The Miami housing market is nothing short of impressive. Located on the Southeast tip of the Florida peninsula, The Magic City has developed a reputation for pristine white-sand beaches, great weather, even better food, and eclectic culture that can’t be found anywhere else. However, it is worth noting that such regional offerings have given way to one of the hottest real estate markets in the country.

The Miami housing market is the primary beneficiary of a highly desirable location for commercial and residential aspirations. Due, in large part, to the lasting impact of the pandemic and the Federal Reserve’s attempt to fight inflation, local inventory has become a commodity for anyone with their finger on the pulse of the local real estate sector. There are many reasons for buyers, sellers, and investors to be interested in the Florida city, which begs the question: Is Miami real estate a good investment? Better yet, is it a good time to buy real estate in Miami?

Foreign and domestic real estate investors, in particular, have found that Florida’s most famous city can serve as a lucrative backdrop for savvy entrepreneurs. However, it’s not enough to invest in Miami real estate without a plan; you need to listen to what the market is saying in the wake of the pandemic and translate each fundamental indicator into a viable action plan.

Let’s take a look at some of the many reasons someone might want to invest in Miami real estate and the various exit strategies that prove most useful to their efforts.

Miami Real Estate Market Overview 2022

-

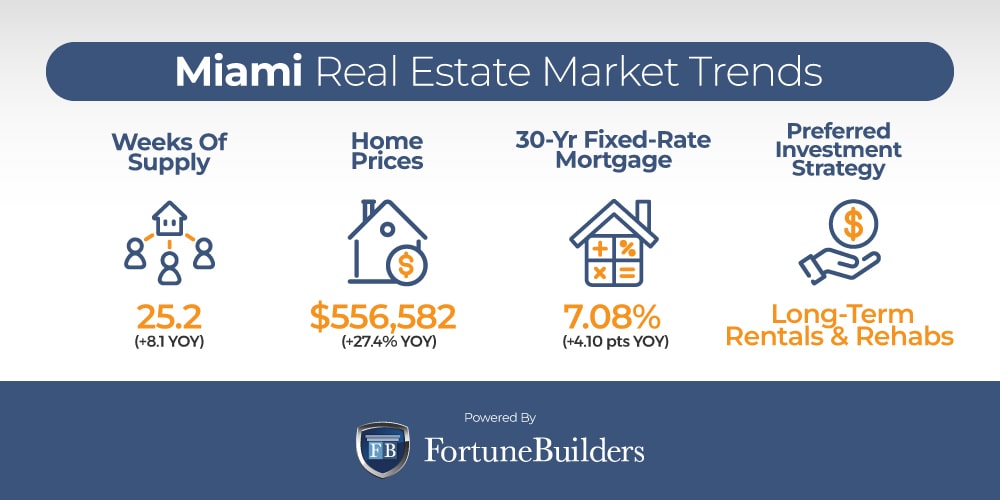

Median Home Value: $556,582

-

Median List Price: $549,667 (+24.9% year over year)

-

1-Year Appreciation Rate: 27.4%

-

Median Home Value (1-Year Forecast): 2.0%

-

Weeks Of Supply: 25.2 (+8.1 year over year)

-

New Listings: 779 (-15.9% year over year)

-

Active Listings: 11,901 (-9.6% year over year)

-

Homes Sold: 566.8 (-26.6% year over year)

-

Median Days On Market: 54 (+0.9 year over year)

-

Median Rent (1 & 2 Bedroom Units: $2,050 (+6.3% year over year)

-

Price-To-Rent Ratio: 22.62

-

Unemployment Rate: 2.3% (latest estimate by the Bureau Of Labor Statistics)

-

Miami-Dade County Population: 2,662,777 (latest estimate by the U.S. Census Bureau)

-

Miami-Dade County Median Household Income: $53,975 (latest estimate by the U.S. Census Bureau)

