondeductible fees (such as title insurance and recording fees), and the lot is valued at $21,000, your property basis used for depreciation will be $80,000.

Then, calculate your rental property’s operating expenses and ownership costs. These costs include cleaning, repair, and maintenance costs, property management, leasing and landscaping fees, pest control, property and landlord liability insurance costs, mortgage interest payments, property taxes, tax preparation fee paid to your accountant, travel costs directly related to visiting your out-of-town property. As an example, say the operating expenses and ownership costs total to an annual deductible expense of $8,000.

The next step is to subtract the total deductible expenses ($8,000) from your total annual rental income ($12,000) to find your net income before depreciation ($4,000). Divide the property basis ($80,000) by the number of years determined by your mortgage (27) to find your annual depreciation expense ($2,963). Then, calculate taxable income by subtracting your annual depreciation expense ($2,963) from your net income before depreciation ($4,000). In this example, your taxable income would total $1,037.

The final step is to calculate rental income tax. Take the annual depreciation expense and multiply by 22% (if married filing jointly with income between $80,251 and $171,050). The total would amount to $228.14.

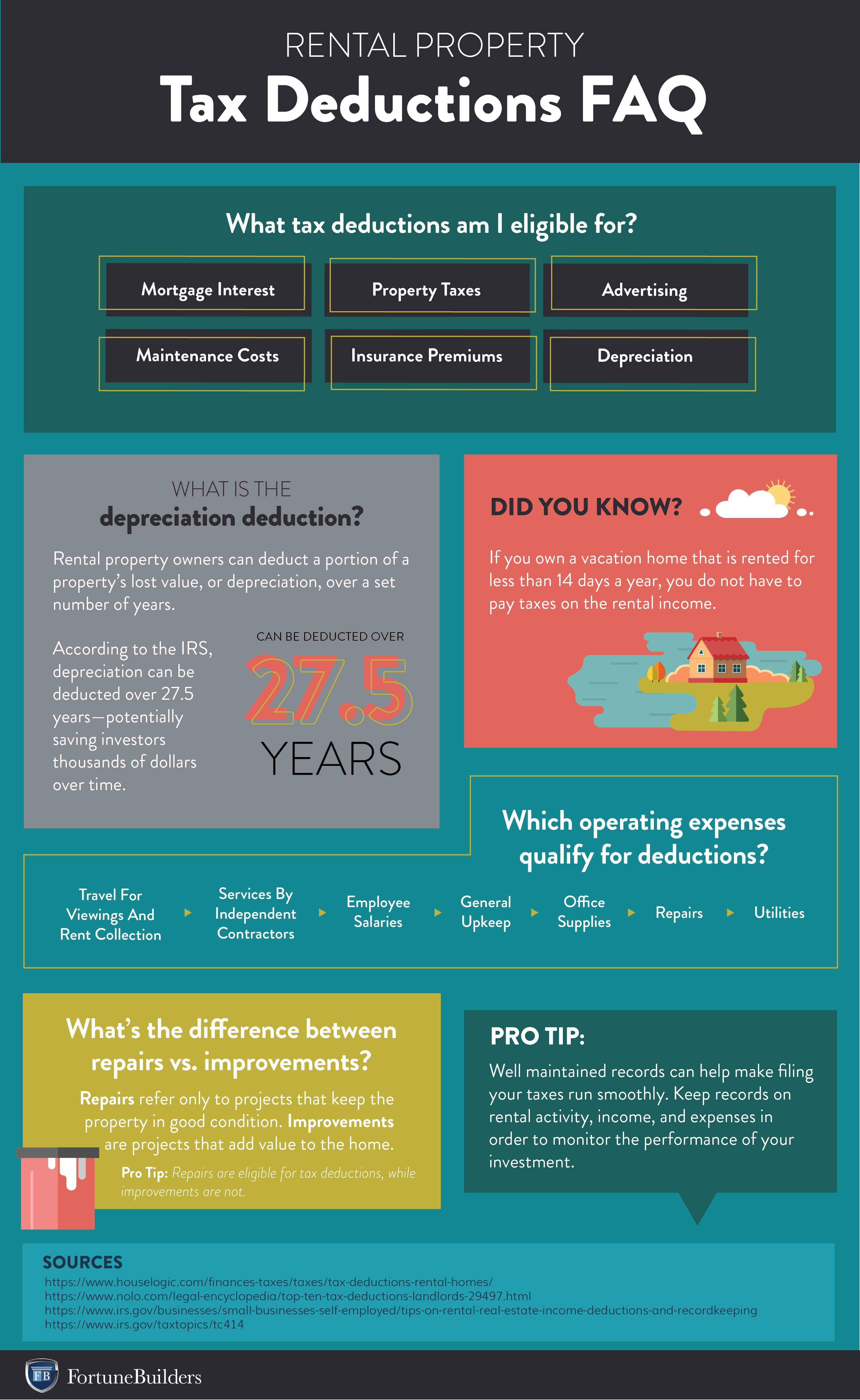

What Deductions are Available on Rental Income?

For investors, rental property profits are often very attractive until tax season comes around. That’s why it is crucial to know which deductions are available to you. Deductions refer to any expenses that can be subtracted from your taxable income. In essence, by reducing your overall taxable income, deductions can decrease the amount you pay in taxes. Dmytro Serheeiv, co-owner at PDFLiner, states that “the rental property allows you to deduct operating and owner expenses, depreciation, capital gains tax deferral, and avoid paying the FICA tax”.

