Whether you are a new business owner or have been doing business for a long time, it’s important to be able to have a business budget to know whether or not your finances are in order. A business budget template will be able to teach you all the concepts you need to know as well as make sure you have all the information to make an accurate budget.

What Is A Business Budget?

A business budget shows all the spending and revenue your business should have over a period of time. It includes all expenses. Most business budgets are done monthly, quarterly, or yearly. You can use the template to fill in estimated revenues and any expected expenses that your business will have over the course of a set period.

It will include everything like salaries, office expenses, technology costs, and any expenses related to software.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Why Is A Business Budget Important?

Budgets are important for all businesses because without one you might not know the costs of running a business. You might also not be able to decide what business decisions you can make since you do not know where you stand financially.

A business budget will allow you to prepare for unexpected expenses and will also allow you to budget for emergencies.

Any business owner that wants to care for their business will make sure to have a budget so that they are setting themselves up for success. Here are just some of the reasons why business budgets are so important:

-

Projects costs related to starting and running a business

-

Plan for future business purchases and investments

-

Determine the portions of your business that need the most capital

-

Prepare for business slowdowns

-

Track revenue, expenses, and cash flow

Free Downloadable Business Budget Template

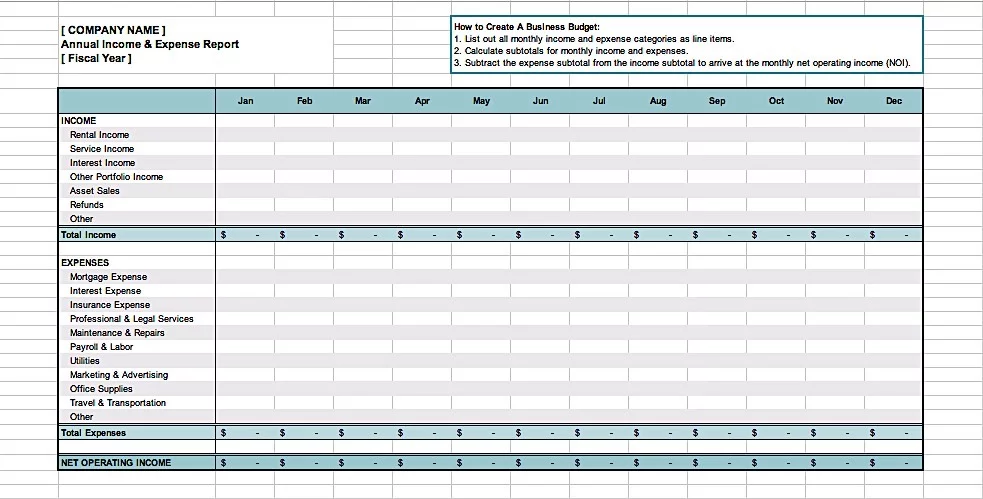

Now that you have been equipped with simple budgeting tips, followed by some more advanced budgeting techniques, perhaps you are now feeling ready to start building your first budgeting mechanism for your business. Download our simple business budget template, here, to help you get started!

How to Create A Business Budget

A business budget is easy to make once you know the right steps to follow. Small businesses often have an easier time making budgets because the complexity of their business is less. Making a budget does not have to be restrictive no matter the size of your business.

You can make a budget to fit your needs, so you don’t feel like you are being punished for not being able to spend your money. When designing your budget you can form income projections, and enter in all your expenses and income. After that, all you need to do is review the budget.

Here are the steps more in-depth to help you get started:

-

Use A Business Budget Template

-

Fill in Revenues

-

Subtract Fixed Costs

-

Consider Variable Costs

-

Plan For Unexpected Expenses

1. Use A Business Budget Template

For this step, you can either purchase a template online or just use an excel spreadsheet. Some templates online are also free. Beginners might have an easier time with a template because it has all the headings and categories for them, they only have to fill in the number.

2. Fill in Revenues

Now you can list all the income from your business. You can rely on market research for this or you can estimate based on the previous year’s revenue if you have it. You can also form your own projections based on what you think the revenue might be based on previous sales.

3. Subtract Fixed Costs

The fixed costs are the recurring costs you have each month, quarter, or year. This might be things like the rent for office space, your insurance, or the fee you pay for website hosting. You will need to subtract all these from the revenue.

All expenses need to be listed in the budget template. Make sure to record everything even if might not seem important at the time. This will make sure you have a record of all expenses in case you do not need your budget and need to find out what went wrong.

4. Consider Variable Costs

Variable costs will change each month or each quarter. For example, your utility bill might not be the same every month but it should be around the same range. Office supplies and the cost of software might also change every month.

When the variable costs end up being lower than you expect, you can use the extra money for things like advertising or other things the business might need.

5. Plan For Unexpected Expenses

No matter how much you might plan, there are always some cases where you will have unexpected costs. One of the main things you need to save for is emergencies. You also need to make sure you are budgeting for extra money to be put back into the business to help it grow.

Otherwise, your business will stay stagnant and you will not be able to be successful. You should also review the budget periodically including expenses, fixed costs, and variable costs. Looking at all the costs will help you know where you can save money.

How Much Should A Small Business Budget Be?

Business budgets vary according to what your business is and the industry you work in. For example, starting a small social media business will be much less than starting up a new restaurant or salon. You need to make sure you tailor the budget to the type of business you have.

