Jump To Another Year For The Boston Real Estate Market:

The Boston real estate market continues to operate at breakneck speeds. Much like everywhere else, real estate in Boston, Massachusetts, has increased in value for the better part of a year. Over the first half of 2021, in fact, the median home value in Boston has tested new highs each month, which begs the question: How is the real estate market in Boston? While the local housing sector has certainly been put to the test in the last year, real estate in Boston is doing well.

Improving consumer sentiment, rising employment levels, and historically low interest rates are paving the way for real estate to thrive in Boston over the course of 2021, and real estate investors who listen to market trends could find themselves in a good position to take advantage of long-term secular trends.

The following will not only provide insight into the current state of the Boston real estate market but it is also intended to offer an in-depth perspective on the area’s most viable investment strategies.

Boston Real Estate Market 2021 Overview

-

Median Home Value: $675,921

-

Median List Price: $694,333

-

1-Year Appreciation Rate: +4.3%

-

Median Home Value (1-Year Forecast): +10.5%

-

Weeks Of Supply: 7.3

-

New Listings: +52.5% year over year

-

Active Listings: -10.37% year over year

-

Homes Sold: +39.5% year over year

-

Median Days On Market (Boston Metro): 18.20 (-1.90 year over year)

-

Median Rent: $2,390

-

Rental Vacancy Rate: 6.9%

-

Price-To-Rent Ratio: 23.56

-

Delinquency Rate: 4.1%

-

Boston-Cambridge-Quincy Unemployment Rate: 5.9% (latest estimate by the Bureau Of Labor Statistics)

-

Boston Metro Population: 692,600 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $71,115 (latest estimate by the U.S. Census Bureau)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Boston Real Estate Investing 2021

There is no doubt about it: The pandemic has had a drastic impact on real estate investors across the country. In one year, markets experienced one of the worst setbacks imaginable, only to rebound stronger than ever. Even in times of distress, investors across the country appear to have weathered the storm and come out on the other side even stronger, at least according to Attom Data Solutions’ latest Home Sales Report.

According to the first-quarter 2021 U.S. Home Sales Report, “the typical first-quarter 2021 home sale in the United States generated a profit of $70,050. That was down from $75,750 in the fourth quarter of 2020 but still up 26 percent from $55,750 in the first quarter of 2020.”

“The typical $70,050 home-sale profit represented a 34.2 percent return on investment compared to the original purchase price – down from 37.1 percent in the fourth quarter of 2020 but still higher than the 30.8 percent level recorded a year ago.”

However, it should be noted that the Boston real estate market is more the exception than the rule. While approximately 90 percent of metro areas in the country experienced increases in profit margins, Boston was one of a select few cities that saw profits from home sales decrease in the first quarter of 2021.

“Aside from Memphis, the biggest annual decreases in metro areas with a population of at least 1 million were in Boston, MA (margin down from 45.5 percent to 39.2 percent); New Orleans, LA (down from 25.8 percent to 20.6 percent); Pittsburgh, PA (down from 36.4 percent to 31.7 percent) and St. Louis, MO (down from 25 percent to 21.6 percent),” said the latest Home Sales Report.

The decrease in profit margins was directly correlated to an increase in home prices. If for nothing else, home prices in Boston have tested new highs each month in 2021. The median home value in Boston is simply too high, effectively chipping away t profit margins when it comes time to sell.

With profit margins on sales growing thinner, the Boston real estate investing community has turned to long-term rental properties. At the very least, years of cash flow can easily justify higher acquisition costs. However, the pandemic has placed several tailwinds at the backs of strategic buy-and-hold investors. In addition to lower profit margins driving investors away from rehabs and flips, interest rates on traditional financing are historically low. To stimulate activity during the pandemic, the Fed dropped interest rates to their lowest point ever. Today, the average commitment rate on a 30-year fixed-rate mortgage is 2.96%, according to FreddieMac. At that rate, it’s relatively cheap to borrow money, and investors in Boston have taken notice.

With interest rates under three percent, investors can simultaneously justify higher acquisition costs and increase monthly cash flow from operations. In addition, with less capital dedicated to interest on each mortgage payment, investors in Boston can pocket more of the city’s average rental rate of $2,390.

