The Phoenix housing market in Arizona has positioned itself very well to suit investors. In addition to the generous amount of momentum real estate in Phoenix has carried over from the last two years, several positive indicators look likely to act as a tailwind throughout 2022 and well into next year. Activity looks to remain strong, as high appreciation rates have not scared off buyers. Perhaps even more importantly, the local economy appears slightly more insulated from the lingering impact of the pandemic than many of its national counterparts. When unemployment spiked due to the pandemic, the city’s unemployment rate remained well below the national average and has recovered faster than many expected. As a result, it is not hard to imagine the Phoenix housing market leading a national recovery.

Phoenix Real Estate Market 2022 Overview

-

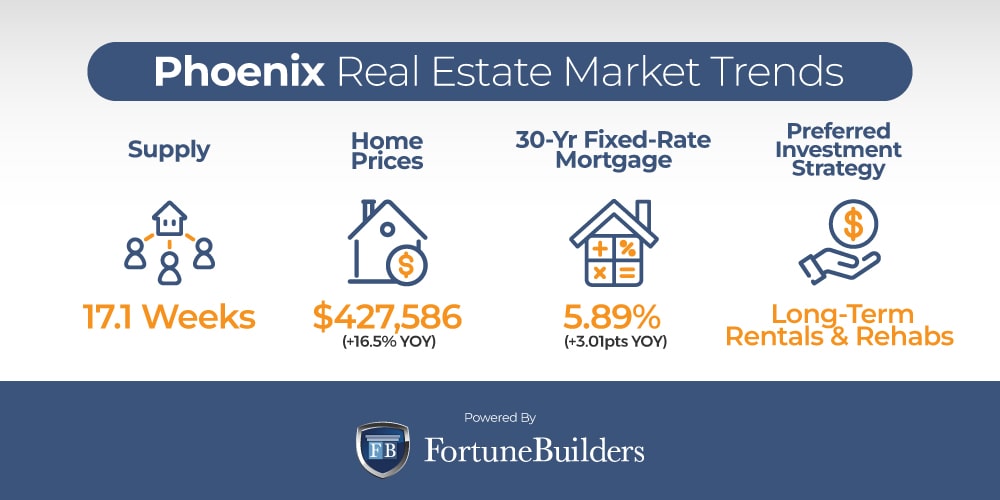

Median Home Value: $427,586

-

Median List Price: $502,333 (+14.2% year over year)

-

1-Year Appreciation Rate: +16.5%

-

Forecasted 1-Year Appreciation Rate: +2.5%

-

Weeks Of Supply: 17.1 (+9.9 year over year)

-

New Listings: 1,845 (-18.8% year over year)

-

Active Listings: 21,622 (+53.0% year over year)

-

Homes Sold: 1,318 (-33.4% year over year)

-

Median Days On Market: 39.0 (+14.3 year over year)

-

Median Rent (1 & 2 Bedroom Units): $1,652 (+3.5% year over year)

-

Price-To-Rent Ratio: 21.56

-

Unemployment Rate: 3.4% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 1,624,569 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $60,914 (latest estimate by the U.S. Census Bureau)

