Jump To Another Year In The Augusta Real Estate Market:

The Augusta real estate market has become the beneficiary of several positive economic indicators. An expected economic recovery, historically low interest rates, and relative affordability culminated in an incredibly attractive housing market. Despite nearly seven consecutive years of appreciation, median home values are still very affordable (at least compared to nearby cities). Not only that, but demand remains persistent in the face of rising prices. As a result, the Augusta real estate investing market has begun to heat up. Real estate in Augusta is currently rewarding investors with attractive price tags and plenty of upside. Very few markets of equal size seem capable of offering the same potential as the Augusta real estate market. However, it is worth noting that the latest rate of appreciation has forced the Augusta real estate investing community to reevaluate its most viable exit strategies.

Augusta Real Estate Market 2021 Overview

-

Median Home Value: $146,066

-

Average Sales Price: $152,625

-

1-Year Appreciation Rate: 20.5%

-

Median Home Value (1-Year Forecast): 11.6%

-

Weeks Of Supply: 9 (-4.2 year over year)

-

New Listings: 203 (+16.7% year over year)

-

Active Listings: 1,733 (-27.9% year over year)

-

Homes Sold: 194 (+4.3% year over year)

-

Median Days On Market: 48.2 (-11 year over year)

-

Median Rent: $1,093 (+10.5% year over year)

-

Price-To-Rent Ratio: 11.13

-

Augusta-Richmond County, GA-SC Unemployment Rate: 3.5% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 202,518 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $42,728 (latest estimate by the U.S. Census Bureau)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Augusta Real Estate Investing

Following the Great Recession, Augusta real estate investing really took off. Though real estate in Augusta took a little longer to bottom out than most cities (around the last quarter of 2013), home values were reminiscent of a coiled spring and ready to appreciate. At the time, home prices looked like a bargain, and rehabbers could take advantage of numerous buying opportunities. For the better part of a decade, rehabbing and real estate “flipping” remained the preferred exit strategy for real estate investors in Augusta.

Home prices in Augusta have increased year-over-year since bottoming out in 2013, which begs the question: Is Augusta, GA a good place to invest in real estate? In a word: yes. Real estate in Augusta looks to be a great investment, as long as those looking to invest listen to what the market is telling them. Unfortunately, the same profit margins investors once found readily available in 2013 are not as easy to find in today’s market, so it’s time to look at a new strategy. That’s not to say rehabbing isn’t still a viable exit strategy in Augusta, but rather that today’s market landscape appears to favor a different approach: long-term exit strategies.

Real estate is cyclical, and rehabbing has enjoyed a run as the country’s most popular exit strategy for several years. Still, the new market landscape created by the pandemic and years of appreciation has shifted fundamental indicators in favor of rental property owners. In particular, here are some of the new Augusta real estate market trends benefiting today’s rental property investors:

-

Interest rates on traditional loans are historically low

-

Lower monthly payments increase monthly cash flow from properties placed in operation

-

Cash flow can easily justify today’s higher acquisition costs

-

Inventory shortages will increase rental demand

As of September, the average rate on a 30-year fixed-rate loan was 3.01%, according to Freddie Mac. While rates are higher than they were at the beginning of the year, they still represent historic lows. Borrowing costs of just over three percent have brought down acquisition costs for those looking to add to their passive income portfolio. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to pad their bottom line.

In any other market, Augusta’s 11.13 price-to-rent ratio would work against rental property owners. If for nothing else, it is unequivocally more affordable to buy than rent in Augusta. However, Augusta’s 1,733 active listings leave much to be desired. There aren’t enough homes to keep pace with the demand created by lower borrowing costs. Even buyers ready and willing to take the leap into homeownership are forced to rent in today’s market, which is great news for rental property owners.

Investors are lucky to have several viable exit strategies at their disposal. Still, none appear more attractive than building a proper rental property portfolio in the wake of new Augusta real estate trends. Simply put, too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

2021 Foreclosure Statistics In Augusta

According to ATTOM Data Solutions’ Midyear 2021 U.S. Foreclosure Market Report, “a total of 65,082 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2021. That figure is down 61 percent from the same time period a year ago and down 78 percent from the same time period two years ago.”

Foreclosures are down across the country, and the entire state of Georgia is no exception. Foreclosure filings in Georgia were down 61.1% from the first half of last year to the first half of this year. That said, the decrease had more to do with government intervention than anything else. To prevent another mortgage crisis, the government prevented lenders from foreclosing on distressed homeowners for the better part of the pandemic. However, government assistance programs are expiring, and the third quarter has seen an uptick in filings.

“As expected, foreclosure activity increased as the government’s foreclosure moratorium expired, but this doesn’t mean we should expect to see a flood of distressed properties coming to market,” said Rick Sharga, Executive Vice President at RealtyTrac, an ATTOM company. “We’ll continue to see foreclosure activity increase over the next three months as loans that were in default before the moratorium re-enter the foreclosure pipeline, and states begin to catch up on months of foreclosure filings that simply haven’t been processed during the pandemic. But it’s likely that foreclosures will remain below normal levels at least through the end of the year.”

