The Nashville housing market has made incredible strides since the start of the pandemic. In fact, Music City is firing on all cylinders and pacing the country’s latest boom. Nearly every indicator is better off today than it was a short time ago, and there’s nothing to suggest the positive trends won’t continue. The city’s unique combination of rising prices and rabid demand promotes a healthy market most cities would be envious of. It is worth noting, however, that real estate in Nashville owes its recent bout of success to one indicator more than any other: millennial participation. Buyers in their mid-30s have flocked to the Nashville real estate market in order to secure affordable housing, effectively propping up the city’s real estate industry. As a result, real estate is in a good place in Nashville.

Nashville Real Estate Market 2022 Overview

-

Median Home Value: $455,304

-

Median List Price: $561,967 (+24.9% year over year)

-

1-Year Appreciation Rate: +30.7%

-

Median Home Value (1-Year Forecast): +11.8%

-

Weeks Of Supply: 8.0 (+2.0 year over year)

-

New Listings: 1,167.8 (+21.9% year over year)

-

Active Listings: 6,698 (+24.6% year over year)

-

Homes Sold: 900.9 (+0.1% year over year)

-

Median Days On Market: 20.5 (+2.5 year over year)

-

Median Rent: $1,496 (+15.6% year over year)

-

Price-To-Rent Ratio: 25.36

-

Unemployment Rate: 2.8% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 678,851 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $62,087 (latest estimate by the U.S. Census Bureau)

-

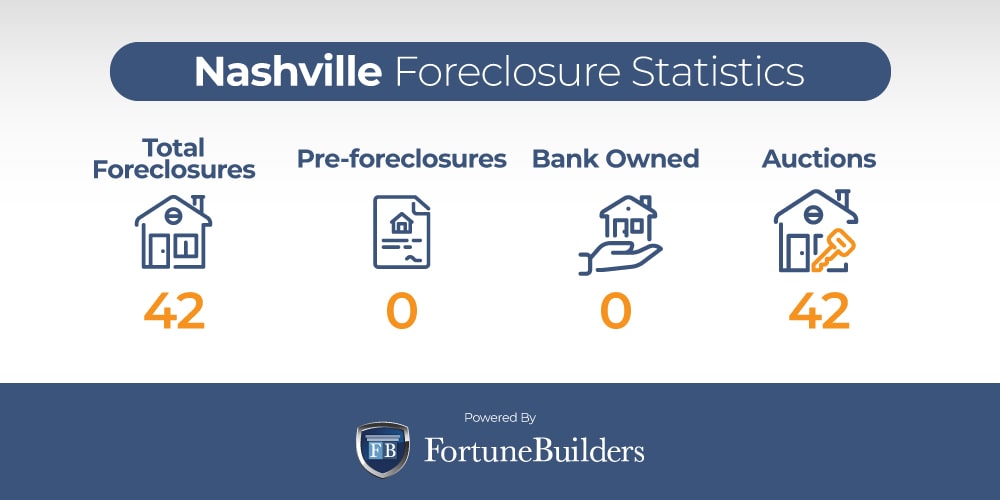

Total Active Foreclosures: 42

[ It's time to escape the rat race. Register to attend a free one-day investing event, where you'll learn how one secret strategy can help you create cash flow from the stock market. ]

Nashville Housing Market Trends 2022

For the better part of two years, most Nashville housing market trends were largely the result of the pandemic. Most notably, supply and demand became severely imbalanced. As more buyers took to the streets to take advantage of relatively low interest rates, sellers remained on the sidelines so they wouldn’t have to turn around and buy in an overpriced market. Prices increased almost exponentially as supply couldn’t keep up with demand.

While supply still remains an issue, Nashville housing market trends are starting to be shaped by different indicators. In particular, demand is dropping in the wake of inflation and higher borrowing costs. The change in dynamic has resulted in the following Nashville housing market trends:

