Key Takeaways

- Investors and prospective buyers should know what it means to buy a home in the summer.

- Whether you are a first-time buyer, a millennial or an investor, there are tips to help improve your home buying strategy.

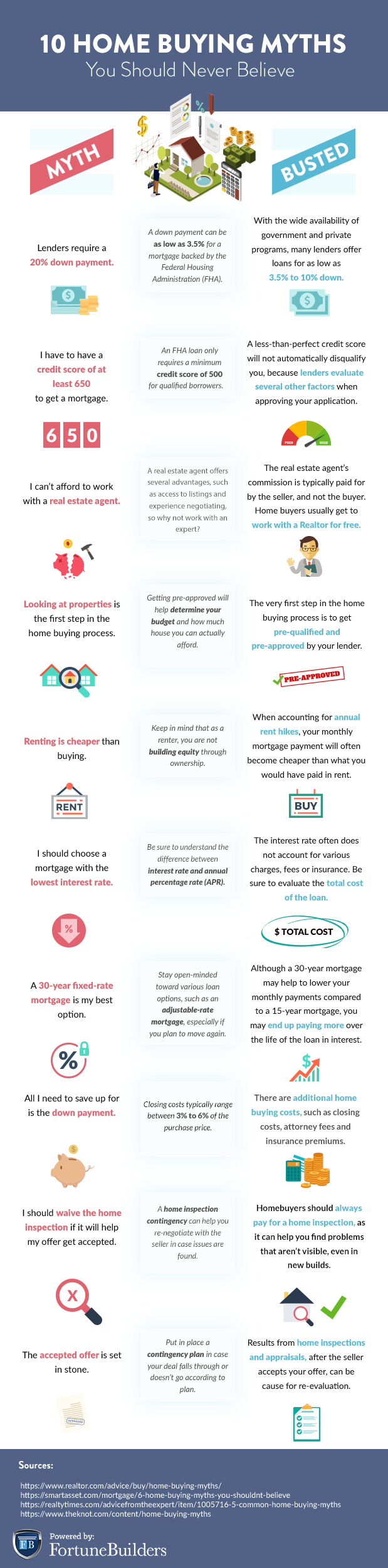

- Be sure to learn about some of the common home buying myths you should never believe.

Summertime is just around the corner, and an already active real estate market is heating up. Now is the perfect time to get equipped with some home buying tips and strategies to help you stand out against what is arguably the most competitive season in the real estate market. Read on to receive first-time home buying tips, tips for millennials, and tips unique to investors. Don’t forget to check out the infographic below, which helps to clear up some of the most common home buying misconceptions that you should know.

Buying A Home In Summer: What Investors And Prospective Buyers Should Know

Although there is some debate on which season marks the busiest home buying market of the year, summer is without a doubt one of the hottest times for purchasing property. Weather represents a prominent factor for buying a home in summer, as sunny weather is more conducive to visiting open houses, as well as a seller’s ability to show off their curb appeal and outdoor living spaces. This may help explain why the greatest number of new listings hit the market in spring, bleeding into summer.

Markedly, prices also tend to drop in the summer months, as sellers who listed their property earlier in the year will start lowering their prices as they become increasingly motivated to sell. One of the best tips for buying a home is provided by Trulia.com, stating that summer homebuyers should try to hold out until August. Prices tend to drop from May through October, and August is when nearly 14 percent of listings get a price cut.

Investors should be aware that they will face plenty of competition from conventional home buyers, many of whom are more willing to come in at list price or higher in order to acquire their dream homes. However, just because a season is very active does not necessarily mean that good deals are not to be had. Summer is the perfect season to ramp up marketing and submitting offers, and to brush up a strategy on identifying the most motivated of sellers.

[ Improve your negotiation skills overnight! Use these 48 PROVEN real estate investing negotiation tricks ]

Things To Know Before Buying A House

- Be selective when choosing your Realtor.

- Consider your long term plans before buying a property.

- Be sure you know how much house you can afford, realistically.

- Practice your negotiation skills to bend the list price to your favor.

- Know that a purchase agreement is a contract.

- Both homebuyers and sellers can protect themselves through real estate contingencies.

The home buying process is quite complex, and inexperienced home buyers can end up with regrets if they do not anticipate what to expect before they begin. Above are some critical things to know before buying a house, which can help elevate your home buying strategy relative to your competitors. According to the National Association of Realtors, 87 percent of homebuyers in 2017 worked with a real estate agent or broker. These professionals are pivotal to the home buying experience, and should be selected with much care. A great Realtor will provide much-needed home buying tips and tricks, such as urging you to consider your long term plans before buying a property. Buying property is a large financial commitment, and even if you are buying for a family of one or two, or to fit a certain lifestyle, home buyers should plan ahead and expect change. At the same time, be sure you know how much you can realistically afford. There is nothing worse than looking at listings without knowing your budget first, and then falling in love with a property that you cannot realistically afford. There are many home buyer calculators available to help you find your home affordability, such as this one from smartasset.com.