If you have no idea how much money you might need, consider talking to someone you know who has a similar business. You can also talk to a financial planner. The location of your business will also determine the budget because rent will be more in larger cities than if you live in a rural area.

Simple Budgeting Tips For Beginners

If you are at the beginning stages of setting up a business, setting up a budget can be tricky. Most likely, you will not have very much historical financial data, forcing you to do a lot of guesswork when trying to create lists of income and expenses. Here are some tips for setting up a small business budget template to help you get started:

-

Time needs budgeting: Budgeting isn’t relegated to capital alone; it must be extrapolated to account for the time spent on a real estate project, too. “Time is money, especially in the real estate industry,” says Gina Castrorao, a real estate analyst at Fit Small Business. Castrorao suggests investors “write down a plan that includes the money [they] will be spending as well as the timeframe in which [they] want to complete the plan before purchasing the property.”

-

Set up a spreadsheet: To get started, you will want to set up a spreadsheet using tools such as Microsoft Excel or Google Sheets. You may even want to explore some of the free business budget templates made available through these applications.

-

b>Don’t try to budget down to the last penny: The main objective of budgeting is to help forecast income and expenses, and learn how to properly allocate funds towards different projects or expenditures. Because of this, it is not necessary to try to track down to the last penny.

-

Spend time categorizing: Most budgets contain two broad categories, income, and expenses, that each contain separate line items for income or expense sub-categories. Take some time to group each recurring income or expense into broader line items to include in your budget, such as “rental income” or “professional services.”

-

Overestimate expenses: Applicable to personal budgeting tips as well, it is always a good idea to overestimate expenses, as well as underestimate revenue. This practice will help create some slack in your budget in case of unexpected events.

-

Revisit your budget consistently: A business budget will constantly evolve as your company shifts and grows. Make a practice of revisiting your budget at least once a month to keep a clear view of your finances.

-

Keep your business and personal finances separate: As you are first starting as an entrepreneur, it is very easy to get your personal and business finances intermingled. Most likely, you will be investing a significant amount of personal funds into your business, thus making it difficult to divest yourself from your business finances. However, it is critical to make this effort early on and develop good habits. This will help remove your personal liability if anything happens with the business and save you from headaches come tax season. A good way to get started is to set up a separate business account and credit card.

5 Small Business Budget Techniques

Now that we have covered some simple budgeting tips to help you get started, much of which are perfectly applicable to personal budgeting tips as well, let us now discuss a few budgeting techniques that you can incorporate into your small business budget template, once you have mastered that basics. The following are some real estate budgeting tips, according to the pros:

-

Check industry standards: A great way to learn how to best budget for your business is to spend time researching financial standards in your niche. You can talk to other business owners in the area, work with an accounting professional who caters to clients in the real estate industry, or even research best practices online.

-

Set financial goals: Most beginners will often fill their business plan budget template with line items that represent literal inflows and outflows of cash. When providing budgeting money tips, a financial professional will advise you to set financial goals for your business, whether it be saving up for an acquisition or building up an emergency fund. When setting financial goals, you can list them as an expense line item on your business budget template, and in a way, pay yourself each month until you reach said financial goals. This way, you will have an easier time holding yourself accountable.

-

Seek professional tax advice: As a business owner, there are a variety of tax rules that vary based on what type of business entity you have established. Tax laws can be very complex, and entrepreneurs would be wise to rely on a tax advisor or accountant. They can help you file for taxes correctly and help you budget for taxes throughout the year.

-

Make use of financial technology: Making use of financial technology, such as business budget template apps and real estate budging software, can help automate your financial process. This can not only save you time and headaches but can increase accuracy by preventing human error.

-

Involve your team: As a business owner, you will be tempted to handle your company’s finances all on your own. However, a business budget template involves everyone in your team, and each member should be aware of principles and can provide insightful ideas to improve your systems.

10 Traits Of A Financially Savvy Investor

There is no singular financially savvy definition, as it can carry a different meaning for different people. Still, in general, a financially savvy person is someone who has an affinity for planning their financial future. This affinity can be cultivated through desire and commitment, but also through planning and education. Do you have the following traits of a financially savvy investor?

-

They are able to delay gratification.

-

They take time to read and continually research.

-

They remain patient.

-

They know when to seek advice from a professional.

-

They stay emotionally divested from their finances.

-

They spend time improving their skills.

-

They look for additional income streams.

-

They are smart about using credit and financing.

-

They plan for the potential risk.

-

They make a long-term plan and stick with it.

How To Become Financially Savvy

Some individuals may be innately financially savvy, but it is a skill and mindset that must be cultivated over time for most investors. Like any other type of discipline, financial savviness is achieved through research, education, planning, and mindfulness. For example, the list of traits above starts with the description of someone who can delay gratification. It can be extremely tempting to reward yourself over every small win, but a successful investor knows how to not give in to every impulse. But, again, this is a skill that takes practice and mindfulness, and not everyone can be expected to be perfect from the start.

In addition to mindfulness and practice, you will find that the financially savvy will get all their tips on budgeting your money through continual education, research, and talking to professionals. Education and research can come from reading periodicals, books on finance, listening to podcasts, or even taking courses. In addition, a good investor inherently knows that working with a professional as needed is one of the best ways to get hands-on, personalized education.

Summary

By now, you should have a good idea of how to create a business budget and how to use one. They are pretty straightforward, especially once you have a business budget template that you can plug the numbers into and use each month. Budgeting for your business will ensure you always have the money you need for day-to-day business costs as well as emergencies.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!