-

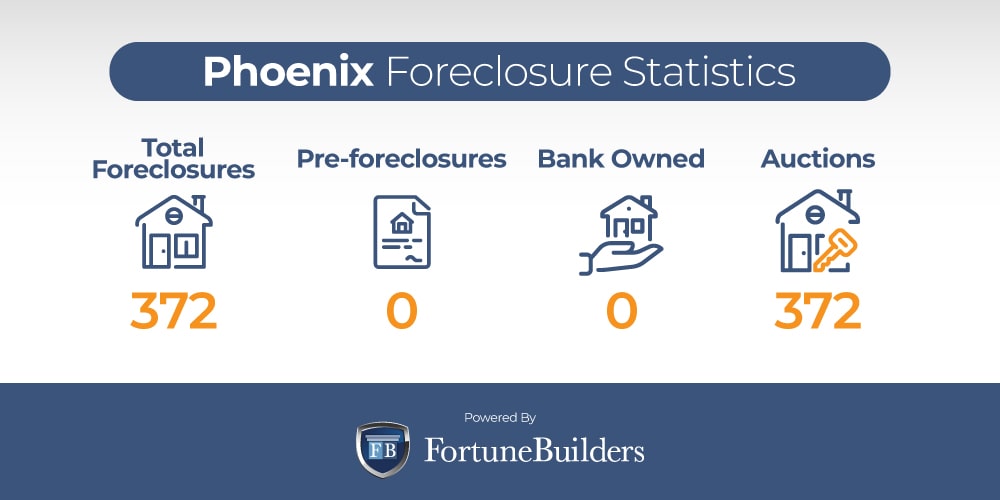

Total Active Foreclosures: 372

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Phoenix Housing Market Trends 2022

Today’s Phoenix housing market trends are a direct result of the local housing sector’s reaction to COVID-19. Everything from home prices to inventory are the result of indicators created in the wake of the pandemic. It is worth noting, however, that the macroeconomic conditions which shaped the last few years are starting to shift. The economy is starting to slow, and inflation is rising at a historic pace. New Phoenix housing market trends are starting to mix with old trends, resulting in an entirely new landscape. Let’s take a look at what real estate investors in Phoenix can expect over the next year:

-

Supply Trends: Not unlike every other major metropolitan area, the Phoenix housing market doesn’t have nearly enough inventory to keep up with demand. If homes continue selling at their current pace real estate in Phoenix will run out of listings in a little over four months. Balanced markets typically have about six months of inventory. Local inventory is on the rise, but it will continue to be insufficient as long as most homeowners refuse to sell and trade their current interest rates for what are most likely higher rates.

-

Home Price Trends: Home prices in Phoenix have risen for the better part of ten years, but June marked the first regression in more than a decade. As mortgage applications declined and activity slowed, many homeowners have had to drop their listing prices to appease buyers. That said, the drop is unique and may not last. The city’s lack of listings will likely continue to drive higher prices in 2022.

-

Interest Rate Trends: Interest rates are increasing to combat inflation. After increasing 3.01 points over the last 12 months, the average commitment rate on a 30-year fixed-rate mortgage is 5.89%, nearly twice as much as rates were at the beginning of the year. The increase has slowed mortgage applications and may contribute to slower rates of appreciation in the future.

-

Investor Trends: Years of appreciation have made it harder for Phoenix real estate investors to find attractive profit margins on rehabs. That said, local foreclosure will help investors find viable homes to flip. Outside of rehabs, however, the Phoenix real estate investing community is turning to long-term rental properties. Relatively low borrowing costs make it easier to increase cash flow from properties in operation.

Phoenix Foreclosures In 2022

According to ATTOM Data Solutions’ latest Foreclosure Market Report, “there were a total of 34,501 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 14 percent from a month ago and up 118 percent from a year ago.”

In August, lenders across the country started the foreclosure process on 23,952 U.S. properties, up 12% from last month and 187% from this time last year.

“Two years after the onset of the COVID-19 pandemic, and after massive government intervention and mortgage industry efforts to prevent defaults, foreclosure starts have almost returned to 2019 levels,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “August foreclosure starts were at 86 percent of the number of foreclosure starts in August 2019, but it’s important to remember that even then, foreclosure activity was relatively low compared to historical averages.”

Foreclosures are up on a national level, and the Arizona real estate market is no exception. The Phoenix housing market, in particular, has a total of 372 foreclosures, all of which are to be sold at auction. Therefore, investors in the Arizona housing market should seek out local auctions if they hope to acquire properties under market value.