Prepare for the next phase of home buying, when you have found the right listing and are ready to put in your offer. Although your real estate agent will assist you through this process, it is always a good idea to practice your negotiation skills. Having a well-researched strategy will provide you with leverage to sway the conditions of the home purchase in your favor, whether it be the purchase price or move-in date. Know that the purchase agreement is a binding contract that can and should be negotiated if any terms are undesirable to you. For example, you can put into place real estate contingencies, such as one for a standard home inspection or mortgage approval, to help protect yourself in case the deal becomes unfavorable.

Home Buying Tips For Millennials

Millennials make up the largest portion of today’s homebuyers, and if you are amongst this group, then perhaps you have received some home buying advice from family and friends. However, chances are, this may have exposed you to some real estate myths or even home buying facts that were once true but are no longer completely correct. Below are some helpful home buying tips for millennials to help expand your knowledge:

- Don’t count yourself out from buying a home: One of the most discouraging yet common home buying myths is making an assumption that you can’t afford to buy a home. Even if buying a home is not possible in the immediate future, you may be surprised that homeownership is not as lofty as a goals as one would think. Most of the time, buying a home is a matter of setting specific financial goals and putting in the energy and focus required to meet those goals.

- Get prequalified: In line with the tip above, sitting down with the lender of your choice to get prequalified can help determine how small or large of a loan to get approved for. Getting prequalified is free and relatively painless, and can be used as just a starting point. A good lender will help you set clear financial goals, whether it be saving up for a down payment, paying down debts or improving your credit score so that you can ready yourself for homeownership sooner than later.

- Know all of the costs upfront: Most of today’s millennials are knowledgeable about the concept of a down payment, but are unfamiliar with other costs of buying a property that can be downright shocking for the unsuspecting. Other price tags to expect include closing costs, moving costs, insurance, HOA fees if applicable, and out-of-pocket costs for maintaining the property.

- Determine what you’re looking for: Buying a home is a long-time commitment, and even if you are currently single, without children, or love your job, you should expect change and plan for the future. Even if a one bedroom bachelor pad may be a great fit right now, you may regret your decision in a few years if you plan to expand your family.

Home Buying Tips For First Time Buyers

Getting ready to buy your first home can be quite intimidating, especially if you are not equipped with enough helpful facts about buying a home. Read the tips below, which can also be used as a checklist, which can help launch your home buying research:

- Check your credit score: Your credit score is one of the important indicators looked at by lenders. Before sitting down with a lender, download a free credit report to find out your score and scrutinize every line item on your report. This will help you find out you credit utilization ratio, and also provides you with the opportunity to find mistakes or old accounts that should have been removed years ago.

- Evaluate your finances: It is imperative that you take a good look at your monthly cash flow, in terms of assets and liabilities, to make sure that you can handle homeownership. Even if you manage to get approved for a mortgage, you will want to make extra sure that you will be able to stay atop of your monthly mortgage payments, as well as other homeownership expenses.

- Save up for a down payment: Many first time home buyers will agree that at the end of the day, saving up enough money for a down payment is one of the difficult aspects of home ownership. Be sure to research financial assistance and grant programs made available, both locally and nationally. Be sure to sit down with mortgage lenders, who can often provide excellent resources to help you reach your financial goals.

- Research current mortgage rates: Many first time home buyers will become laser focused on the purchase price of a home, but in reality, they should also evaluate the total cost of financing a home over the life of the mortgage. Using mortgage rates is a good way to help compare different mortgage products between lenders, and home buyers should also evaluate the annual percentage rate (APR) to help understand how much the loan will end up costing over the life of the term.

Home Buying Tips For Investors

Buying property as an investor can be a completely different experience than buying a home for yourself. This can mean learning how to look at properties strictly through a financial lens, and learning how to divest yourself from emotional attachment. Familiarize yourself with the tips below:

- Determine your funding source: Lenders typically require a larger down payment for investment properties, and will often have stricter lending requirements when compared to a traditional homebuyer. Investors will sometimes sidestep the need to go through a lender by obtaining financing through a private or hard money lender.

- Calculate your operating expenses: Investors should always expect to have to pay monthly expenses that will take away from any income generated by a specific property. This can include mortgage payments, insurance, maintenance, and addressing unexpected issues that may arise. Estimate your operating expenses as accurately as possible, and thus your net operating income, to decide whether or not the investment will be worth it.

- Estimate your rate of return: In addition to calculating your operating expenses, another good indicator for whether or not your investment is worth your while is the rate of return. For every dollar you have invested, what will you gain in return? Because there are other factors to consider, such as appreciation, it is a personal decision to determine what rate of return will be deemed worthwhile.

- Invest in a low-cost property: At the end of the day, a property with minimal expenses will make for a healthy bottom line. Investors should always opt to pay for a professional inspection to get a sense of the quality and condition of the property, and make sure that the property will not prove to be a money pit instead of a cash cow.

Home Buying Myths You Should Never Believe

It is completely normal to ask friends and family for advice and home buying tips, but beware of those who provide you with myths about buying a home. Homebuying is a very personal experience that varies from individual to individual, and should be treated as such. These great variations in home buying experiences can unfortunately lead to misinformation, even from well-meaning relatives. At the end of the day, the best home buying facts can be sourced from experienced professionals in the real estate industry. Enjoy the debunking of some of the most common home buying myths below: