Key Takeaways

- Foreclosure investing has served as a viable gateway into the world of real estate investing.

- Those that know how to find foreclosure homes may find they are already one step ahead of the competition.

- Buying foreclosed houses is a great exit strategy for beginners to exercise.

Foreclosure investing is a great strategy for new and seasoned real estate entrepreneurs. More importantly, real estate foreclosure investing doesn’t need to be as intimidating as people make it out to be. Despite many misconceptions, it is actually a great way to get started in the industry. Those capable of investing in foreclosed homes successfully may be awarded a new way to diversify their investment portfolio and increase their chances to turn a profit.

The Benefits Of Investing In Foreclosed Homes

When buying a foreclosure investment property, the seller is typically motivated. Therein lies the true benefit of working with distressed properties: motivated sellers. Due, in large part, to the homeowner’s inherent need to sell his or her property as quickly as possible, an investor may leverage their position to facilitate a deal that benefits both parties involved.

The following list represents some of the most common benefits awarded to those that know how to find foreclosure homes:

- Motivated Sellers: Motivated sellers are more inclined to accept an offer because of their particular situation. As a result, they are usually easier to work with. Investors with the owner’s best interests in mind will certainly appreciate extending a helping hand, and there’s no reason not to expect the owner to reciprocate their appreciation.

- Leverage: Investors may leverage their position in a number of different ways. It is entirely possible for resourceful investors to provide unique solutions to the owner’s distressed situation. For example, in return for a discount, investors may offer to help the owner move or even shorten the closing window. Provided everyone is on the same page, there’s no reason the impending solution couldn’t benefit everyone involved.

- Equity Spreads: Buying homes in pre-foreclosure allows buyers to create significantly larger equity spreads. Banks don’t want to take back homes if they don’t have to, which enables buyers to request a significant discount.

- Great Deals: Distressed homeowners selling during the pre-foreclosure process are desperate to get out of their mortgage payment in order to avoid foreclosure. As such, distressed properties typically sell for a discount to facilitate a faster deal.

- Quick Buying Process: If the price is right and the seller is motivated, buying foreclosure properties is typically faster than purchasing an investment property the traditional way.

- Niche Market: The more specific a new investor’s exit strategy is, the better. Focusing on pre-foreclosures could be a smart move for anyone looking to hone their skills. Creating a personalized niche can help you sharpen your marketing strategies to be more effective, as well as build business systems and standardized processes to get these types of deals completed and closed.

Should I Buy A Pre-Foreclosure Home?

Provided the right opportunity presents itself, investors should absolutely consider buying a pre-foreclosure home. Distressed properties have become synonymous with attractive profit margins that aren’t typically seen in non-distressed properties. Investing in pre-foreclosed homes may be one of the best decisions new investors decide to make. It is the distressed nature, after all, that serves as a catalyst for the same benefits investors across the globe have come to covet.

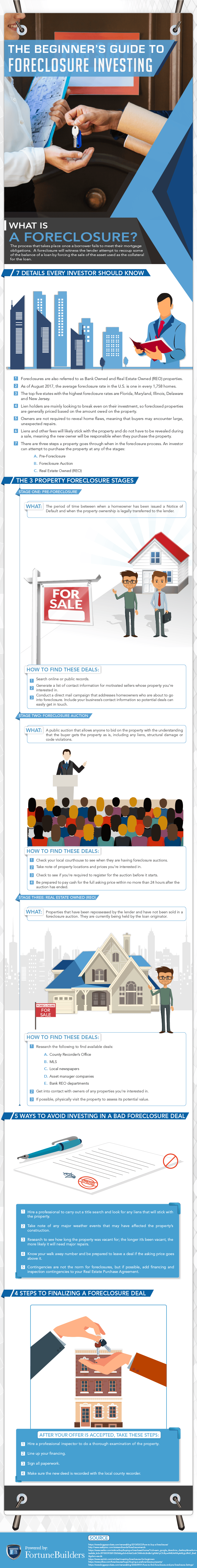

Of course, to partake in the benefits of distressed homes, you need to know exactly what you are getting into. For a better idea of what to expect over the course of a foreclosure deal, please reference the following infographic:

[ Looking for ways to start increasing your monthly cash flow? Register to attend our FREE real estate class to learn how to utilize passive income strategies in your local market! ]

Summary

Foreclosure investing has become synonymous with the preferred exit strategies of new investors. Buying foreclosed houses represents a chance to take advantage of an opportunity few other types of homes can offer. The nature of distressed properties can very easily tip the scales in favor of savvy investors, but I digress. It’s not enough to simply invest in foreclosures; you need to do it correctly. Only then will you be made privy to the benefits of investing in pre-foreclosed homes.

Have you ever been intrigued by the benefits of foreclosure investing? Let us know why you are interested in investing in distressed properties in the comments below.