Phoenix Median Home Prices 2022

The median home value in the Phoenix real estate market has reached $427,586. At its current valuation, the median home value in Phoenix is higher than the $356,026 mark held by the national average. It is worth pointing out that today’s home values result from years of historical appreciation. For example, the median home value in the Phoenix metro area dropped as low as $133,000 towards the end of 2011 (when the Great Recession was at its worst).

Since then, however, real estate in Phoenix has made up a lot of ground. Thanks to an improving national economy, positive sentiment, and (ironically) a distinct lack of available inventory, real estate has appreciated more than two hundred percent, a feat few cities can even come close to matching. Over the same period, the national average increased just north of one hundred percent.

Phoenix has been one of the country’s fastest appreciating markets in the last two years. Since the beginning of the pandemic, the median home value has increased by 63.2%. The latest increases are due to a distinct lack of availability and increasing demand.

Of particular importance is how the Phoenix housing market is expected to fare moving forward. The pandemic has a lot of people asking the same question: Is Phoenix, AZ, a good place to invest in real estate? The simplest answer is yes; the Phoenix housing market offers plenty of opportunities for investors. Still, the pandemic’s new market environment has shifted how investors view their exit strategies.

Phoenix Housing Market Forecast 2022 – 2023

The Phoenix housing market looks a lot like its national counterparts. In particular, a distinct lack of housing and increasing demand have led to historical appreciation. However, the real estate market is constantly in flux. While it is too early to tell precisely where the Phoenix housing market will be in the distant future, it is possible to forecast what will likely happen over the next year. With that in mind, here is a Phoenix housing market forecast that is most likely to play out:

-

Home Values Will Increase: The median home value in the Phoenix housing market is $427,587, representing an increase of 16.5% over the last 12 months. The increase is largely the result of supply and demand constraints. Moving forward, the same seller’s market is expected to continue. Too many buyers will be competing over too few homes in 2022 and 2023, causing the median home value to increase, perhaps as much as 2.5%.

-

Rents Will Increase: Rent prices in the Phoenix housing market have jumped 3.5% in as little as one year, significantly trailing the 12-month pace of home value appreciation. That said, the increase in home prices has created more renters than usual. As a result, it is safe to assume rents will increase over the next 12 months.

-

Interest Rates Will Increase: In order to combat inflation, the Federal Reserve will increase interest rates; it’s not a question of if, but rather when. The only real question is how high rats will go. Some forecasts are calling for more than five increases, but even if there are fewer higher rates will impact home prices.

-

Rental Properties Will Be More Popular: Higher acquisition costs, lower profit margins, and a lack of availability are turning more Phoenix real estate investors to the rental market. Long-term rental properties look to be the better play in today’s market where monthly rents can help offset higher prices. Additionally, the lack of inventory in the housing market will drive more tenants to rental units, effectively reducing the risk of vacancies.

Should You Invest In The Phoenix Real Estate Market?

Arizona’s capital (and its surrounding metro area) has served local investors well for the better part of a decade, which begs the question: Is Phoenix a good real estate investment? The answer is simple: yes. Investors who know how to navigate today’s real estate landscape will find Phoenix has plenty of opportunities. If for nothing else, the current pandemic has disrupted daily routines and market indicators, which leaves new openings to capitalize on.

The Phoenix real estate market developed a reputation for catering to rehabbers over the last decade. Investors coveted real estate for various reasons, not the least of which included a disproportionately high foreclosure rate and attractive profit margins. The lower home values resulting from the Great Recession were too hard to pass on at the time, and investors cashed in.

However, it is worth noting that the local real estate market has come a long way since then. Coming off of nearly a decade’s worth of appreciation, home prices are much higher today, and the same attractive profit margins investors coveted in 2012 are harder to come by. Real estate prices have tested new highs each month in 2022.

On its way to today’s appreciation rates, the Phoenix housing market spent all of last year leading the national market higher. In fact, Phoenix saw some of the nation’s biggest increases in home prices from 2020 to 2021. According to ATTOM Data Solutions’ Year-End 2021 U.S. Home Sales Report “those with the biggest year-over-year increases in median home prices were Worcester, MA (up 39.6 percent); Barnstable, MA (up 39.2 percent); Boston, MA (up 28.8 percent); Boise, ID (up 27.2 percent) and Phoenix, AZ (up 26 percent).”