The Augusta real estate market will follow the same trends as the rest of its counterparts: foreclosures will increase throughout 2021. Therefore, investors who position themselves well and line up financing now may be able to lend distressed homeowners a hand. At the same time, real estate investors in Augusta can land their next deal for less than today’s average prices.

2021 Median Home Prices In Augusta

For the better part of a decade, the Augusta housing market has seen its median home value increase in conjunction with the national average. Since the end of 2013, prices have maintained an upward momentum. In the last year alone, real estate in Augusta appreciated 20.5%. However, as they currently stand, median home values are now $146,066, according to Zillow’s Home Value Index. For some perspective, the median home value in the U.S. appreciated 17.7% in the last 12 months.

Despite recent appreciation rates, it’s still more affordable to buy a home than rent one long-term. With a price-to-rent ratio of around 11.13, owning a home is considerably cheaper than renting one in most parts of the city. As a result, demand has increased despite a mere nine weeks of available inventory.

Thanks to affordable housing prices, the Augusta real estate market has drawn more interest than busier neighboring cities. That, combined with a strong economy, has made local real estate a commodity. More and more people are looking to buy in the area, which bodes incredibly well for Augusta real estate investors. Not only is it possible to acquire affordable deals, but few comparable cities appear to have better profit margins. So, for the time being, real estate in Augusta looks to be a good investment. It is worth noting, however, that prices will continue to rise for the foreseeable future. Until inventory can keep up with demand, prices will continue their upwards trajectory.

Augusta Real Estate Market: 2020 Summary

-

Median Home Value: $107,745

-

1-Year Appreciation Rate: 4.1%

-

Median Home Value (1-Year Forecast): 3.2%

-

Average Days On Market: 79

-

Median Rent Price: $950

-

Price-To-Rent Ratio: 9.45

-

Percent With Negative Equity: 5.3%

-

Unemployment Rate: 2.9% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 196,939 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $40,545 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 13.77%

-

Foreclosure Rate: 1 in every 2,136 (4.6%)

Augusta Real Estate Investing 2020

Augusta real estate market trends were directly correlated to the lasting impacts of the Coronavirus in 2020. If for nothing else, a new real estate landscape was left in the wake of the pandemic. Following the introduction of COVID-19, local real estate shuttered in the face of fear and uncertainty. The previously hot Augusta real estate market cooled off in a matter of weeks, as activity was nonexistent. Homeowners took listings off the market, buyers refused to tour properties, and loan underwriters weren’t even working.

Fortunately, real estate in Augusta received the catalyst it needed when the Fed announced it would be lowering interest rates. From March through the end of the year, borrowing costs dropped for nine consecutive months. By the end of 2020, the average commitment rate on a 30-year fixed-rate mortgage was approximately 2.65%. Simply put, rates were lower than ever, and more buyers started to participate in the market (despite the lingering effects of the Coronavirus). It is worth noting, however, that inventory levels were incapable of keeping up with the demand created by lower borrowing costs. In a matter of weeks, demand turned into competition, and homeowners increased prices accordingly. The median home value in Augusta increased 13.2% from March (when rates were lowered) through the end of the year.

Few markets were able to keep pace with the gains witnessed in Augusta over the course of 2020, and local investors were forced to alter their exit strategies. Appreciation rates in 2020, in addition to the seven consecutive years of gains leading up to it, made attractive profit margins on flips harder to come by. Real estate in Augusta was getting too expensive for most rehabbers in 2020, which is why many investors turned their sights on rental properties. Thanks primarily to record-low borrowing costs, investors could justify 2020’s high prices. More importantly, however, lower monthly payments meant landlords could increase monthly cash flow from operations. Local indicators leaned heavily in favor of long-term strategies in 2020, and the trends continued into the following year.

Augusta Real Estate Market: 2015 Summary

-

Current Median Home Price: $148,945

-

1-Year Appreciation Rate: 1%

-

Unemployment Rate: 6.6%

-

Population: 197,872

-

Median Household Income: $44,187

Augusta Real Estate Investing 2015

Augusta real estate news was generally positive in 2015. The local housing market, much like the rest of the country, benefited from the expansion of the U.S. economy at the time. However, unlike the rest of the country, a strong government and healthcare presence supported any progressive Augusta real estate trends. For all intents and purposes, real estate in Augusta thrived in the presence of strong job growth, excellent medical institutions, a stable economic base in Fort Gordon, and low living costs. These factors, and more, combined to make the Augusta housing market a prime candidate for growth.

According to Zillow, the median home price in Augusta in 2015 was somewhere in the neighborhood of $89,208. Even with a modest appreciation rate, local real estate was able to outpace the average for all of Georgia. While homes in Augusta were well ahead of state trends, they were relatively far behind the rest of the country. Of course, this means homes in the city were relatively affordable, and Augusta real estate investing benefited as a result.

While Augusta managed to outpace the entire state of Georgia in terms of home values, the rental market remained affordable. Low rental prices contributed to the area’s relatively low cost of living. The cost of living was about 21.3% lower than all of Georgia. It should go without saying, but a low cost of living within an affordable market makes for very attractive homes, especially to first-time buyers and real estate investors.