If that wasn’t enough to encourage the Boston real estate investing community to add to/build a rental property portfolio, the city’s 23.56 price-to-rent ratio is currently leaning heavily in favor of landlords. At that level, it is much more affordable to rent a home in Boston than to own one. Consequently, demand for rental properties in Boston is already high due to the city’s meager 7.3 weeks of available inventory. Even prospective buyers who can afford to own are relegated to the renter pool due to a lack of listings. As a result, recent demand has enabled landlords to increase rates and mitigate the risk of vacancies.

All things considered, the Boston real estate market has been very conducive to the investor community. While high prices have limited profit margins on rehabs and flips, short-term exit strategies remain viable. However, rental properties have become the most attractive investment strategy in the wake of the pandemic.

2021 Foreclosure Statistics In Boston

According to Attom Data Solutions’ Q1 2021 U.S. Foreclosure Market Report, a total of 33,699 U.S. properties received a foreclosure filing (default notices, scheduled auctions or bank repossessions) in the first quarter of this year. According to the latest research, nationwide foreclosures are up 9.0% from the last quarter of 2020 but down 78.0% from this time last year.

“The foreclosure moratorium on government-backed loans has virtually stopped foreclosure activity over the past year,” said Rick Sharga, executive vice president of RealtyTrac, an ATTOM Data Solutions company. “But mortgage servicers have been able to begin foreclosure actions on vacant and abandoned properties, which benefits neighborhoods and communities. It’s likely that these foreclosures are causing the slight uptick we’ve seen over the past few months.”

However, it is worth noting that while nationwide mortgage delinquencies fell to pre-pandemic levels as recently as the last quarter of 2020, Boston saw higher year-over-year foreclosure filings.

According to CoreLogic’s latest Loan Performance Insights Report, the Boston-Cambridge-Newton MA-NH metropolitan area finished 2020 with a 4.6% delinquency rate, up 3.1% from the previous year. Numbers have yet to be released approximately halfway through 2021, but it’s safe to assume foreclosures will increase in Boston over the rest of the year.

2021 Median Home Prices In Boston

The median home value in the Boston real estate market is $675,921. However, to truly understand today’s prices, they must be placed in context with the national housing market. The median home price in the United States is $281,371, which begs the question: Why is Boston real estate so expensive?

To better understand what current values reflect, it helps to take a step back and look at how prices have performed over a longer period of time. For example, the median home value in Boston was as low as $386,000 approximately nine years ago (when the recovery really started to gain momentum). Since then (October 2012 to today), the median home value has increased 75.1%. The significant increase was due—primarily—to three indicators: a strengthening economy, increasing sentiment in the housing sector, and (ironically enough) a lack of available inventory. Thus, for some added context, the median home value in the United States increased 69.5% over the same period of time.

Over the last 12 months, appreciation rates have started to heat up. From April 2020 to today, the median home value has increased 4.3% in the wake of the Coronavirus and its lingering impact. Looking forward, prices are expected to appreciate at an even faster rate. With competition forecasted to increase and inventory to remain tight, it is safe to assume home values in the Boston real estate market may increase by as much as 10.5%

The primary driver behind the double-digit price increase is the lack of inventory. Whereas a “healthy” market typically boasts somewhere between four and six months of inventory, Boston currently has about 7.3 weeks or 58.9% less than this time last year. Moreover, even the homes that do make it to the Boston real estate market are only listed for an average of 18.2 days due to the area’s immense level of competition.

Inventory is expected to remain tight for the foreseeable future, which will contribute to further appreciation. However, help is on the horizon. With a light finally visible at the end of the tunnel, the end of the pandemic should bring about new building permits.