Property owners may be eligible for several deductions, including:

-

Property Depreciation: This is one of the most well known deductions available to real estate investors. Property depreciation refers to lost value as a result of wear and tear, though determining the amount eligible for this deduction can be tricky. To learn more about calculating rental property depreciation, be sure to read this article.

-

Interest: Interest refers to any mortgage or loan interest paid by property owners in a given year. Investors can also deduct the interest on business related credit cards. As a whole, interest is one of the biggest deductions for rental property income tax.

-

Repairs: Repairs are classified as projects that keep the property in “livable” condition and can be deducted from taxable income. For example, costs associated with replacing broken windows, fixing plumbing issues, etc.

-

Employee Costs & Independent Contractors: Property owners can deduct any employee wages from their taxable income. This includes anyone hired for property maintenance, repairs, contract jobs, and more.

-

Insurance: Insurance premiums relating to rental activity can qualify as deductions, such as fire, flood, theft and liability insurance.

-

Travel related to rental activity: Anytime investors (or landlords) travel for rental related activities, such as property viewings or trips to the hardware store, may qualify as a deduction. Pay careful attention to potential deductions for overnight travel, as travel deductions are often closely monitored by the IRS.

-

Home Office Expenses: For the most part, home office expenses can be deducted from an investor’s taxable income. In order for home office expenses to qualify, investors must be able to prove the office is their primary place of business.

-

Legal Services: Any fees paid to attorneys, property managers, accountants, and advisors may be deducted as operating expenses.

The 14-Day (Or 10%) Rule

Before you start adding up your tax obligations, make sure your property is classified as a rental in the eyes of the IRS. There is a requirement in place, called the 14-day rule or the 10 percent rule, that determines whether you have to report the income generated from a rental property.

If you rent a property 14 days or less each year, then you do not have to report that as rental income. In this case, the property is considered a personal residence and not an official rental property. If you rent the property for 15 or more days, the property is considered a rental and income would be subject to the included tax obligations.

Now, the 10 percent obligation comes in when comparing the number of days rented vs. personally used. The IRS states that as long as the property is used as a personal residence for, “10 percent of the total days rented to others at fair market value” it will not be considered a rental property for tax purposes. These stipulations can be confusing, but they can make a huge difference when tax season rolls around.

How to Report Rental Income

In order to report rental income, investors will need to submit Form 1040 along with Schedule E papers. Form 1040 is the basic income tax form that anyone filing federal taxes will need to submit. It requires filers to report on their personal information, such as their social security number and number of dependents. Form 1040 will also have investors report their earnings information.

The Schedule E form is crucial when asking, “how is rental income taxed?” This paper is where total income, expenses, and depreciation for each rental property will be reported. Investors may need to submit multiple Schedule E forms depending on the number of properties they own and operate. However, it is important to know that even if you fill out more than one Schedule E form, only report the “totals” on one paper.

Investors should keep well-maintained expense and income records year-round to ensure the process runs smoothly during tax season. It is good to keep records of rent checks, business receipts, and any paperwork relating to possible deductions. Finally, always double-check the information provided when reporting rental income. It is always a good idea to err on the safe side when filing your paperwork.

Selling Your Rental Property

You should be aware of the tax implications of selling a rental property. Any profits made on the sale of a rental property will be taxed as long-term capital gains. Therefore, the amount of money you will pay will vary depending on how much profits you made. This tax is only applicable if you have owned the property for over a year, which is typical for most rental properties. In addition, be aware of a depreciation recapture tax. While owning a rental property, you may have benefitted from the depreciation of the property, which lowers the taxable income of the rental. However, you will owe taxes on the total amount of depreciation expenses you claimed throughout the ownership of the property.

Using A 1031 Exchange

A 1031 exchange is named after the U.S. Internal Revenue Code from section 1031. This allows an investor to avoid paying capital gains taxes when they sell a property by reinvesting the proceeds into another investment property. There are certain rules that need to be followed while doing this, such as the new property must be equal in value or higher than the property being sold.

You will also need a qualified intermediary in order to execute a 1031 exchange, as they will be in charge of the proceeds of the sale and will be in charge of transferring funds to the seller of the new property. The qualified intermediary simply holds the funds from the initial sale until the new property is bought, in which they then transfer the funds from the previous sale into the new sale. This is necessary to complete a 1031 exchange, and the qualified intermediary cannot have any other relationship with the parties involved in the sales outside of this position. If you follow the correct steps and rules you could save big by using a 1031 exchange for your next real estate investment.

Summary

There is an overwhelming amount of information available on rental property and taxes. That’s why investors must be critical of questions like, “how is rental income taxed” and “is rental income taxable.” By maintaining organized records, researching potential deductions, and familiarizing yourself with the reporting process, you can help ensure tax season runs smoothly for your business. Rental income taxes do not have to be intimidating; they just require foresight and planning on behalf of investors.

Did this article help answer your questions on rental income taxes? Share your thoughts in the comments below:

Start generating passive income with single-family rental properties!

If you're interested in investing in real estate, but don't have the time or experience to start, click the banner below to see JWB Real Estate Capital's full-service solution for a truly stress-free investing experience.

The information presented is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing provided shall constitute financial, tax, legal, or accounting advice or individually tailored investment advice. This information is for educational purposes only.