Jump To Another Year In The Indianapolis Real Estate Market:

The Indianapolis real estate market has become the beneficiary of several positive trends spanning the entire state of Indiana. Not unlike every other market in the country, The Crossroads of America has seen home values rise in the wake of three very specific indicators: positive sentiment in the real estate industry, a strong economy, and a distinct lack of available housing. While not unique to the city, these three factors have proven incredibly pivotal in shaping today’s market. However, it is worth noting that while real estate in Indianapolis is firing on all cylinders, it has the added benefit of affordability. Despite nine consecutive years of price growth, Indiana’s capital remains relatively affordable. As a result, the city has seen demand grow in the face of recent appreciation, which bodes well for everyone, especially investors. All things considered, Indianapolis real estate market trends look positive and should only get better over the course of 2021.

Indianapolis Real Estate Market 2021 Overview

-

Median Home Value: $174,876

-

1-Year Appreciation Rate: +13.9%

-

Median Home Value (1-Year Forecast): N/A

-

Median Rent Price: $1,125

-

Price-To-Rent Ratio: 12.95

-

Unemployment Rate: 4.5% (latest estimate by the Bureau Of Labor Statistics)

-

City Population: 876,384 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $47,873 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 14.51%

-

Foreclosure Rate: 1 in every 6,562 (1.5%)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Indianapolis Real Estate Investing

Is Indianapolis a good place to invest in real estate? The answer is simple: yes, under the right circumstances. Investors across the country emphasize marketing for distressed properties, and the Indianapolis real estate investing community is no different. Doing so awards them with the ability to implement a targeted marketing campaign. Perhaps even more importantly, however, are the higher profit margins that have become synonymous with motivated sellers. That said, there’s one type of distressed property local investors should pay special considerations to: auction homes. Representing 51.0% of distressed assets in the Indianapolis real estate market, auction homes are the largest distributor of foreclosed homes in the city. Indianapolis real estate news, as a result, should point investors in the direction of local auctions.

As their names suggest, auction homes are assets that were seized from homeowners who were unable to keep up with mortgage obligations, only to be placed up for auction in an attempt to recoup losses for the loan originator. Auctions award investors the opportunity to secure deals with good profit margins. Therefore, today’s investors should visit local auctions to tip the scales in their favor. Pulling from the largest pool of distressed assets should increase their odds of landing a good deal.

Of course, knowing where to find real estate deals in the Indianapolis housing market is only part of the equation. Once investors secure deals, they need to know what to do with them, which begs the question: Which exit strategies are working the best for local real estate investors?

With a price-to-rent ratio of 12.95, it is currently more affordable to buy a house within city limits than to rent one, which speaks volumes to the local real estate market. Not only are more people financially prepared to become buyers, but it’s actually cheaper to buy than rent. Any other year, Indianapolis’ price-to-rent ratio would work against landlords. However, insufficient inventory levels have prevented even the most serious buyers from buying; there aren’t enough homes to go around. As a result, landlords have found themselves with units which demand a lot of attention. The lack of available inventory suggests landlords will have a lot of demand, which may allow them to increase asking prices over the course of 2021.

In addition to demand, historically low borrowing costs are helping to offset today’s high prices. As of the second quarter, the average 30-year fixed-rate mortgage reported by Freddie Mac was 3.13%. At that rate, borrowing costs have increased over 2021 but still represent low borrowing costs. With rates as low as they are, prospective landlords can simultaneously offset today’s high prices and increase monthly cash flow. In fact, it’s the borrowing costs onset by the pandemic which have shifted Indianapolis real estate market trends in favor of landlords. That’s not to say investors aren’t still flipping homes in Indianapolis, but rather that rental properties benefit from more positive indicators.

2021 Foreclosure Statistics In Indianapolis

According to RealtyTrac, a nationally recognized real estate information company specializing in distressed properties, the Indianapolis real estate market has a relatively high distribution of distressed properties. With approximately one out of every 6,562 homes in some stage of distress (default, auction or bank-owned), the area boasts a foreclosure rate of 1.5%, which remains higher than the 0.8% bar set by the rest of the country.

The following zip codes represent the neighborhoods with the highest foreclosure rates in the city, and may be the best areas to invest in Indianapolis:

-

46218: One in every 2,145 homes is in some state of foreclosure

-

46278: One in every 3,020 homes is in some state of foreclosure

-

46225: One in every 3,469 homes is in some state of foreclosure

-

46222: One in every 3,827 homes is in some state of foreclosure

-

46208: One in every 3,947 homes is in some state of foreclosure

Foreclosures have trended downwards in the Indianapolis real estate market for several years, but the pandemic will most likely reverse recent trends. The financial hardships onset by COVID-19 should increase the number of delinquent homeowners in 2021. Therefore, forward-thinking investors may be able to position themselves to help struggling homeowners. In doing so, the Indianapolis real estate investing community may help many homeowners avoid bankruptcy while landing their next deal.