-

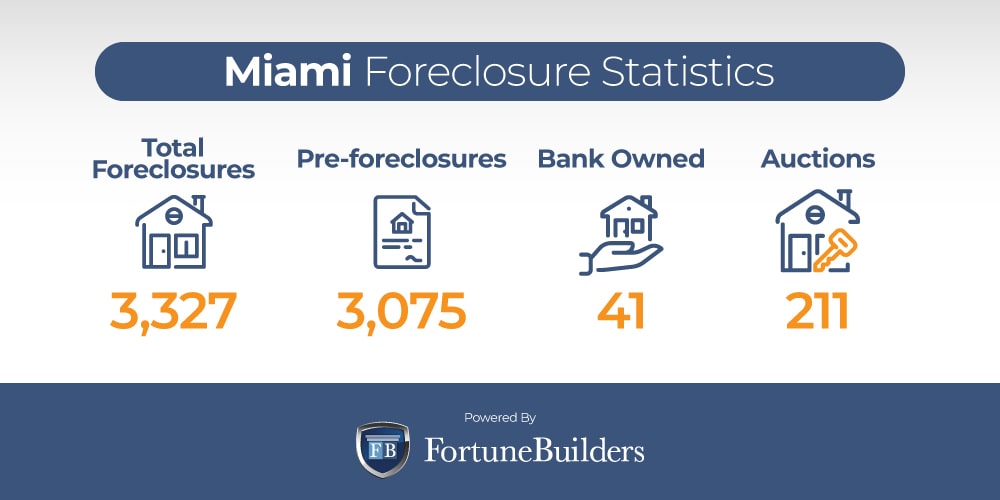

Total Foreclosures: 3,327

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Miami Real Estate Market Predictions 2023

Miami real estate news has kept pace with the national industry. However, in light of the Fed’s decision to tighten on the entire United States housing sector, markets across the country may start to act independently. Higher interest rates and less activity will dictate the way things head over the next 12 months. While it is too early to tell exactly what real estate in Miami will look like for the foreseeable future, it is possible to interpret what the current marketplace has in store. Here is a look at the Miami real estate market trends which are most likely to last into 2023 and beyond:

-

Buying a house in Miami will get more expensive: The median house price in Miami has increased 27.4% over the last year. The increase was directly correlated to supply and demand constraints brought about by the pandemic. That said, there’s nothing to suggest the same indicators won’t drive prices higher over the next 12 months. While demand is certainly declining in the wake of higher mortgage rates and a looming recession, the city’s 25.2 weeks of supply isn’t enough to keep up with pent-up demand. The lack of housing could increase home prices another 2.0% by the end of 2023.

-

Miami foreclosures will increase: Foreclosures in Miami are on the rise. While government aid and moratoriums prevented lenders from starting the foreclosure process on delinquent owners in the past, the assistance is over. The moratoriums are set to expire and owners will be expected to come current on payments. As a result, Miami saw some of the most foreclosure starts in the third quarter of 2022. Moving forward, the trend is expected to continue, as the growing threat of a recession is likely to increase the number of delinquent homeowners in the area. It is too soon to tell how many foreclosure starts the Miami housing market will see in 2023, but it’s safe to assume there will be more.

-

Rental properties will be the most viable investment strategy: Home price appreciation has detracted from profit margins, effectively making rehabs less attractive to investors. However, the same indicators that lowered profit margins on flips made rental properties more attractive. In particular, rents have recently increased at a faster pace than home values in Miami. Perhaps even more importantly, rents should continue to increase as long as home prices do. With more people being relegated to the renter pool, landlords stand to benefit immensely.

Miami Housing Market Trends 2022

The Miami real estate market has largely followed in line with national trends. As the Fed continues to tighten on the housing sector by increasing interest rates, activity wanes and sentiment shifts. Nonetheless, trackable trends have started to take shape in the Miami housing market, not the least of which include:

-

Supply Trends: With approximately 11,901 active listings, the Miami housing market has about 25.2 weeks of available inventory. While Miami has more inventory than most markets, it still doesn’t have enough homes to keep up with demand. That said, mortgage applications are slowing due to higher interest rates, but demand still greatly outweighs supply. Inventory will increase moving forward, but not at a pace that will bring balance to the market. Things are heading in the right direction, but Miami still needs more time to regress to the mean.