Boston Real Estate Market Trends In 2021

The Boston housing market has kept pace with the national industry. However, in light of the Coronavirus, markets across the country may start to act independently. While it is too early to tell exactly what real estate in Boston will look like for the foreseeable future, it is possible to interpret the pandemic’s impact in a meaningful way. Here is a look at the Boston real estate market trends which are most likely going to have a lasting impact:

-

Improvements In Unemployment Will Increase Demand: Over the course of the pandemic, unemployment spiked to historic levels in Boston. However, as more Americans get vaccinated, and Boston continues to lift restrictions, unemployment will improve. At about 5.9%, Boston’s unemployment rate is much better than it was a year ago, and it’s still improving. If the trend continues, more buyers may enter the market and increase competition even further. As a result, there appears to be a growing correlation between the strengthening economy and higher appreciation rates.

-

New Builds Are Still Too Far Out: Building permits are nowhere near where they were before the pandemic, and there’s currently no sign of a significant increase coming soon. Therefore, we must expect inventory to remain tight. Prices will most likely continue to increase, and competition will only worsen as more people start heading back to work.

-

Rentals Will Receive An Influx Of Demand: Today’s supply and demand issues will spill over into the rental market. In fact, Boston’s 23.56 price-to-rent ratio all but ensures the rental market will receive added attention. With rentals represent the most affordable means of living, landlords will find their units receiving just as much demand as today’s sellers. As a result, vacancy rates are expected to drop, and rental rates will rise.

The Impact Of COVID-19 On The Boston Housing Market

More than a year into the pandemic, the impact of COVID-19 on the Boston housing market is starting to come into focus. Over the last year and a half, fear and uncertainty played havoc with many of the most trustworthy indicators. Nobody knew what to make of the new market landscape in the wake of the Coronavirus. Now that we are officially halfway through 2021, it’s safe to assume we have a better idea of the impact COVID-19 will have on the Boston housing market.

The most noticeable changes people will realize are the government’s actions to facilitate more activity. In response to the pandemic, in fact, interest rates were dropped to catalyze homebuyers. As a result, at the beginning of 2021, the average commitment rate on a 30-year fixed-rate mortgage from Freddie Mac sat at 2.65%. Homeowners and investors have come out in droves to take advantage of today’s lower rates, and more are expected to do so as unemployment continues to improve.

It is worth noting, however, that supply is nowhere close to being able to keep up with demand in the Boston real estate market. While plenty of buyers are ready and willing to act, there isn’t enough inventory. As a result, competition and home prices have increased almost exponentially. The city’s median home value has jumped 4.3% in the last year, and there’s nothing to suggest the trend won’t continue. Forecasts suggest home values could increase by as much as 10.5% over the next 12 months.

In the coming year, the fallout of the pandemic will continue to increase both demand and competition. Prices will continue to rise as long as inventory remains low. New builds are expected, but the pandemic stalled efforts. Until more homes can be brought to market, expect prices to keep rising.

Boston Housing Market: 2020 Summary

-

Median Home Price: $541,000

-

Unemployment Rate: 4.0%

-

1-Year Job Growth Rate: 1.9%

-

Population: 667,137

-

Median Household Income: $75,667

2020 Boston Real Estate Investing

Local investors have become the beneficiary of some rather favorable indicators. Demand remains intact, despite nearly a decade’s worth of appreciation. Many of the city’s offers are coming in over the asking price. Competition is expected to grow even fiercer, which could bode incredibly well for the entire investing community. That’s not to say there will be more buyers, but rather that there will be even fewer homes available for sale.

“I have had multiple offers over asking price on two homes that went under agreement in March,” Kurt Thompson, a broker with Keller Williams in the Leominster area and president of the Massachusetts Association of Realtors. “We are still seeing a significant shortage of homes available for sale, and the COVID-19 crisis is likely to cause some sellers to delay bringing their homes on the market, making that shortage even worse.”

Prices are historically high at the moment, which begs a couple of important questions: Is Boston real estate a good investment? Perhaps even more importantly, is it a good time to buy a house in Boston?

Boston Housing Market: 2016 Summary

-

Median Home Price: $541,000

-

Unemployment Rate: 4.0%

-

1-Year Job Growth Rate: 1.9%

-

Population: 667,137

-

Median Household Income: $75,667

Boston Real Estate Investing 2016

Boston real estate news couldn’t have been better for local real estate investors in 2016. The housing sector confirmed it was one of the hottest areas to own property in the entire country. As a result, home prices skyrocketed beyond the national average, as the median home price reached as high as $558,000 on the year. While very appealing to the real estate investing community and local homeowners, even better was the city’s appreciation rate, which was one of the most competitive in the country at the time. As a result, the Boston housing market was able to build off of 2016, as it made its way to become the powerhouse it is today.