2021 Median Home Prices In Indianapolis

Indianapolis real estate news is positive on the home value front, which begs an important question: Is now a good time to buy Indianapolis real estate? Today’s median home price in Indianapolis is the direct result of nearly a decade’s worth of appreciation. Since March 2013 — when the market bottomed out during the last recession — local home values have managed to increase an average of 80.8%. At $174,876, today’s median home value has not only returned to pre-recession levels but surpassed them. To put things into perspective, the median home value in the United States increased slightly more over the same period of time, and now sits comfortably at about $272,446.

There is no doubt about it: The national real estate market has outpaced the Indianapolis real estate market over the course of the latest recovery. Indianapolis real estate appreciation wasn’t on the same level as the rest of the country. However, the local real estate industry has made up a lot of ground in as little as one year. In fact, Indianapolis appreciation rates have outpaced those of the national average since February 2020. Since then, real estate in Indianapolis has appreciated 13.9%. The rest of the country, on the other hand, increased a slightly more modest 9.9% in the same time.

Here’s a list of Indianapolis neighborhoods that have appreciated the most since 2000 (according to NeighborhoodScout):

-

E Michigan St / N Oriental St

-

E 25th St / N College Ave

-

N Meridian St / E 25th St

-

Butler U / N Meridian St

-

Central Ave / E 49th St

-

E 38th St / N College Ave

-

Indianapolis / Indiana U-Purdue U-Indianapolis

-

N Meridian St / W 16th St

-

Central Ave / E 20th St

-

E 46th St / N College Ave

The latest bout of increases is likely the result of three prominent indicators: inventory, sentiment, and the local economy. Residents have seen their local economy improve year-over-year, increasing the number of people looking to actively participate in the housing market. With an unemployment rate of 4.5%, the city has a strong foundation to build off of. More people can afford to buy than last year, which has improved market sentiment. Consequently, there isn’t enough available housing to meet the demands of each new buyer. Listed homes are nothing less than a commodity targeted by more competition than in years past. As a result, just about every Indianapolis housing market forecast suggests supply and demand will continue to drive prices higher and higher.

Indianapolis Real Estate Market: 2020 Summary

-

Median Home Value: $148,200

-

1-Year Appreciation Rate: +10.8%

-

Median Home Value (1-Year Forecast): +4.9%

-

Median Rent Price: $1,125

-

Price-To-Rent Ratio: 10.97

-

Average Days On Market: 61

-

Unemployment Rate: 2.6% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 867,125 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $44,709 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 14.51%

-

Foreclosure Rate: 1 in every 2,159 (4.6%)

Indianapolis Real Estate Investing 2020

Indianapolis real estate market trends flirted with each end of the spectrum. At the beginning of the year, real estate in Indianapolis was about as hot as anywhere else. Despite increasing home values, demand persisted, and activity was supporting a healthy industry. That said, the Coronavirus’s impact on the real estate market threatened to put an end to years of progress. In just a few weeks, fear and uncertainty onset by COVID-19 all but halted activity. Bottlenecks formed during the mortgage process as bank employees couldn’t work, homeowners refused to show or list homes, and buyers didn’t want to tour strangers’ homes in person. By the end of the first quarter, it looked as if the housing market was in trouble.

Fortunately, the Fed lowered interest rates enough to spark more activity. In association with pent-up demand and more savings, lower borrowing costs spurred a significant amount of activity across the country, and Indianapolis was no exception. More and more people started to actively participate in the market, but activity quickly turned into demand. Since inventory levels were still low, demand quickly turned into competition, which caused home values to rise 13.1% in 2020.

The rapid rate of appreciation forced the Indianapolis real estate investing community to rethink its most viable exit strategies. In years past, Indianapolis was known for flipping and rehabs. However, price increase ate into profit margins, so much so that investors turned to longer-term strategies. With borrowing costs so low, many investors turned to rental properties. With rates well under three percent at the time, investors could simultaneously offset higher acquisition costs and increase monthly cash flow from properties in service.

Indianapolis Real Estate Market: 2019 Summary

-

Median Home Value: $139,200

-

1-Year Appreciation Rate: 14.4%

-

Median Home Value (1-Year Forecast): 2.5%

-

Median Rent Price: $995

-

Median Days On Market: 63

Indianapolis Real Estate Investing 2019

The Indianapolis real estate market in 2019 took the momentum from the country’s hottest cities and used their success to its advantage. The higher prices of primary metropolitan areas like Chicago and Pittsburgh, for example, drove more potential homebuyers to search for cheaper alternatives. As a result, the real estate industry benefited primarily from three fundamental indicators: low prices, strong economies, and a growing population. For all intents and purposes, the Indianapolis real estate market did really well for itself in 2019.