-

Home Price Trends: Not unlike every other major metropolitan area in the country, the Miami housing market has seen prices increase for the better part of a decade. The largest increases have taken place in the last three years, since the beginning of the pandemic. That said, we may have seen peak appreciation. While home prices will keep increasing, they most likely won’t return to the pace they saw in the last few years. Sellers are losing their power in the market because of recent Fed decisions, which should slow appreciation in 2023.

-

Interest Rate Trends: The Fed’s decision to fight inflation with higher interest rates has increased the average commitment rate on 30-year fixed-rate loans. At 7.08%, mortgage rates have more than doubled year-to-date and are up 4.10 points year-over-year. In doing so, the price of buying a home has jumped thousands of dollars for today’s buyers. If that wasn’t enough, macroeconomic indicators suggest rates will continue rising to bring down inflation. With higher rates more than likely to hit the Miami hosing market, the cost of acquiring a home will keep rising.

-

Investor Trends: Prior to the pandemic, home flipping was the dominant exit strategy used by Miami real estate investors. However, home price appreciation has all but eliminated profit margins on flips. Homes are simply too expensive to flip. That’s not to say flipping isn’t a viable exit strategy in Miami (it still is), but rather that economic indicators are leaning heavily in favor of long-term strategies like rental properties.

Let’s take a look what today’s Miami housing market trends have meant for nearby counties.

Miami-Dade County Housing Market Trends

Miami-Dade County housing market trends can be broken down as follows:

-

Sale Price: $475,000 (+17.3% year over year)

-

Sale $/Sq. Ft.: $343 (+16.7% year over year)

-

Total Homes Sold: 2,357 (-30.3% year over year)

-

Days On Market: 51 (-4 year over year)

Broward County Housing Market Trends

Broward County housing market trends can be broken down as follows:

-

Sale Price: $394,000 (+12.6% year over year)

-

Sale $/Sq. Ft.: $280 (+17.6% year over year)

-

Total Homes Sold: 2,497 (-26.2% year over year)

-

Days On Market: 46 (-1 year over year)

Palm-Beach County Housing Market Trends

Palm-Beach County housing market trends can be broken down as follows:

-

Sale Price: $432,015 (+20.0% year over year)

-

Sale $/Sq. Ft.: $270 (+17.4% year over year)

-

Total Homes Sold: 2,239 (-26.0% year over year)

-

Days On Market: 50 (+3 year over year)

Miami Foreclosure Statistics 2022

Foreclosures decreased during the pandemic due to government assistance and related moratoriums. The government actually stepped in and prevent foreclosures from taking place to avoid another housing crisis. However, with what looks like the worst of the pandemic now in the rearview mirror, help is expiring and foreclosures are on the rise.

According to a recent ATTOM Data Solutions U.S. Foreclosure Market Report, “there were a total of 92,634 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 3 percent from the previous quarter and 104 percent from a year ago.”

The Florida real estate market is certainly no exception to the latest increase in foreclosures. With one in every 3,099 homes in Florida in some state of distress, Florida has the ninth most foreclosures out of all the states. Not surprisingly, the Miami housing market had a lot to do with the state’s heightened rate of distress. In fact, the Miami hosing market had the fifth highest foreclosure stat rate in the third quarter of 2022.

“Among the 223 metropolitan statistical areas analyzed in the report those that posted the greatest number of foreclosure starts in Q3 2022, included New York, New York (4,621 foreclosure starts); Chicago, Illinois (3,950 foreclosure starts); Los Angeles, California (2,275 foreclosure starts); Philadelphia, Pennsylvania (1,991 foreclosure starts); and Miami, Florida (1,990 foreclosure starts).” according to ATTOM Data Solutions’ Q3 2022 U.S. Foreclosure Market Report

Miami Median House Prices 2022

The median home value in Miami is $556,582; that’s a significant departure from where it was approximately 10 years ago. In 2012, when the market was clawing its way out of the last recession, the median home value in Miami was somewhere in the neighborhood of $201,000. Since then, house prices have increased—on average—by 176.9%. However, it is worth noting that new indicators introduced by the pandemic contributed to some of the biggest gains in that time.