Prices have risen so much over the last two years that rehabbing has taken a back seat to what looks like the most attractive exit strategy: rental properties. To be clear, that’s not to say rehabbing isn’t a viable investment strategy anymore, but rather that the impact of the Coronavirus on real estate appears to favor passive income investors.

There are currently three things working on behalf of passive income investors in today’s marketplace, and they are all the result of what has happened in response to the Coronavirus:

-

Interest rates on traditional loans are historically low

-

Years of cash flow can easily justify today’s higher acquisition costs

-

The price-to-rent ratio suggests high home prices will increase rental demand

As of September, the average rate on a 30-year fixed-rate loan was 5.89%, according to Freddie Mac. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to increase monthly cash flow from operations. Perhaps even more importantly, rental property owners will be building equity in a physical asset with someone else’s money. That said, raises have risen, and they are expected to keep rising. The Federal Reserve just increased rates for the first time in three years, and the impact will hit housing prices. Still, even as prices rise, rates are still historically low.

At 21.56, the city’s price-to-rent ratio suggests it may be more affordable to rent than to own. In fact, demand for rental properties is currently very high, as they are not only more affordable, but the presence of the Coronavirus has drastically reduced inventory. Even those who wish to buy a home in today’s market will be forced to rent, which will certainly drive up demand for rental properties. That said, the median numbers we were looking at earlier started to lean in favor of the Phoenix real estate investing community. As demand increases, competition will allow rental property owners to increase prices.

Investors are lucky to have several viable exit strategies at their disposal in the Phoenix housing market. None appear more attractive than building a proper rental property portfolio in the wake of a pandemic. Too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

In addition to an attractive rental market, investors in the Phoenix housing market will appreciate everything else the city has going for it:

-

Affordable Real Estate

-

High Appreciation Rate

-

Growing Rental Market

-

Arizona Has Lower Taxes

Affordable Real Estate

Affordability is relative, which plays to the Phoenix housing market’s favor. If for nothing else, the median home value in Phoenix is actually much higher than the national average. However, real estate in Phoenix looks affordable to many of the people moving from California and Nevada, which has turned into a lot over the course of the pandemic. Therefore, while Phoenix may look expensive relative to Arizona and the national average, it looks affordable to those migrating from western states.

High Appreciation Rate

Few real estate markets have appreciated at a faster rate than Phoenix, and there’s no reason to believe the trend won’t continue. With just over four months of available inventory and plenty of demand, appreciation is the result of mounting competition; so much so, in fact, that home values have increased as much as 16.5% over the last year. In that time, Phoenix was one of the fastest appreciating cities in the country. Subsequently, the fundamentals haven’t changed much. Phoenix is still lacking inventory, and more people are looking to buy with interest rates on the rise. The convergence of these indicators suggests prices will continue to rise for the foreseeable future.

Growing Rental Market

The rapid rate of appreciation in the buyer’s market has inversely impacted the rental market. As values increase, more and more buyers are priced out of the market. In fact, even those who can afford to buy have been relegated to the renter pool because of a lack of inventory. Either way, more buyers haven’t been able to buy, which means demand for rentals has increased. The growing rental market is a direct result of the supply and demand constraints, and there’s nothing to suggest the demand for rentals won’t keep growing.

Arizona Has Lower Taxes

As perhaps one of the most attractive reasons for moving to Phoenix, the entire state of Arizona has attractive tax incentives; that is to say that the state has relatively low rates. When compared to California, where many people are migrating from, Arizona’s taxes look much more reasonable. The lower tax rate has served as an incentive for more people to move to places like Phoenix, and should continue to be a catalyst for positive net migration. In particular, seniors moving to Arizona will enjoy a lot of benefits. The state’s tax code does not tax social security income. Additionally, there is also no gift tax, estate tax, or inheritance tax.