In as little as one year (December 2017 to December 2018), the median home value appreciated by 14.4%, which was nearly twice as much as the national average. Thanks to said appreciation and particularly favorable market conditions in the area, Indianapolis’s median home value was $139,200 about halfway through the year.

In 2019, it was considered a relatively cheap city to buy-in. As a result, demand increased in conjunction with prospective buyers looking to trade the high prices of Chicago and Pittsburgh for the more modestly priced “Indy.” Even after the previous year’s impressive appreciation rate, people still chose Indianapolis, which worked out well for investors.

Indianapolis Real Estate Market: 2016 Summary

-

Median Home Price: $146,900

-

1-Year Appreciation Rate: 5.5%

-

3-Year Appreciation Rate: 20.4%

-

Unemployment Rate: 5.0%

-

1-Year Job Growth Rate: 1.6%

-

Population: 852,866

-

Median Household Income: $39,015

Indianapolis Real Estate Investing 2016

While rising home prices were polarizing in different parts of the country, the Indianapolis housing market remained on course with the national average in 2016. The first quarter of 2016 saw home prices dip just below the national average, settling at $146,900, while appreciation rates kept pace with the rest of the country.

Indianapolis real estate trends saw homeowners seeking long-term investments do well in 2016. The one-year appreciation rate was 5.5 %, compared to the national average of 6.1%, while the three-year appreciation rate was 20.4% compared to 22.6%. Price appreciation and principle payments boosted total equity growth for the Indianapolis real estate market, and the trend is continuing.

The one major advantage for homeowners and renters was the city’s affordability. As one of the more affordable housing markets in the country, homeowners paid 6.8% of their income on monthly mortgage payments during the first quarter, compared to the national average of 14.5%. That number was actually lower than the city’s historical average of 9.0%, which was more than two times less than the national average at the time.

Indianapolis Real Estate Market: 2014 Summary

-

Current Median Home Price: $148,700

-

1-Year Appreciation Rate: 6.4%

-

3-Year Appreciation Rate: 16.9%

-

Unemployment Rate: 5.6%

-

1-Year Job Growth Rate: 3.0%

-

Population: 852,866

-

Percent Of Underwater Homes: 5.4%

-

Median Income: $51,087

-

Average Days On Market: 75

Indianapolis Real Estate Investing 2014

Indianapolis real estate news in 2014 was positive. At the time, there were really good things happening across the city: resale inventory tightened, and prices rose in the existing home market. Perhaps the only thing missing in the region was sustained economic growth to provide the local housing market with the fuel it needed to thrive.

The Indianapolis housing market’s median home price was $148,700. While prices in the region were up from the previous year, they were considerably below the national average ($212,267). Subsequently, like most markets in the U.S., homes were starting to appreciate at a slower rate. In 2014, homes in the area appreciated 6.4% over the course of a year. However, in the previous three years, Indianapolis homes appreciated by as much as 16.9%. These gains helped remove the city from the post-recession price weakness it had been experiencing.

Historically high appreciation rates boosted equity in a relatively short period of time. Moreover, Indianapolis real estate investing benefited from the increases. Indianapolis real estate trends began to take shape and can be seen impacting the city for years. Unemployment was better than the national average, and employment growth was strong compared to many markets across the country.

Indianapolis Housing Statistics In 2014:

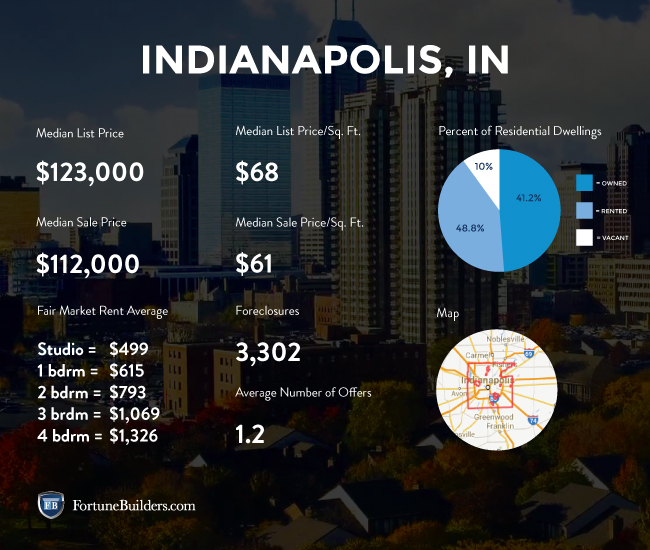

Indianapolis County Map:

Have you thought about investing in the Indianapolis real estate market? Does Indianapolis real estate investing interest you in the slightest? If so, what are you waiting for? We would love to know your thoughts on real estate in Indianapolis in the comments below:

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!