-

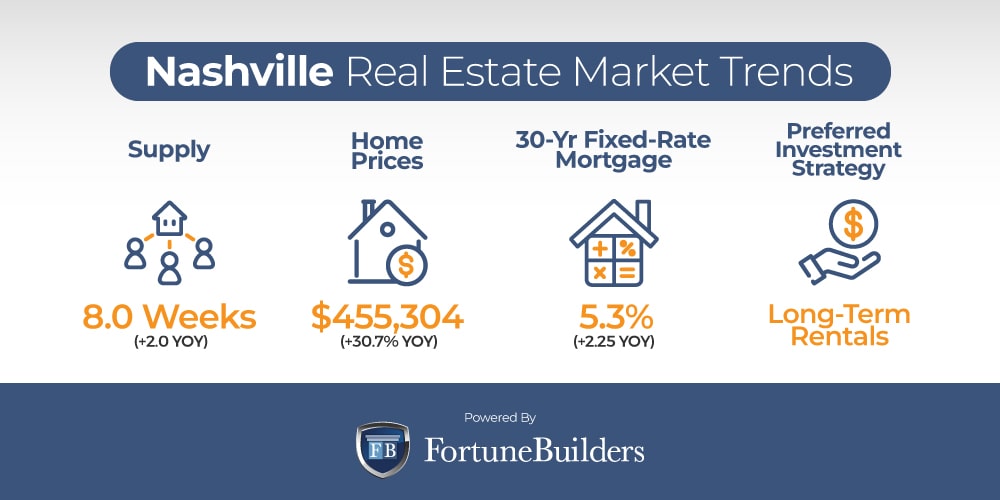

Supply Trends: At the moment, the Nashville housing market has about two months of inventory available; that means listings will last about eight weeks if homes continue to sell at their current pace. While inventory levels are up about two weeks year over year, they are nowhere near where a balanced market should be. Much like everywhere else, Nashville doesn’t have enough inventory to keep up with demand. The latest increase in interest rates has dropped mortgage applications, but demand still greatly outweighs supply, and the trend is expected to continue for the foreseeable future.

-

Home Price Trends: House prices in Tennessee have increased upwards of 27.1% over the last 12 months, and the Nashville housing market is a large reason why prices appreciated so much. Due to supply and demand constraints, the average home price in Nashville has increased 30.7% over the Appreciationppreciation rates will temper because of higher interest rates and a slowing economy, but home values are expected to continue increasing. Though not as fast as previous years, experts expect prices to increase an additional 11.8% over the next 12 months.

-

Interest Rate Trends: The consumer price index, a broad measure of everyday goods and services related to the cost of living, just rose 9.1% year over year. The increase represents the fastest rate of inflation the U.S. economy has seen since 1981. As a result, it is all but certain interest rates will continue to rise to combat inflation. The rate on a 30-year fixed-rate mortgage has already increased 2.40 points over the last year, and now sits around 5.3%. Moreover, the high rate of inflation suggests rates will rise in the very near future, further increasing the cost of homeownership in the Nashville housing market.

-

Investor Trends: Over the last few years, low borrowing costs and high home prices have pushed the Nashville real estate investing community towards long-term rental properties. If for nothing else, borrowing costs were able to help offset high acquisition costs and home prices reduced profit margins on quick flips. Low interest rates actually helped landlords increase monthly cash flow.

Nashville Median Home Prices 2022

The Nashville median home price is now somewhere in the neighborhood of $455,304. On its way to today’s price point, the median home value in Nashville has touched every end of the spectrum over the last decade. As recently as ten years ago, average Nashville home prices were as low as $165,000. At the time, the market was bottoming out during The Great Recession; that means local home values have appreciated 175.9% in just 10 year’s time.

It is worth pointing out that the fastest rate of appreciation in the last decade has taken place during the pandemic. Since the first quarter of 2020, when COVID-19 was officially declared a global emergency, Nashville home prices have increased an average of 54.8%. In the last year alone, the average house in Nashville has appreciated about 30.7%.

Local home prices have increased at a historic pace in the wake of COVID-19. As the Fed dropped interest rates in 2020 to spark activity in the housing market, buyers came out in droves. However, inventory wasn’t anywhere near ready to keep up with demand; the resulting competition has driven up prices in the Nashville real estate market ever since.

The same macroeconomics that have driven prices up for more than two years are still in play, which means local home values are expected to continue rising. Over the next 12 months, Nashville home prices may increase another 11.8%. Appreciation will continue, but at a slower rate than in the past. The latest increase in interest rates has already taken a toll on mortgage applications and competition has decreased, but Nashville is still a seller’s market.

Nashville Foreclosure Statistics 2022

On a national level, there were a total of 30,881 U.S. properties with foreclosure filings as recently as May; that means one in every 4,549 housing units had a foreclosure filing in the month. The national foreclosure rate was up a modest 1.0% from the previous month at the time. Year over year, however, foreclosure filings increased 185.0%. The trend will likely continue in today’s inflationary environment.

“While there’s some volatility in the monthly numbers, foreclosure activity overall is continuing its slow, steady climb back to normal after two years of government intervention led to historically low levels of defaults,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “But with inflation now at a 41-year high, and runaway prices on necessities like food and gasoline, we may see foreclosure activity ramp up a little faster than most forecasts suggest.”

The Tennessee housing market is no exception to the rule. In May, one in every 11,187 homes entered into the foreclosure process across the state. Today, there are about 44 foreclosures in Nashville, TN. Moving forward, foreclosures are expected to rise. In addition to government assistance expiring, inflationary pressure will lower the value of the dollar and most likely make it more difficult for more homeowners in the Nashville real estate market to keep up with mortgage obligations.

Nashville Real Estate Market Forecast

The most recent Nashville real estate market forecast for 2022 is the first time forward-looking trends have deviated from their most recent trajectory. Consequently, recent forecasts were all the direct result of the pandemic. Today’s Nashville real estate market forecast, however, is directly correlated to the new macroeconomic environment created by how the U.S. economy handled the pandemic. In other words, the Nashville housing market will now need to navigate an inflationary economy with higher interest rates, lower demand, and persistently insufficient inventory levels. Things look different in Nashville, which begs the question: What do forecasts look like moving forward?