According to the U.S. Bureau of Labor Statistics, the state of Georgia had an unemployment rate that exceeded the national average, 6.3%, and 5.4%, respectively. Unfortunately, nearly halfway through 2015, Augusta was more a part of the problem than the solution. As of May, the city’s unemployment rate was 6.6%.

Augusta real estate investing focused primarily on distressed property deals. According to RealtyTrac, more than 300 homes were in some state of foreclosure at any given time in 2015. Foreclosures were 53.0% higher than they were last year.

While availability was appreciated, the price in which these properties may be acquired was perhaps more important to the Augusta real estate investing community. According to RealtyTrac, distressed properties sold for an average of $51,211 in the Augusta housing market. That is nearly half the price of non-distressed properties and really helped real estate investors.

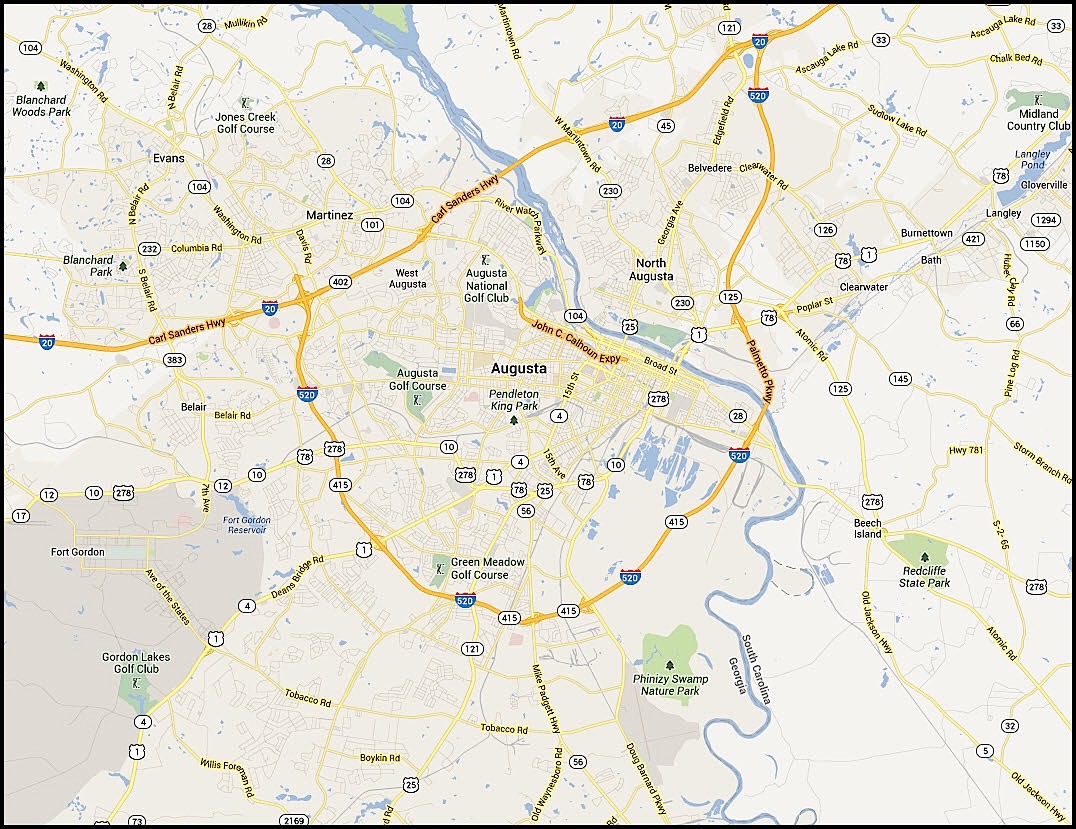

Augusta County Map:

Augusta Real Estate Market Summary

Augusta real estate market trends are largely the result of the Coronavirus. Despite being more than a year into the pandemic, the effects of COVID-19 are still apparent. In particular, real estate in Augusta is testing new highs each month due to increased demand and a lack of inventory. As a result, the Augusta real estate investing community has turned to long-term rental properties to combat higher home prices and lower profit margins on flips. In addition, the new interest rate environment makes rentals the most viable investment strategies in 2021 and should continue to do so for the foreseeable future.

Have you thought about investing in the Augusta real estate market? Does Augusta real estate investing interest you at all? If so, what are you waiting for? We would love to know your thoughts on real estate in Augusta in the comments below:

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/augusta-ga/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

http://www.freddiemac.com/pmms/

https://www.redfin.com/news/data-center/

https://www.meybohm.com/market-insights/augusta-3

https://www.bls.gov/eag/eag.ga_augusta_msa.htm

https://www.census.gov/quickfacts/richmondcountygeorgia

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.attomdata.com/news/market-trends/foreclosures/attom-august-2021-u-s-foreclosure-market-report/

https://www.attomdata.com/news/market-trends/foreclosures/attom-mid-year-2021-u-s-foreclosure-market-report/