Where To Invest In The Phoenix Housing Market

Not unlike every other city in the country, the Phoenix housing market may be broken down into several neighborhoods. Consequently, some neighborhoods offer the Phoenix real estate investing community more opportunities than others. As a result, those looking to break into the Phoenix real estate market should consider investing in the following neighborhoods:

-

Vistancia

-

Laveen

-

Deer Valley

Vistancia

Located on the Northwest outskirts of Phoenix, Vistancia has miles of open space, which is one of the primary reasons it has garnered so much attention. As the pandemic served as a catalyst for more work-from-home trends and an exodus away from metropolitan areas, Vistancia allowed Phoenix residents to live near a major city without sacrificing open spaces. As a result, the local neighborhood has thrived, and so too may investors. Here’s a look at the underlying indicators investors will come across:

-

Median Sales Price: $670,000 (+16.5% year over year)

-

Number Of Homes Sold: 105 (-31.4% year over year)

-

Median Days On Market: 36 (+13 year over year)

-

Sale-To-List Price: 99.3% (-2.4 pts year over year)

-

Homes Sold Above List Price: 25.7% (+31.8 pts year over year)

Laveen

Laveen is only eight miles from downtown but is still bordered by wide open spaces. This particular neighborhood gives residents the ability to enjoy a hybrid mix of suburban and metropolitan lifestyles. At the same time, Laveen has attracted buyers who have grown to enjoy larger living arrangements and spaces throughout the pandemic. Here’s a quick look at the underlying numbers investors may want to look at:

-

Median Sales Price: $71,995 (+19.8% year over year)

-

Number Of Homes Sold: 306 (-0.65% year over year)

-

Median Days On Market: 31 (+11 year over year)

-

Sale-To-List Price: 100% (-3.9 pts year over year)

-

Homes Sold Above List Price: 35.5% (-36.3 pts year over year)

Deer Valley

In continuing the trend of wide-open spaces, Deer Valley is just a short distance from downtown and home to expansive, wide-open areas. In particular, Deer Valley is developing a reputation for hiking and mountain biking. Speaking of developing, this neighborhood is an up-and-coming area with plenty to see and do. Deer Valley’s rise to prominence has resulted in the following fundamentals;

-

Median Sales Price: $455,000 (+21.2% year over year)

-

Number Of Homes Sold: 650 (-27.5% year over year)

-

Median Days On Market: 25 (+7 year over year)

-

Sale-To-List Price: 99.5% (-3.2 pts year over year)

-

Homes Sold Above List Price: 34.4% (-27.6 pts year over year)

Summary

The Phoenix housing market is perhaps one of the country’s hottest, despite all of the obstacles presented by the current pandemic. In fact, the disruption created in the wake of the Coronavirus looks like it currently represents a new opportunity for long-term investors. While rehabbing remains an attractive exit strategy in Phoenix, building a rental property portfolio looks to be more advantageous at the moment.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/phoenix-az/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

https://www.redfin.com/news/data-center/

https://www.freddiemac.com/pmms/pmms30

https://www.bls.gov/eag/eag.az_phoenix_msa.htm

https://www.census.gov/quickfacts/fact/table/phoenixcityarizona/PST045219

https://www.redfin.com/neighborhood/100403/AZ/Peoria/Vistancia/housing-market

https://www.redfin.com/neighborhood/102104/AZ/Phoenix/Laveen/housing-market

https://www.realtytrac.com/homes/az/maricopa/phoenix/

https://www.redfin.com/neighborhood/98264/AZ/Phoenix/Deer-Valley/housing-market

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.attomdata.com/news/market-trends/foreclosures/attom-august-2022-u-s-foreclosure-market-report/

https://www.attomdata.com/news/market-trends/home-sales-prices/attom-year-end-2021-u-s-home-sales-report/