-

Home Values Will Rise: In the past, home values increased rapidly because demand greatly outweighed supply. Today, the same indicators are still at play. There aren’t enough listings to keep up with the competition. However, rising interest rates and a lack of sellers have already decreased mortgage applications. As a result, competition still persists, but not at the same level as in the past. Looking forward, prices will keep rising, but at a slower pace.

-

Rents Will Rise: The Nashville housing market only has about two months of inventory and housing prices are prohibitively expensive. Consequently, demand for rentals will increase over the course of 2022 and into next year. Rents have already increased 15.6% over the last year, and today’s indicators suggest rents will increase at a faster pace over the next 12 months.

-

Interest Rates Will Rise: The latest consumer price index report showed the largest increase in inflation the United States has seen since 1981. In order to combat inflation and weaken the dollar, the Fed is expected to increase interest rates even further. While the number of points interest rates will increase is still up for debate, it’s only a matter of time until the move is made. As a result, the cost of owning a home in the Nashville real estate market will increasing accordingly.

Should You Invest In The Nashville Housing Market?

The Nashville housing market has been one of the hottest in the country for the better part of 10 years. The unique combination of affordable homes and high demand made real estate in Nashville a desirable commodity. In that time, the Nashville real estate investing community enjoyed a lucrative run flipping houses with high profit margins. In recent history, however, appreciation has eaten away at profit margins. The cost of buying a home has made it harder to flip real estate in Nashville, which begs the question: Is Nashville good for investment property?

While higher home prices have made it more difficult to flip real estate in Nashville, rehabs remain a popular exit strategy. Nonetheless, the new real estate market created in the wake of the pandemic actually looks more attractive to long-term investors who buy rental properties. If for nothing else, passive income investors are the beneficiaries of several positive market indicators:

-

While inflation may be peaking, interest rates are still relatively low on traditional mortgages

-

Lower borrowing costs increase monthly cash flow from operations

-

Years of cash flow can easily justify today’s higher acquisition costs

-

With a price-to-rent ratio of 25.36, it is more affordable to rent than own in the Nashville housing market

Building a rental property portfolio, or adding to an existing one, looks more attractive to Nashville real estate investors than ever before. Despite years of appreciation, borrowing costs are still attractive. The average rate on a 30-year fixed-rate loan was 5.3% halfway through the year, according to Freddie Mac. While rates have already increased year-to-date, they are still historically low and significantly reduce the cost basis of buying a home in Nashville.

In addition to helping with acquisition costs, low mortgage rates can also increase cash flow from properties placed in operation. rising increasing 15.6% in the last year, and expected to jump even higher over the course of 2022, it is entirely possible to pay off a mortgage with someone else’s money.

In addition to low mortgage rates and cash flow potential, Nashville has a price-to-rent ratio that leans heavily in favor of investors. At 25.36, the price-to-rent ratio in the Nashville housing market suggests it is more affordable to rent than own. Consequently, fewer people can afford to buy, driving up rental demand and the amount landlords can charge.

The Nashville real estate investing community is lucky to have several viable exit strategies at its disposal. Still, none appears more attractive than building a proper rental property portfolio at the moment. In addition to what was already discussed, local investors may also benefit from:

-

Population Growth: The Nashville housing market has seen a significant influx in positive net migration. Over the last 10 years, Music City’s population has increased 20%, with much of the growth coming from the pandemic. If for nothing else, work-from-home trends enabled more people to move to the Nashville real estate market.

-

Job Market: According to an analysis from The Wall Street Journal and Moody’s Analytics, the Nashville housing market is home to the second hottest job market in the country, trailing only the Austin real estate market.

-

Attractive Renter’s Market: With a price-to-rent ratio of 25.36, it is considerably more affordable to rent a home in the Nashville housing market than to rent one. As a result, more residents are turning to a rental market that is just as stressed as the housing market itself. Demand is increasing exponentially, and landlords will be able to increase rents for the foreseeable future.

Summary

The Nashville housing market isn’t short of opportunities for local real estate investors. While flipping strategies have helped prop up the real estate market for the better part of a decade, today’s prices may actually promote an alternative strategy: buy and hold rental properties. Nashville real estate investing may look more attractive to those intent on buying and holding, as today’s rental prices may actually offset the historically high home values. Moving forward, the inflationary economy will only work more in favor of landlords, which is great for anyone looking to invest in Nashville real estate.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/nashville-tn/home-values/

https://www.zillow.com/tn/home-values/

https://www.zillow.com/research/data/

https://www.freddiemac.com/pmms

https://www.redfin.com/news/data-center/

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.bls.gov/eag/eag.tn_nashville_msa.htm

https://www.census.gov/quickfacts/fact/table/nashville

https://www.realtytrac.com/foreclosures/nashville-tn/

https://www.attomdata.com/news/market-trends/foreclosures/attom-may-2022-u-s-foreclosure-market-report/

https://www.sofi.com/learn/content/foreclosure-rates-for-50-states/

https://www.wkrn.com/special-reports/in-migration-to-music-city-on-the-rise/