The market was a safe haven for both home price increases and equity gains. On the other hand, the city wasn’t exactly known for its affordability, even in 2016. However, despite increases, the ratio of income paid to monthly mortgage payments in the first quarter of 2016 was well below its historical average, coming in at 12.1% for the first quarter.

Unemployment was actually better than the national average, sitting at 4.0%, which was good for the time. That represents a one-year decrease of 0.6%. However, the job growth rate could have used some improvement. At the time, it was one of the primary indicators holding the city back. For the first quarter, the job growth rate was 1.9%.

Boston Housing Market: 2014 Summary

The Boston housing market demonstrated an increased propensity towards stability in 2014 compared to other metropolitan areas of a similar demographic. However, in the face of historically high appreciation rates, gains are starting to show signs of slowing down, once again suggesting a period of stabilization.

However, price gains were not the only thing leveling off in the Boston real estate market in 2014. It would appear as if inventory levels did the same. In recent memory, tight inventory has limited buying potential, but the number of homes for sale in 2014 didn’t meet demand. Fortunately, a shift in supply changed towards the fourth quarter, as the market stayed relatively balanced (or at least better than last year).

Boston Real Estate Investing 2014

While affordability remained an issue for some homeowners in the area during 2014, local real estate investors turned to foreclosures. In fact, the median sales price for a non-distressed home was $511,500 during the first quarter, while the median sales price of a foreclosure home was $330,000, or 35.0% lower than non-distressed home sales—a savings of more than $181,000 for real estate investors looking to capitalize on the foreclosure market.

The city had roughly 696 foreclosures on the market in 2014, each of which represented an investing opportunity. Local investors also recognized that those numbers were on the rise. Over the course of a month, foreclosures rose 16.0% during the first quarter of 2014. An overwhelming majority of the foreclosures within the Boston housing market were of the pre-foreclosure variety. In fact, pre-foreclosures during 2014 made up 64.9% of the entire foreclosure market. That was a 140.0% increase over the course of a year. Auction foreclosures represented 32.4% of the market in a distant second, while the remaining foreclosures were bank-owned. Bank-owned foreclosures were the only distressed properties that declined year-over-year. Real estate investing, as a result, has seen an uptick in the acquisition of distressed properties.

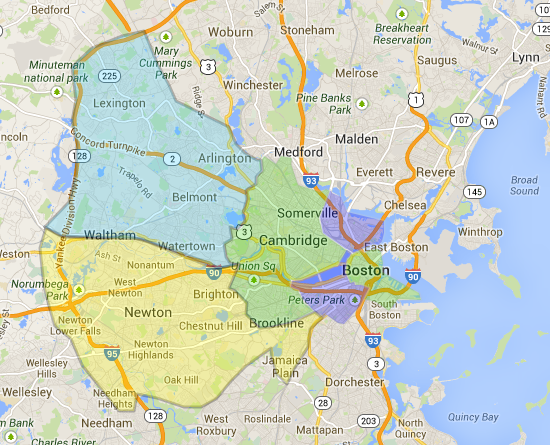

Boston Real Estate County Map:

Boston Real Estate Market Summary

The Boston real estate market has paced the national sector for the better part of a decade. For the better part of ten years, real estate in Boston has been considered the nation’s housing sector’s upper echelon. That said, even the best market was hit hard by the pandemic. As it turns out, Boston wasn’t as insulated from the Coronavirus as it would have hoped. As a result, unemployment spiked slightly more in Boston than the national average and has come down at a slower pace. Nonetheless, housing activity in lieu of unemployment has picked up. Once people get their feet underneath them, this market will take off. We have already seen the beginning of positive trends, and the rest of 2020 should impress.

Have you thought about investing in the Boston real estate market? If so, what are you waiting for? We would love to know your thoughts on real estate in Boston in the comments below:

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!