Over the last 12 months, the Miami median house price increased 27.4%. The last year of appreciation was largely the result of more demand, less inventory, and lower interest rates. If for nothing else, the Fed’s decision to lower borrowing costs served as a catalyst for many homebuyers who happened to have larger savings accounts from government stimuli and fewer reasons to spend money over the last year. It didn’t take long, however, for the demand to turn into competition. With 25.2 weeks of supply, Miami is primarily a seller’s market, and homeowners have increased their prices accordingly.

Moving forward, the lack of available listings will only continue to increase home values in Miami, to the tune of about 2.0% over the next 12 months. Prices will increase, but at a slower pace because of higher mortgage rates.

Miami Real Estate Investing 2022

Not unlike the rest of the country, the Miami real estate market appears to have reached a tipping point. Prices are appreciating at such a historical rate that gross flipping profits are growing slim. Simply put, price increases have been eating into profit margins in Miami for quite some time, and investors are starting to take notice.

Prices are growing prohibitively expensive, which begs the question: Is Miami a good place to buy a property? Better yet, is it worth investing in Miami real estate? In a word: yes. While prices have increased exponentially in the wake of the pandemic, new economic indicators have brought about a more promising exit strategy: building a rental property portfolio.

There are four, in particular, the Miami real estate investing community will want to consider buying rental properties in today’s market:

-

Lower borrowing costs

-

Lower risk of vacancies

-

Cash flow potential

-

Historically high home values

The demand for rental properties will increase due to the city’s 22.62 price-to-rent ratio. At its current level, the city’s price-to-rent ratio already suggests renting is more affordable than owning. It is only safe to assume home prices will drive more people towards renting. Subsequently, even prospective buyers will be relegated to the renter pool because of Miami’s insufficient inventory levels. The resulting demand will enable landlords to increase rental rates and mitigate the risk of vacancy simultaneously.

If local demand isn’t enough to convince the Miami real estate investing community to start building a rental property portfolio, today’s interest rates should “move the needle.” According to Freddie Mac, the average commitment rate on a 30-year fixed-rate mortgage eclipsed 7.0% in the third quarter. While rates have more than doubled year to date, they still represent a great buying opportunity. For starters, borrowing costs will help justify today’s higher home values. Additionally, mortgage rates will help Miami real estate investors increase cash flow from properties placed in operation. At the very least, the less rental property owners are obligated to spend on their mortgages each month, the more they can pocket from rent checks.

Investors are lucky to have several viable exit strategies at their disposal in the Miami real estate market. Still, none appear more attractive than building a proper rental property portfolio in the wake of the pandemic. Too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

Summary

The Miami real estate market has been firing on all cylinders for the better part of a decade. Even amid a pandemic, real estate in Miami is nothing short of a hot commodity. Rental properties, in particular, appear to have several tailwinds supporting real estate investors. Low borrowing costs, increasing demand, and a lack of inventory all suggest that long-term buy-and-hold strategies are now just as attractive as their short-term counterparts. In fact, local investors may find that the pandemic has created a market that is more favorable to landlords. As a result, it looks as if the Coronavirus actually created a unique window of opportunity for passive income investors.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/miami-fl/home-values/

https://www.zillow.com/research/data/

https://www.freddiemac.com/pmms

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.realtyhop.com/blog/housing-affordability-index-october-2021/

https://www.redfin.com/news/data-center/

https://www.redfin.com/county/479/FL/Miami-Dade-County/housing-market#trends

https://www.redfin.com/county/442/FL/Broward-County/housing-market

https://www.redfin.com/county/486/FL/Palm-Beach-County/housing-market#trends

https://www.realtytrac.com/homes/fl/miami-dade/miami/

https://www.bls.gov/regions/southeast/fl_miami_msa.htm

https://www.census.gov/quickfacts/fact/table/miamidadecountyflorida/POP060210

https://www.attomdata.com/news/market-trends/foreclosures/attom-september-and-q3-2022-u-s-foreclosure-market-report/

https://www.attomdata.com/news/market-trends/home-sales-prices/attom-q3-2022-u-s-home-sales-report/